DXY depreciated 1.3% to 112.60 in the overnight session. The last few times an overbought DXY fell this much in a day were 16 June this year and 26 March 2020. Despite the Fed’s hawkish narrative, US bond yields are off Wednesday’s highs in sympathy with their UK counterparts following the intervention by the Bank of England. However, equity investors could not shake off the Fed’s determination to slow demand to control inflation. Dow, S&P 500 and Nasdaq Composite fell 1.5%, 2.1% and 2.8% respectively. Consensus expects today’s US PCE core inflation to rise to 0.5% MoM in August from 0.1% in July or to 4.7% from 4.6% in yoy terms.

As the third quarter ends today, the USD’s strength has run up against interventions from Japan and the UK, besides reprisals from China after the last jumbo Fed hike on 21 September. China will be away for the Golden Week holidays next week. Attention will turn towards the US midterm elections on 8 November and Europe’s readiness to weather winter without Russian energy.

GBP rebounded 2.1% to 1.1117. Bank of England Chief Economist Huw Pill affirmed that there would be a significant response to the crisis triggered by the mini-budget at the next monetary policy committee meeting on 3 November. The market believes the BOE might hike 100 bps to 3.25% after pledging to buy long-dated government bonds until 14 October to stabilize the Gilt market. The 10Y Gilt yield retreated from Wednesday’s 4.6% high to 4.14% on Thursday. Expect Chancellor Kwasi Kwarteng to stand his ground on the mini-budget during his keynote address at the Conservative party conference on 3 October.

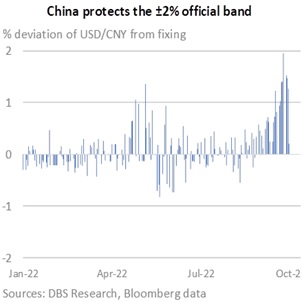

CNY rebounded to 1.1% to 7.1250 per USD, 0.2% above the fixing. Yesterday, the People’s Bank of China stated on its website against betting on a one-sided appreciation in the exchange rate. On Wednesday, PBOC told banks to reinstate the counter-cyclical factor in their daily fixings. USD/CNY held more than 1% above the fixing after the Fed lifted its end-2022 rate forecast to 4.4% from 3.4% at the FOMC meeting on 21 September. Last Friday, the spot rate hit the ceiling of the ±2% official band after UK’s mini-budget pummelled GBP/USD below 1.09. Apart from bolstering the USD’s haven status, the GBP crisis and USD/CNY trading above its 2019 highs above 7.20 probably motivated speculators to mistake China for losing control of its exchange rate.

Quote of the day

“It’s not the size of the dog in the fight, it’s the size of the dog in the fight.”

Mark Twain

30 September in history

Germany and Russia agreed to partition in Poland in 1939.

Subscribe here to receive our economics & macro strategy materials.

To unsubscribe, please click here.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.