- SSB has not been garnering much attention

- That is set to change as yields have risen significantly

- There could be marginal liquidity tightening if rates stay high

Singapore Savings Bonds (SSBs) will see increasing demand from individuals in the coming quarters as short-term yields continue to grind higher. To recap, SSBs are a special type of Singapore Government Securities (SGS) with features that make them suitable for individual investors. These bonds are redeemable at par in any given month without any penalties for early exit. We had analysed the impact of SSB on SGD liquidity condition previously (see here). Many of those conclusions still hold and we now take another look at these dynamics in today’s context.

Short-term USD interest rates are finally rising as the Fed kicked off with a 25bps hike in March. This marks the exit from two years of extraordinarily low interest rates as the world battles the pandemic. Moreover, the Fed has flagged the likelihood that jumbo-sized (50bps) hikes may be in the offing. Short-term SGD rates (including the SORA), which are highly correlated to USD rates, should head meaningfully higher in the coming quarters. Accordingly, this would impact the demand for SSB as yields become more attractive.

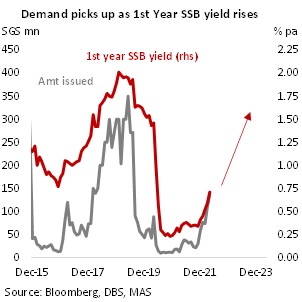

Our analysis indicated demand is highly sensitive to the 1st year yield in SSB. Total demand tends to pick up meaningfully once the 1st year yield get close to 1.5%. While the latest issue offers a rate <1% (for the 1st year), there has been a noticeable pick up in SSB applications from depressed levels seen in much of 2020/21.

If the Fed funds rate heads to 2.5% by end-2022 as we expect, we would reasonably expect that short-term SGD rates would climb towards 1.5%. All else equal, SSB could see demand of about SGD 370mn a month, similar to average seen in the 12 months ending June 2019 (when USD and SGD interest were high). To put things into perspective, the average total applications for the first four months of 2022 stands at only SGD 100mn.

There are some nuances to consider. First, how long would the period of high interest rates last? If the US keeps rates high for two years, the net drain could be around (SGD 4.4bn). This figure may seem small but could still tighten liquidity at the margin.

Second, 12M fixed deposit (FD) rates in Singapore appears to be high. Given the high correlation between SSB demand and 1st year yields, investors probably view FD and SSB as substitutes. In 2015 to 2019, FD rates are significantly lower than SSB’s 1st year yield. This could account for why demand for SSB was relatively strong. By contrast, the 12M FD rate is now meaningfully higher than the SSB’s 1st year yield. This dynamic could dampen SSB demand somewhat.

Third, the stickiness of SSB holdings should be considered. As interest rates step up, it gets more and more attractive to continue holding. This also has to be balanced against new SSB issues, which would look increasing attractive to current holders. SSBs issued over the past two years could be vulnerable to switching as investors redeem issues with low yields and redeploy into newer issues (with higher yields).

The upshot is that SSBs are going to be a drain on system liquidity. While the quantum is relatively small compared to the total bills outstanding, it could still be a swing factor if investor demand stays high for an extended period. This could be relevant if liquidity conditions are somewhat tight as shown by elevated MAS bill rates and FD rates. We expect demand for SSB to surge at the upcoming issuance given the that the cutoff yield for the 1Y T bill auction hit 2%.

To read the full report, click here to Download the PDF.

Topic

Explore more

E & S FlashThe information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.