- Trade

- Import Services

- Letter of Credit Issuance

Letter of Credit Issuance

Guarantee payment to your suppliers

- Trade

- Import Services

- Letter of Credit Issuance

Letter of Credit Issuance

Guarantee payment to your suppliers

A Letter of Credit (LC) is issued at your request to assure payment to your supplier up to a stated amount, within a prescribed time.

Stronger ties

Build stronger relationships and support new business opportunities

On your terms

Ensure the necessary documents are received for goods clearance

Secure

Documents are checked for compliance and terms before you make payment

Help when you need it

Our experts can offer you advice and expertise

Leverage our “AA-” and “Aa1” credit ratings

Provide your sellers with assurances of payment through our Letters of Credit

Save time and ensure fast delivery

Apply for a Letter of Credit online via DBS IDEAL

| Sight Letter of Credit | |

| Issuing bank will honour payment at “sight”, meaning payment is made once documentation received is in order. |

| Usance Letter of Credit | |

| Issuing bank will accept the draft once all documentation received is in order and agree to pay on the due date. |

| Red Clause Letter of Credit | |

| Allows the issuing bank to make a partial advance payment to the seller upon receipt of documentation. |

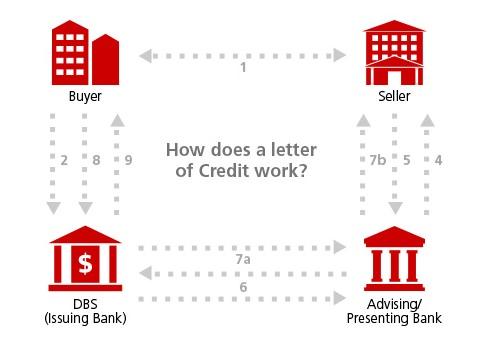

- The buyer and seller enter into a contract and agree that payment be made on the basis of Letter of Credit

- Buyer approaches DBS (issuing bank) to issue Letter of Credit in favour of the seller

- DBS issues Letter of Credit which is advised through its branch or correspondent bank (advising bank) in the seller’s country

- Advising bank advises Letter of Credit to the seller

- Upon receipt of the Letter of Credit, the seller prepares shipment and delivers documents to presenting bank

- Presenting bank despatches documents to DBS for payment

- DBS pays the presenting bank upon verifying the documents are in order

Upon receipt of payment, presenting bank pays the seller - Buyer pays the document amount to DBS

- DBS forwards the documents to the buyer, who can now use them to obtain the goods

Submit your application through one of the following channels:

-

SmartForm

-

API*

*Contact your Relationship Manager or call us at 1800 222 2200 for more information.

| Can you issue a Letter of Credit to my seller, without a DBS facility? | |

| Please refer to Online Letter of Credit |

| How do I complete the LC application form? | |

| Please refer to our explanatory notes or contact us. |

“DBS helps us a lot in establishing whether the market, bank and customers are good enough for us.”

Mr Chandru Dadlani, Director - Aakash International Pte Ltd

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?