How CPF LIFE can help in your retirement

![]()

If you’ve only got a minute:

- The CPF Lifelong Income for The Elderly (CPF LIFE) Scheme is a national annuity scheme that provides monthly retirement payouts for as long as you live.

- There are 3 CPF LIFE plans to cater to different retirement needs – The Basic plan, Standard plan and Escalating plan.

- You can increase your CPF LIFE payouts by topping up your CPF accounts or deferring the payout date.

![]()

The CPF Lifelong Income for The Elderly (CPF LIFE) Scheme is a national annuity scheme that insures you against running out of your retirement savings by offering the certainty of lifelong monthly payouts.

Many of us may have large amounts of savings in our CPF accounts, but do we know how much of our accumulated wealth can last us during our retirement? It’s hard to gauge - spend too much too soon and we might not have enough if we live longer than we expect; spend too little and we might deprive ourselves from fully enjoying our retirement. This is a major dilemma.

Thanks to advancement in technology and healthcare, we are likely to live longer than previous generations. In fact, Singaporeans have one of the highest life expectancies in the world. Therefore, we need to be financially prepared and make sure that our savings and assets will not be depleted before we run out of breath.

This is where CPF LIFE comes in - it gives us peace of mind in retirement by providing us with a monthly payout no matter how long we live.

Here are 7 things you need to know about CPF LIFE.

1. How does CPF LIFE provide payouts for retirement?

When you join CPF LIFE, the premium for your CPF LIFE plan will be paid with CPF Retirement Account (RA) savings. Generally, this premium goes into the Lifelong Income Fund which will generate the CPF LIFE monthly payouts for life.

With the CPF LIFE scheme, you will continue to receive monthly payouts even if your premium is used up.

2. Which CPF LIFE Plan should I choose?

There are 3 CPF LIFE plans to cater to different retirement needs:

Everyone’s retirement needs and expectations are different - ask yourself what kind of retirement income you would need.

If you are worried about the cost of living going up over time, you may need a retirement income that increases every year. The Escalating Plan could be more suitable as the payouts increase by 2% each year to protect against inflation. However, do note that the initial payout will be lower by 20% compared to that of CPF LIFE Standard Plan. So you need to consider if you can make do with the Escalating Plan’s initial lower payouts.

Both the Standard Plan and Basic Plan provide monthly payouts that are relatively level. For the Basic Plan, the monthly payouts are lower but its bequest (monies due to beneficiaries upon the member’s death) is higher than that of the Standard Plan, up to about age 90.

For the CPF Life Basic Plan, only about 10-20% of your RA savings will be deducted as CPF LIFE premium when you join CPF LIFE. The monthly payouts are paid from your RA till about age 90. Thereafter, the payouts will be paid out from the CPF LIFE Lifelong Income Fund. This explains why the bequest is higher under the Basic Plan as the interest portion in your RA will form part of the bequest amount. The bequest under the other 2 plans is lower as the interest in the Lifelong Income Fund will not be included.

All 3 plans will give a payout for as long as you live, although the payout and bequest amounts will be different. The key to choosing a suitable plan is to work out how much you will need during retirement. Other considerations include how much bequest you want to leave your beneficiaries, and how long you think you can live.

Read more: The importance of Estate Planning

3. How much money will I get monthly under CPF LIFE?

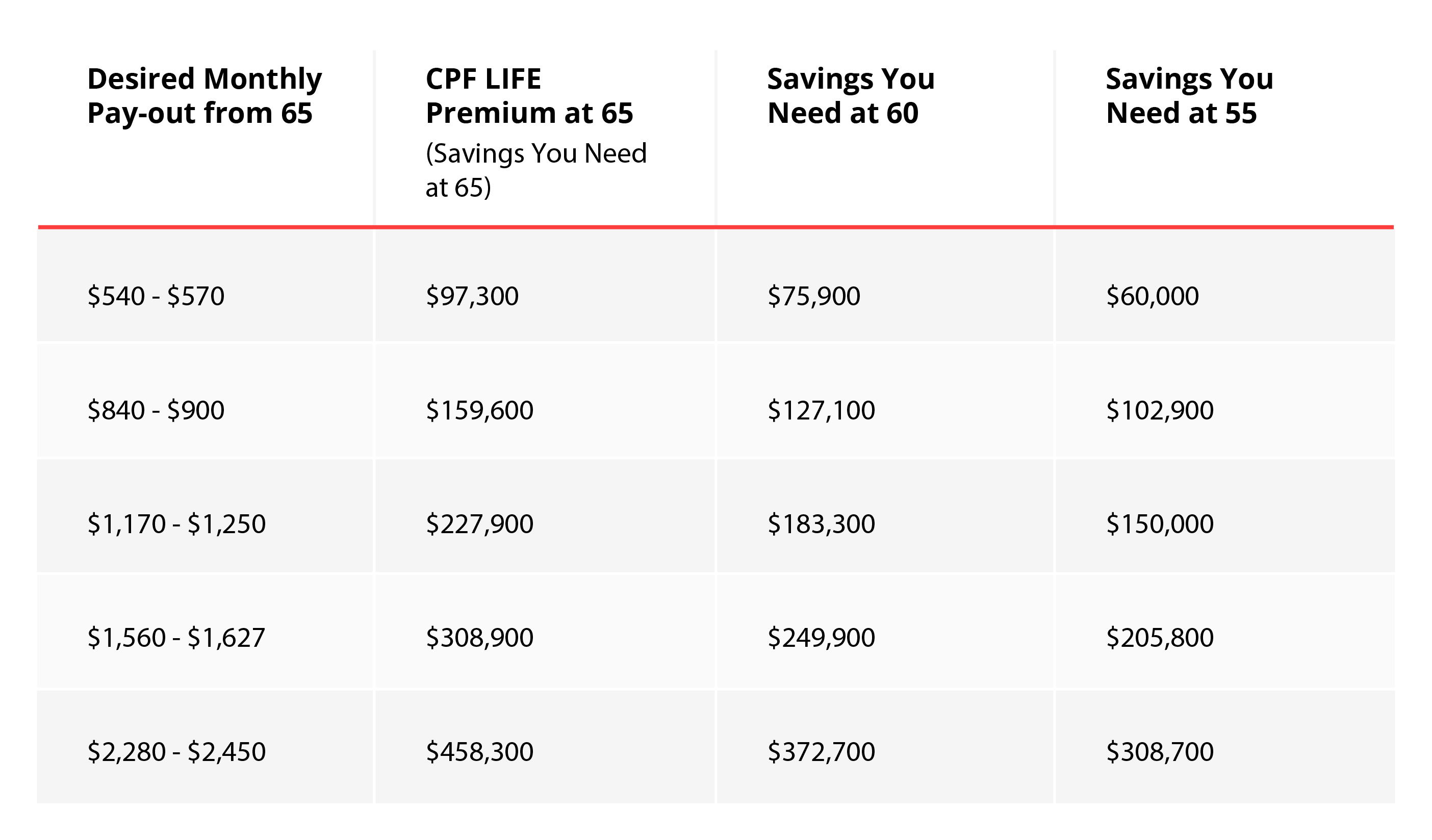

The amount of monthly payouts that you will receive will depend mainly on how much you have in your RA when you join the scheme and which CPF LIFE Plan you choose. Generally, the more savings that you use to join CPF LIFE, the higher your payouts will be.

As an indication, you will need S$227,900 in your RA at 65 to receive a monthly payout of S$1,170 - S$1,250. For the same payout, a much smaller sum of S$150,000 is required if you set it aside in your RA at an earlier age of 55.1

This is because CPF interest rates of up to 6% will help you grow your savings through compound interest.

Source: CPF Board1

Note that these monthly payouts are estimates based on the CPF LIFE Standard Plan for members who turn 65 in 2034 computed as of 2024. Payouts may also be adjusted to account for long-term changes in interest rates or life expectancy. Such adjustments (if any) are expected to be small and gradual.

Not sure how much you’d need? You can use the CPF LIFE Estimator to help you find out which plan is right for your retirement needs.

4. How can I increase my CPF LIFE monthly payouts?

There are 2 ways for you to increase your CPF LIFE payouts.

i) By topping up your RA

You can increase your payouts by making use of the Retirement Sum Topping-Up (RSTU) Scheme to top up your Special Account (SA) (for recipients below age 55) or RA (for recipients aged 55 and above).

The money in your combined CPF accounts allows you to earn interest of up to 6% per year, if you are age 55 and above. While savings in your SA and RA earn a base interest of 4%, the Government pays extra interest on the first S$60,000 of your combined balances (capped at S$20,000 for Ordinary Account (OA)).2

Please refer to the details on extra interest in the table below.

|

Age |

Extra interest (capped at S$20,000 for OA) |

|---|---|

| Below 55 years old | 1% per annum on the first S$60,000 |

| 55 years old and above | 2% per annum on the first S$30,000, 1% per annum on the next S$30,000 This means that you earn up to 6% on your retirement savings. |

ii) Defer your CPF LIFE payouts

If you prefer to continue working after your retirement age or do not need your payouts yet, you have the option of deferring them up to the age of 70. This allows your CPF LIFE payouts to grow by up to 7% for each year deferred.

This will give you up to 35% increase in payouts as your CPF savings will accumulate more interest. The latest age you can start your payouts is 70, after which they will automatically begin.

You will always get back at least the amount of money that you put into CPF LIFE. If you pass away before your premium is used up, the balance will be given to your beneficiaries.

Read more: 9 CPF ‘hacks’ to grow your nest egg

5. Is there a way to supplement CPF LIFE for my retirement?

Of course! There are many ways to supplement your retirement income. Private annuities, insurance plans and investments are just some products you can look at. However, it is key that you have a clear idea of your risk appetite and time horizon as you take on these products to supplement your retirement income.

At the same time, you’d also need to factor in the amount of money you can set aside for these vehicles at a time when you do not have a recurring monthly income.

Retirement insurance/annuity

There are private annuities that are basically like CPF LIFE but offered by insurers. If the budget fits, you may consider investing such a plan and enjoy 2 retirement income streams. There are also retirement income insurance plans that you can look at.

A retirement insurance cover can provide some flexibility in terms of the income amount and desired retirement age to commence payments over a chosen period. Most of these plans allow customers to select income payout periods, such as 5, 10, 15 and 20 years starting from age 55.

Using a retirement insurance can supplement your CPF LIFE as an alternative income source in your golden years. In fact, it is important to think about your retirement in phases and plan accordingly to decumulate using a time-segmented strategy.

The main advantage of a retirement income insurance like RetireSavvy is its flexibility. It allows you to defer your retirement age and adjust your income payout period. In addition, the inclusion of non-guaranteed components on top of guaranteed income can provide potential upside for a higher payout, depending on the performance of the fund in which the premium is invested in.

Some retirement insurance plans also offer additional coverage for long-term care – an important component for retirement years.

Find out more about: RetireSavvy

Investments

Investments continue to be an important part of building wealth and income during your retirement. Any kind of investment could work to supplement your CPF LIFE plan if it is stable enough to provide steady income.

For example, you can consider dividend investing, buying risk-free bonds like the Singapore Savings Bonds, investing in Real Estate Investment Trusts (Reits) or fixed income exchange-traded funds (ETFs).

Not sure on how to DIY your investments? A roboadvisor like digiPortfolio can help as well.

Read more: I’m ready to invest, how can I start?

Find out more about: Retirement digiPortfolio

6. Consider monetising your home to increase CPF LIFE payouts

Both the Lease Buyback Scheme (LBS) and the DBS Home Equity Income Loan will be able to help you monetise your homes to receive a stream of CPF LIFE payouts in your retirement years, while continuing to live in it.

If you own a HDB flat and are eligible, the government LBS can help you unlock your property value in preparation for retirement. Under the LBS you can sell part of your flat's lease to HDB and choose to retain the length of lease based on the age of the youngest owner. Part of the sales proceeds will be used to top up to the CPF Full Retirement Sum (FRS, S$205,800 in year 2024) if your balance falls short. This translates to higher CPF LIFE payouts.

If you own a private home and are between the ages of 65 and 79, you can consider the DBS Home Equity Income Loan. If you are a Singapore citizen or PR, it allows you to borrow against your fully paid private residential property to top up your CPF RA savings which will be used for CPF LIFE.

Key features include no monthly loan repayments, with the loan amount and accrued interest payable only at loan maturity, fixed interest rate of 2.88% p.a. throughout the loan tenure, and the flexibility to sell the property anytime and repay the loan with no penalty.

The minimum loan amount would be the amount needed for you to top-up your CPF savings to meet the FRS for your cohort. The maximum amount that can be borrowed is the amount required to top-up to the prevailing CPF Enhanced Retirement Sum (ERS, S$208,700 in 2024).

Read more: Helping your parents plan for retirement

Find out more about: DBS Home Equity Income Loan

7. How is CPF LIFE different from the Retirement Sum Scheme (RSS)?

Both the CPF LIFE and RSS are annuities that provide payouts for your retirement. The main difference between the 2 is that under the RSS, your payouts will stop once your RA savings are depleted. For CPF LIFE, you continue to receive payouts no matter how long you live.

For those who were born before 1958, they would automatically join the RSS. However, they have the option to switch to CPF LIFE at any time before turning 80. Most of us will be automatically enrolled into CPF LIFE.

Read more: CPF LIFE or Retirement Sum Scheme?

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Start planning for retirement by viewing your cashflow projection on Plan & Invest tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Source:

1CPF Board, Receive lifelong monthly payouts with CPF LIFE, retrieved 16 Jan 2024.

2CPF Board, CPF interest rates, retrieved 16 Jan 2024.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?