Wednesday was choppy from the same worries over Fed hikes and US recession. DXY appreciated from 103.77 to 104.61 during the European session, in line with the US Treasury 2Y yield rising to 3.08% from 3.15%. DXY stabilized around 104.50 during the New York session when the 2Y yield pulled back to 3.11% on weaker equities. The US 10Y bond yield also rose during the European session from 3.17% to 3.25%, only to return to 3.17% from weak US equities. S&P 500 started 1.2% higher only to end 2% lower during the session. Nasdaq Composite was worse, falling 3% after opening 1% higher. New York Fed President John Williams wants to frontload hikes to get rates to 3.0-3.5% this year and to 3.5-4.0% in 2023 if the US economy permits.

The chief economist of the US Conference Board expects a shallow technical recession from 4Q22 into 1Q23. The board’s consumer confidence index plunged from 103.2 in May to 98.7 in June, below 100 for the first time since February 2021. Most of the drag came from expectations which fell to 66.4, its weakest level since March 2013. Consumers fear strong headwinds from elevated inflation (especially food and gas prices) and more rate hikes. Although they were optimistic about employment prospects, fewer consumers expected incomes to increase, with more expecting them to decline. A fortnight ago, the Fed reported that US household wealth fell in 1Q22 for the first time in two years in 1Q from equity losses outpacing house price gains. On a positive note, the present situation index remained high at 147.10 after slowing modestly from 147.40 in May. Household balance sheets have remained strong but caution may lead consumers to save.

The Richmond Fed’s Fifth District Survey of Manufacturing Activity also disappointed. The composite index extended its slide to -19 in June; consensus expected a smaller decline of -7 from -9 in May. The volume of new orders fell from -16 in May to -26 in June while the decline in shipments was milder from -14 to -15. Producers reported some indication of supply chain relief. However, the employment index doubled to 16 from 8 amidst an elevated wage index. Prices paid decreased while prices received increased. The business outlook for the next six months deteriorated to -26 from -13.

Today, the European Central Bank Forum on Central Banking 2022 concludes with a panel discussion on the “Challenges for monetary policy in a rapidly changing world” with the leaders of the ECB, Fed, Bank of England and the Bank for International Settlements. The Fed and the BIS strongly support frontloading hikes to restore price stability. ECB and BOE favour 25 bps hikes but will keep the door open for larger moves to anchor rising inflation expectations from second-round wage pressures. Fed Chair Jerome Powell did not rule out a US recession though Fed officials have recently pushed back against such talk. BOE talked about one a couple of meetings back and confidence in the UK economy has been sliding with the approval ratings of the Johnson government.

In her opening remarks yesterday, ECB President Christine Lagarde does not believe the Eurozone will slip into recession. She acknowledged that monetary policy would be challenging because of “broadening and intensifying” inflation”, citing a doubling in Eurozone’s wage growth, persistent supply bottlenecks and high energy prices from the Russia-Ukraine war. Her comment suggests that the ECB could deliver a larger 50 bps hike is possible on 8 September after the 25 bps increase in the deposit facility rate rising 25 bps to -0.25% on 21 July. On Friday, consensus expects Eurozone CPI to rise to 8.5% YoY in June from 8.1% in May.

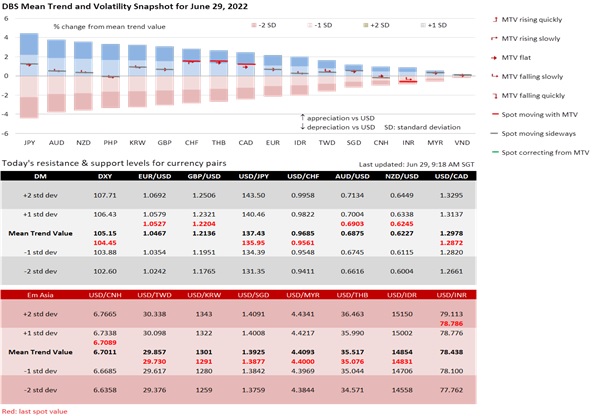

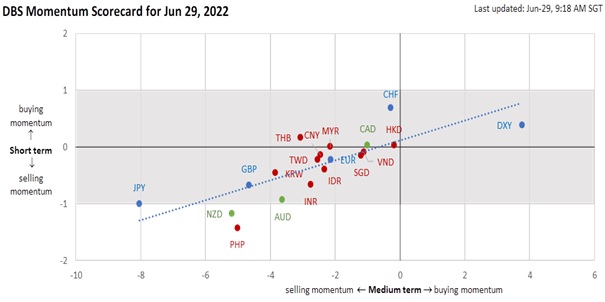

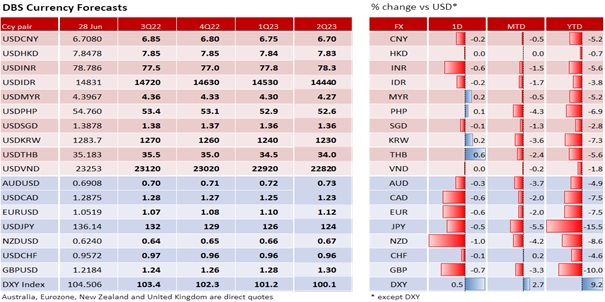

Overall, DXY is likely to keep struggling with its largest component, the EUR with markets least optimistic about the GBP.

Quote of the day

“Inflation in the euro area is undesirably high and it is projected to stay that way for some time to come.”

ECB President Christine Lagarde

29 June in history

US withdrew troops from Korea after World War II in 1949.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.