Will Property still be your pot of gold?

By Lorna Tan

![]()

If you’ve only got a minute:

- Current property prices are not sustainable unless we start to see salaries increase at a faster rate.

- Some middle-aged Singaporeans are caught with having too much savings locked up in property with little left to invest in other asset classes that can offer superior returns and liquidity.

- Consider growing your wealth more holistically through a diversified investment portfolio to maximise the risk-reward from all investments.

![]()

It is often said that Singaporeans have a love affair with property. After all, the asset class has worked well in the past, especially for older Singaporeans, as a vehicle to accumulate wealth and as a legacy for their loved ones. This is because the value of homes and investment property has jumped by multiple folds over the years.

But is this a sustainable investment approach for Singaporeans, moving forward?

DBS latest report “Will Property still be your pot of gold?” highlighted that a new private property may no longer be “that pot of gold” that Singaporeans can solely rely on as their retirement nest egg. In fact, some middle-aged Singaporeans – likely those in the sandwich generation – are caught in an undesirable situation of having too much savings locked up in property with little left to invest in other asset classes that can offer superior returns and liquidity. So, what have worked in the past may no longer be enough nor cost-effective for those working towards financial freedom.

This research paper is the third instalment in the DBS NAV Financial Health Series that analysed publicly available data as well as aggregated and anonymised data insights from 1.2 million DBS retail customers.

Here are 5 key highlights and financial planning tips from this study.

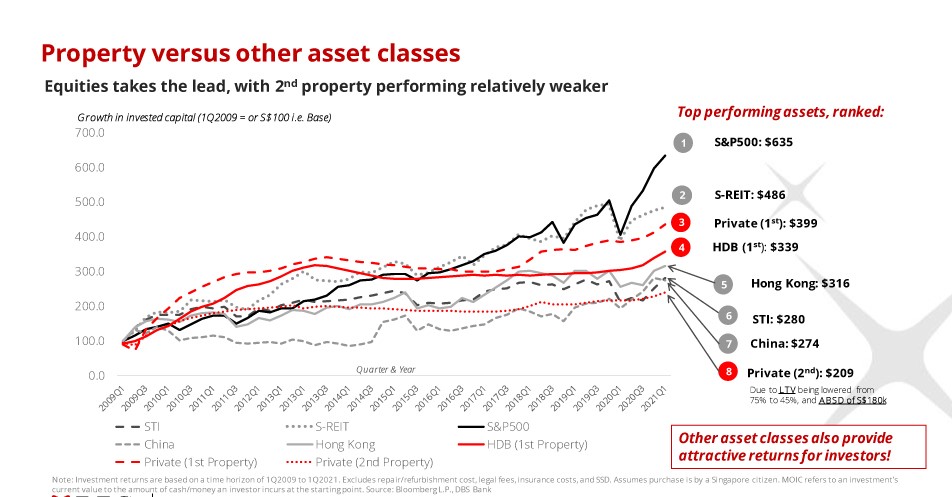

1. Other asset classes offer higher returns and liquidity

Property market returns are no longer as attractive as before, no thanks to cooling measures. After studying the total returns of different asset classes from 1Q2009 to 1Q2021, the best performing investments were S&P500 and S-Reits, followed by property assets.

More specifically, for every $100 invested, an investor will stand to receive returns of about $635 from the S&P500 Index (a stock market index in the US that tracks 500 large, listed firms) and $486 from S-Reits, versus $399 and $339, should the same amount be invested in a first private property or HDB flat instead.

Buying a 2nd private property yielded the lowest growth, with a return of a mere $209 per $100 invested, which significantly falls short of the returns on equities. This is due to lower loan-to-value (LTV) ratio and higher acquisition costs such as the Additional Buyer’s Stamp Duty (ABSD).

For example, the total one-off costs for a second property worth $1.5 million is about $227,350 or 15% of the total price. Would you buy a stock if you knew that it would decline by more than 15% in value the next moment?

Tips

Rather than putting all eggs in one basket or thinking that our property is equivalent to a retirement ticket, consider growing our net worth through a diversified investment portfolio.

While property may remain a core part of the portfolio, the inclusion of other asset classes – for example, equities, Reits, exchange-traded funds, bonds and alternatives, as well as CPF and SRS savings – will form a more balanced investment strategy that can go a longer way to achieve financial resilience. The right mix of assets can help to maximise the risk-reward from all investments.

Take advantage of digibank to set up a holistic financial plan and close your money gaps by investing in other asset classes conveniently and cost-effectively through low-cost digital investing solutions like the robo-advisor digiPortfolio and regular savings plans.

More than 2.4 million customers have planned and invested with digibank. We found that these users across most age and income groups are generally investing greater sums of capital in a year – at about $7,500 – which is more than double the amount invested by an average retail customer at $3,000. Customers who invest more actively will be better positioned to grow their net worth.

2. Specific groups of Singaporeans face challenges in housing affordability and retirement planning

Housing affordability tends to be the most stretched (based on median mortgage-to-income ratios) among those with income up to $5,999/month, and in the 30-49 age group who were also found to exhibit the lowest propensity to invest.

Private property owners in the 30-39 and 40-49 age groups were found to have higher mortgage-to-income ratios at an average of 0.27 (27%) (ranging between 19-46%) and 0.26 (26%) (ranging between 19-39%) respectively.

These age groups are also most likely experiencing a peak in their financial commitments, given priorities such as having to care for their children and provide for their elderly parents at the same time, or upgrading to a new and bigger home.

With mortgage payments typically making up the largest component of a household’s monthly recurring expense, the ability for these groups of customers to plan for their retirement is negatively impacted.

Tips

While financial planning is for everyone, those in the middle-age group will likely require more help since they would have multiple financial responsibilities, such as servicing mortgage loan, insurance premiums, and supporting their children and parents. In addition, they need to mitigate against risks like longevity, inflation, illnesses, job loss and prepare for their retirement.

It is important to keep a pulse on short and long-term goals like financial freedom and have a comprehensive plan to navigate their journey. This includes having adequate insurance protection and a sound estate plan so that dependants can continue with their lifestyle should something untoward happen to you.

Invest wisely with positive cashflows in suitable investments, build passive income streams by toping up their CPF and SRS savings and continuously upgrade their financial knowledge, to achieve sustainable financial wellness.

3. Housing affordability is a concern

Income growth has generally kept pace with property price increases in the past. But in the last five years, increasing property prices have outpaced salary growth. Income growth has slowed to 1.2% (median income) and 1.7% (80th percentile). This is one of the lowest growth rates in 20 years, while property prices rose at a faster pace of 2.1%. This means that property is starting to get unaffordable.

Considering a like-for-like property upgrade today, price-to-income ratios are estimated to rise to almost 15 times for the median income household, and 8.3 times for a household in the 80th income percentile. This is the highest in 20 years. This means current prices are not sustainable unless we start to see salaries increase at a faster rate. Historically, the ratio has been about 10 times for the median income household.

DBS data showed that there is evidence of stretched affordability ratios in recent years, with upgraders buying smaller homes (homes sizes have declined 20% since 2010), while paying higher prices on a per square foot (psf) basis (average psf jumped by 50% since 2010). Given work-from-home arrangements necessitated by the Covid-19 pandemic, there may be a shift in preference towards bigger homes This will further stretch affordability and implies that households will increasingly need to be dual income, to achieve greater financial flexibility.

Tips

Affordability is key when it comes to purchasing a big-ticket item like property – do your sums carefully to see if you will be able to commit to the mortgage payments over time before making your purchase. Do note that a 20% drop in income will drive mortgage servicing ratios up by 5-9%, which will cause significant financial stress on households.

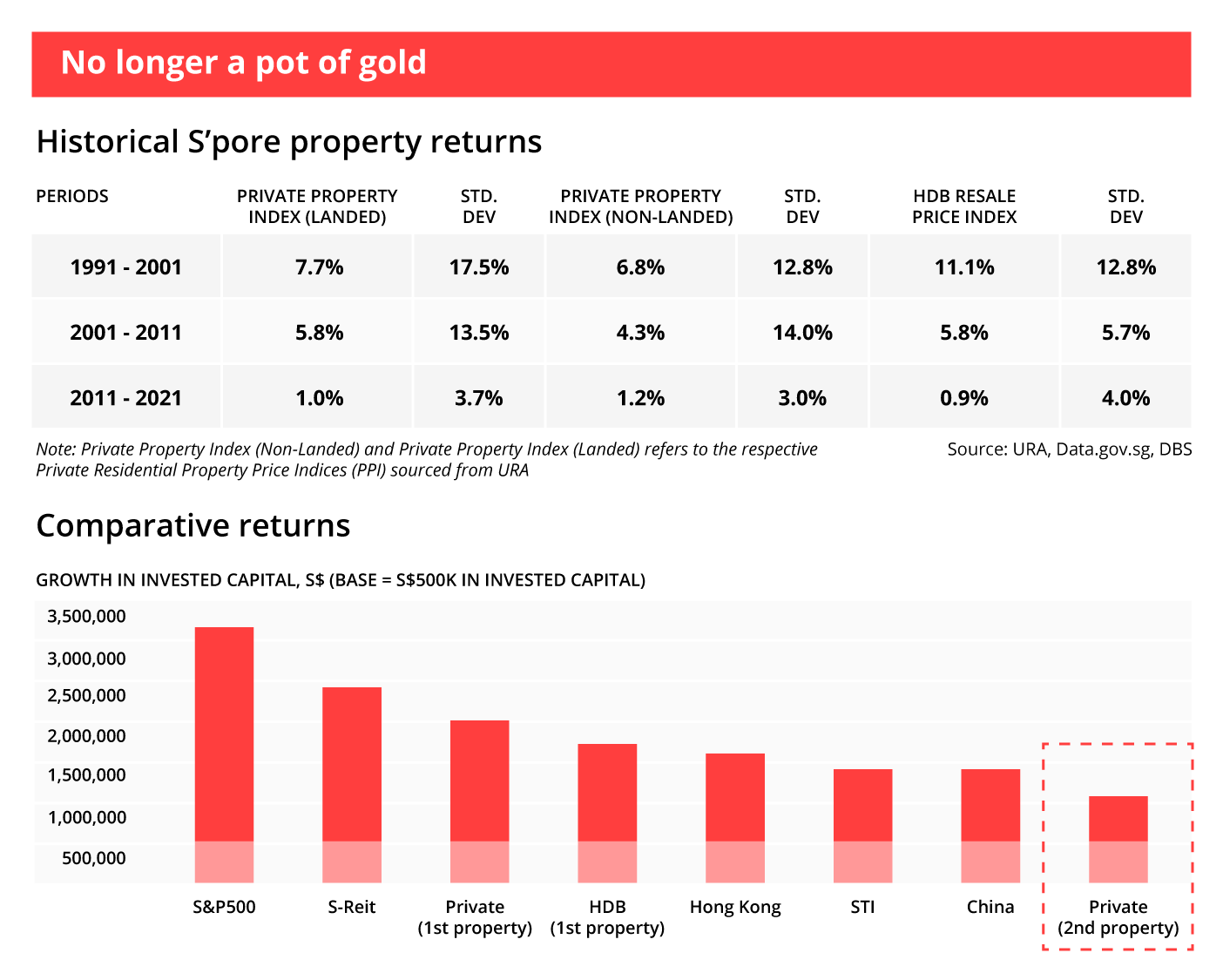

4. Slower rate of property price increase in recent years

Note: Investment returns are based on a time horizon of 1Q2009 to 1Q2021.

Source: Bloomberg L.P., DBS Bank

In the recent decade, property price growth has been modest. The Singapore property market had a compound annual growth rate of 5.9% between 1991-2011, before slowing to 1.1% in 2011-2021. More specifically, in 1991- 2001, private property prices rose 6.8-7.7% and HDB resale by 11.1%, before slowing to a mere 1.0-1.2% and 0.9%, respectively, between 2011-2021.

For the earlier generation of Singaporeans, especially the baby boomers (defined as those born between 1946-1964), it is no surprise that property was a major contributor to household wealth over time.

While there has been a recent upswing in buyer sentiment – driven by upgraders, DBS remains watchful of the pace of increase in the private property price index (PPI) and HDB resale index, both of which rose approximately 7% and 11% respectively over the past year, despite the pandemic and the government’s continued hawkish stance on the property market.

5. Impact of changing demographics and overall demand for homes

The changing demographics amid an ageing population and tighter manpower policies may result in a lower demand for property in the future and make it challenging to find tenants. And do keep in mind that the authorities might implement more cooling measures if property prices continue to climb.

Ready to start?

Speak to a Wealth Planning Manager today for a financial health check, and how you can better plan your finances.

Alternatively, check out NAV Planner to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?