- The US is tracking essentially zero growth in 2Q

- Europe is slowing sharply due to energy insecurity and inflation

- Our Nowcasting model for China is tracking less than 1% growth in 2Q

- Slowing growth will bring easing inflation, scaling back expected rate hikes

- Easing pressure on energy and food prices will bring cheer to the EM

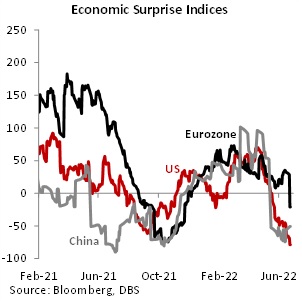

Signs are gathering around the world that sustained rise in interest rates is beginning to affect demand. In the US, Atlanta Fed’s Nowcasting is pointing to zero growth (quarter-on-quarter, seasonally adjusted, annualised) in 2Q, reflecting weakening of housing starts and exports. High inflation and strong USD are crimping investment and trade, two critical drivers of growth.

The slowdown extends beyond residential investment and trade. Consumer sentiment has worsened considerably over the spectre of inflation and high interest rates. Fiscal spending, a major source of support in 2020 and 2021, has faded entirely, with the US federal government’s fiscal deficit nearly zero in the first five months of 2022. Businesses, sensing a weakening of demand, are beginning to run down inventories as opposed to building them.

Outside of the US, the Euro area, despite no policy tightening from the ECB so far, is stumbling over high inflation, energy insecurity, and the war in Ukraine. Data surprises have turned negative sharply, and the possibility of the ECB hiking rates, barely in the horizon just a few months ago, has now risen dramatically.

China is having a torrid time taming the coronavirus pandemic, with mobility restrictions of varying degrees across the mainland. The country remains essentially shut to the outside world for movement of personnel, although trade figures reflect that goods are moving in a fairly orderly manner. Our Nowcasting model is tracking sub-1% real GDP growth in 2Q.

As we look past 2Q, it is not all doom and gloom. Slowing growth is cheering the markets, as that suggests less tightening work for the Fed in its quest to stabilise inflation. Softening of energy prices over the last few weeks can only help consumers worldwide. For emerging markets, pressure could be released from capital outflows and currency depreciation, not to mention the much-followed current account balance. With the market for food commodities also seeming to peak, some of key sources of market angst may begin to fade during 2H22.

To read the full report, click here to Download the PDF.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.