There are plenty of options available. Check the following table for details:

| Payment Channel | Payment credited on | Remarks |

|---|---|---|

| DBS Internet Banking/digibank | Payment is immediate | For DBS/POSB account holders only |

| Phone Banking/ATM | Next working day (if payment is made before 11.30pm from Mon-Sat, & before 8pm on the last working day of the month) | For DBS/POSB account holders only |

| SMS Banking | Next working day (if payment is made before 11.30pm from Mon-Sat, & before 8pm on the last working day of the month) | Minimum/ Full payments can be made via SMS Banking after successful one-time registration. |

| AXS Stations | Next working day (if payment is made before 4.55pm on Weekdays). Payment made on Friday (after 4.55pm) and on weekends will be credited to your Card Account on Tuesday (provided it is a working day). | - |

| Quick Cheque Deposit | 3rd working day | If you drop the cheque in by 1pm |

| Cheque Mail-in | 3rd working day after we receive the cheque | Please make cheques payable to ‘DBS-Cards’ |

| Cash Payment at DBS/POSB branches | Next working day | - |

| InterBank GIRO | 3rd working day | You will need to complete GIRO application form |

You will have 20 interest-free days to make payment before your next Statement of Account is generated. After which, if you have not made full payment by the payment due date, you will be billed for interest, calculated daily from the date your transaction(s) were posted to your card account until full payment is received, subject to a minimum S$2.50.

For partial payment or non-payment by the due date, there will be Finance Charges at 25.90% per annum levied. Finance charges are calculated daily from the date each transaction is posted to your card account until full payment is received. A minimum finance charge of S$2.50 is applicable.

Late Payment Charge will be levied on each main card account if the minimum payment due is not received and credited to your card account by the payment due date.

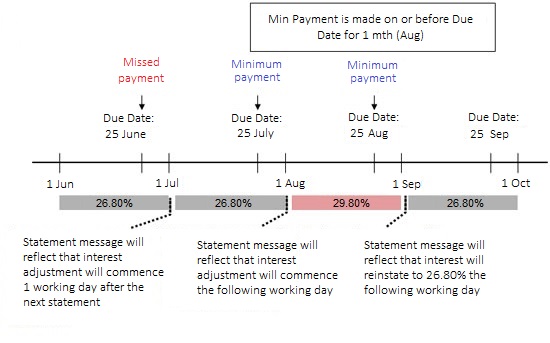

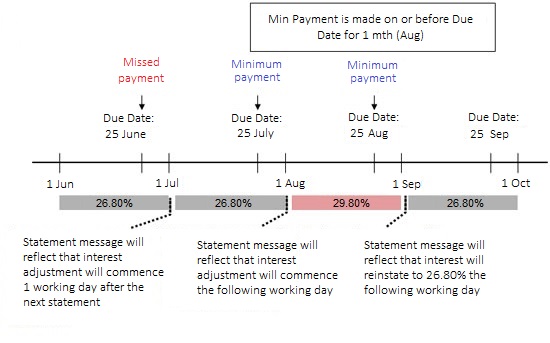

If the bank does not receive the required minimum payment by its due date (for example, due date on 25 June as illustrated in the example below), the interest rate applicable to your Credit Card account will be increased by 3% p.a. on top of the prevailing interest rate (”Increased Interest Rate”). This Increased Interest Rate shall be applied to the outstanding balance in your Credit Card account from the first working day after the date of the subsequent Credit Card account statement following your Credit Card account statement (i.e. from August’s statement), and used to compute the finance charges applicable to your Credit Card account.

This additional interest rate shall be applied even if minimum payment is received by the Bank on or before the due date of the following month (i.e. in July).

In the event that the minimum payment is made in full on or before the due date for the next statement (for example for August statement), the Increased Interest Rate shall be reinstated to the prevailing interest rate on the first working day after your next Statement Date (i.e. from September’s statement).

Example:

Any adjustment/reinstatement to the prevailing interest rate will be reflected in your monthly statement under your Account number.

Example:

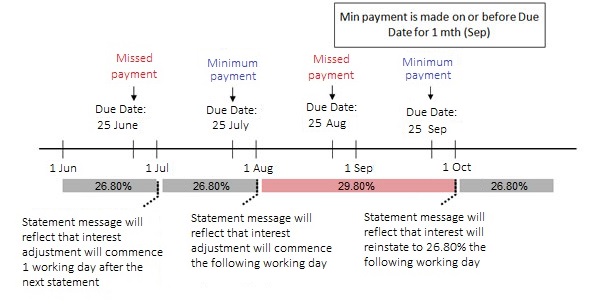

If you miss your payment again during the period of the 1 month during which you must maintain minimum payment in order for the Increased Interest Rate to be reinstated to the prevailing interest rate, the Increased Interest Rate will continue to apply until minimum payment is made in full for 1 month period. Using the example above, the prevailing interest rate will only be reinstated from October’s statement.

Example:

- If you pay your credit card balance in full each month by the due date.

- If you pay the minimum amount each month by the due date, you can avoid late payment charges.