Investing using the Core-Satellite approach is akin to having a balanced meal. Like the main course, the Core keeps you going for the long run; and like speciality dishes on the menu, the Satellites capture a selection of in-season opportunities.

The Core is thus likened to a balanced diet of global multi-assets for the longer-term, while the Satellites are opportunistic, short-to medium-term investments. Taken together, they provide the potential for higher-than-market returns and allow for stability spiced up with seasonality.

The Core-Satellite approach provides these advantages:

- Stability

Holding your assets for the long-term reduces the impact of market volatility at the end of the day. - Diversification within the Core

Spreading your Core investments across and within asset classes and regions helps you maximise returns and minimise risk. - Diversification from adding on Satellites

By taking advantage of market mispricings in the short-to-medium term, your Satellites add another layer of diversification, as they invest in trending themes and sectors.

Components of a Core-Satellite portfolio

| The Core | The Satellites |

|---|---|

|

|

To provide stability, the main ingredients of your Core Portfolio should be:

- Multi-asset to decrease overall volatility: bonds that are your carbohydrates for stable cash flow, equities that are your proteins for richer returns, and other assets that are like vegetables in your main course to diversify the risk

- Global for access to best-in-class assets and foreign investments

- Long-term because timing the market is difficult

These have the additional benefit of helping you to avoid emotional binging that can sway your investing decisions. By keeping you invested for the long-run like a nutritious meal, the Core Portfolio makes it less likely that you sell the “winners” prematurely when hungry for profit. Regular rebalancing also makes it less likely that you cling to “losers” in the hope of recovering losses. And so, you can ride out the markets’ ups and downs.

In contrast, your Satellites complement your steady Core, like seasonal fruits that bring you sweeter returns at certain times. They are:

- Opportunistic which means you can add them to enhance returns by taking advantage of trending themes and sectors

- Typically, short-term or sometimes medium-term investments

- Inclusive of technical factors and valuations

A menu to satisfy every appetite

As every investor has a different risk appetite, your Core-Satellite portfolio should be designed according to your individual goals, personal situation, preferences, risk tolerance and the length of time you want to hold the investments for.

Assets should be allocated depending on the type of risk profile you have: conservative, moderate, balanced, or aggressive.

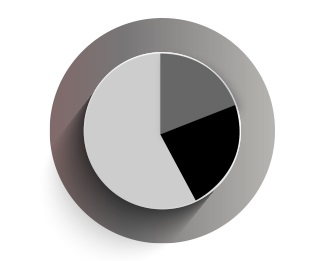

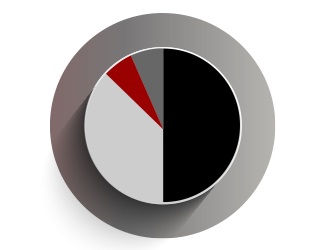

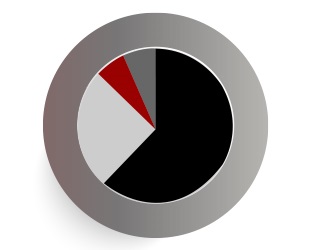

Conservative

Preserving capital with minimal risk exposure.

Moderate

Capturing some capital growth with low risk exposure.

Balanced

Capturing modest capital growth through a balanced risk-and-return approach.

Aggressive

Maximising capital growth potential through exposure to a large portion in risky assets.

You may also wish to expand the size of your Satellite portions as opportunities arise, or as your needs change.

Putting together your own Core-Satellite portfolio can be as time consuming as whipping up a balanced meal with multiple side dishes. Speak with our investment experts to curate a menu of products for your personalised portfolio.

Contact me