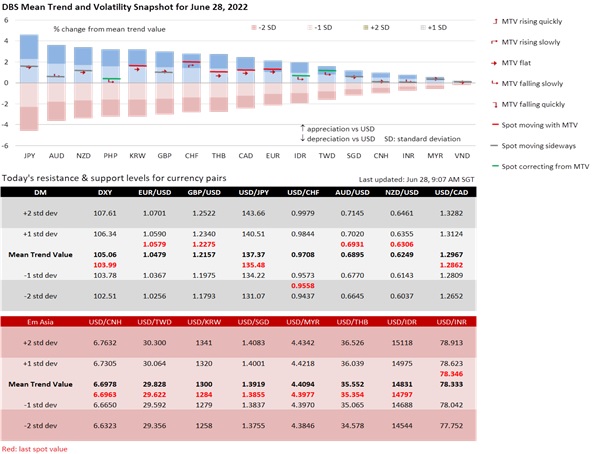

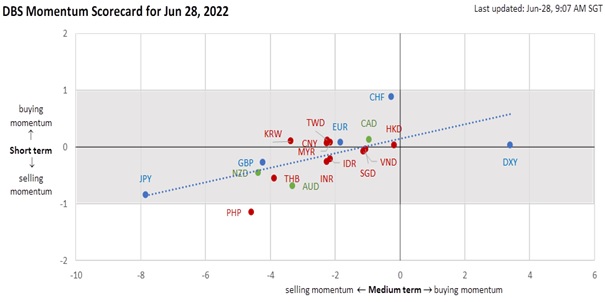

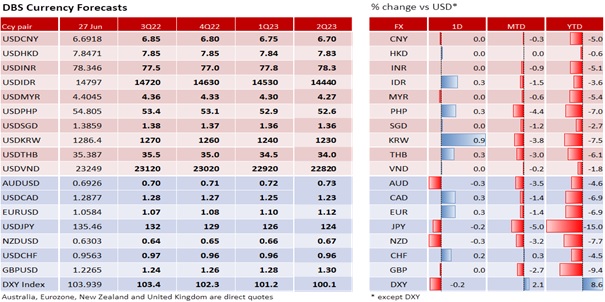

DXY depreciated to 103.95, below 104 for the first time since 9 June. DXY depreciated by an average of 0.2% in the past four out of five sessions. It needs to break the support at 103.50 to extend its downtrend. The European currencies led the sell-off in the DXY – SEK (+0.4%), EUR (+0.3%) and CHF (+0.2%). JPY bucked the trend with a 0.2% loss but held close to 135 per USD in the past three sessions. USD/CAD is looking to extend its fall beneath the 1.2860 low seen on 16 June. USD/CHF has already done so by edging into a lower 0.95-0.96 range last Friday after consolidating a week between 0.96 and 0.97. GBP/USD also entered a tight range on 17 June but has spent more time trying to push above 1.23 than it did below 1.22.

Since 16 June, EUR tried and failed a third time to close above 1.06 but has found buyers whenever it dipped below 1.05. Today, the European Central Bank will kick off its two-day Central Banking Forum 2022 “Challenges for monetary policy in a rapidly changing world” in Sintra, Portugal. The panel discussions should demonstrate the convergence amongst the Western central banks to anchor inflation expectations via rate hikes. This should go some way to explain why the major exchange rates have been more consolidative than trending. Nonetheless, EUR bulls will be looking at Friday’s Eurozone CPI to decide if the ECB hasten hikes from the telegraphed 25 bps in July to 50 bps in September.

US stocks could not extend last week’s rally. Dow, S&P 500 and Nasdaq Composite ended Monday lower by 0.2%, 0.3% and 0.7% respectively. Investors remained wary of bear market rallies and could not shake off lingering US recession worries. The Dallas Fed’s Texas Manufacturing Outlook Survey was grim. General business activity fell deeper into negative territory to -17.7 in June from -7.3 in May. New orders turned negative for the first time in two years from a decline in demand, resulting in marked falls in capacity utilization and shipments. However, prices and wages increased strongly amidst robust employment growth and longer workweeks.

Today, the Richmond Fed’s Fifth District Survey of Manufacturing Activity is expected to stay negative for a second month. Consensus expects the composite index to be -5 in June after it fell to -9 in May from +14 in April. In the last survey, firms reported weaker shipments and new orders and were less optimistic about conditions in the next six months. However, some producers also reported supply chain improvement. While many companies raised wages, the employment index fell to 8 in May from 22 in April.

US 10Y bond yield firmed 7 bps to 3.20%; 2Y rose 5.8 bps to 3.12%. After the stronger-than-expected CPI readings, the market remains wary of upside surprises in Thursday’s US PCE deflators. Consensus sees PCE headline inflation picking up to 0.7% MoM in May from 0.2% in April, and PCE core inflation rising to 0.4% from 0.3%. Given the concern about consumer demand by manufacturers in the Fed surveys above, today’s Conference Board consumer confidence index should matter. Consensus expects the headline index to slow to 100 in June from 106.4 in May, and how much present situation index will fall from 149.6 in May. In the last survey, consumers were already pivoting away from big-ticket items (e.g., cars, homes and major appliances) and vacations to spending on services because of high inflation and rising interest rates.

Overall, markets are paying more attention to the resilience of US consumer demand and private investment that the Fed relies on to expedite rate hikes to neutral.

Quote of the day

“You cannot simultaneously prevent and prepare for war.”

Albert Einstein

28 June in history

In 1914, Austrian Archduke Franz Ferdinand was assassinated, setting of events that began World War I. Five years later, the Treaty of Versailles ending The Great War was signed on the same day in 1919.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.