Should you invest in SG property?

![]()

If you’ve only got a minute:

- The Buyer’s Stamp Duty (BSD) was increased since 15 Feb 2023, and the ABSD for residential property was increased on 27th April 2023.

- With property cooling measures increasing the cost of property ownership, lower loan-to-value ratios and higher buyer stamp duties, investors can consider alternative ways to invest in properties without owning a physical property.

- Buying a property requires a huge capital outlay compared to other investments and it is an illiquid asset, so buyers should exercise prudence and weigh the risks and returns.

![]()

Property prices in Singapore seem to head only in one direction – north. Despite rounds of cooling measures, inflation and mortgage interest rates doubling last year, Singaporeans and investors continue to show demand for homes.

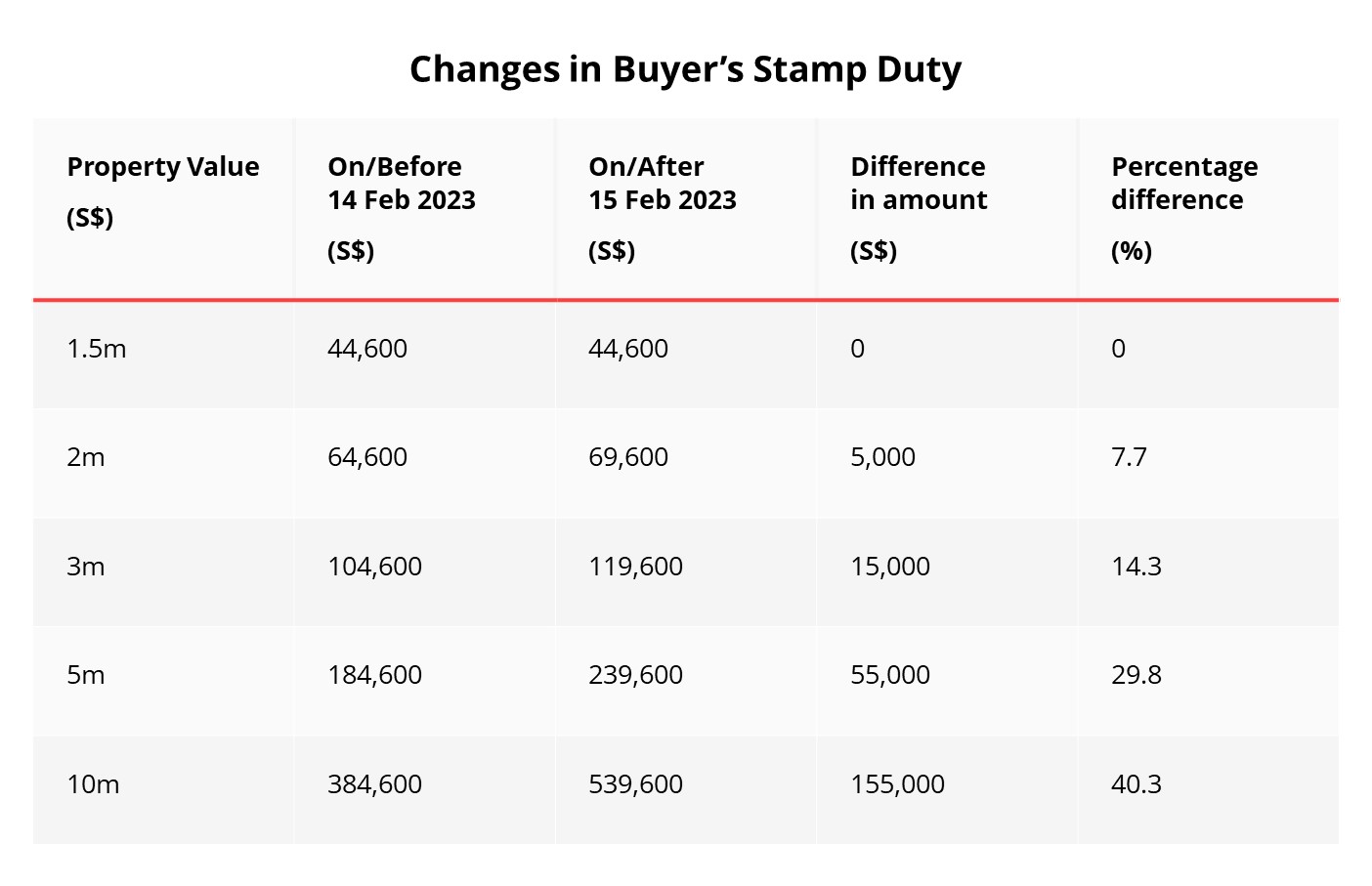

SG Budget 2023 highlighted that the Buyer’s Stamp Duty (BSD) for higher-value residential and non-residential properties would be raised from 15 February 2023. The changes are expected to affect 15% of residential properties and 60% of non-residential properties.

To recap, a round of property cooling measures was announced in September 2022. They included a tightening of the maximum loan limit for HDB loans, an increase in TDSR and MSR calculation by 0.5 percentage point and that private homeowners will need to wait for 15 months after the sale of their home before they can purchase a non-subsidised HDB resale flat.

But with demand for properties in Singapore going strong and the “safety” of property investing in a country with a stable political climate, many seem to think they will be able to buy high and sell higher.

What are the implications of these cooling measures for potential home buyers?

Increase in Buyer Stamp Duty (BSD)

From 15 Feb 2023, the portion of the value of residential property in excess of $1.5 million and up to $3 million will be taxed at 5%, while that in excess of $3 million will be taxed at 6%, up from 4% previously.

For non-residential properties, the portion of the value of the property in excess of $1 million and up to $1.5 million will be taxed at 4%, while that in excess of $1.5 million will be taxed at 5%, up from the previous rate of 3%.

The quantum for increase in BSD is not huge in absolute terms for properties up to $2 million. However, for more luxurious properties, the increase in BSD becomes substantial. Thus, it is fair to say that this increase in BSD will likely have little effect on potential buyers looking at properties below $2 million.

Recent cooling measures affecting property buyers

In September 2022, the government announce a round of cooling measures to moderate housing demands for resale HDB flats and encourage prudent borrowing in the face of rising interest rates.

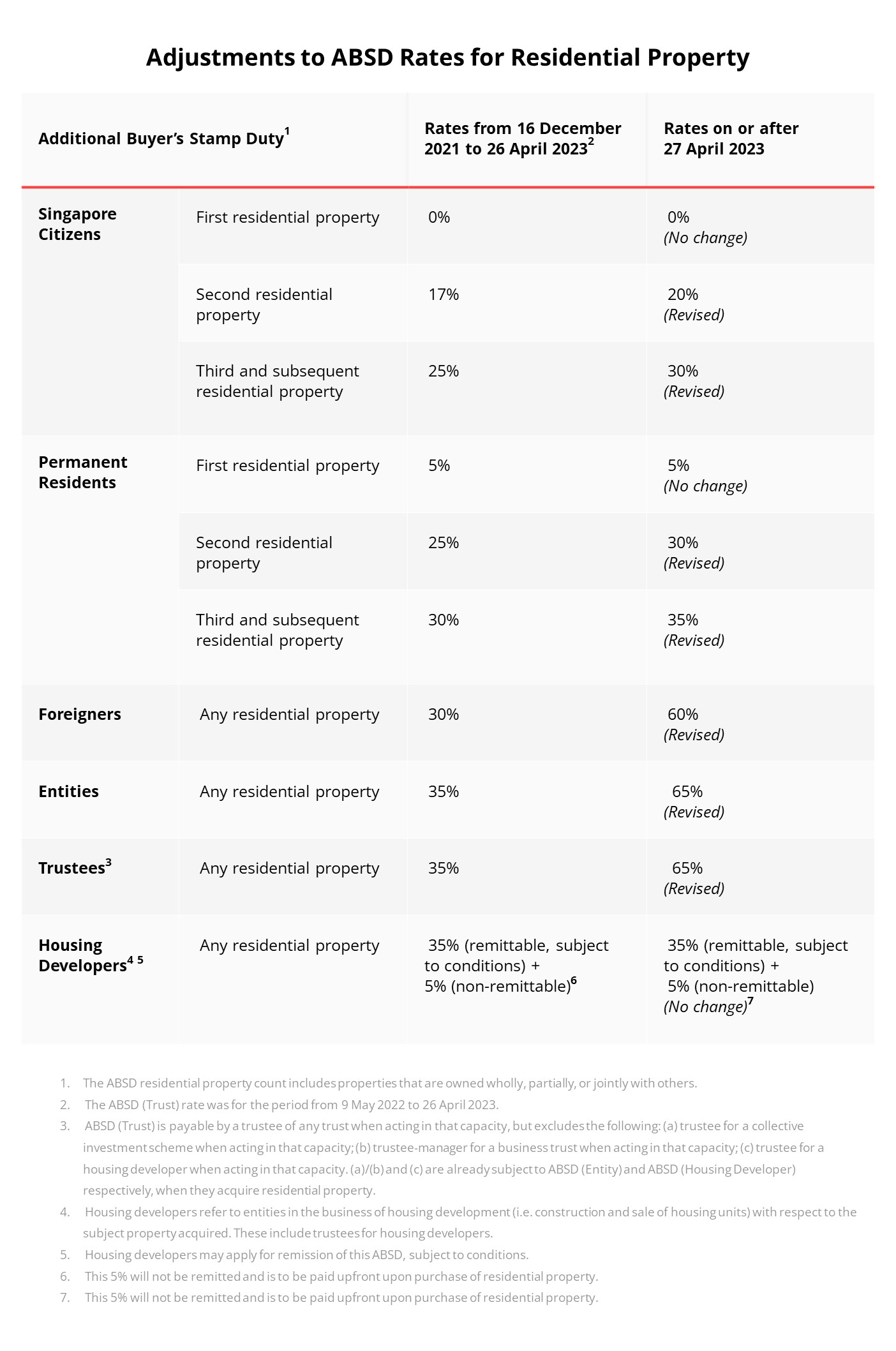

This came less than a year after the cooling measures announced in Dec 2021 which raised the Additional Buyer’s Stamp Duty (ABSD) rates, tightened the Total Debt Servicing Ratio (TDSR) threshold, and lowered the Loan-To-Value limit (LTV) for loans.

On 27th April, the government announced an additional round of cooling measures by increasing the Additional Buyer’s Stamp Duty (ABSD). The revisions to the ABSD rates is believed to help moderate investment demand and to alleviate the tight housing market for both owner-occupation and rental.

To illustrate the changes, let us assume a couple who is living in a paid-up HDB flat and looking to buy an investment property worth $2.5 million.

| Property price | $2.5m |

| Down payment | 5% cash - $125,000 20% CPF - $500,000 |

| Home loan amount | 75% - $1.875m |

| Monthly loan repayments (based on 25-year mortgage, 4% fixed rate) | $9,897 |

| Buyer’s Stamp Duty | $94,600 |

| Additional Buyer’s Stamp Duty (ABSD) | 20% for 2nd property for Singaporean - $500,000 |

With the BSD and ABSD, the upfront cost for buying an investment property increases the total cost substantially. This brings the total upfront cost of investing in a $2.5 million property to $1,219,600 ($625,000 + $94,600 + $500,000).

If buyers are keen to rent out the investment property, do keep in mind that with current home loan rates at about 4%, it may be tough for rental yields to exceed that threshold, given that rental yields for Singapore have traditionally been around 2.5 to 3%, unless rents head north and remain elevated.

Property price outlook

Analysts from DBS Research team posits that property prices will likely moderate amid higher interest rates and tighter lending limits, but a significant drop is unlikely. A slowdown in property prices of between 1% and -3% in the Singapore property market in 2023 is likely, due to constrained buyer affordability amidst a modest economic growth outlook.

For wealthy property investors, the higher BSD will likely not have much of an impact, since they are likely attracted to Singapore as a safe haven and global financial hub. However, the latest changes to ABSD announced on 27th April might create some deterrence especially to foreign investors. The 30% increase in ABSD is the steepest increase in the 3 rounds of cooling measures thus far as the previous 2 rounds only had a moderating effect.

For Singaporeans buying a second property, the changes in BSD and ABSD are considerably muted compared to a foreign investor’s but nonetheless, increases the overall costs as well. They would need to gauge whether the huge capital outlay is worth their objective of buying the property and ensure that the mortgage burden does not weigh too heavily on household income.

Alternatives to Singapore property

For those with strong belief in the growth and resilience of the Singapore property market, there are many ways to partake in the sector without having to physically own an investment property.

Reits

If you have invested in stocks, you might have come across the term “Reits.” Reits are real estate investment trusts, a structure where investors can buy shares of companies which own or manage a portfolio of income-producing real estate. Reits trade on stock exchanges like shares and are popular with yield-hunting investors because they are required to distribute 90% of income earned as dividends to unitholders

Investing in Reits is probably one of the most accessible ways for one to invest in real estate due to its low entry cost. Individuals are able to purchase S-Reits through brokers like DBS Vickers with a minimum investment of 1 lot or 100 units. If the unit price of a particular S-Reit is $2, this means you will be able to invest in a portfolio of income-generating real estate assets for a reasonable $200 (excluding brokerage fees and tax).

Read more about the basics of Reits here

Property stock

Investing in property counters on the stock exchange is another way for investors to invest in the property market without buying real estate. These are companies that hold several properties and either lease them out or can choose to sell them.

One of the major differences between property stocks and Reits is that it is mandatory for Reits to pay out at least 90% of their net income after tax as dividends while it is largely up to the management of property counters to pay out dividends.

Some of the property counters may have their hands in other businesses as well, which can affect the overall valuation of the stock. Ensure that you understand the fundamentals of the company before you invest in one.

Property Exchange-traded Fund (ETF)

An ETF is a type of pooled investment fund that trades on a stock exchange. It seeks to track the performance of an underlying index. ETFs generally trades like a listed stock, and you can buy and sell them in the same way as stocks.

The advantage of investing in the property market via an ETF is that you do not need to stock-pick and it allows you to invest in a basket of Reits easily. You can even diversify into the property market in different regions and countries, allowing you to capture returns from countries that have higher-yielding properties.

Should you invest in Singapore property?

Given that property remains an attractive investment class in Singapore, many may continue their quest in acquiring an investment property here despite the high cash outlay, higher BSD and ABSD. Before buying a new property, it is best to take a hard look at your finances to ensure affordability, since property investment is a long-term financial commitment.

It will also make sense to weigh the risk, opportunity cost of paying a large capital upfront and compare with the alternative ways of investing in properties or other asset class instead.

Start Planning Now

Check out DBS MyHome to work out the sums and find a home that meets your budget and preferences. The best part – it cuts out the guesswork.

Alternatively, prepare yourself with an In-Principle Approval (IPA), so you have certainty on how much you could borrow for your home, allowing you to know your budget accurately.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?