Legacy planning is about arranging your affairs for the benefit of your loved ones, when you are no longer around. In a nutshell, it is about optimising your wealth/resources to leave as much as you can to your dependents, and minimising the risk of your dependents squabbling over what you leave them.

For the sake of your family, here are 4 things you must know about legacy planning:

The first thing you will have to do is to draw up a Will. This is a critical bedrock of legacy planning.

The ‘Last Will and Testament’ is a legal document which outlines your wishes on how your assets (also known as ‘Estate’) will be distributed on your passing away. And dying without a ‘Last Will and Testament’ is known as ‘dying intestate’ in legal terminology. For your loved ones, this is a big headache on top of the heartache of grieving and loss.

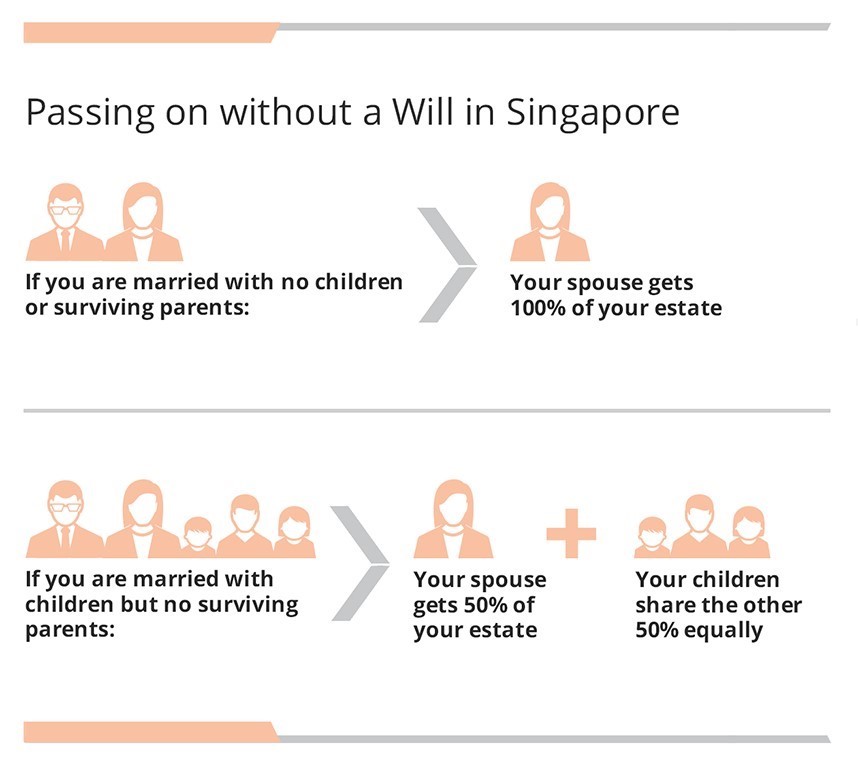

That’s because if you pass away without a Will, your assets will be distributed accordingly to civil law, which may not accord with your wishes.

Do consult a specialist lawyer for the many possible outcomes, depending on your family circumstances. But here are two examples of what could happen, based on Singapore’s intestacy laws.

And if you die overseas, the distribution of your Estate can become even more complicated because generally, the laws of intestacy are based on the laws of the country in which you pass away.

Also, your Estate will then go into Court Administration. This is likely to cause administrative and legal delays, and possibly higher costs in accessing your Estate because:

- Your next-of-kin have to apply to the Courts for their appointment as Administrators of your Estate. This generally takes longer than a Grant of Probate where you have a Will and have named an Executor;

- If you have children under the age of 21, the Court requires two administrators;

- And they both need to provide “surety” or find a willing person to commit their assets to repay any misappropriated assets from the Estate.

Think of the financial hardship this may cause your dependents. This is why a Will is critical

In conjunction with the Will, decide on and name one or more executors to your Will. The Executor will administer and distribute your Estate according to your Will.

Even if you already have a Will, ensure it is up to date, and reflects your changing personal and family circumstances. It does not cost much for a solicitor to draw up a Will for you. A few hundred dollars might save your loved ones a lot of unnecessary strife.

Term life: protection for a specific period

Term life insurance is useful as a means of protecting your loved ones – particularly those financially dependent on you – during a specific period or “term”.

This is an affordable way to obtain “death benefit” for your family and/or beneficiaries. It is an agreement under which the policyowner, who is also the life-insured, pays a fixed amount over an agreed period of time. After that period, you will need to obtain new coverage at new terms – or go without cover.

Term life insurance may make sense if you are seeking a relatively low-cost way of protecting your family during your working years. That is, if you pass away during those prime working years – when your family is likely to be dependent on you – there will be a pay out to your family. This will ensure that your family is protected financially at a time when they are most vulnerable.

The limitation of term life insurance is that it does not build value. If your objective is to only protect your family when they are financially dependent on you, term life could be sufficient. But if your objective is to leave something behind when you pass away – regardless of how long you live – then you may want to consider whole life insurance.

Term life insurance may make sense if…

| You are seeking a relatively low-cost way of protecting your family during your prime working years. |

But term life has its limitations because…

| It does not build value. |

Whole life insurance: features both protection and an element of savings

With whole life insurance, you pay a fixed premium every year for the whole of your life.

The legacy planning element is obvious: When you pass away, your dependents will get a lump sum of an agreed amount. So, it offers financial protection for your family in the unfortunate event you pass away while they are still young and financially dependent on you.

Beyond that, it also serves as a form of savings, building value over time, to eventually bequeath to your family, if you live to a ripe old age.

Whole life insurance has an obvious legacy planning element…

| It allows you to protect your family during your prime working years. |

| It serves as a form of savings to be bequeathed, if you live to a ripe old age. |

Universal Life Insurance (ULI)

Universal life insurance (often known as ULI) is another instrument that can be used for the “legacy” purpose of leaving your loved ones with financial support when you are no longer around. Where it differs from whole life and term insurance is in the flexibility it offers. It is also usually denominated in US Dollars.

There are two components to ULI – a “protection” component which provides an agreed pay-out on the death of the insured person, and a wealth accumulation component. So, the premium payable for ULI also has two components:

- The cost of insurance component and

- the so-called “cash value” component.

Where it differs from whole life insurance is the flexibility in the payment of premiums; the ability to access a portion of the cash value built up in the policy; and the ability to borrow to pay the premiums.

With ULIs, the death benefit on your passing away is the higher of either the amount agreed in the insurance contract (that is, the “face amount”) or the cash value accumulated in the policy (also known as the “policy value”).

Universal Life Insurance is more flexible in terms of…

| The payment of premiums; |

| The ability to access a portion of the cash value built up in the policy; and |

| The ability to borrow to pay the premiums. |

This is about maximising the financial assets you can bequeath to your loved ones when you pass away. One way is to use insurance products to enlarge the amount you can leave to your loved ones.

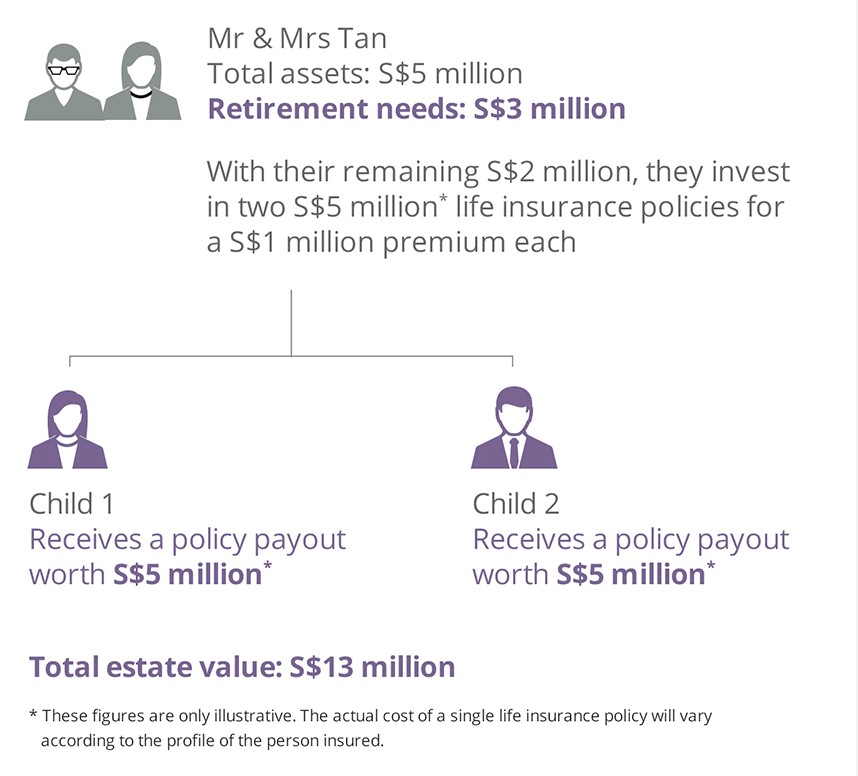

Case Study

Maximising the value of your estate

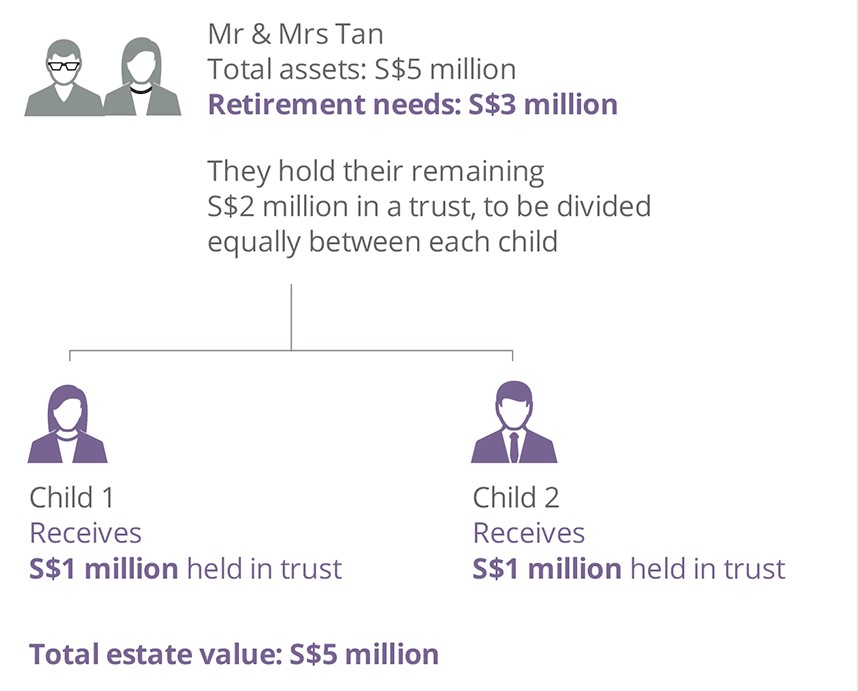

Mr and Mrs Tan, both 54, have assets worth a total of S$5 million. They plan to use S$3 million for their retirement, with the remaining S$2 million divided equally between their 2 children as their inheritance.

Without Universal Life Insurance

Mr and Mrs Tan choose an irrevocable trust to bequeath S$1 million to each child as their inheritance when the couple passes on.

With Universal Life Insurance

For their children’s inheritance, Mr and Mrs Tan buy two life insurance policies, each with a single premium of S$1 million. Upon their passing, each policy pays out S$5 million* and maximises their legacy to their children.

The choice of financial planning instruments will impact legacy planning. By utilising life insurance policies, the Tan’s have increased the overall value of their Estate.

There may be instances when a simple equal distribution of assets may not be possible or desirable.

One common example is the family home, which may be a large part of an Estate. Where an individual has, say, 2 children, it may not be practical to bequeath the home to both children, without forcing a sale and distribution of the proceeds of the sale.

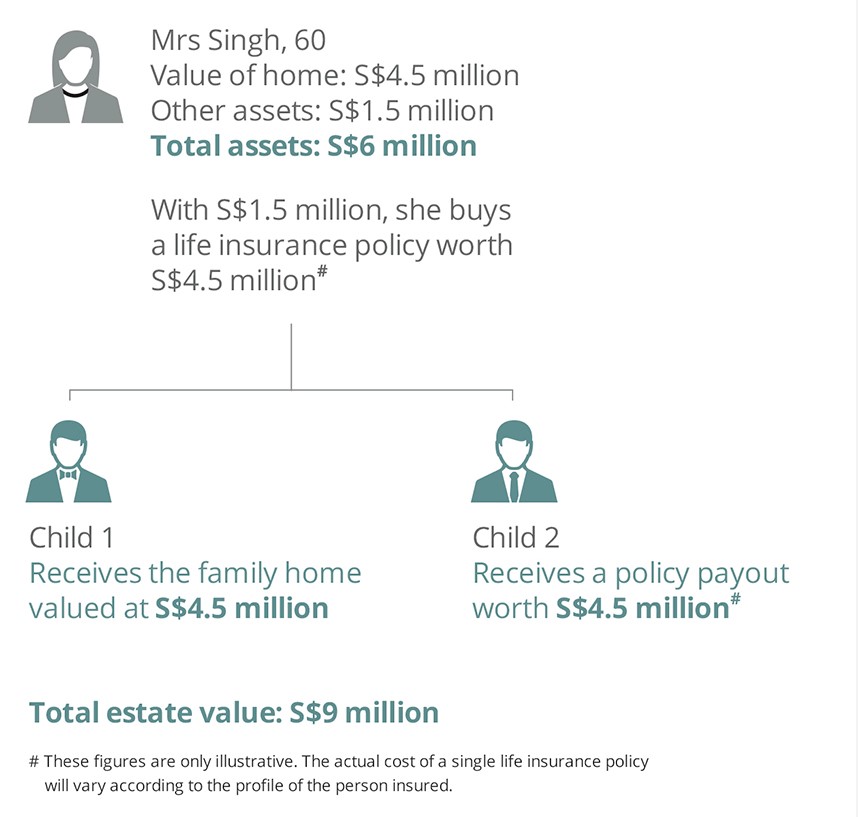

Case Study

Dividing an estate equitably

Mrs Singh has total assets of S$6 million, including the family home valued at S$4.5 million. She wishes to bequeath her assets equally between her 2 children, without dividing or selling the family home. To achieve this, she can buy insurance of the same value of her home, and equalise the inheritance she leaves her children.

Estate equalisation can help preserve the value of assets like a home or a large collection, as well as prevent disputes between heirs. Through life insurance policies, Mrs Singh has also increased the overall value of her Estate.

There are many more details you would need to be familiar with in legacy planning, particularly with regards to how insurance policies work to achieve your goals. But hopefully the above is a useful starting point in your plans.