Planning for you (children) and me

By Lorna Tan

It is easy to understand why most parents place their children’s needs ahead of theirs. However, this is one of the main reasons why they end up delaying their retirement planning.

Despite concerns on outliving their nest egg and funding their healthcare in their old age, many parents still put their children’s education and development needs first.

As a result, these parents may face a situation where they have fewer financial resources to plan for their golden years. To make up for the trade-off, they work longer, lower their retirement lifestyle expectations and/or turn to their kids to fund their future expenses. In the process, their children become the next sandwich generation, having to care for their parents and their own kids. And the cycle continues.

Here are six things for parents to consider when they plan for retirement.

Placing equal emphasis on kids and retirement

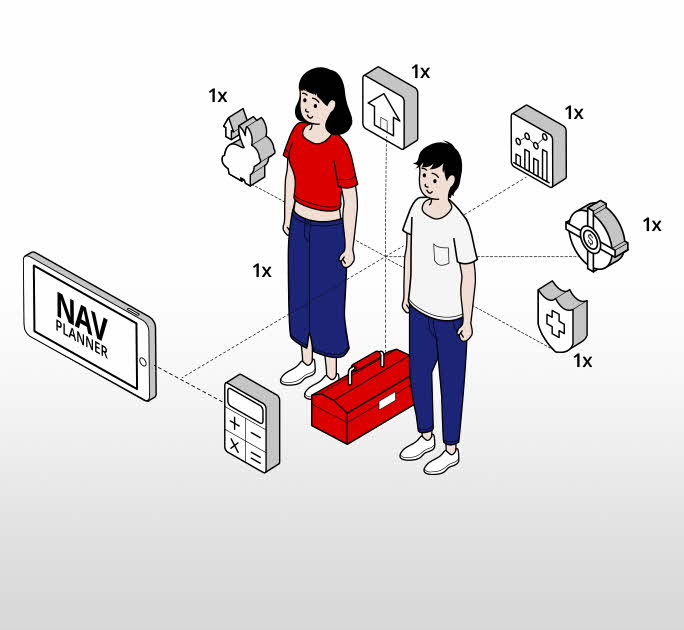

Planning for our kids’ education and our retirement need not be mutually exclusive. Both can go hand in hand. Just like young Timmy and his mother, Adithi Po in the POSB Po family retirement campaign, they realised they could plan for both goals at the same time.

It is not selfish for parents to consider their own retirement needs early. In fact, planning for our future as we plan for our kids’ needs will lead to more sustainable outcomes. And when we can take care of our own retirement, our kids will be less burdened financially and together, we can live more.

Besides, relying solely on our kids for our retirement is not sustainable, what with the rising cost of living, healthcare costs and the volatile market environment. Better to be financially independent and rely on ourselves.

Set up a sound retirement plan

Set up a comprehensive financial plan which includes covering your protection needs, the distribution of your assets, as well as planning for your retirement. To make realistic projections, visualise your retirement lifestyle and quantify your likely income flows and expenses for your needs and wants in your golden years.

Continue to monitor your plan regularly and made necessary adjustments. It is important to review as there will always be changes in our financial circumstances. By doing this while we are still employable, we have more opportunities to learn a new skillset and can decide to work longer, if the need arise.

Commitment to long-term investing

It is never too early to set up a retirement plan. The earlier we start, the longer is the time horizon for our funds to compound and grow over time. It helps to give us a long-term investing perspective while we are working towards short and mid-term goals like buying the first home, annual vacations and children’s education. At all times, do not to lose sight of our long-term financial needs.

In addition, knowing that we have time in the market increases our confidence that we should be able to ride out the volatility in the investing environment. We can ignore the noise in the market and minimize adverse knee-jerk reactions.

Power of compounding

Thanks to the power of compounding, the benefits of investing early outweighs that of investing later. The younger you are when you start investing, the more you will benefit from compounding. Let’s say Daisy starts investing at age 25, socking S$200 a month in a portfolio earning 8% pa, while Ben begins investing in the same portfolio at age 45 but puts in twice as much money, that is, S$400 a month.

At age 65, both will both have invested a total of $96,000, but Daisy’s investment would have grown to nearly $700,000, while Ben’s investment would be worth only $235,600. The reason why Daisy’s investment has grown so much more than the other – even though both invested the same amount of money – is because of 20 extra years of compounding.

Look out for investment opportunities

Constantly monitor for suitable investment opportunities that can help work your money harder. There is a range of investment tools in the market offering low to potentially high returns but do take note of the associated risks.

To avoid timing the market, you can set up a regular savings plan via Invest-Saver which requires a low investment sum of S$100. It offers access to exchange-traded funds and unit trusts. Another option is the robo-advisory platform digiPortfolio where consumers can invest in global portfolios.

Do your due diligence by upgrading your financial knowledge to help you better understand what you are investing. Staying invested in a diversified portfolio containing a mix of asset classes will help you limit exposure to concentrated risks.

Government schemes

Keep abreast of government schemes like the national annuity scheme Central Provident Fund (CPF) LIFE. Its predictable and lifetime cash pay outs will be an important source of income flow during our golden years.

Many enhancements have been made to CPF schemes but not all members are aware of the various ways they can optimise their retirement savings by leveraging the CPF accounts’ attractive interest rates. There are also tax reliefs we stand to enjoy by making cash top-ups to our own accounts and that of our loved ones. Doing so will beef up ours and their retirement savings.

Other government schemes include the Supplementary Retirement Scheme (SRS) which can help to supplement your CPF LIFE pay outs during retirement. Not only do you enjoy tax savings with every dollar of SRS contribution (subject to conditions), you can invest your SRS funds to make your savings work harder for you. Leaving them idle will only yield low annual returns of 0.05%.

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Start planning for retirement by viewing your cashflow projection on DBS NAV Planner. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?