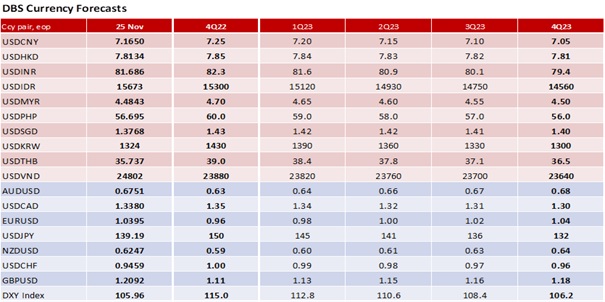

Although US CPI and core inflation slowed to 7.7% YoY and 6.3% respectively in October, the readings were too high above the 2% target for the Fed to lower its guard. The same can be said for the lower readings expected in Thursday’s October PCE deflator (6% consensus) and core inflation (5% consensus). On Friday’s jobs report, the fewer 200k nonfarm payrolls consensus expects for November will be high relative to pre-Covid levels. November’s CPI inflation readings, which come a day before the FOMC meeting, could surprise on the upside.

EUR could correct lower from the top of its 1.0220-1.0480 range of the past fortnight. The European Central Bank believes that monetary policy is not restrictive enough to lower double-digit inflation to its 2% target. On 30 November, consensus sees CPI inflation slowing to 10.4% YoY in November from 10.7% in October and core inflation unchanged at 5%. Unfortunately, the Eurozone is entering a technical recession in 4Q22 and 1Q23. Hence, the ECB is leaning towards a smaller 50 bps hike on 15 December after the jumbo 75 bps hike on 27 October. At the same meeting, the governing council will discuss the “key principles” of quantitative tightening without announcing a start date. Expect Bundesbank President Joachim Nagel to push the ECB to reduce its bond holdings at the start of 2023. Nagel and ECB President Christine Lagarde are speaking on 28 November and 2 December.

We are cautious about GBP after it rose above 1.20 for the first week since 12 August. GBP is well above its pre-mini budget level of 1.13 and has rebounded 17% from its new all-time low of 1.0350 on 26 September. Although the Conservative Party has dismantled the mini-budget and elected a new prime minister, inflation continued to double-digit levels, with the UK economy falling below pre-Covid levels. The bets for more rate hikes by the Bank of England will exacerbate the UK recession, also feeling the drag from fiscal spending cuts. There is no guarantee that the downturn will not extend beyond the expected four quarters into 2Q23. In September, consensus first predicted -0.2% growth in 2023, an outlook that has deteriorated to -0.4% in November and -0.8% last week. Not surprisingly, CFTC data showed the GBP’s recovery from unwinding short positions instead of accumulating long positions. In short, GBP is vulnerable if the USD regains some composure this week from the Fed and US data.

Quote of the day

“If people are doubting how far you can go, go so far that you can’t hear them anymore.”

Michele Ruiz

28 November in history

New Zealand was the first country to allow women to vote in 1893.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.