- Trade

- Import Services

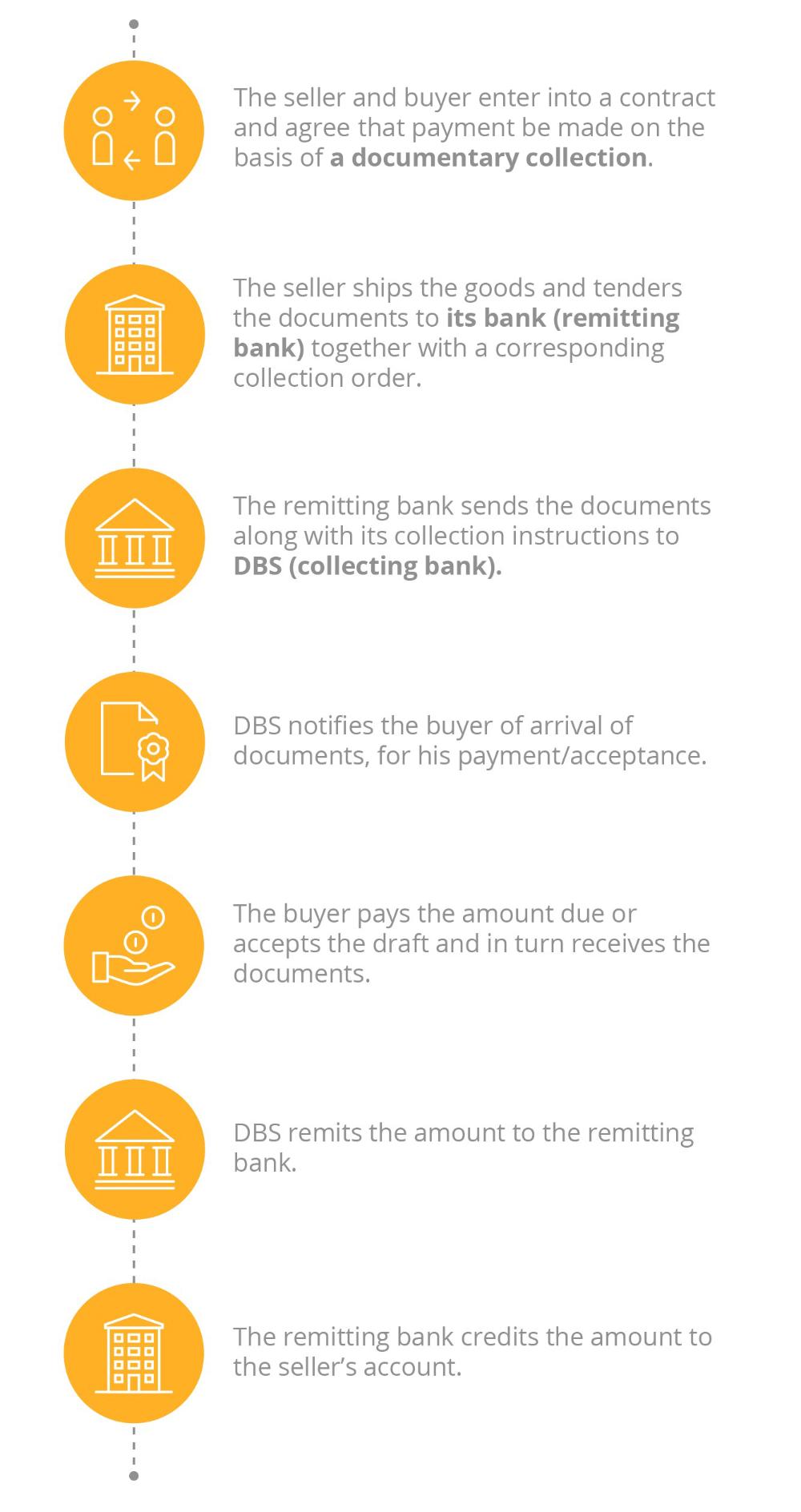

- Inward Bill Collection (DA/DP)

Inward Bill Collection (DA/DP)

Facilitate trade activities with our documentary collection service

- Trade

- Import Services

- Inward Bill Collection (DA/DP)

Inward Bill Collection (DA/DP)

Facilitate trade activities with our documentary collection service

Documents against Acceptance (DA)

We release the import documents to you upon acceptance of the bills of exchange/drafts. You promise to pay the seller on a fixed date

Documents against Payment (DP)

We release the import document to you upon your payment

Convenient collection

Submit and collect your documents easily at Trade Document Counters island-wide

Real-time notification

Subscribe to DBS IDEAL to be informed of status

Facility-free service

Apply for Inward Bill Collection without the need for a credit facility

Best service time

Submit forms before 6pm (on working days) to enjoy same-day process

Free up cash flow

Ask DBS to finance your purchase of goods to turn your business around faster

| How do I know the documents have arrived? | |

| We will inform you when your documents arrive at DBS by phone or fax. However, if you are using DBS IDEAL, we will notify you through the system. |

| Where do I collect the documents? | |

| We will contact you to arrange for your collection. You can choose to collect at any of our Trade Document Counters. |

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?