Making sense of insurance documents

NAV TL;DR

If you don’t have time to read through the whole article, you can check out our short version below.

- Insurance documents might seem complex, but it is important to understand what you are purchasing.

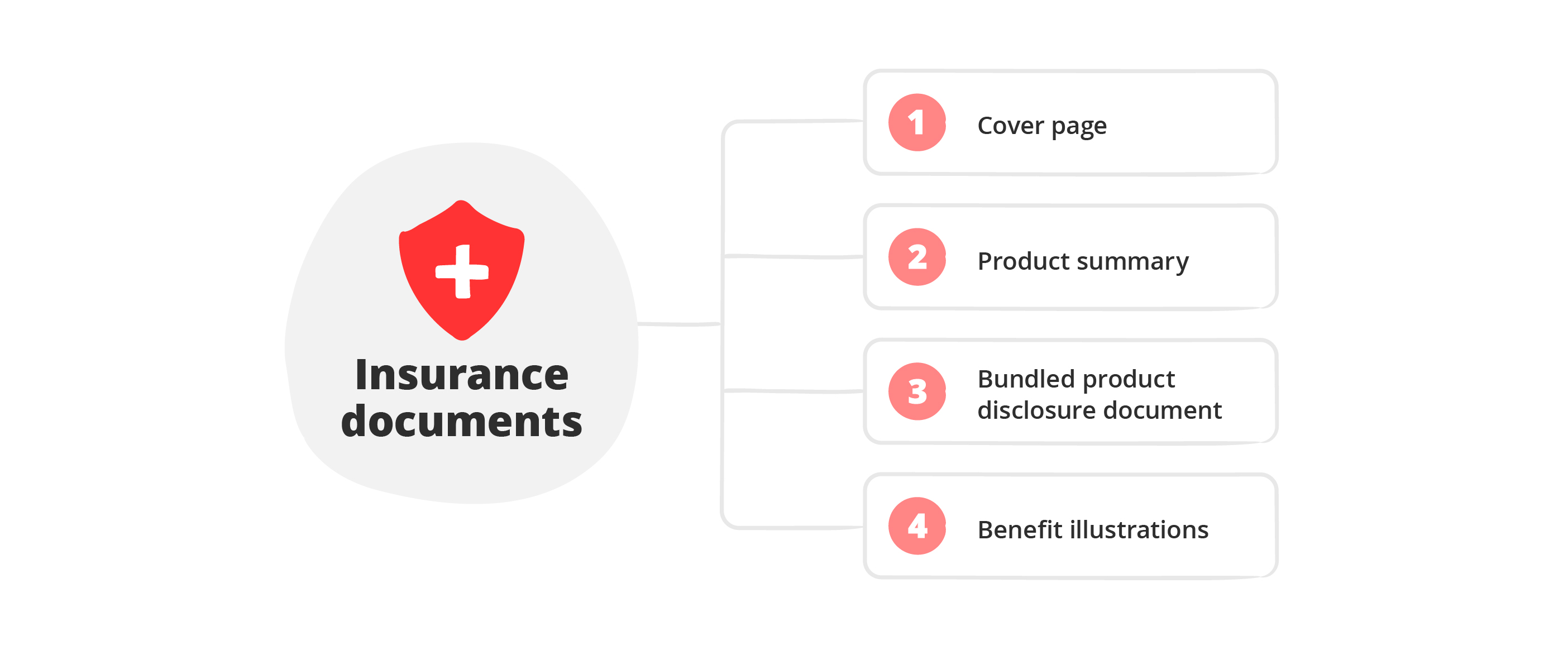

- You can have a good idea about the product benefits and exclusions by reading 4 key documents – the cover page, product summary, bundled product disclosure document and benefit illustration.

- Insurance is a long-term commitment so always ensure that you can afford the premiums for the policy tenure. Policyholders who surrender their plan prematurely are likely to incur losses.

![]()

Jenn had a rude shock when she realised that her savings-type plan had returned lower-than-expected when the policy matured last month. Not only were the payouts much lower, the terminal bonus was also not paid at maturity.

Yet, it was clearly stated in her policy plan that both the projected maturity values and terminal bonus were not guaranteed.

You could have heard of stories similar to Jenn’s or experienced the same situation. While a lot of effort has gone into making insurance policies more easily understood, it is no doubt a complex document for the man on the street. It is no wonder that many end up relying on their financial advisor to communicate the benefits and terms, when it should be our responsibility to make sense of them. Doing so can help us make better purchase decisions, as well as reduce the possibility of being led into buying unsuitable products due to misrepresentation.

Although there are different considerations for the various types of insurance, learning to decipher the following key sections of an insurance policy can help you have a clear idea of the benefits of the plan at a glance.

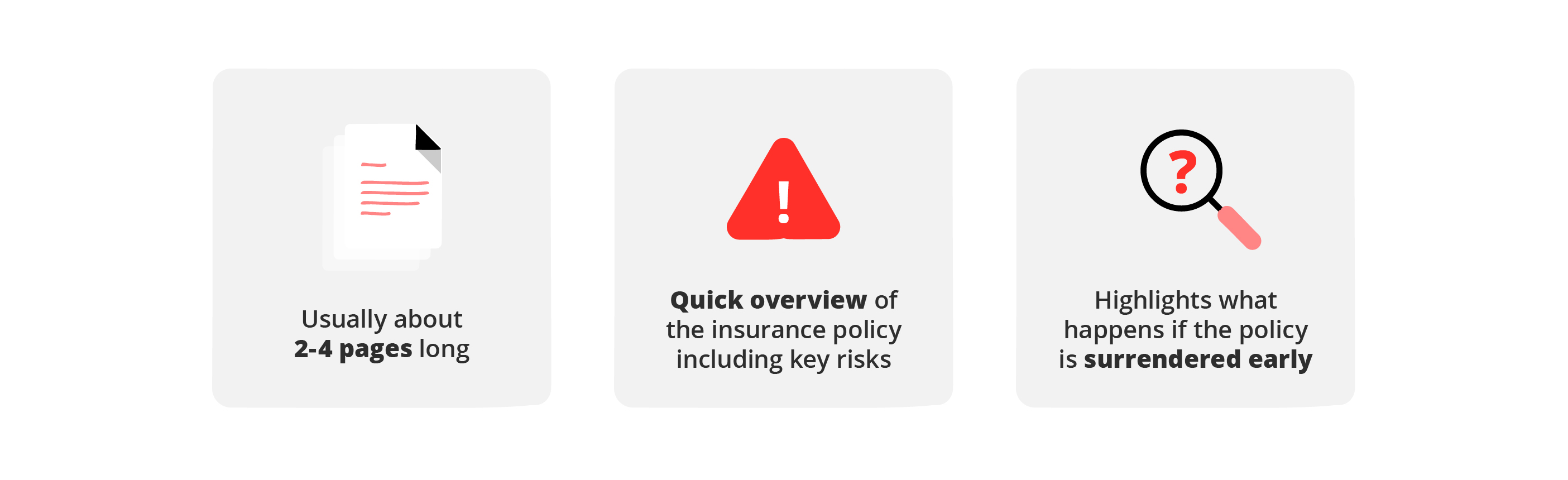

Cover page – A quick overview

The cover page, which is usually 2 to 4 pages long, gives a quick overview of the insurance policy including key risks. It also highlights what happens if the policy is surrendered early.

For a participating policy (an insurance plan that pays dividends to the policy holder), its historical performance, expenses of the participating fund and the expected yield to maturity (YTM) based on the illustrated investment rates of returns are provided.

For endowment plans, the YTM will be provided, while for whole life policies, the yield at surrender at age 65 or 40th policy year would be shown.

Product summary – Description of features

The product summary is a simple document that describes the features, benefits, fees and charges of the insurance plan you are buying.

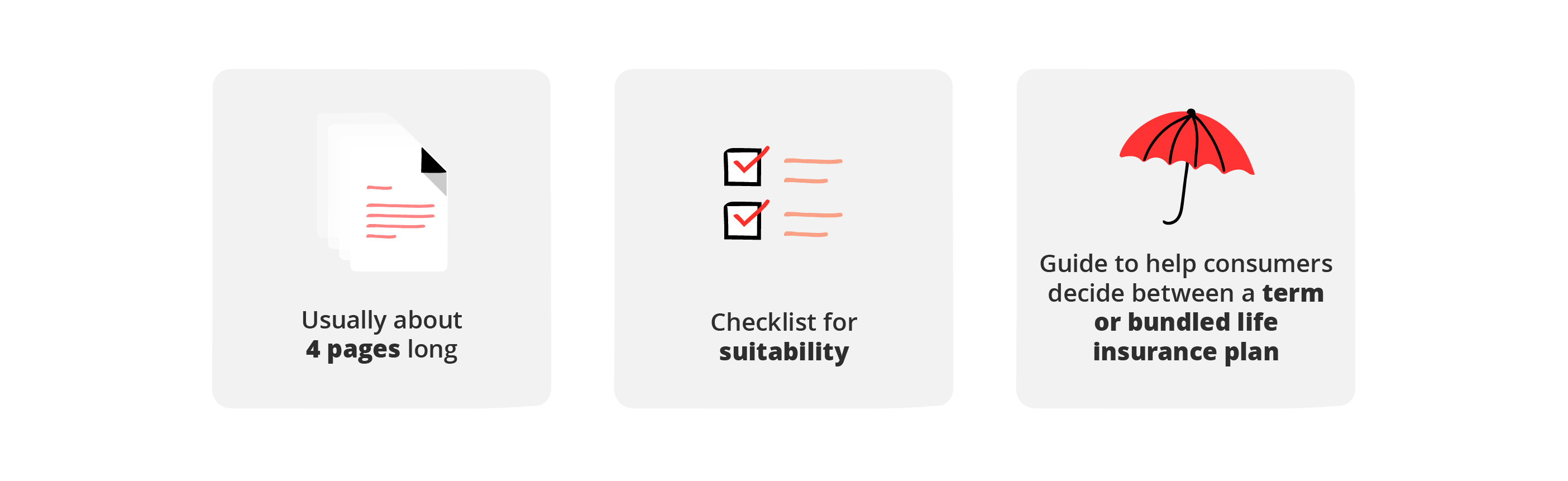

Bundled product disclosure document – Checklist for suitability

The bundled product disclosure is required for most participating life policies and non-participating life policies. It offers a checklist for consumers to decide if the product at hand is suitable for them and that he/she is aware of the choices available.

The document, that is usually about 4 pages long, seeks to help consumers decide if a term plan or a bundled life insurance is more suitable for them. It also provides a guide for consumers who want to just buy a term plan for protection.

You might have already heard of the often-used phrase – “buy term and invest the rest”. Some advisors and consumers are aware of the higher fees paid for bundled product, thus advocating for one to buy term for protection and investing the extra cash on their own. This is because term plans come with a lower premium, but they do not return any cash values. Comparatively, bundled products charge a higher premiums but there would be cash values and a potential return.

The document provides a comparison between the benefits of a bundled product with a $100,000 death benefit and a term plan. With the savings that typically come from buying a term policy, you can opt to invest the remaining funds yourself. The document shows a comparison if you can earn either a 0.5%, 2.5% or a 4% return on your own over the period of the policy.

Benefit illustration – Projection of payouts

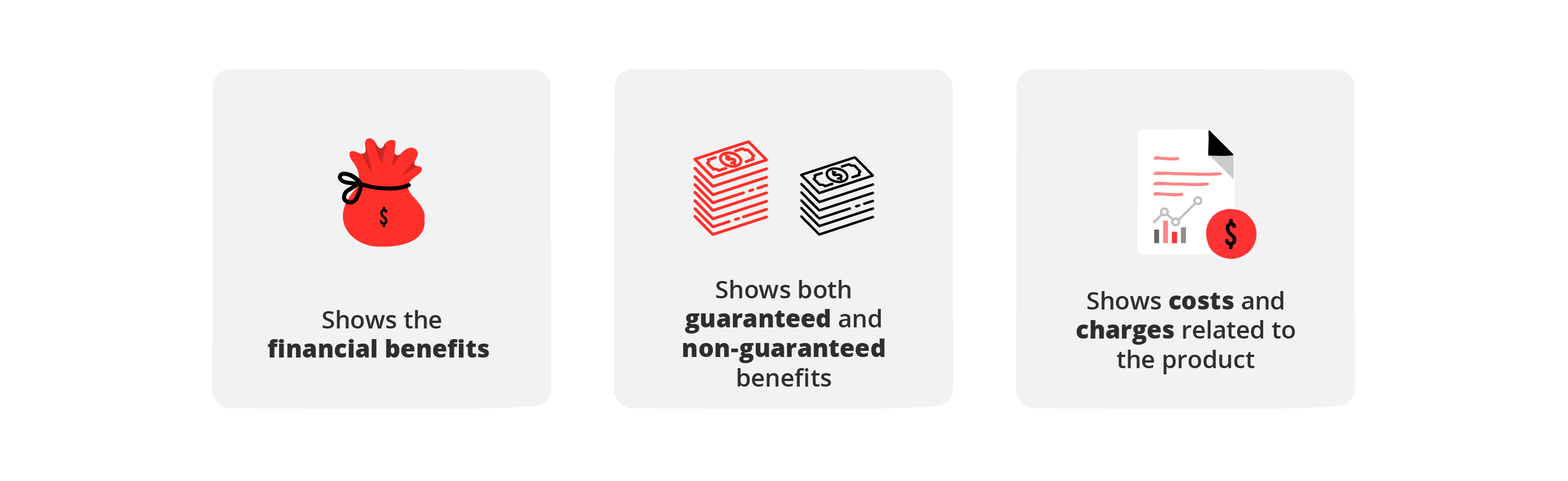

It is tempting for consumers to gloss over the benefit illustration of an insurance policy because of the cluster of numbers. Yet, this could have been the most important section since it shows the financial benefits you could receive if you buy the policy, surrender, make a claim or hold it till maturity.

The benefit illustration will show both guaranteed and non-guaranteed benefits, as well as the costs and charges related to the product. To illustrate the benefits and costs of the insurance plan, the insurer typically assumes two investment returns rates – 3% and 4.25% for endowment plans; 4% and 8% for investment-linked insurance products. Do note that these rates are used purely for illustrative purposes and do not reflect the real return rates of the policy.

These rates were set by the Life insurance Association (LIA) and do not reflect the lower and upper limits of the returns.

Before you commit

Since the projected returns in the benefit illustration do not represent real returns, one way for you to assess the product is to look at the guaranteed values since this is the amount the insurer is obliged to pay. You can compare this amount to see if it at least matches the total premiums paid.

You can also compare the potential returns of the insurance with other types of investment products, keeping in mind that every product comes with different risks. If you do not find the guaranteed returns attractive at all, it is perhaps better to buy a term plan for protection and invest your money on other products.

Some endowment plans offer a flexible cashback option that provides you with a cash sum during the policy term. For instance, there are plans that could give you 5% of the sum assured annually. While it might sound like an attractive offer that you are getting some “returns” every year, the truth is that the cashback is likely coming from the premium you paid and may negatively affect the maturity value.

Finally, insurance is a long-term commitment so always ensure that you can afford the premiums for the policy tenure. Policyholders who surrender their plan prematurely are likely to incur losses.

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Alternatively, check out NAV Planner to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?