A Guide on Customer Knowledge Assessment (CKA)

-

What is the purpose of a Customer Knowledge Assessment (CKA)?

The purpose of the Customer Knowledge Assessment (CKA) is to ascertain a potential investor's financial knowledge and experience to understand the risks and features of Unlisted* Specified Investment Products prior to any purchases made online or at the Bank's branch.*Unlisted Specified Investment Products refer to the following 2 Product Categories:

Product Category Examples of Unlisted Specified Investment Products A. Collective Investment Schemes (CIS) and Investment-linked Life Insurance Policies (ILPs)

B. Specified Investment Products which are neither listed nor quoted on a securities market or a futures market (excluding CIS & ILPs)• Unit Trusts; and/or

• Investment-linked Life Insurance Policies

• Currency-linked Investments;

• Structured Deposits;

• Asset-backed Securities & Structured Notes;

• Equity-linked Notes; and/or

• Foreign Exchange Margin Trading Line and Foreign Exchange Forward Contracts -

How often will I need to go through the Customer Knowledge Assessment (CKA)?

If you have been assessed to have attained a positive CKA outcome, the Bank will not be required to conduct a CKA on you when you buy the unlisted Specified Investment Product online during the one year period. Otherwise, the Bank will have to conduct a new CKA on you before allowing you to purchase an unlisted Specified Investment Product online during the one year period.The positive outcome of the CKA for any unlisted Specified Investment Product is valid for a period of one year from the date of the assessment.

After a year has elapsed from when the CKA was first conducted, the Bank will have to conduct a new CKA before allowing you to purchase an unlisted Specified Investment Product online. -

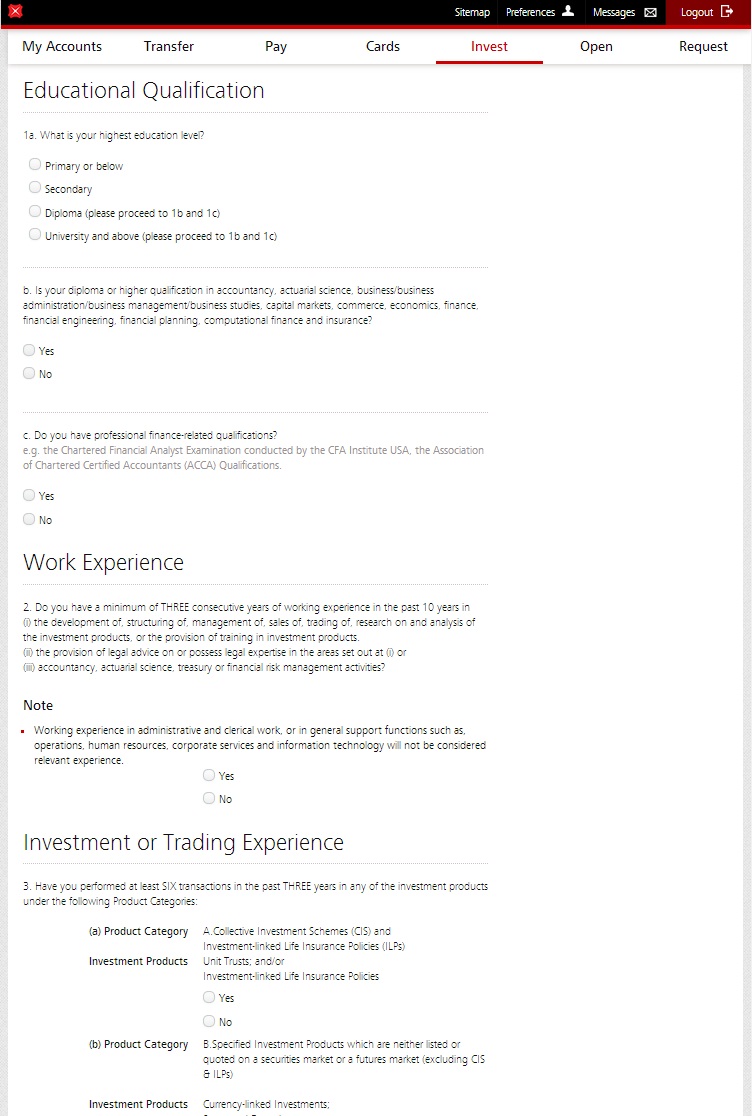

What are the questions under CKA?

There are 3 questions to be answered by the potential investor under CKA relating to the potential investor's (i) highest education attained; (ii) occupation in the past ten years; and (iii) investment experience in Unlisted Specified Investment Products.A sample of the questions to be answered by the potential investor is as follows:

-

How does a potential investor satisfy CKA?

A potential investor who satisfies any of the following may be assessed as possessing the knowledge or experience in an unlisted Specified Investment Product for the purpose of the satisfaction of the Customer Knowledge Assessment in the Specified Investment Product concerned:- You should hold a diploma or has higher qualifications in accountancy, actuarial science, business/business administration/business management/business studies, capital markets, commerce, economics, finance, financial engineering, financial planning, computational finance and insurance; or

- You should have a professional finance-related qualification e.g. the Chartered Financial Analyst Examination conducted by the CFA Institute, USA and the Association of Chartered Certified Accountants (ACCA) Qualifications;

- You should have a minimum of 3 consecutive years of working experience in the past 10 years in:

- the development of, structuring of, management of, sale of, trading of, research on and analysis of investment products , or the provision of training in investment products;

- the provision of legal advice on or possess legal expertise in the areas set out at (c)(i); or

- accountancy, actuarial science, treasury or financial risk management activities

- You should have invested in the following unlisted Specified Investment Products:

- For transactions in collective investment schemes (referred to as "CIS") and investment-linked life insurance policies (referred to as "ILPs"), the investor has transacted in CIS or ILPs at least 6 times in the preceding 3 years; or

- For transactions in Specified Investment Products which are neither listed nor quoted on a securities market or a futures market (excluding CIS and ILPs), the investor has transacted in any Specified Investment Products which are neither listed nor quoted on a securities market or a futures market (excluding CIS and ILPs) at least 6 times in the preceding 3 years;

Where the investor is assessed to not possess knowledge or experience in an unlisted Specified Investment Products, but subsequently demonstrates sufficient understanding of the features and risks of that Specified Investment product through financial education, the investor may be deemed to possess the knowledge to transact in that unlisted Specified Investment Product.

Glossary

- FAA Section 2(1): Interpretations "investment product"means - (a) any capital markets product as defined in section 2 (1) of the Securities and Futures Act; (b) any life policy; or (c) any other product as may be prescribed;

- "capital markets product" means any securities, futures contracts, contracts or arrangements for the purposes of foreign exchange trading, contracts or arrangements for the purposes of leveraged foreign exchange trading, and such other products as the Authority may prescribe as capital markets products;

- "life policy" has the same meaning as in the First Schedule to the Insurance Act (Cap. 142), but does not include any contract of reinsurance;

Insurance Act, First Schedule: Definitions related to life business "life policy" means any policy which -

- provides for the payment of policy moneys on the death of a person or on the happening of any contingency dependent on the termination or continuance of human life;

- is subject to payment of premiums for a term dependent on the termination or continuance of human life;

- provides for the payment of an annuity for a term dependent on the termination or continuance of human life; or

- is a combination of any of the above. An accident and health policy that provides for the payment of policy moneys on the death of a person is not a life policy.

- FAA Section 27: Recommendations by licensed financial advisers

- No licensed financial adviser shall make a recommendation with respect to any investment product to a person who may reasonably be expected to rely on the recommendation if the licensee does not have a reasonable basis for making the recommendation to the person.

- For the purposes of subsection (1), a licensed financial adviser does not have a reasonable basis for making a recommendation to a person unless -

- he has, for the purposes of ascertaining that the recommendation is appropriate, having regard to the information possessed by him concerning the investment objectives, financial situation and particular needs of the person, given such consideration to, and conducted such investigation of, the subject-matter of the recommendation as is reasonable in all the circumstances; and

- the recommendation is based on the consideration and investigation referred to in paragraph (a).

- Where -

- a licensee, in making a recommendation to a person, contravenes subsection (1);

- the person, in reliance on the recommendation, does a particular act, or refrains from doing a particular act;

- it is reasonable, having regard to the recommendation and all other relevant circumstances, for the person to do that act, or to refrain from doing that act, as the case may be, in reliance on the recommendation; and

- the person suffers loss or damage as a result of doing that act, or refraining from doing that act, as the case may be,

- In this section, a reference to the making of a recommendation is a reference to the making of a recommendation expressly or by implication.

- This section shall not apply to any licensed financial adviser or class of licensed financial advisers in such circumstances or under such conditions as may be prescribed.