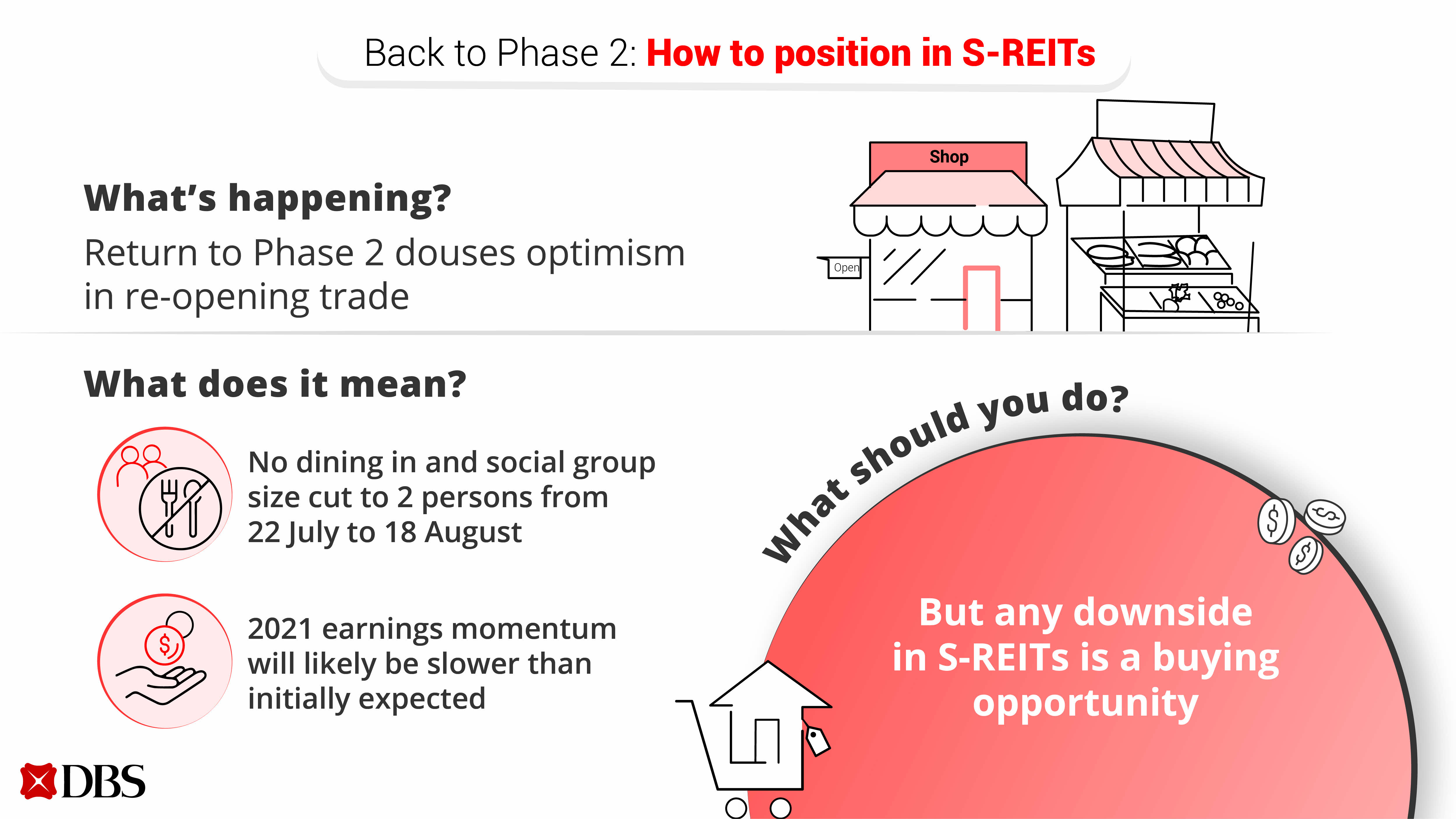

Story of the day

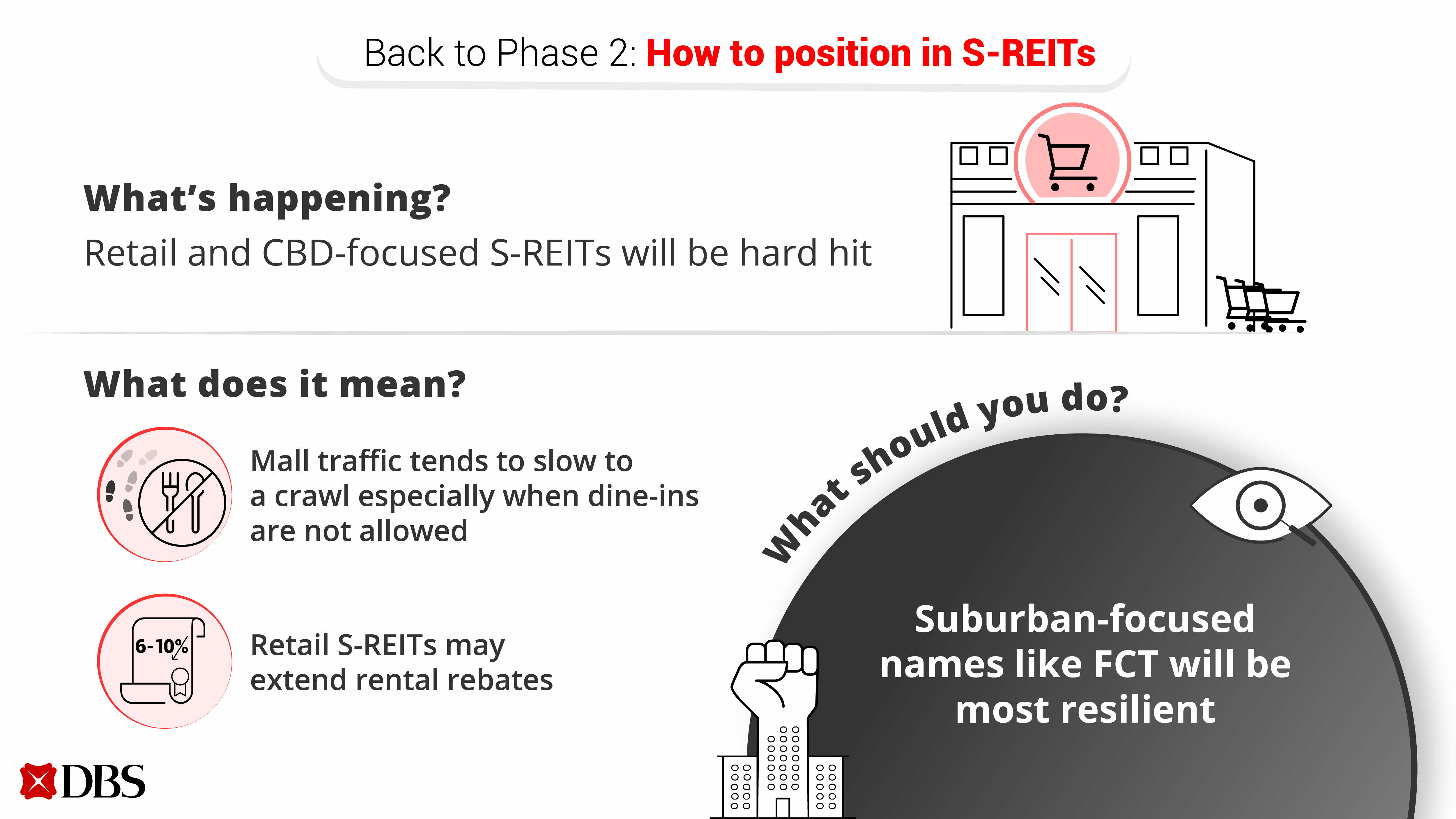

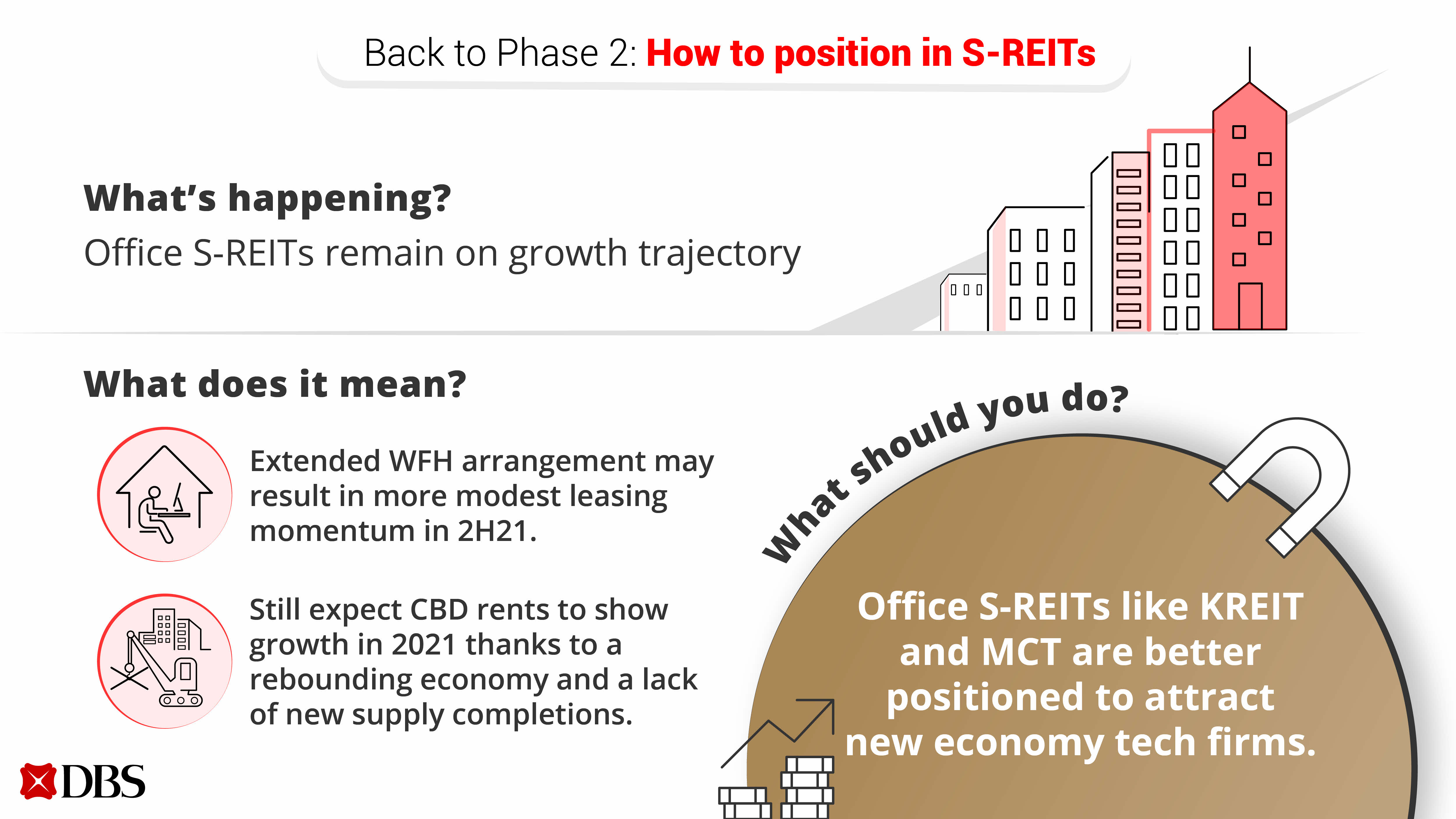

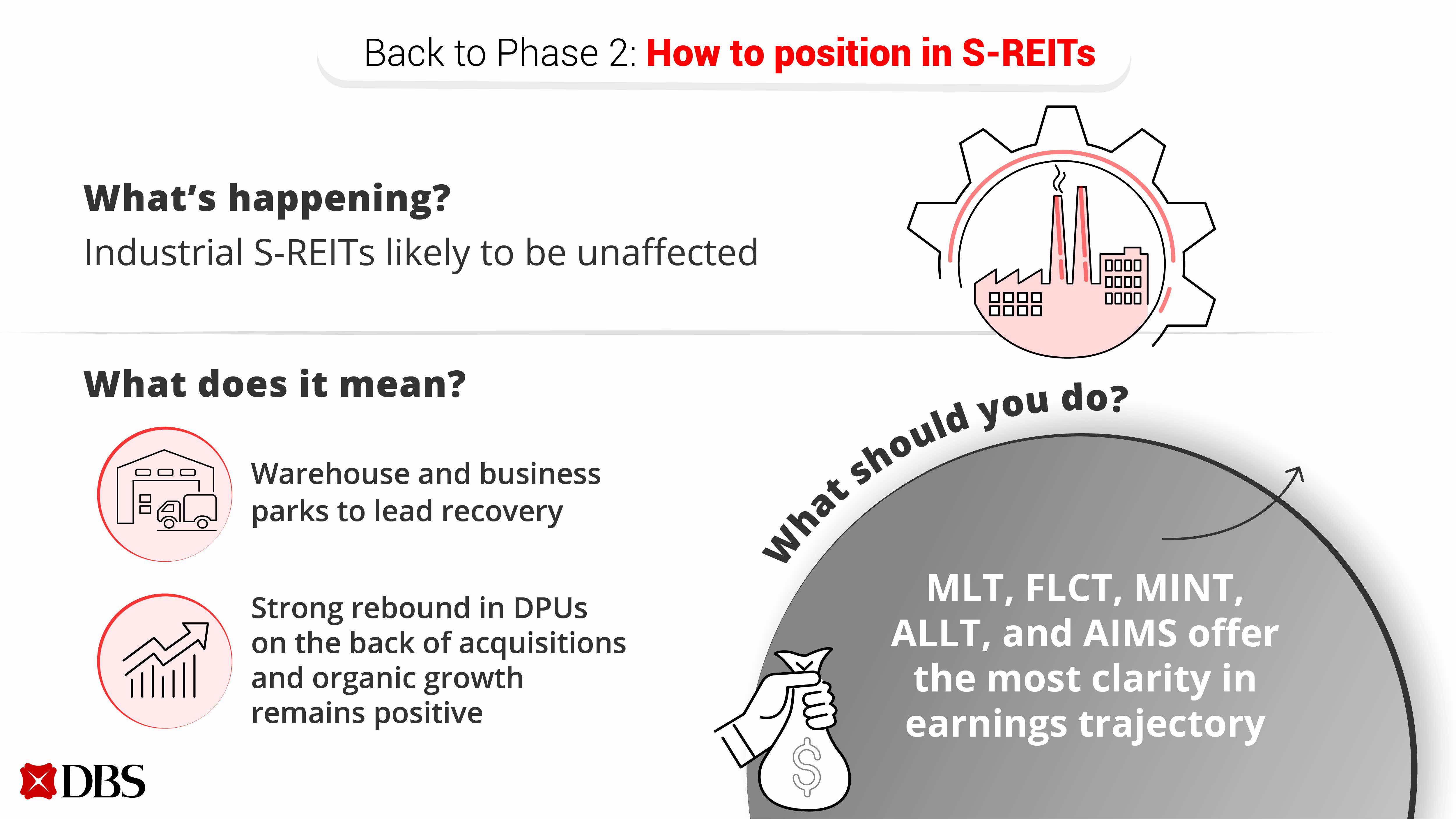

Singapore is back in Phase 2 (Heightened Alert) as authorities work to curb the sharp rise in Covid-19 transmissions in the community. This brings the economy back to a painful square one and S-REITs are not spared. However, we believe any downside is an opportunity to gain exposure to S-REITs at lower levels.