Story of the day

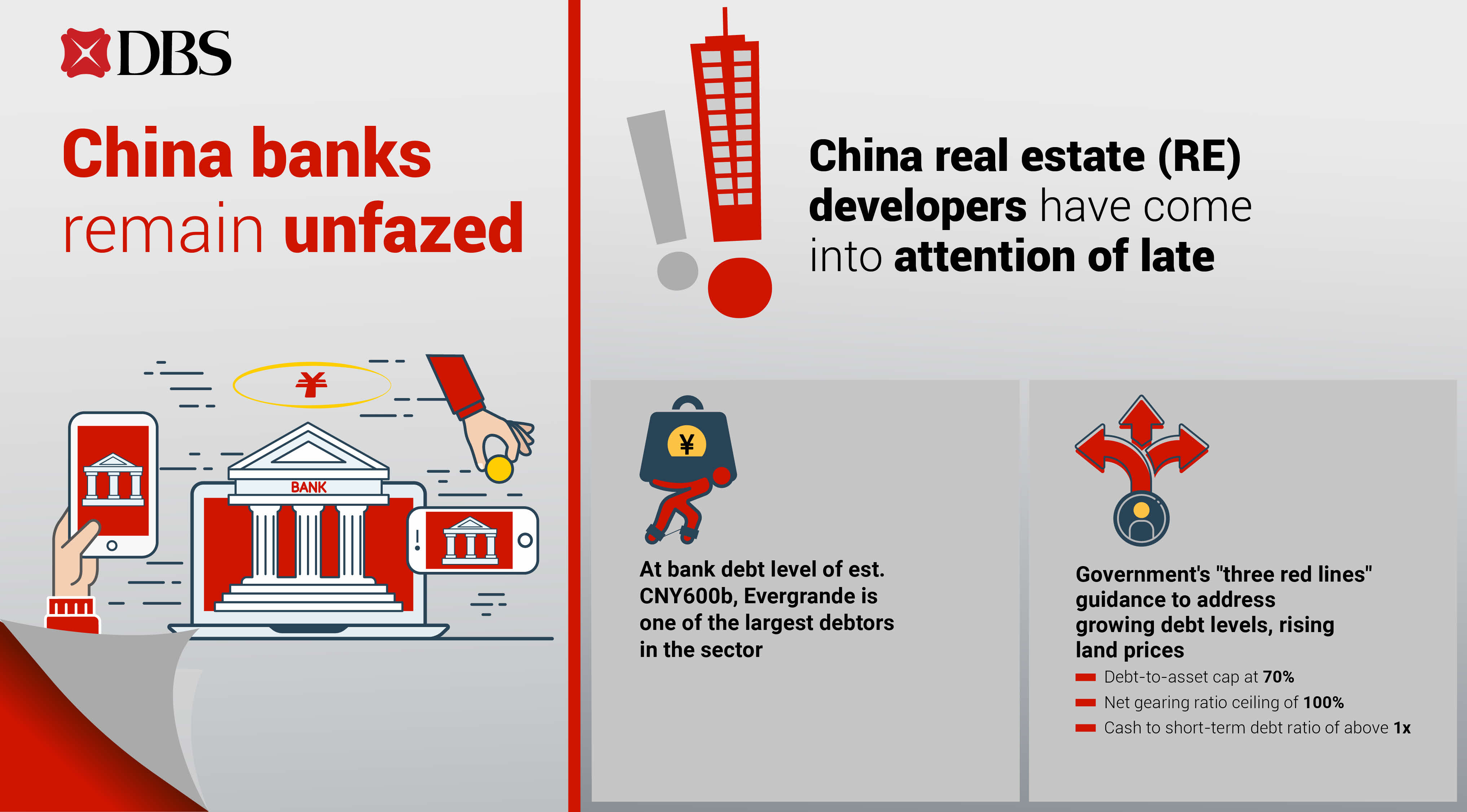

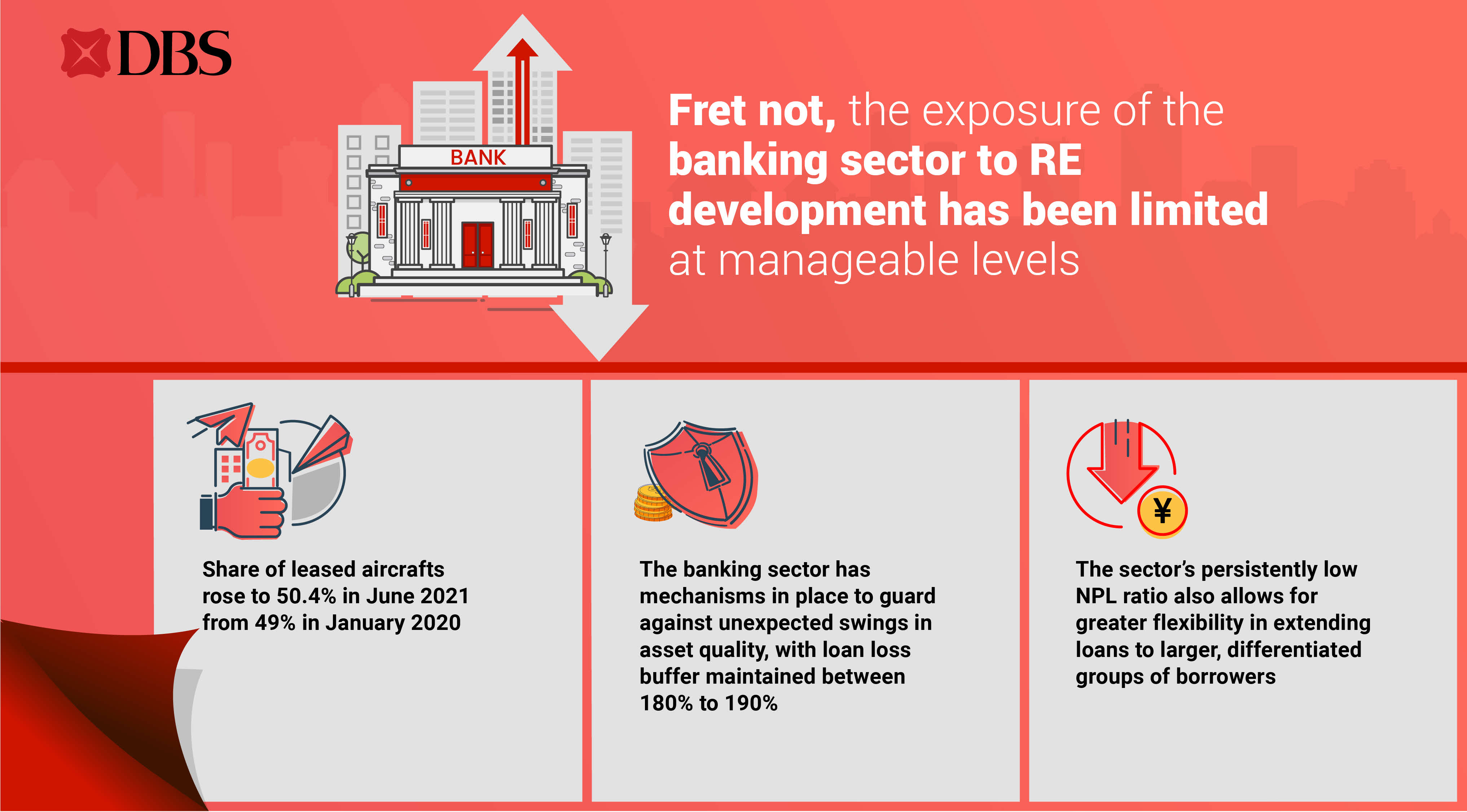

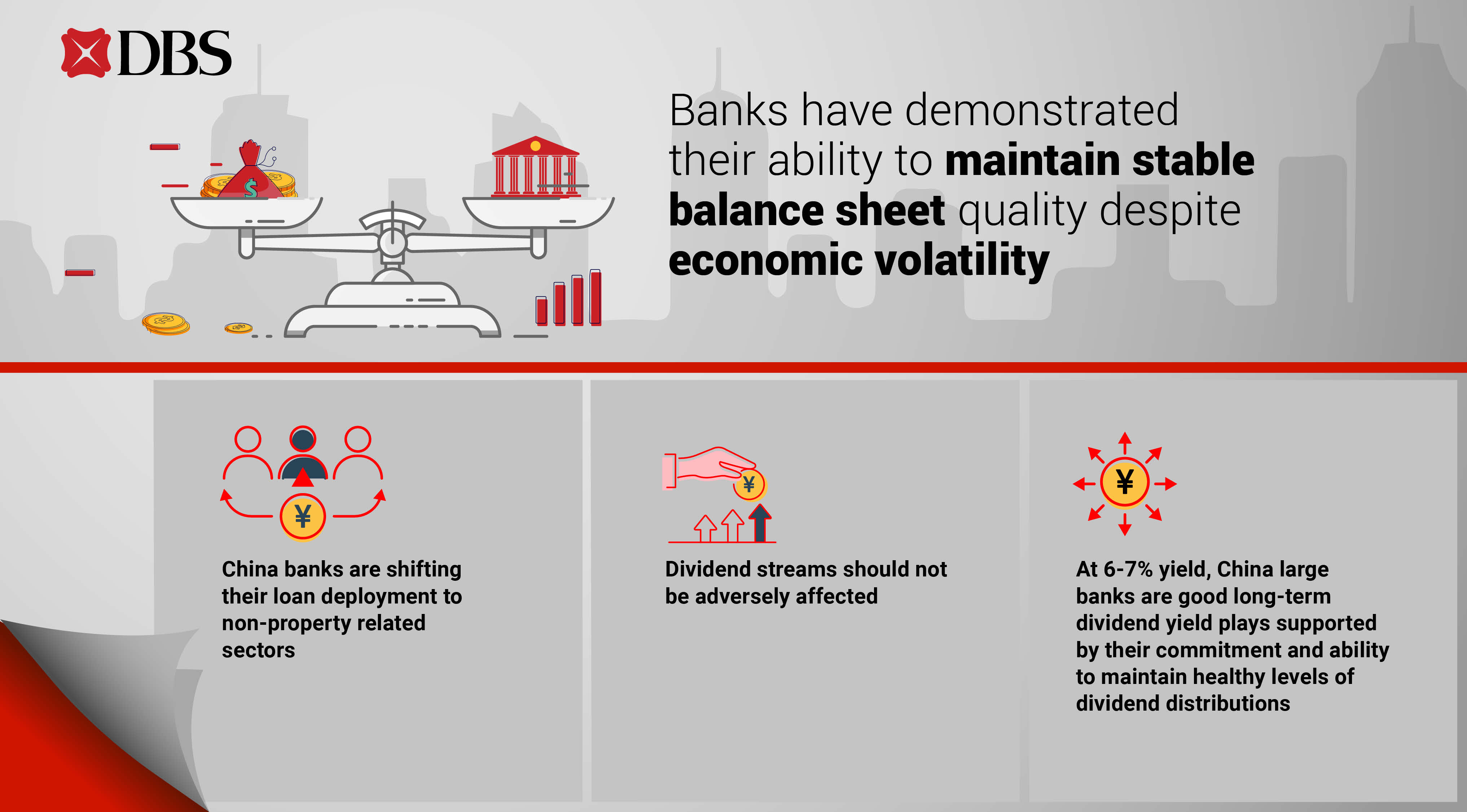

China's banking sector has come into the limelight amid the looming risks from the real estate sector, but the DBS Chief Investment Office thinks that the banks will have the support of the authorities. Investors should not be demoralised by the recent developments. The sector is still an attractive component on the Income side of a Barbell portfolio.