- Conflict-related supply disruptions and resilient global demand see oil prices rally year-to-date

- US oil production has grown, driven by higher production from the shale patch

- M&A is transforming the US shale industry by lowering break-even prices & stabilising production vol

- Oil & gas plays continue to be a relatively safe-haven investment

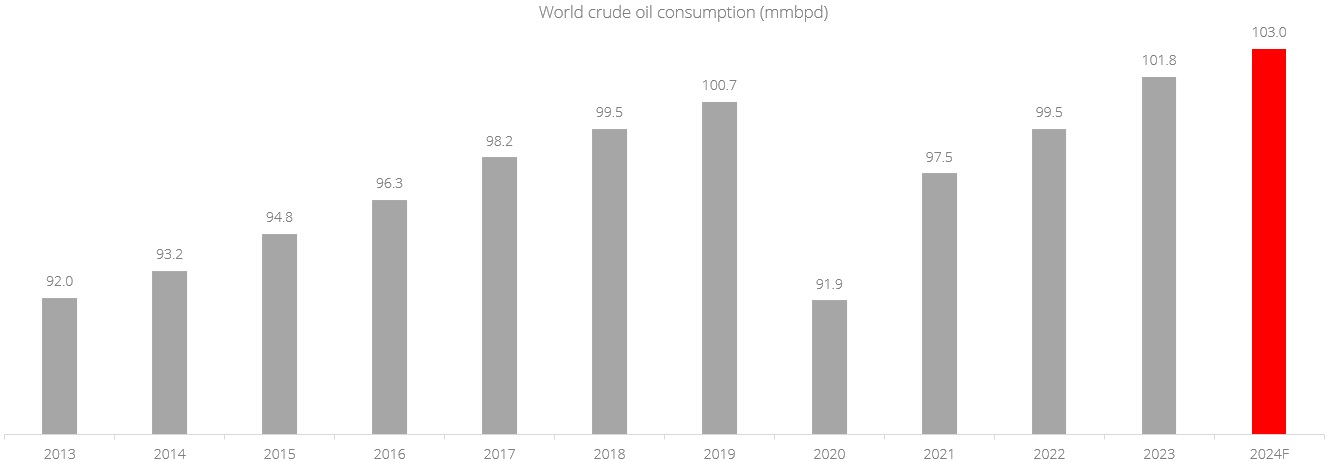

Improving fundamentals drive higher oil prices. The trajectory of oil prices has defied initial expectations this year, surging despite softening economic conditions and restrictive monetary policy in the West. Year-to-date, WTI and Brent crude oil prices rose 13.7% and 11.3% respectively, and currently stand by at USD81.48/bbl and USD85.73/bbl (as of March 18). The surge in oil prices can be attributed to: (i) disruptions in the global supply chain driven by geopolitical conflicts (e.g. Houthi attacks in the Red Sea, Ukraine's assault on Russian refineries etc.), (ii) ongoing production cuts by OPEC+, and (iii) a surge in global demand exceeding earlier projections for 2024. In Feb 2024, the International Energy Agency (IEA) revised its oil demand growth forecast upwards from 860,000 barrels per day to 1.2 million barrels per day (mmbpd). The US Energy Information Administration (EIA) and OPEC+ have similarly upgraded their forecasts for oil demand growth in 2024; EIA predicts a 1.4 mmbpd increase while OPEC+ projected a robust oil demand growth of 2.25 mmbpd. Moreover, US crude reserves are below historical trend due to a sustained drawdown on the strategic petroleum reserves (SPR) since Aug 2020, and any efforts to replenish the SPR will see a further increase in oil demand.

Figure 1: Oil demand on the rise; surpassed pre-Covid highs

Source: IEA

US shale oil makes a strong comeback. Amid these favourable conditions, US oil production has shown a steady uptrend since 2H23. After averaging around 12.3mmbpd for the first seven months of 2023, similar to the 2022 exit rate of 12.1mmbpd, US oil production jumped since August and exited 2023 at a run rate of 13.2mmbpd, much higher than street estimates earlier in the year, and close to prior record levels last seen in early 2020 pre-Covid. The increase was driven by higher production from the shale patch. Over the last couple of years, we had seen a slowdown in US shale production as the listed US independents focused more on profitability and shareholder returns and less on capex and production volumes, but that story has changed. US shale is firmly back in the reckoning over the last six months or so and gaining market share, as oil prices stay elevated on the back of sustained production cuts by the OPEC+ members. The US is now the world’s largest oil producer by a margin, following production cuts by Saudi Arabia and Russia, and looks set to be a key swing producer with dominant position in the global oil markets. Shale accounts for approximately 76% of total US oil production, making shale an increasingly indispensable component of global supply.

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")