Story of the day

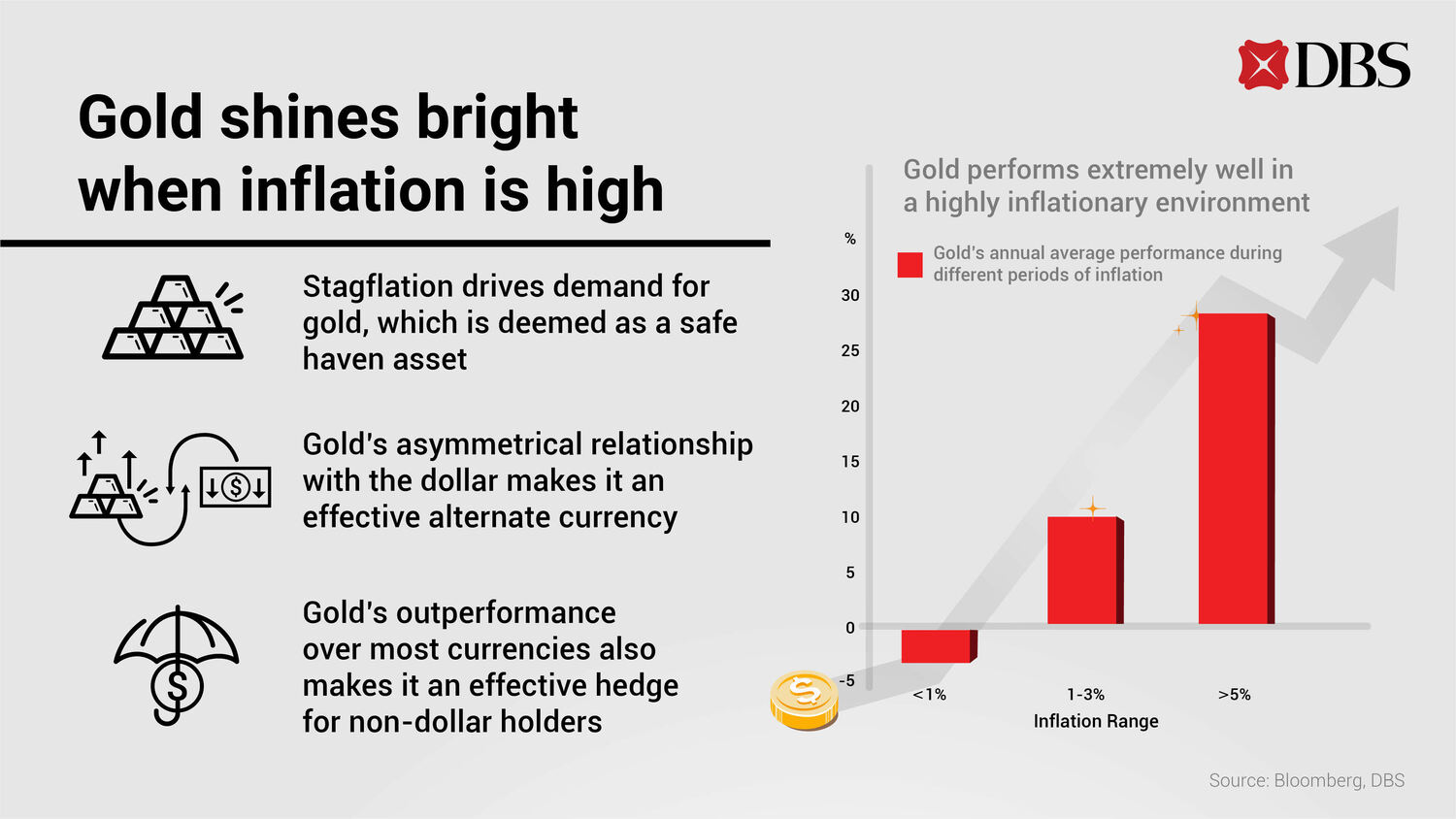

With the consumer price index rising to its highest in 30 years, the outlook of gold came under focus in 2021.Moving into 2022, the scenario of runaway inflation hurting consumer sentiment, as well as rate hikes impacting market sentiment are uncertainties that investors have to grapple with and insure against.