In the capital markets, Covid-induced concerns have nudged ESG (environmental, social and governance) factors to take centre stage in investment decisions. PHOTO: PEXELS.COM

THE practice of philanthropy is far less common among Asia's wealthy, with the region still navigating its recent wealth boom compared to its Western counterparts.

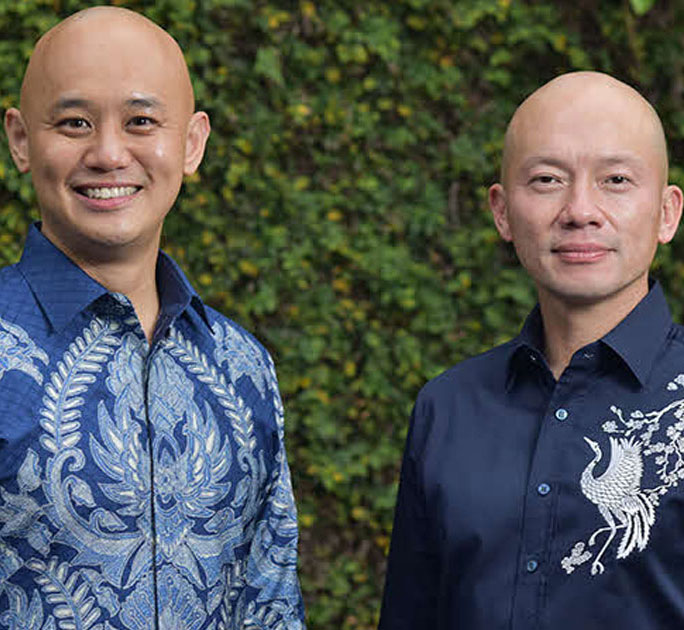

This is, perhaps, also in part due to the traditional Confucian mentality sometimes ingrained in Asians: "I take care of my family, you take care of yours", said Lam Nguyen-Phuong, private equity veteran and advocate of social entrepreneurship, though he noted that this mindset is definitely changing with time.

Indeed, this mindset has to change - and fast - as the global pandemic raises renewed societal concerns.

Private banks, serving well-heeled individuals in key positions to make an impact, play a crucial role in driving this change by advocating philanthropy and social entrepreneurship to support the growing ecosystem of social enterprises.

Such organisations aim to solve social and environmental problems while maintaining profitability - a structure that all businesses of the future should possess.

"In the future, every company should have a dual bottom line. Purpose and profits go hand in hand, and that should be the norm rather than the exception . . .

"We must change the way we do business, because we will not survive as a society or a planet if we do not bring down the walls that compartmentalise economic, social and environmental activity," said Mr Lam, who is also a client of DBS Private Bank.

The private bank works closely with DBS Foundation - established in 2014 to support social entrepreneurship in the region - to connect Mr Lam and other like-minded clients to social enterprises so as to direct more funding to support these ventures.

As an example, Mr Lam works with DBS to support Agape, which provides inclusive training and employment opportunities to vulnerable and marginalised groups such as ex-offenders, persons with disabilities and low-income women. It also operates the Singapore National Care Hotline amid Covid-19.

Beyond just Singapore, the bank taps its regional network to build a broader ecosystem of social enterprises from neighbouring markets.

"While Singapore of course has its need for social impact work, this is far less than some other countries in the region," said Mr Lam.

As awareness over societal needs and shared responsibility continues to grow, giving back is no longer limited to traditional ways of writing cheques or building local community schools.

Investors have been warming up to the "venture philanthropy" approach through conversations with the bank, said Joseph Poon, group head of DBS Private Bank.

Venture philanthropy typically applies conventional venture capital principles when searching for companies to fund.

But instead of pumping money into a Silicon Valley startup, for instance, a venture philanthropist may invest in a food marketplace that sells donated food to low-income communities at a discount.

In a separate example, private philanthropy was the largest source of DAMH (development assistance to mental health) in 2019, providing US$58 million out of US$160 million, according to data from the Institute for Health Metrics and Evaluation.

Over the longer term, Mr Poon expects more private banking clients to shift away from traditional philanthropy and towards providing ongoing support.

This will likely go beyond funding to include the mentoring of social entrepreneurs by industry titans and giving social enterprises a broader platform to scale their business and amplify their social impact, among others, he added.

"This way, the benefactors bring to the table not just their financial capital, but also their business acumen, connections, and social clout, which will surely add substantial impetus to create the changes these social enterprises seek to bring about."

The broader goal is for such activities to extend beyond direct private banking clients and to their children.

DBS' Future Leaders Programme, for example, engages the next generation on key issues. The private bank also connects those who are passionate about certain causes, or are themselves founders of social enterprises, with like-minded social enterprises to potentially collaborate and address certain societal gaps.

"It's important to have a bank that shares your values. Sustainability has become a popular topic in recent years but for many, it's more talk than action," said Mr Lam.

In the capital markets, Covid-induced concerns have nudged ESG (environmental, social and governance) factors to take centre stage in investment decisions.

A record US$5 billion was invested in sustainable funds in Asia in the last four months of 2020, bringing the region's total to US$25.4 billion - up 131 per cent from 2019, data from Morningstar showed.

Nearly 80 per cent of investors in Asia-Pacific raised their ESG investments "significantly" or "moderately" in response to Covid-19, according to a MSCI survey this year.

At DBS Private Bank, assets under management (AUM) in ESG funds jumped 350 per cent year to date as at June 2021.

When the bank relaunched its MSCI ESG Outperformance product late last year, total AUM raised was seven-fold that of the amount raised at the first launch in 2018.

It is also on track to introduce 10 new sustainable investments by yearend; two were onboarded since April.

"In the next few years, we can expect ESG to become so ubiquitous that it may not even need to be separately addressed. Taking investments as a case in point, ESG considerations are likely to be fully embedded into the standard assessment process," said Mr Poon.

As a key next step, the private bank looks to expand its ESG conversations with clients beyond their personal wealth, and to help make the connection between sustainability issues and their own businesses.

"Our business-owning private banking clients hold in their hands the immense potential to create change. We have started on this chapter; it's still early days but the momentum is gathering," said Mr Poon.

This article was written by Natalie Choy and first published in The Business Times on 18 Aug 2021.