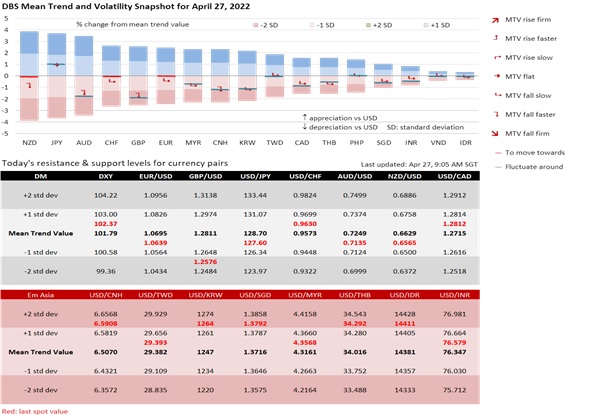

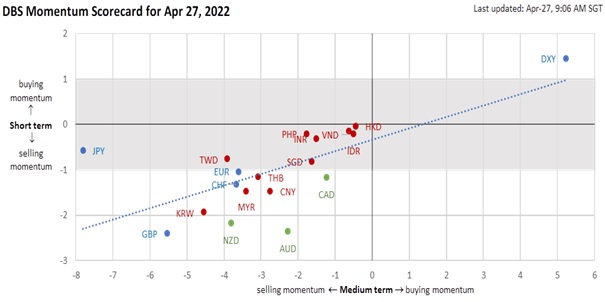

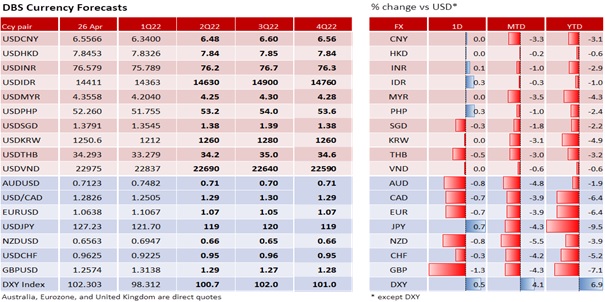

DXY appreciated the fourth session by 0.6% to 102.34. USD bulls are wary that the DXY’s rise towards its March 2020 high of 102.99 is coming on the back of the weak sentiment. Despite expectations for a hawkish FOMC meeting on 4 May, the US Treasury 10Y yield eased the third session by 10 bps to 2.72%, down from the year’s highest close of 2.94% a week ago. US stock indices were lower on poor guidance during the 1Q corporate earnings season. The US Conference Board’s consumer confidence index disappointed in April, slowing to 107.3 instead of rising to 108.2 from 107.6 in March. Despite the hot labour market, consumers were unhappy about elevated inflation eroding their paycheques. Hence, the higher PCE deflator inflation expected on Friday would no longer be positive for the US economy, especially if Thursday’s advanced US GDP growth slowed to an annualized 1.1% QoQ saar (consensus) in 1Q22 from 6.9% in 4Q21.

EUR depreciated 0.7% to 1.0638, near its Covid-low on 23 March 2020. German Finance Minister Christian Lindner wants the European Central Bank to return to its price stability mandate and not focus on providing growth. The German government is looking to lift this year’s inflation forecast to 6.1% from its 3.3% projection in January. On Monday, the German IFO business confidence index surprised on the upside to 91.8 in April; consensus had expected a fall to 89.0 from 90.8 in March. The government also announced that it has become less dependent on Russian oil, enough to manage a continent-wide full embargo on Russian oil and deliver heavy military equipment to help Ukraine defend against Russia’s aggression. Not surprisingly, ECB officials are coming together towards a decision to end net asset purchases in early 3Q22 and raise the -0.50% deposit facility rate after that. Conviction will build if Eurozone core CPI inflation (on 29 April) hits the 3.2% YoY consensus in April from 2.9% in March.

With the DXY back at its two-year Covid-high and the JPY becoming a safe haven after dropping to a two-decade low on risk aversion, CNY is considered overvalued, far from its weakest Covid level of 7.1670 per USD in May 2020. More so given the spread of Covid cases from Shanghai to Beijing, and the market’s desire for more monetary easing to support the economy. Hence, the first cut in China’s FX reserve ratio on Monday is considered insufficient to curb the fall in the currency. To extend depreciation, CNY will need to break the resistance at 6.60, its weakest level in March 2021. Apart from weaker stock markets, commodity currencies such as the AUD and NZD are also under pressure from the currencies playing catch up to USD strength in the Asia Pacific, their largest export destination. In Southeast Asia, the SGD has depreciated 2.2% ytd to 1.3791 per USD, its weakest level since July 2020. The IMF’s latest forecast for global growth to come in below 4% this year has not been positive for externally dependent Asian countries.

Subscribe here to receive our economics & macro strategy materials.

To unsubscribe, please click here.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.