5 tips for first-time home buyers

![]()

If you’ve only got a minute:

- Carefully plan your budget by considering immediate costs like downpayment and future expenses such as monthly mortgage repayments. Explore government subsidies and grants to maximise affordability.

- Be mindful of hidden costs and evaluate loan options between HDB and bank loans based on interest rates, maximum loan amounts and repayment flexibility to make an informed decision.

- Prioritise your preferences when selecting your home by considering factors like proximity to your workplace, public transportation, and family’s needs, as well as the potential trade-offs between accessibility and affordability.

![]()

Buying your first home is a huge step into adulthood. It means moving out of your parents’ place and into your own.

Since your new home is likely one of the most expensive purchase in your life time, it is important to carefully think about the finances involved in your home buying process. The last thing you’d want is to be blindsided by unexpected costs.

Whether you’re considering a built-to-order HDB Flat (BTO), resale flat or private property, here are some considerations and solutions to help you navigate your home buying journey.

1. Types of property available

The cost of your home is greatly dependent on the type of property you choose.

Here are 3 common property types in Singapore:

- Public housing: HDB flats

- Hybrid of public-private housing: Executive condominiums (ECs)

- Private property: private condominiums, apartments, landed houses

Your eligibility depends on a few things, including your age and whether you’re purchasing the flat with someone else.

You can check your eligibility status for various HDB types here.

2. Plan your budget wisely

| Once you have decided on a property type and price range, it’s time to move on to the practical monetary considerations. | |

|---|---|

| Immediate costs |

|

| Future costs |

|

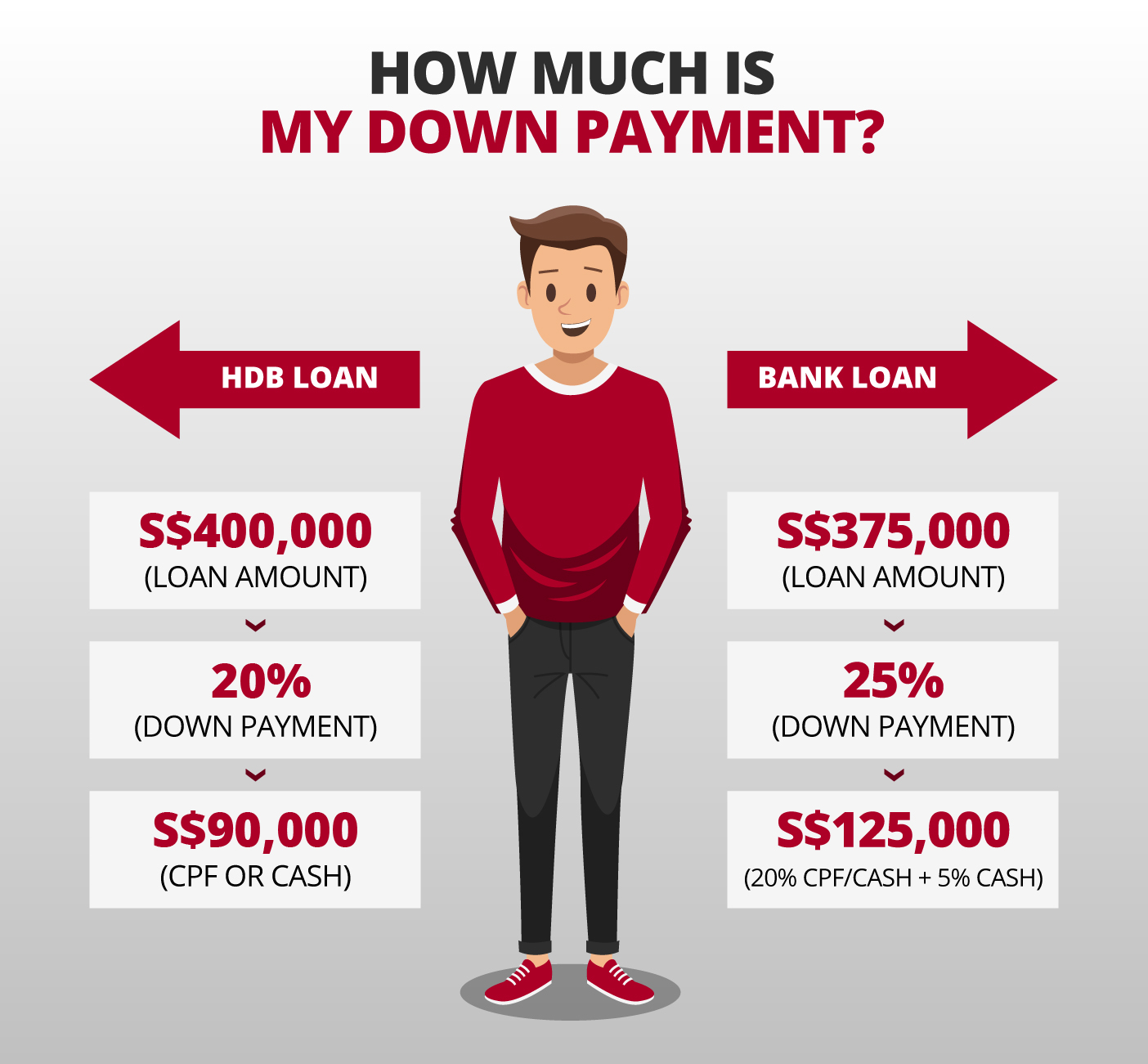

For many first-time home buyers, the downpayment (immediate) is the biggest financial concern.

| HDB Loan | Bank Loan | |

|---|---|---|

| Downpayment | At least 20% of the purchase price, which can be paid in full using your CPF Ordinary Account (OA), with cash, or a combination of both. | 25% of the purchase price, with 5% payable in cash and the remaining 20% payable in cash or your CPF OA savings. |

Let’s take a S$500,000 HDB flat as an example.

If you already a property in mind and know its price, you can use the DBS MyHome planning tool to find out the downpayment needed for your dream home. Otherwise, you can use it to find out your property price range.

You can also get an estimate of the loan that HDB or the banks will grant to you. This will be based on your (and your spouse’s) gross monthly income and existing financial commitments (if any).

The best time to get this estimate is before your search begins as it helps you filter for properties that are within your affordability.

Consider getting an In-Principle Approval (IPA) as it determines the maximum loan amount you’re eligible for.

Mortgage repayment

Unlike the minimum down payment which is quite simple to calculate, the monthly repayment on your mortgage is more complex since it largely depends on the loan amount and tenure you choose.

For example, if you’re buying a S$500,000 HDB flat with your partner (25-year tenure - bank loan), you can expect to pay about S$1,928* every month, based on a 3.75% loan rate.

If you decide to shorten the loan tenure to 15 years, the monthly repayment goes up to S$2,727*. With a larger cash outlay, you might find yourself cash-strapped during unforeseen situations.

*Numbers derived from Repayment calculator

Government subsidies and grants

For HDB flats, do compare the various government subsidies and grants available as it can lead to significant savings.

Read more: What are the housing grants available in Singapore?

3. Property location

Location is the one of the most important factors when choosing your home. Here are some considerations to take note of.

Distance from your workplace: You might want to consider somewhere nearer to your workplace. For example, the commute between Ang Mo Kio and Changi Business Park can take up to 2 hours.

Distance from the MRT station: The proximity of your home to public transportation (MRT station/bus terminals) also has a large impact on your daily life as it saves you time and effort in commuting. They do typically cost more due to the convenience.

Distance from your parents: Staying within 4km of your parents qualifies you for the Proximity Housing Grant (PHG). But chances are, our parents stay in mature estates – where new BTOs and resale flats could be pricier.

Here’s how some first-time homeowners have gotten the most out of the accessibility vs affordability trade-off:

- Buy smaller units, and then upgrade as their family expands

- Purchase properties in non-mature estates. Based on the Feb 2024 BTO sales launch, you would have paid at least S$451,000 for a 4-room BTO in a mature estate (Bedok), and S$300,000 for one in a non-mature estate (Choa Chu Kang).1

Buying a property in a non-mature estate compared to a mature estate offers approximately 33.48% discount based on the prices from the Feb 2024 BTO sales launch.

4. Additional costs to budget for

There’s a whole range of fees and charges that apply to home buyers. If you’re getting a BTO or flat directly from HDB, do take note of:

- Property valuation reports,

- Buyer stamp duty fees,

- Property taxes,

- Home or fire insurance fees.

If you’re thinking about resale flats, these are some of the other costs you’ll have to factor in:

- Property agent commissions,

- Fee to process the option to purchase (OTP)

- Higher renovation costs.

- Cash over valuation

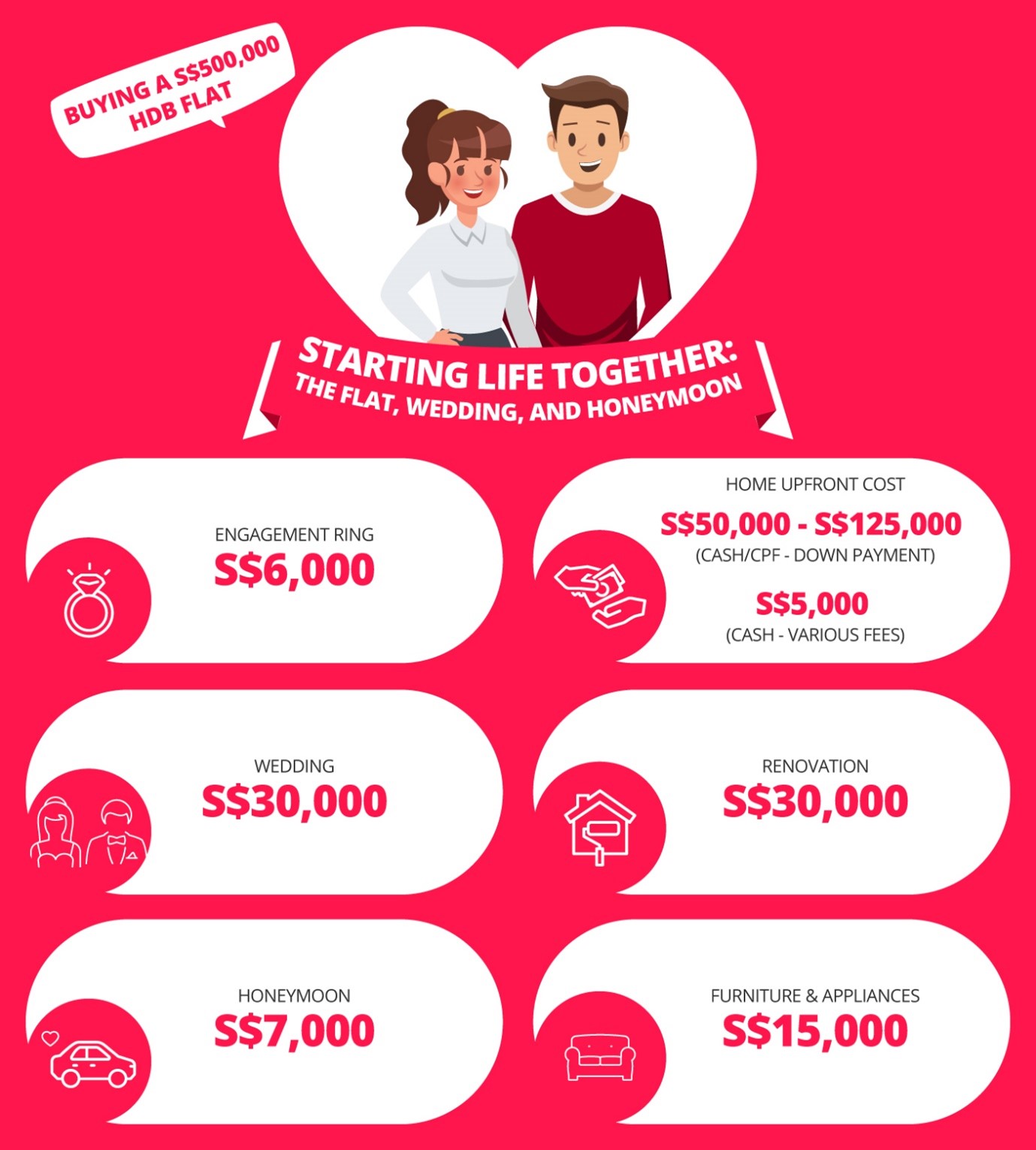

For couples, home purchase often coincides with other significant expenses like marriage, honeymoon and planning for a baby.

Other expenses include renovating, furnishing and buying electronics and appliances for your new home.

You’ll also want to be prepared for the financial responsibilities of utilities, groceries, maintenance, and more, on top of the monthly mortgage.

These added costs will likely impact your finances in the initial years of moving into your new home.

5. HDB loans vs bank loans

Interest rates for HDB loans are fixed at 2.6% p.a. (0.1% above the CPF Ordinary Account interest rate) for the entire loan tenure, providing stability and predictability for your monthly repayments.

Bank loan interest rates, on the other hand, are based on the interest rate packages offered by banks and they can be either fixed or floating. The floating rates fluctuate and can significantly decrease or rise over time. Currently, bank loan interest rates are higher (close to 3% p.a. or more).

Read more: Fixed or floating home loan – which is better?

Here are some differences between the 2 types of loans.

| HDB Loan | Bank Loan | |

|---|---|---|

| Maximum loan amount | Up to 80% of the purchase price for new flats. For resale flats, it is 80% of the resale price or market valuation (whichever is lower). | Up to 75% of bank valuation or purchase price (whichever is lower). |

| Use of CPF-OA savings | You must use the available savings in your CPF-OA for the purchase of the flat before an HDB housing loan is granted for the remaining amount. However, you have the flexibility of leaving up to $20,000 in your OA for future needs. |

Up to 75% of bank valuation or purchase price (whichever is lower). |

- The loan to value limit (LTV) for HDB is higher compared to a bank, which means you can borrow more for a HDB loan (80%) than a bank loan (75%).

- Lower downpayment for HDB loan – 20%, higher downpayment for bank loan – 25%.

- HDB loans allow you to pay for your downpayment fully with CPF monies, whereas for bank loans, 5% of the downpayment must be paid in cash, and the remaining 20% with cash or CPF.

- There is no early repayment penalty for HDB loans, but a amount, subject to the terms of the loan ) with a bank loan if it is within the locked-in period (typically 1 to 3 years).

The maximum home loan you can borrow depends on your:

- Loan-to-Value ratio (LTV)

- Total Debt Servicing Ratio (TDSR)

- Mortgage Servicing Ratio (MSR)

The Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR) are in place to prevent you from committing to monthly repayments that are higher than what you can handle.

Read more here: What you need to know before getting a home loan

Interest rates alone should not be your only criteria when looking at a home loan package. Here’s what else you should look out for when comparing loan packages:

- Differences in fees

- Charges for early repayment

- Interest rate type (Fixed rate or floating rate)

- Loan tenure

- Extras such as free legal and valuation subsidies, and in-built home loan insurance

Start Planning Now

Check out DBS MyHome to work out the sums and find a home that meets your budget and preferences. The best part – it cuts out the guesswork.

Alternatively, prepare yourself with an In-Principle Approval (IPA), so you have certainty on how much you could borrow for your home, allowing you to know your budget accurately.

Sources:

1HDB, “Feb 2024 BTO Flat Supply and Pricing Details’. Retrieved 21 Mar 2024.

2CPFB, “3 differences between an HDB loan and a bank loan”. Retrieved 21 Mar 2024.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?