Retire smart with SRS

![]()

If you’ve only got a minute:

- The Supplementary Retirement Scheme (SRS) is a voluntary scheme that can complement your Central Provident Fund (CPF) savings to better prepare you for your golden years.

- Receive tax relief for every dollar contributed to your SRS. The total personal income tax relief claimable in a year is S$80,000.

- Invest your SRS savings to achieve potentially higher returns for your retirement.

The life expectancy of Singaporeans is among the highest in the world at 82 for men and 86 for women in 2023.1

Essentially, a longer lifespan means requiring a longer stream of income to supplement your golden years, however, bearing in mind the risks that comes along with it – overspending, inflation, healthcare needs, to name a few.

CPF is a key pillar of Singapore’s social security system that helps Singaporeans and Permanent residents (PRs) set aside funds to build a strong foundation for retirement. Your CPF monies can also be utilized for housing and healthcare needs. While it is easy to know how much savings we have accumulated, it is not possible to predict our own life expectancy. That is why we have CPF LIFE, a longevity insurance annuity scheme that provides us with a steady stream of lifelong retirement income starting as early from age 65 (for members born in or after 1958).

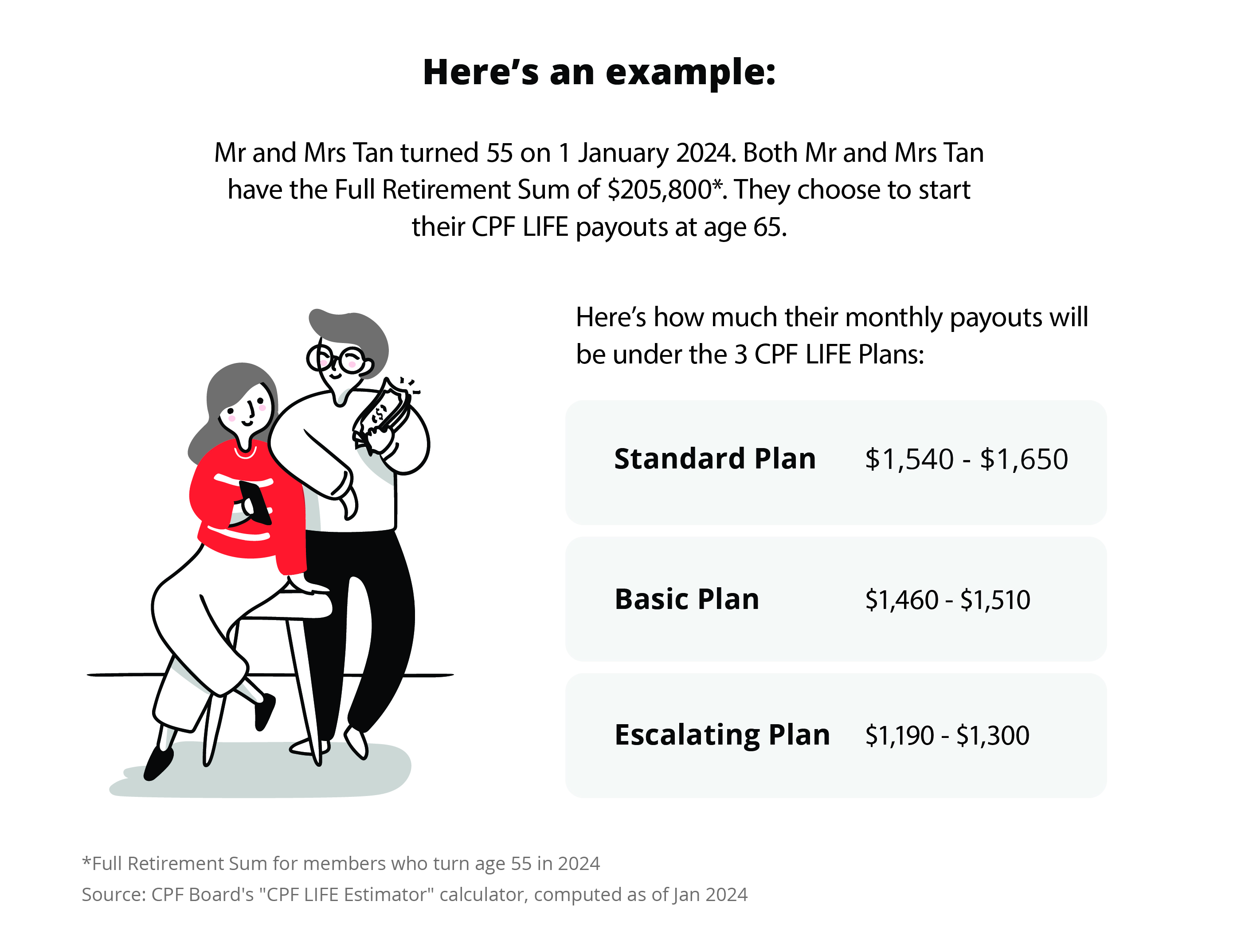

There are 3 types of CPF LIFE plans you can choose from:

- Standard Plan: Offers level monthly payouts.

- Basic Plan: Offers progressively lower monthly payouts when your CPF balances fall below S$60,000.

- Escalating Plan: Offers increasing payouts, payouts increase by 2% every year for life to address rising costs of living.

Build an additional retirement pot

The SRS is a voluntary savings scheme that complements your CPF savings for retirement. With SRS, you can build more savings on top of your CPF.

Here are 5 things to know about the SRS.

1. You can contribute any amount, as many times as you wish throughout the year

You can make your annual SRS contributions by:

- Putting in a lump sum by 31 December,

- Topping up as and when your cashflow allows, up to the cap, or

- Setting aside S$1,275 monthly to make full S$15,300 by 31 December.

Do note that the contributions are subject to a cap of S$15,300 for Singaporeans and PRs, and S$35,700 for foreigners. Foreigners have a higher SRS contribution limit as they are excluded from tax relief via CPF contributions.

Tip: The SRS is a useful retirement savings tool, particularly if you are a foreigner/non-PR, as you will not have CPF contributions. In addition, your employer can also contribute voluntarily to your SRS.

2. Enjoy tax relief

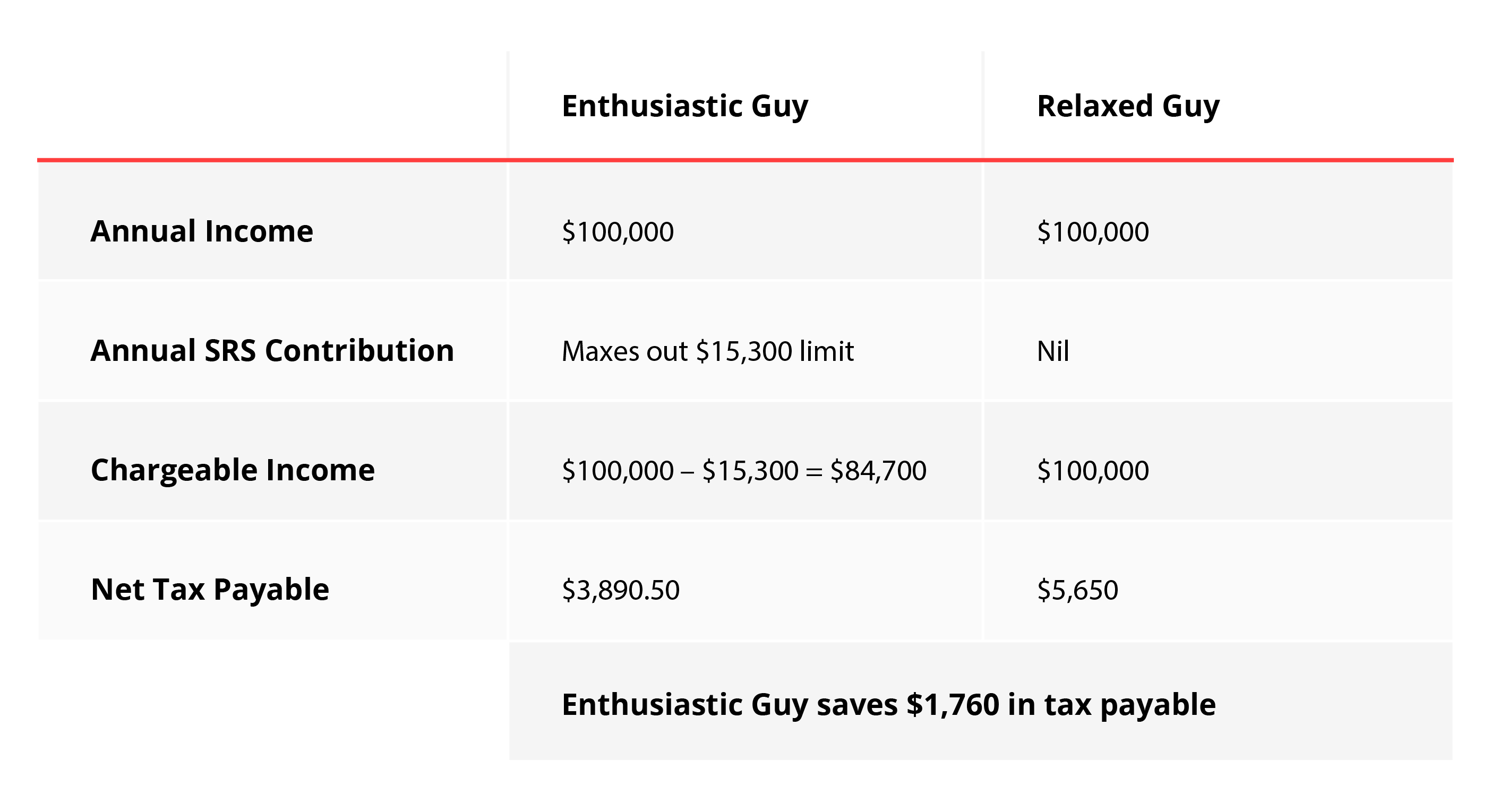

The SRS offers attractive tax benefits. Every dollar you contribute to SRS is eligible for tax relief. Your SRS contributions are subject to a cap on personal income tax relief of S$80,000 yearly. Put simply, it is a limit on the total amount of tax reliefs you can claim and it applies to the total amount of all tax reliefs claimed, including any relief on voluntary CPF contributions made. To qualify for tax reliefs in the following year of assessment, contribute to your SRS by 31 December yearly.

Here’s an example of how SRS can help you save on taxes2:

3. Investing your SRS funds

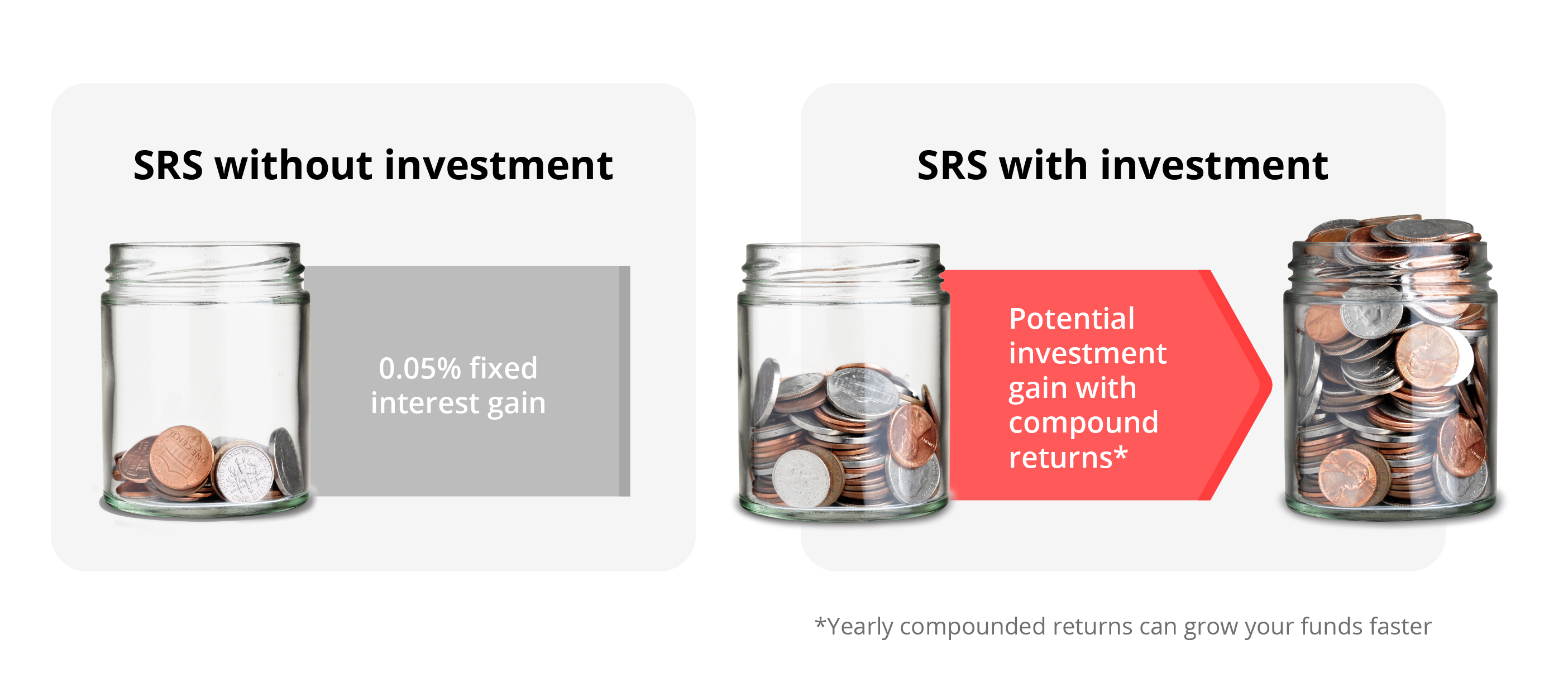

Unlike your CPF savings, your SRS monies cannot be utilized for housing and medical needs. While CPF offers interest rates of 2.5% p.a. (Ordinary Account) to 4% p.a. (for Special, MediSave, and Retirement Accounts), with additional interest rates for those age 55 and above, savings in your SRS account with the bank only earn you 0.05% interest p.a.

Rather than leaving your SRS funds idle, invest them to enjoy potentially higher returns and accumulate tax-free returns as well.

Make your SRS monies work harder for you by investing them in endowment plans, shares, exchange traded funds, real estate investment trusts, fixed deposits, Singapore Savings Bonds, and unit trusts.

4. Long-term savings with SRS

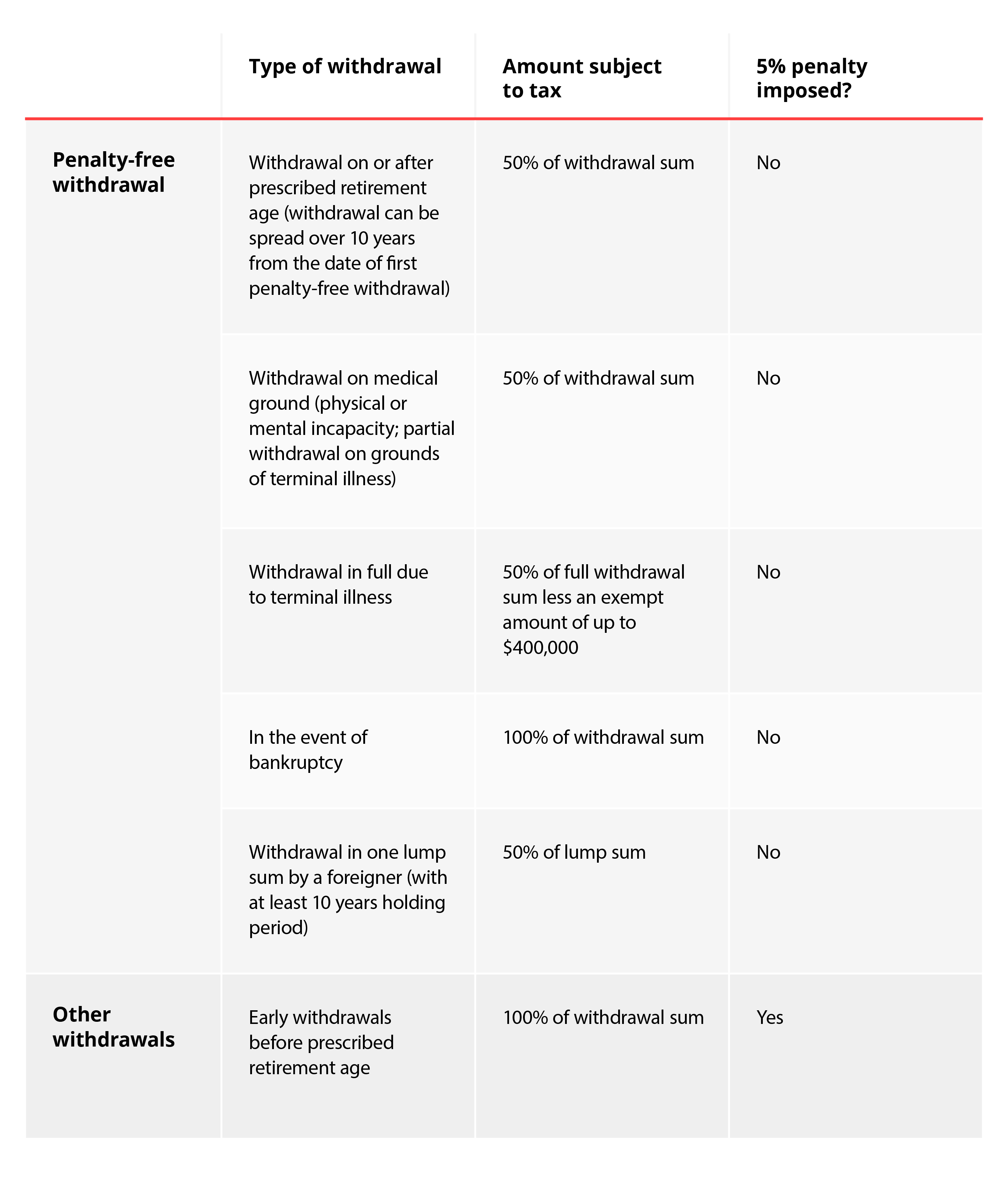

Since SRS is a voluntary scheme to encourage individuals to save for retirement, you need to have a long-time horizon when setting your monies aside. Therefore, any withdrawals made before the statutory retirement age (currently age 63, effective from 1 July 2022) will incur a 5% withdrawal penalty, and 100% of the amount withdrawn will be subject to tax.

The penalty will only be waived under certain circumstances including death, medical grounds, and bankruptcy.

Your statutory retirement age for penalty-free withdrawal is based on the statutory retirement age prevailing at the time of your first contribution. If you have already opened an SRS account and made your first contribution, any subsequent change in the statutory retirement age (e.g. up to age 65) will not affect you. When you withdraw at retirement, only 50% of the sum will be subject to tax. You can spread your withdrawals over a period of up to 10 years to potentially enjoy tax savings.

Tip: Evaluate your personal financial situation before making any SRS contributions. Ensure that these are funds that you can lock up for the long-term.

5. Opening an SRS Account

All Singaporeans, PRs, and foreigners who derive any form of income can make SRS contributions in the current year. You must be:

- At least 18 years of age

- Not an undischarged bankrupt

- Not having a mental disorder

- Capable of managing yourself and your affairs

SRS accounts are managed by the three local banks, including DBS. You can only have 1 SRS account at any point in time. You will not be allowed to open a new account if you previously had an SRS account which was closed after withdrawing all the monies due to the following reasons:

- Having attained the retirement age that was prevailing when you made your first SRS contribution

- On medical grounds.

1Worldometer, “Life Expectancy by Country and in the World (2024)”, Retrieved on 12 Jan 2024.

2IRAS, “SRS Contributions and Tax Relief”, Retrieved on 12 Jan 2024.

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Start planning for retirement by viewing your cashflow projection on DBS Plan & Invest tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?