We revised our currency forecasts after the FOMC meeting. In line with the Fed’s higher rate projections, our chief economist now sees the Fed Funds Rate rising to 4.5% this year before peaking and pausing at 5% next year. Earlier on 5 September, after the hawkish Jackson Hole Symposium, he forecasted the peak and pause at 4% in December.

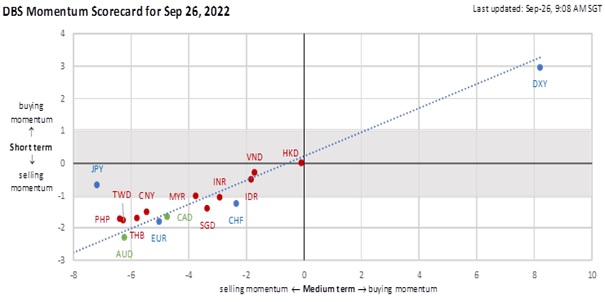

Hence, we see the USD topping out in 4Q22 instead of 3Q22. In YTD terms, DXY appreciated 18.3% last week, near the mightiest surges of 27.1% and 20.4% in August 1981 and November 1982, respectively. However, DXY corrected after it peaked for the year, leaving full-year gains lower at 15.8% and 12.1% in 1981 and 1982, correspondingly.

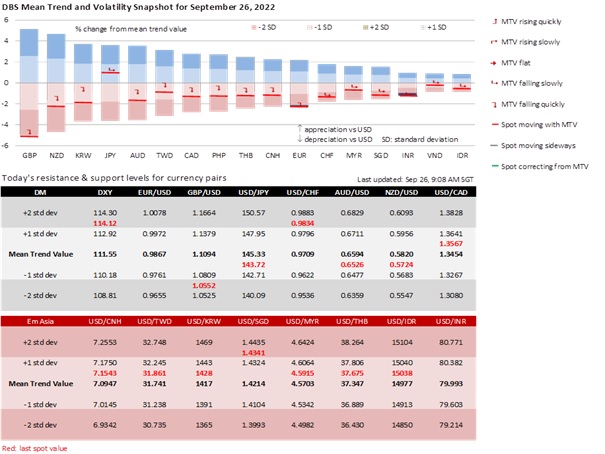

Meanwhile, brace for another week of USD strength and volatility. DXY appreciated 3% to 113.20 last week, its strongest close since May 2002. Fed officials are speaking from Monday to Friday. They will justify why the Fed Funds Rate needs to rise to 4.4% instead of 3.4% this year, the revised projections at last week’s FOMC meeting. Hence, the Fed can deliver a fourth 75 bps hike in November. Like CPI a fortnight ago, Friday’s PCE core inflation should rise by 0.5% MoM (consensus) in August from 4.6% in July.

However, the higher the DXY climbs, the greater the risk of a sharp correction. On 27 September, US recession fears may show up in US consumer confidence, especially if the present situation index falls sharply. DXY is expensive; its 14-day RSI closed at 77.5. With the Fed Funds Rate slightly restrictive at 3.25%, above its estimated 2-3% range, some Fed officials could also start talking about slowing the pace of hikes to 50 bps in December.

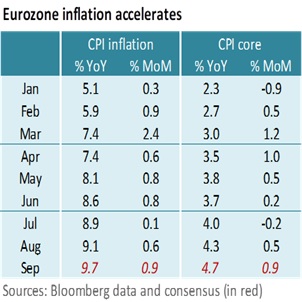

EUR depreciated 3.3% to 0.9687 last week, its weakest close since August 2022. EUR is oversold as per its 14-day RSI at 28.8. Many European Central Bank (ECB) officials speak from Monday to Friday. The highlights are ECB President Christine Lagarde on Monday and Wednesday and ECB Chief Economist Philip Lane on Thursday. On 30 September, brace for a surge in the CPI inflation estimate to 9.7% YoY (consensus) in September from 9.1% in August, and core inflation to 4.7% from 4.3%. Expect Lane to have a hard time convincing his colleagues to slow down the pace of hikes.

GBP is within striking distance of its lifetime low of 1.0520 in February 1985. Last week, GBP depreciated 4.9% to 1.0859, its weakest close since March 1985. GBP is under tremendous pressure as per its ultra-low 14-day RSI reading at 16.7. First, the Bank of England’s second 50 bps hike to 2.25% fell short of the Fed’s third 75 bps hike to 3.25% despite the greater inflation pressure in the UK. Second, the markets dumped GBP and propelled 2Y Gilt yield to almost 4% on Chancellor Kwasi Kwarteng’s mini-budget. The National Institute of Economic and Social Research (NIESR) estimated that the Truss government’s borrowing-to-spend plan would widen the budget deficit to 8% of GDP this financial year. US President Joe Biden criticized the plan to boost growth as “trickle down” economics that never worked. Others criticized the tax cuts for adding to inflation. The Telegraph newspaper reported that Tory MPs would vote against the tax cuts if the GBP breaks parity against the greenback.

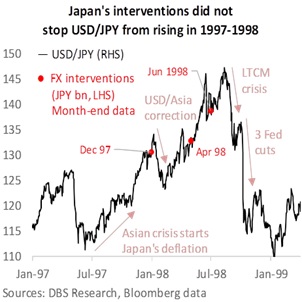

Don’t expect Japan’s first intervention since 1998 to stop the JPY from depreciating on monetary policy divergences. Last Thursday, USD/JPY pushed above 145 to almost 146 on the Bank of Japan’s pledge to maintain its ultra-loose monetary policy, less than a day after the Fed forecasted a higher peak in US rates. The intervention sent USD/JPY down for less than five hours. USD/JPY recovered during the New York session to end the week at 143.31, still eyeing 1998’s high of 147.66. The US Treasury Department and the Swiss National Bank confirmed that they had not participated in the intervention. When Japan last intervened, from December 1997 to June 1998, USD/JPY kept rising on Japan’s deflation during the Asian crisis. It took financial stress from the collapse of Long-Term Capital Management to trigger US rate cuts to send USD/JPY down. Similarly, it was the hard landing in the US economy that lowered USD/JPY in 1980 and late 1983.

Quote of the day

“A new world order is being born and…the moment of delivery is actually the most dangerous.”

Singapore Minister for Foreign Affairs Dr Vivian Balakrishnan

26 September in history

In 1950, United Nations troops recaptured Seoul from North Korean forces.

Subscribe here to receive our economics & macro strategy materials.

To unsubscribe, please click here.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.