- Private real estate (PRE) could be seeing early signs of pressure, requiring a deeper look at risks

- Inflation and rising interest rates vs a cooling economy could make it challenging for managers

- This environment could deal a double whammy on the riskiest opportunistic and value-added strategies

- We encourage investors to carefully assess their PRE investments on their fundamental merits

With most public markets in the red throughout most of 2022, the prevailing trend of thought was that private assets were a comparative safe haven as there was no need to face “mark-to-market” losses in investors’ portfolios. However, rapidly rising interest rates and a cooling economy are impactful developments that would unlikely leave private market investments above the fray. To imagine that absence of volatility implies the absence of risk is akin to the proverbial ostrich burying its head in the sand to hide from danger, and we would encourage investors to exercise more prudence in their risk assessment to be better prepared for potential stresses in these illiquid markets.

One area that could perhaps be seeing early signs of pressure is private real estate (PRE), for example, with top investment managers experiencing withdrawal requests from retail investors concerned about the sector’s outlook. Soaring borrowing costs are causing some property owners to struggle, as a year of rate hikes has perhaps spelled the end of an era for employing cheap leverage to amplify returns. Meanwhile, heightened inflation has pushed up construction and property enhancement costs, while growth headwinds could make it more challenging for some managers to manage vacancies and rents. Given the interplay of these movements, we believe this warrants a deeper look into the risks in PRE.

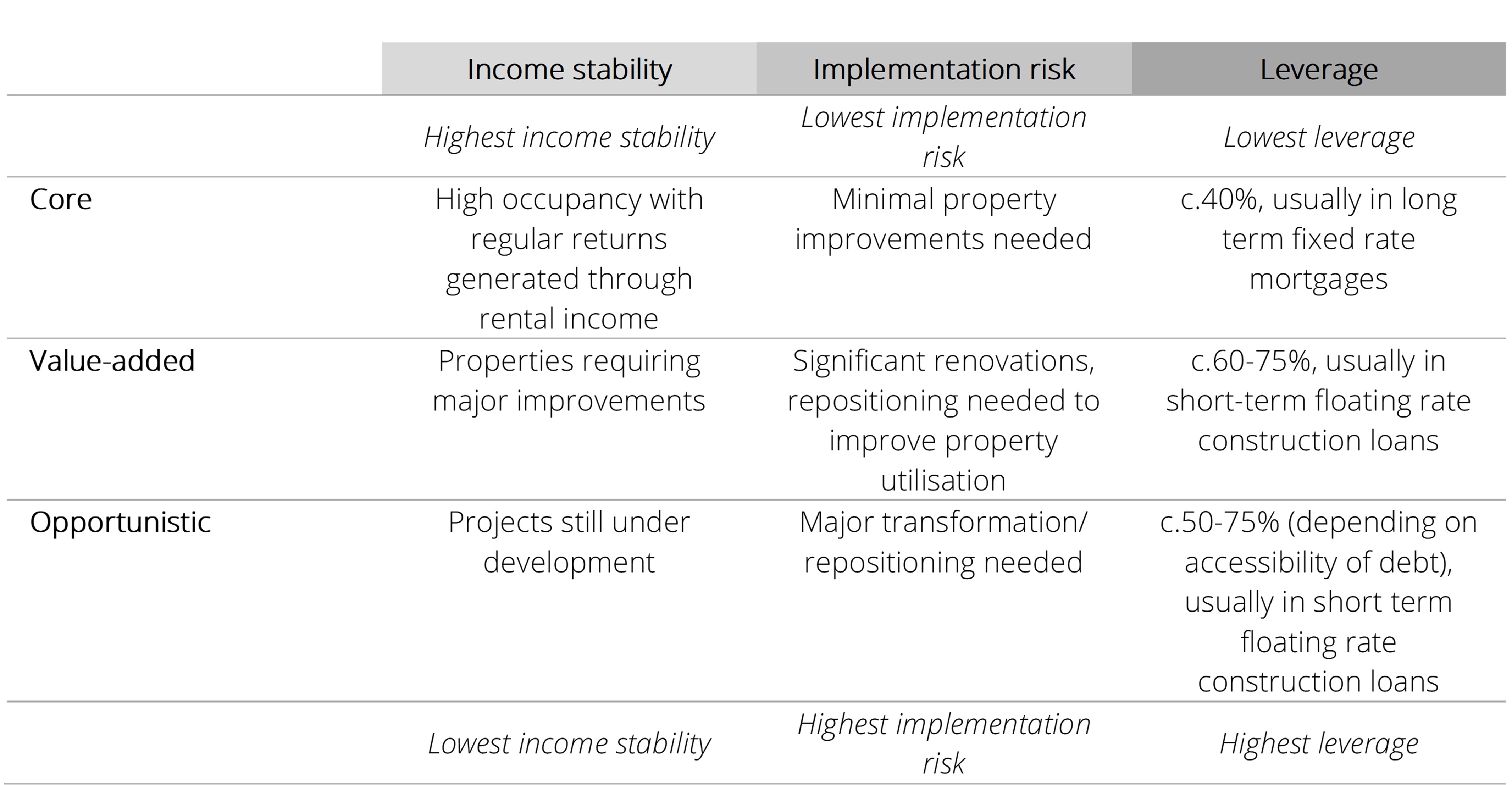

Types of PRE investment strategies. The following diagram illustrates the broad categories of PRE strategies and some of their significant features:

Source: Pitchbook, DBS

Risks in PRE investing

2. Rising interest rates resulting in higher financing costs

In our 4Q22 Private Assets Outlook, we called for calibration in private market investing given the rapidly rising interest rate environment and the pervasiveness of leverage to amplify returns in private market investment structures. As with other private market investments, the PRE space is not exempt from these risks, considering financing used in asset acquisition and property development.

3. Rising interest rates weigh on property values

According to the Green Street Commercial Property Price Index, US and Europe commercial property values have fallen 16% and 11% respectively in 2022 as rising financing costs and limited availability of capital has weighted on deal flow and asset valuations. Managers, facing mounting pressure to generate returns to compete with risk-free yields, are treading carefully to avoid overpaying for assets, spelling a challenging exit environment. Beyond mark-to-market losses in property holdings, falling property values could compound challenges in financing, for example, due to maximum loan-to-value provisions and loan covenants linked to property values.

Caution warranted for riskiest PRE strategies. In summary, we believe that high inflation and rising borrowing costs in the current environment are expected to deal a double whammy on the riskiest opportunistic/value-added strategies in PRE, with portfolios exposed to properties undergoing construction, and assets that are highly leveraged using short-term floating rate loans. While falling valuations could soon provide attractive opportunities for managers seeking to purchase quality assets at discounted prices, this would only benefit managers with the strongest track records and sufficient dry powder to deploy.

Nonetheless, we also note the potential for pockets of resilience in core strategies exposed to high quality assets, particularly in sectors benefitting from secular shifts like logistics properties in the US from the onshoring of supply chains and e-commerce demand. While PRE strategies have shown good risk-adjusted returns and diversification benefits over the long run, we would still encourage investors to carefully assess their PRE investments on their fundamental merits, and not be lulled into a false sense of security based on stagnant prices alone.

Download the PDF to read the full analysis.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.