- Trade

- Banker’s Guarantee/SBLC

- Banker’s Guarantee / Standby Letter of Credit

Banker’s Guarantee / Standby Letter of Credit

Provide assurance and peace of mind to your beneficiaries

- Trade

- Banker’s Guarantee/SBLC

- Banker’s Guarantee / Standby Letter of Credit

Banker’s Guarantee / Standby Letter of Credit

Provide assurance and peace of mind to your beneficiaries

Reassure your buyers or sellers of payment no matter what happens.

An independent undertaking

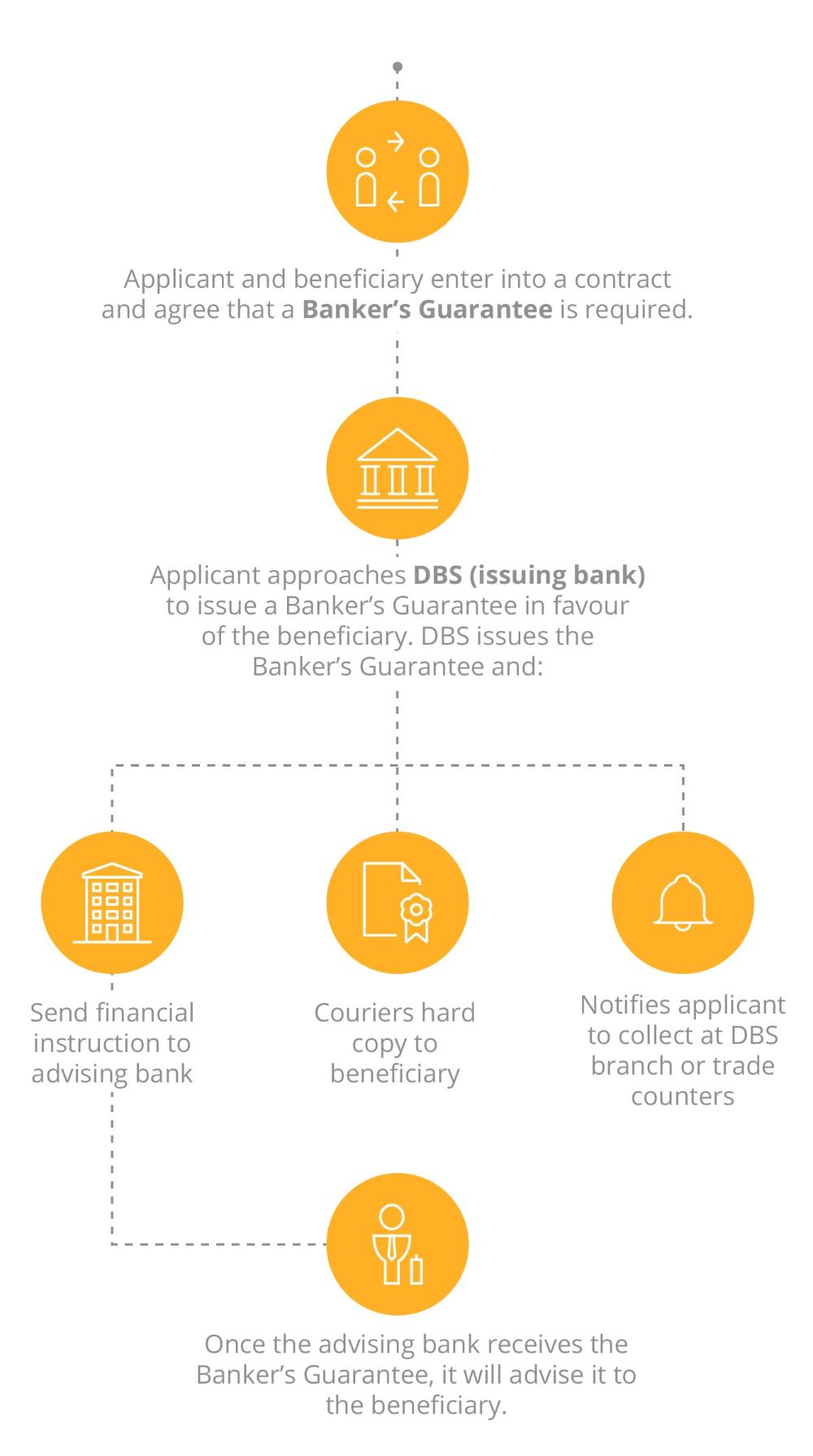

Banker’s Guarantees are independent undertakings which help to mitigate payment risks for the beneficiary

Added assurance

We will pay to your beneficiaries upon receipt of a claim that complies with the terms of the guarantee

Easy collection

Pick up your banker’s guarantee from any of our Trade Document Counters and DBS collection branches

If you have a trade credit facility with us:

- Apply through DBS IDEAL, our online platform

- Submit your application form at our Trade Document Counters or collection branches

Apply online for a cash-backed Banker’s Guarantee.

| When do I apply for a Banker’s Guarantee or a Standby Letter of Credit? | |

| The beneficiary will specify what to apply for. |

| How do I complete the application form? | |

| You may refer to the explanatory notes, or contact us for help. |

“DBS is prompt, understanding and flexible.”

Mr Jonathan Yap, Director - Starburst Engineering Pte Ltd

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?