- China eases Covid-zero policies; economic recovery and upward rerating of equity valuations expected

- Additional supportive measures addressing economic concerns and revival of mobility are ongoing

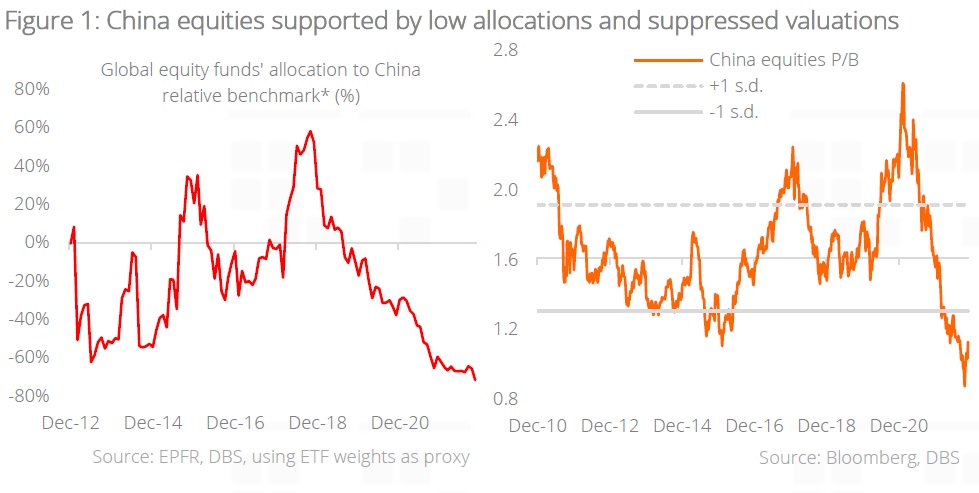

- With valuations at multi-year lows and rerating in motion, investors should dollar-cost average down

- We are constructive on domestic oriented sectors such as A-shares, financials, and more

Dynamic Covid-zero policy pivot – measures for partial reopening. The Chinese government has relaxed its Covid-zero policy and issued 10 calibrated measures for partial reopening, one of which includes home quarantine for non-serious cases. We believe this key policy pivot will lead to economic recovery and an upward rerating of equity valuations. China equities had dropped more than 60% between the mid-February 2021 peak and the recent end-October low. Even after the current rebound, it is still some 50% away from the peak. Given these conditions, it seems opportune to dollar-cost average down.

Further supportive policies materialising. As mentioned in our CIO Perspectives report dated 25 October, until new policies are announced and implemented with further clarity, investment communities will remain watchful over macro policy directions, such as strict Covid policies, frameworks on new economy sectors, and plans to address existing debt issues among real estate developers. While China’s government has issued additional supportive measures since our report was published, what’s notable here is the pivot away from Covid-zero policies. We expect further positive measures to be announced in future with the Politburo’s commitment to supporting economic activity.

Rerating to continue. We believe there is compelling upside potential for China equities to rerate from current levels, driven by the ongoing introduction of government measures to alleviate key concerns regarding Covid-zero policies, real estate sector problems, and economic goals, as mentioned in our previous report. These positive catalysts are now falling into place as we had predicted. The market has lauded such moves as evidenced by recent share price rebounds.

Valuations at multi-year lows. China equities are trading at 11x forward PER and 1.1x price-to-book. The subdued valuations – both absolute and relative to global equities, and significant underweight allocations among investment funds – will continue to act as a supporting factor to initiate a longstanding rerating after the sentiment was suppressed over the past quarters.

Time to dollar-cost average down. We reiterate our stance to stay constructive on China equities and the timing has materialised to dollar-cost average down. Investment opportunities are emerging as China re-opens; we stay constructive on domestic oriented sectors which are at the forefront of the re-opening ripple. These include A-shares, new economy and e-commerce platforms, China consumer brands, beneficiaries of government fixed asset expenditures, and high dividend yielding financials.

Download the PDF to read the full analysis.

Topic

Explore more

CIO PerspectivesThis information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.