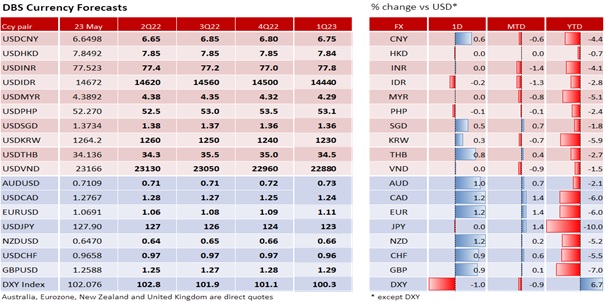

DXY depreciated 1.1% to 102, its weakest level since 25 April. Dow, S&P 500 and Nasdaq Composite rallied 2%, 1.9% and 1.6% respectively. The increases in the US Treasury yields were modest relative to those in the stock market. The 2Y bond yield increased 4 bps to 2.62% while 10Y firmed 7 bps to 2.85%. US President Joe Biden is considering removing some of the Trump-era tariffs on Chinese imports to fight US inflation. CNY recovered most in Asia by 0.7% to 6.65 per USD. The improvement in risk appetite and a stronger CNY boosted commodity currencies. NZD appreciated 1.2% ahead of the 50 bps hike to 2% expected at tomorrow’s Reserve Bank of New Zealand meeting. AUD appreciated 1% while CAD gained 0.6%. Reserve Bank of Australia Assistant Governor Christopher Kent estimated the neutral rate as 2-3%, a reminder that the 25 bps hike to 0.35% earlier this month was only the start of a normalization cycle in Australia.

Atlanta Fed President Raphael suggested the Fed could pause in September after delivering two 50 bps hikes in June and July to the floor of the 2-3% neutral zone. Speaking today, Fed Chair Jerome Powell will probably maintain the resolve to keep hiking until inflation comes down. Hence, investors hope this Friday’s PCE inflation will slow to 0.2% MoM (consensus) in April from 0.9% MoM in March. More importantly, they will not want the core PCE deflator (expected to be unchanged at 0.3% MoM) to repeat the surprise monthly jump in core CPI inflation.

EUR appreciated most by 1.2% to 1.0691. European Central Bank President Christine Lagarde affirmed the growing chorus within the ECB to end negative interest rates in 3Q22. The ECB will increase the deposit facility rate from -0.50% via 25 bps hikes at the 21 July and 8 September meetings. Bundesbank President Joachim Nagel declared the end of wage moderation in Germany and expected higher wage deals in the second half of the year. German Finance Minister Christian Lindner said the EU’s top priority must be to fight inflation. Although the EU plans to suspend budget rules to 2023 on the war in Ukraine, Germany does not intend to increase fiscal spending and urged member countries to be fiscally responsible. Having rebounded from its 1.0350 low on 13 May, EUR is approaching resistance at 1.0770 or its 50-day moving average.

CHF appreciated 0.9% to 0.9658 per USD, its strongest level since 26 April. Swiss National Bank governing board member Andrea Maechler will support rate hikes if inflation stays outside the official 0-2% target range. Over the past three months to April, Switzerland’s CPI inflation has risen above 2% YoY to 2.5% but core inflation was unchanged at 1.5%. Favouring CHF strength, especially against the EUR, to help fight inflation, the SNB is closely monitoring the ECB’s push to end negative rates. The SNB policy rate is -0.75%. Having fallen from its 1.0065 peak on 16 May, the next support for USD/CHF is probably between 0.9560 and 0.96.

Quote of the day

“The secret of politics? Make a good treaty with Russia.”

Otto von Bismarck

24 May in history

In 2022, Russia and the US signed the Strategic Offensive Reductions Treaty also known as the Moscow Treaty.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.