2021 Digital Readiness Survey

APAC, UK AND USREGIONAL REPORT FOR CORPORATES

Please enter details to read further

2021 Digital Readiness Survey

2021 Digital Readiness Survey Executive Summary

Executive Summary About The Survey

About The Survey Crystallising Digital Strategies

Crystallising Digital Strategies The Digital Journey Is Never Over

The Digital Journey Is Never Over Opportunity For Openness

Opportunity For Openness Treasurers To The Fore

Treasurers To The Fore Risks Differ Across Geographies

Risks Differ Across Geographies Not Going Digital Is The Greatest Risk

Not Going Digital Is The Greatest Risk Top-Line Growth Is The Lead KPI

Top-Line Growth Is The Lead KPI Banks Playing A Key Role In Fintech

Banks Playing A Key Role In Fintech APIs Pass The Tipping Point

APIs Pass The Tipping Point Smart Contracts The Smart Choice

Smart Contracts The Smart Choice Transaction Services Investment Holds Sway

Transaction Services Investment Holds Sway Ecommerce Fuels Growth

Ecommerce Fuels Growth ESG The Next Growth Frontier

ESG The Next Growth Frontier Key Conclusions

Key Conclusions Where To From Here?

Where To From Here?If 2020 saw corporates in Asia Pacific (APAC) rise to the challenge of accelerating their pace of digitalisation, 2021 reflects a shift in corporates' approach towards a clearer and more holistic digital transformation.

Going digital for these corporates has changed from initially being reactive and internally focused to being much more proactive and encompassing all aspects of the business ecosystem, including key external relationships and drivers. As the pandemic and global trade disorder continue, we are seeing corporates engaging in new ways of working, providing critical support to key actors in their supply chains, and continuing to pivot sales and distribution models to meet the contactless demands of their customers and partners.

The DBS Digital Readiness Survey for Treasurers is designed to chart this progress through the lens of digital transformation. This year we learned that seven in ten (70%) corporates in the region now have a digital transformation strategy in place, a marked increase from 57% a year ago. And the strategies are getting considerably clearer.

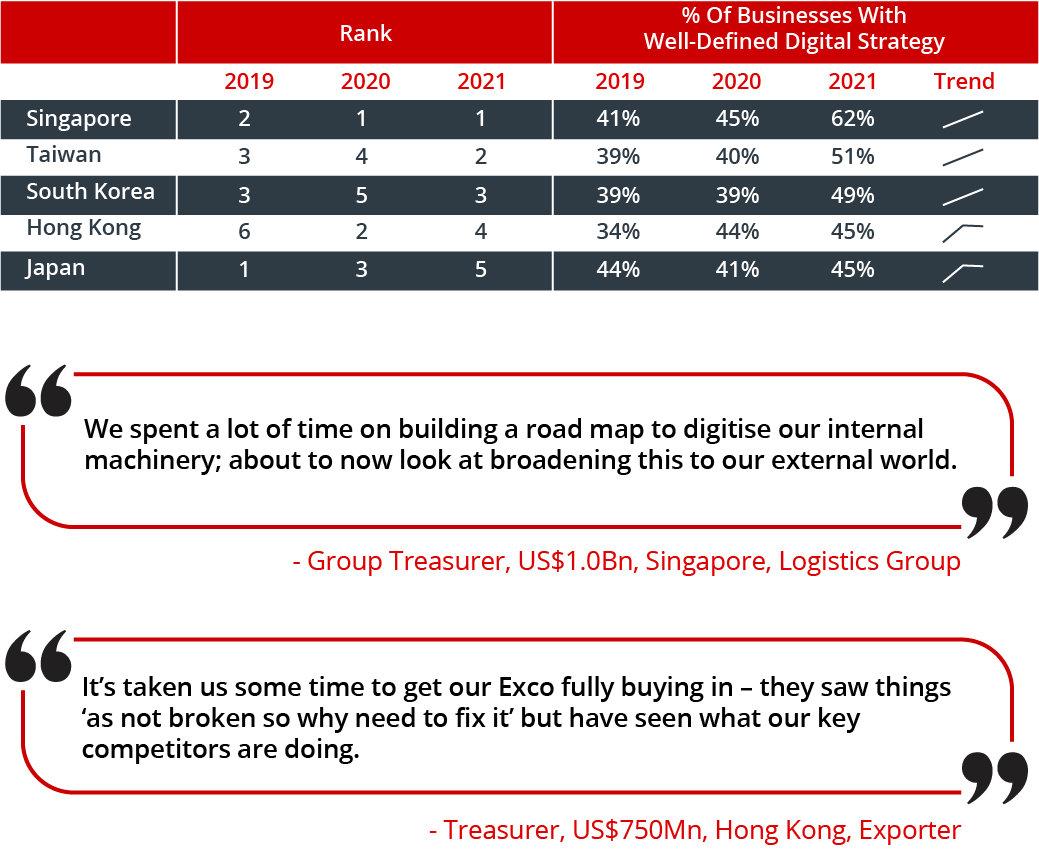

Singapore leads with the highest proportion of corporates having a clearly defined digital strategy at 62%, followed by Taiwan (51%) and South Korea (49%).

But we are finding that digital transformation is perhaps a journey that is never over. It's a journey of continuous fine-tuning and enhancement. And it is a journey that Treasurers are actively championing and resourcing, all the while increasing their standing as an informer of the digital strategy, not simply an inheritor of it.

We have also learned that digital transformation can be a complex matter and comes with its own set of challenges, but that Treasurers see these as secondary to the relative downside of not going digital.

This paper highlights the key findings of the DBS Digital Readiness Survey for Treasurers, setting them in the context of the 2019 and 2020 surveys. We hope you discover new insights in the pages that follow, as we summarise the progress that Treasurers are making, championing digital transformation across their organisations.

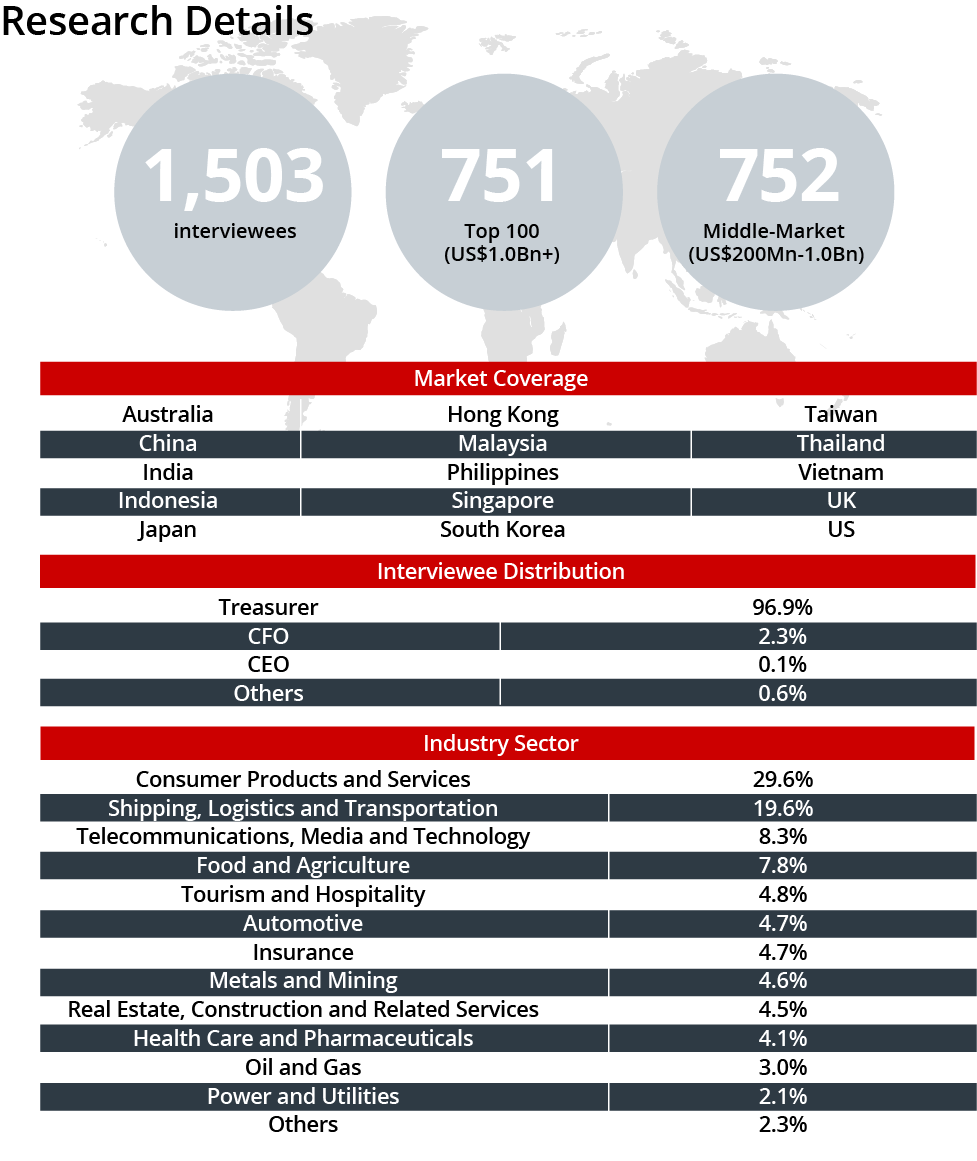

DBS has partnered with East and Partners (East) to continue its Digital Readiness Survey1 for the third round.

The main objectives of the survey programme are:

The first round of research in 2019 reported on country-level results for 13 markets across Asia Pacific (APAC).

This was then broadened into 2020 to encompass the UK and the US serving as international comparison benchmarks in Round II.

Into Round III, we have broadened the survey universe to include SMEs, to learn about how they are digitalising to survive and thrive in the 'new normal' business environment.

This paper outlines the key findings on large corporates and Middle-Market companies. The full results for the parallel SME research are available here.

1 Previously known as DBS Digital Treasurer Survey.

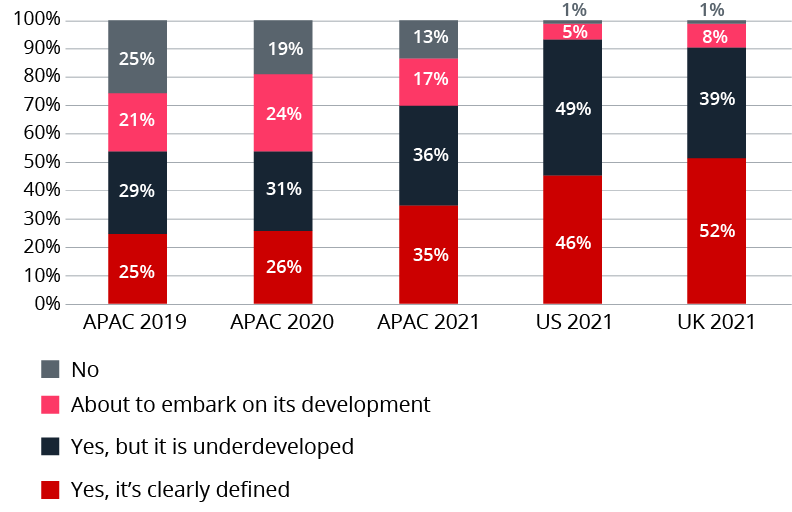

Corporates in APAC have made material progress in developing and executing their digital strategies since the inaugural round of this research in 2019, significantly closing the gap with international benchmarks including the US and the UK.

Seven in ten (70%) corporates in the region now have a digital transformation strategy in place, a marked increase from 57% a year ago and 54% two years ago. In 2020, there was a material drop in the number of corporates with no strategy as corporates scrambled to draw up and execute tactical digital engagement plans in response to the pandemic. This year, corporates appear to be crystallising these plans into a more holistic enterprise-wide digital strategy that covers their entire ecosystem of customers, suppliers, employees and partners.

Of particular note, the proportion of APAC corporates with a clearly defined strategy has seen the largest jump on record, up 32% year-on-year.

While digitalisation in APAC has seen a strong acceleration over the past 12 months, the region as a whole continues to lag behind the US and the UK where a larger proportion of corporates have a clearly defined digital strategy – 46% and 52% respectively in the US and UK in comparison to a regional average of 35% in APAC.

% of corporates

Similar to the previous year's results, the Top 100 revenue ranked companies across APAC are more likely to have a digital strategy in place than their middle-market counterparts, however the gap is closing quickly with middle-market corporates now only four percentage points behind (down from eight points a year earlier).

Experiences from the top five markets in APAC suggest that the digital journey may be an 'infinite game' for corporates, as the quest for digital-readiness appears to be a continuous process of fine-tuning and enhancement.

Singapore maintains its lead position with the largest proportion of corporates having a clearly defined digital strategy at 62%. Taiwan (51%) and South Korea (49%) have moved up two spots each from last year to place second and third respectively.

In contrast, digitalisation efforts among corporates in Hong Kong is flattening as the proportion of corporates with a clearly defined strategy has only seen a one percentage point increase year-on-year to 45%. Our research suggests that this is due to a number of corporates who are continually reviewing and redefining their digital plans and priorities, to ensure that they are fit for purpose in an ever-changing market. We have seen similar occurrences in other countries, including Japan where the number of companies with clearly defined strategies actually fell over 2020.

It is also representative of corporates now understanding the importance of broadening their digitalisation plan to extend beyond internal efficiency optimisation and into external relationship engagements, including a review of finance and banking capabilities, and re-modelling their sales and distribution channels.

Although corporates in APAC have been making strong progress across their digital plans, further openness to key enablers of change will help to accelerate their transformation efforts.

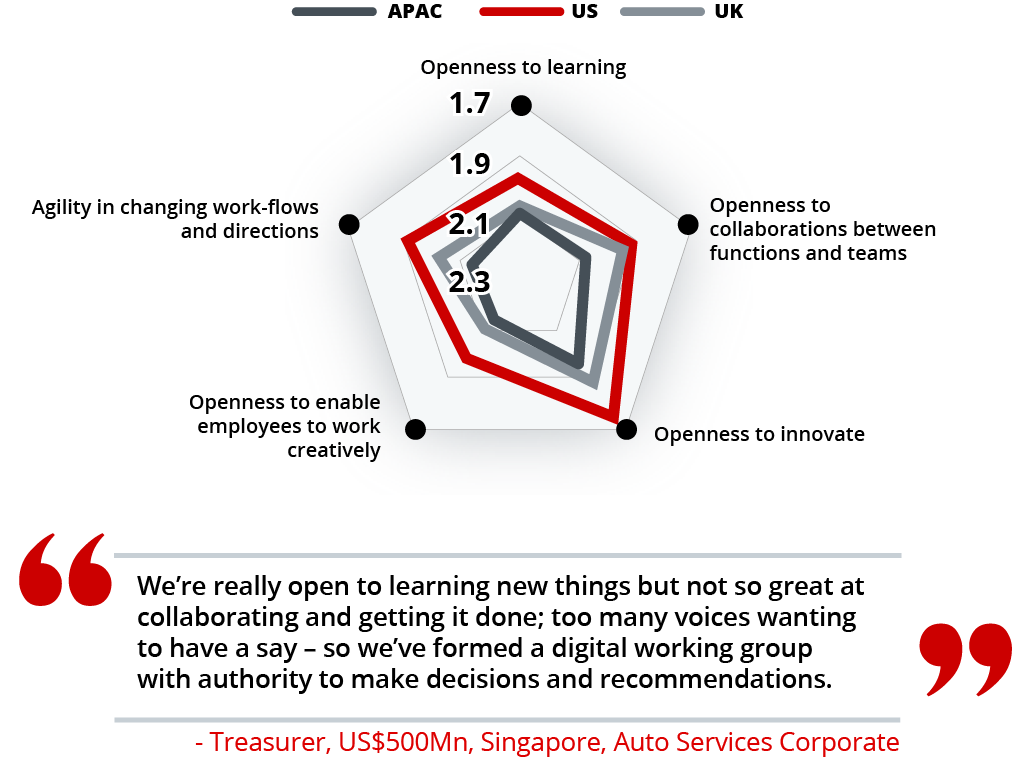

Apart from having a clearly defined plan, supported by the right investment in technology innovation and talent, the survey also reveals five key organisational factors that are driving successful digital transformation, including openness to learning, openness to collaborations between functions and teams, openness to innovate, openness to enable employees to work creatively and agility in changing work-flows and directions.

APAC generally underperforms the US and the UK across all five digitalisation receptiveness factors tracked, but corporates in the region are relatively more open to learning and innovating with average ratings of 2.06 and 1.97 respectively (on a 1-5 scale, with 1 = excellent and 5 = poor). Notably, improving the agility in changing workflows and direction represents the widest receptiveness gap to international benchmarks, with APAC corporates rating 2.14 versus the UK (2.03) and the US (1.91).

Treasurers in the survey have been quick to suggest that businesses in the region might not be learning fast enough to keep pace with the rate of change around them. And this is reflected in their increasing calls for external help and resourcing, particularly from their banks.

It is increasingly clear that to deliver an effective digital transformation requires much more than just enabling new technology. It requires a broader cultural and organisational transformation to encourage "openness" across the enterprise – an openness "to what is possible".

Ratings on a 1-5 scale (1 = excellent and 5 = poor)

Leveraging their expertise in risk management, data analytics and payments, Treasurers in APAC are increasingly stepping out of their traditional role to help in the navigation of their companies' digital transformation.

With the pandemic forcing strategic shifts and changes to business models, Treasurers are increasingly finding themselves in the digitalisation driver's seat. Not only are one in five (22%) Treasurers proactively pushing the digital agenda within their organisation, but a similar proportion (17%) of treasuries are now resourcing the delivery of the strategy.

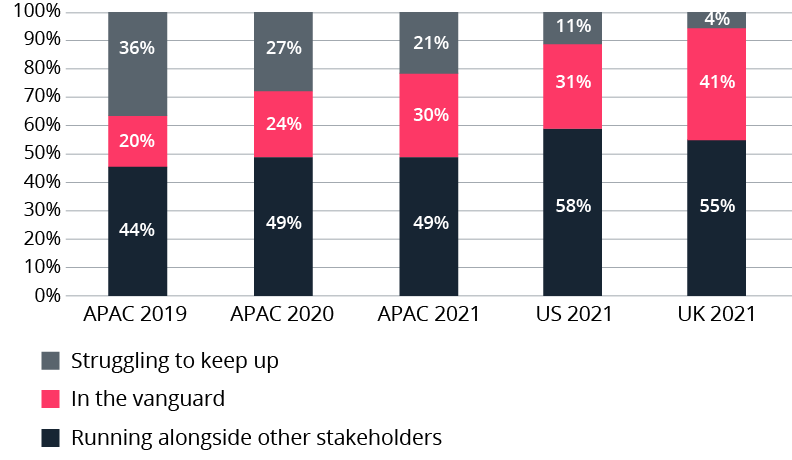

Encouragingly, Treasurers are successfully maturing in their "new" digitalisation responsibilities. Just one in five (21%) Treasurers in the region are now struggling to keep up with digital transformation, decreasing from 27% a year ago and 36% in 2019. The proportion of Treasurers in APAC that feel they are in the vanguard (30%) is now on par with the US (31%), led by corporates in China (64%) and Singapore (52%). Key areas of activity have included digitalising workflows to increase sales velocity, building resilience into supply chains and improving organisational effectiveness.

Considering the path treasury has taken in the US and the UK, the future direction of travel is unlikely to be any different for APAC. Treasury will continue to play an increasing role in the digital journey, providing an important source of influence and executional capacity for the ongoing transformation.

% of corporates

Digital transformation can be a complex matter and comes with its own set of challenges, depending on both the internal and external operating environment.

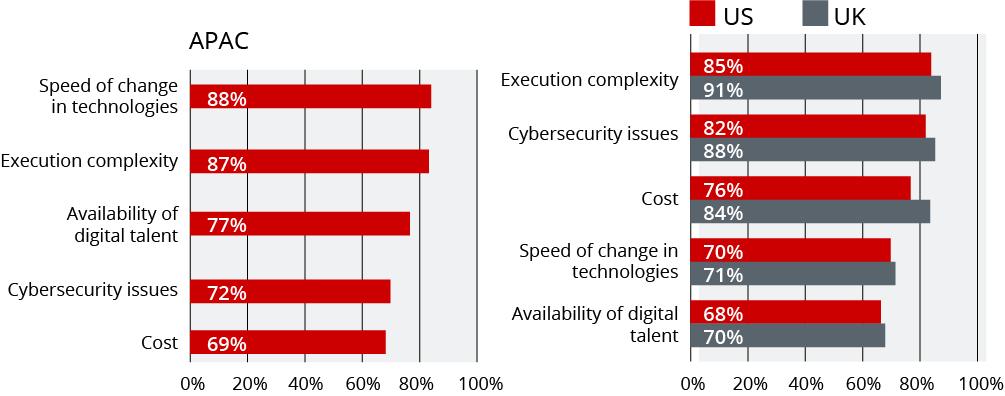

Similar to last year's survey findings, the top three challenges highlighted by APAC Treasurers in adopting new technology are the speed of change and complexity in enabling technologies (88%), execution complexity and delivery (87%) and the lack of availability of digital talent (77%).

Whilst ranking third, the lack of availability of digital talent was particularly pronounced year-on-year as companies actively competed for a limited pool of developers, technology architects and data scientists.

This lack of availability of digital talent is also a key contributing factor to the challenge of keeping up with the speed of change and complexity of enabling technologies. Increasing the pool of digital talent through continuous development and targeted incentivisation will have a knock-on effect in mitigating several of the other risks and challenges being faced by corporates in APAC.

In the UK and the US, execution complexity and delivery, cybersecurity and cost, top the list of challenges in adopting new technologies. Whilst cybersecurity concerns have heightened over the year, cybersecurity only just makes It into the list of top five challenges for APAC, as against a close second to executional complexity, in both the US and the UK.

% of corporates

As corporates continue to move more and more critical infrastructure onto the cloud, we expect the relative importance of cybersecurity to continue to rise in relation to other risks. Recent region-specific threats and the continued pace of digitalisation will only but amplify the priority of cybersecurity and required vigilance on the part of corporates operating in APAC.

Another area of divergence between regions appears to be in the challenges in navigating the regulatory environment. Interestingly, fewer corporates in APAC (24%) are concerned with the possibility of the regulatory environment disrupting digital plans, as against 32% for corporates operating in the US and 41% for the UK.

While there are attendant risks to digitalising the business, Treasurers see these as secondary relative to the downside risk of not going digital.

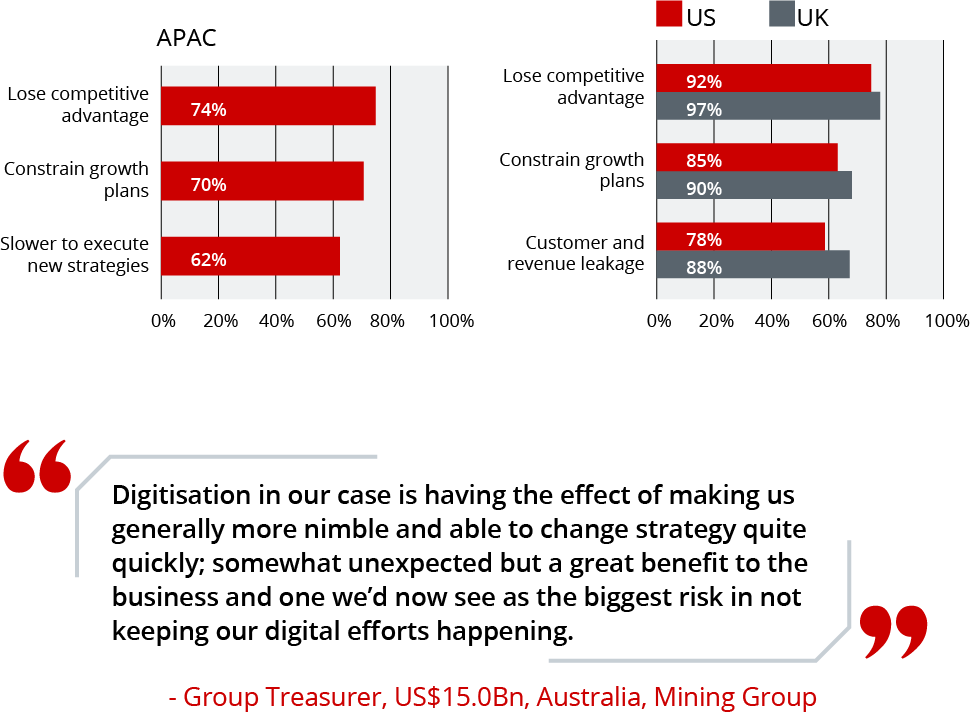

Digital transformation is risky, but not transforming is even riskier. Treasurers are not only pushing the digital agenda within their organisation, but they are very clear as to risks of not doing so. Treasurers in APAC (74%), along with their peers in the US (92%) and the UK (97%), are aligned in identifying erosion of competitive advantage as the biggest risk in not digitalising. The pandemic has certainly widened the gap in competitiveness between digital and non-digital corporates beyond previous expectations.

As the pandemic drags on, digital transformation has not only ensured the future survival of 'switched on' corporates via contact-free sales and service models, but also defined a 'new normal' business environment for corporates to thrive in, through CX-led, personalised and frictionless digital propositions and services. Corporates that do not engage in such a way in the future, will do so at their peril.

Most corporates in APAC do appreciate that delays in going digital will limit their future growth plans (70%) and also slow down the execution of new strategies or implementation of change programmes (62%). Whilst there is also a growing concern amongst APAC corporates that delays in going digital will impact talent retention (60%) – a particular challenge for the APAC region – the UK and the US are more likely to be concerned about the direct impact on customer and revenue leakage.

% of corporates

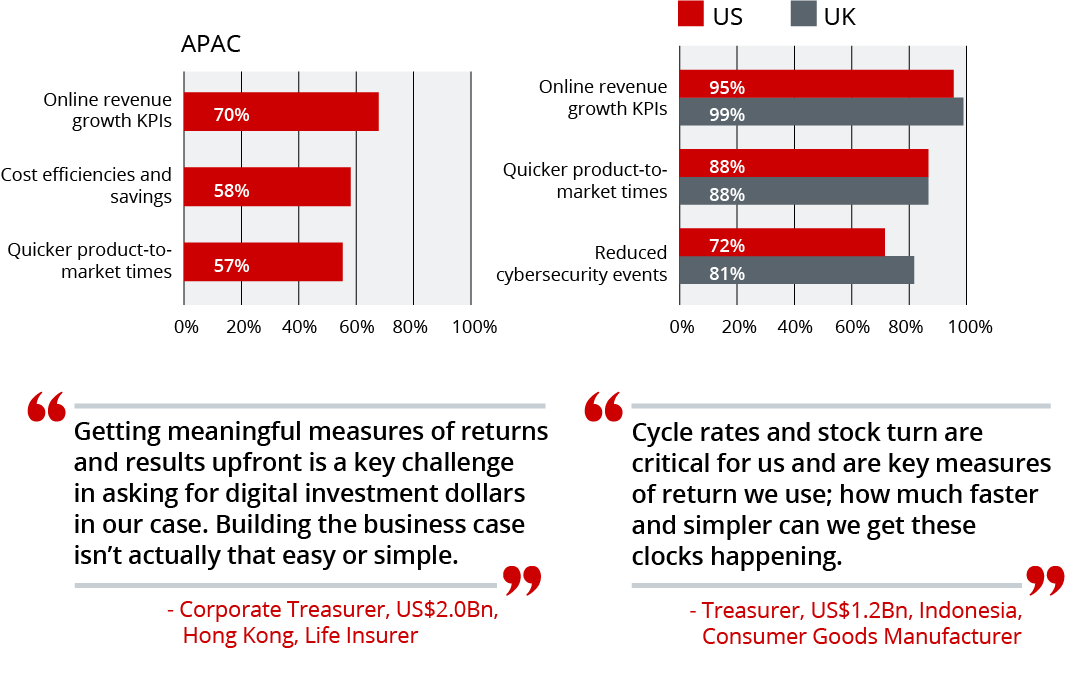

Online revenue growth has overtaken cost-efficiency measures as the most cited key performance indicator (KPI), when evaluating the return on investment from digital transformation.

With over nine out of ten (92%) corporates across APAC now having formal KPIs in place to measure the success of their digital transformation projects, there is a growing discipline surrounding the sizable investments being made in this area.

Where previously cost-efficiency gains were the focus of the initial internal back-office digital transformations, the broadening of focus to transforming external customer journeys has led to the rise of online revenue growth as the key measurable outcome and KPI for seven in ten (70%) corporates.

Although not necessarily the lead KPI, cost-efficiencies and savings are still in focus (58%), and faster product-to-market times (57%) is also emerging as a credible measurement of Digital ROI – as corporates accelerate the development of digital products and services to meet the everchanging needs and desires of consumers.

Although only one out of ten (8%) of APAC corporates are not tracking the progress of their digital transformation against formal KPIs, it is more common an issue in Australia (25%), Japan (25%) and Vietnam (31%).

The results also show that APAC digital transformation KPIs are similar to those used by corporates in the US and the UK, however, the latter are also tracking the number of cybersecurity events being experienced – a potential metric for APAC corporates to consider in their plans forward.

% of corporates

Increasingly, APAC corporates are relying on and partnering with their banks to identify the right fintech solutions and providers as they struggle to keep up with the pace of change and complexity in enabling technologies.

There has been a clear appetite amongst progressive Treasurers to employ the latest innovations in technology to remedy legacy challenges. However, Treasurers are increasingly aware that buying their way out of the challenge is not always the answer, particularly if it results in a plethora of systems, add-ons and additional vendor relationship issues.

Similar to the UK, over eight in ten (85%) APAC corporates are now partnering with banks to seek their help in narrowing down the field of digital treasury and transaction solutions to optimise functionality, interoperability, security and ease of use. Notably, there has been a large increase in demand for bank advisory in this space in the Philippines (up 22 percentage points to 89%), Taiwan (up 21 percentage points to 82%) and India (up 19 percentage points to 89%).

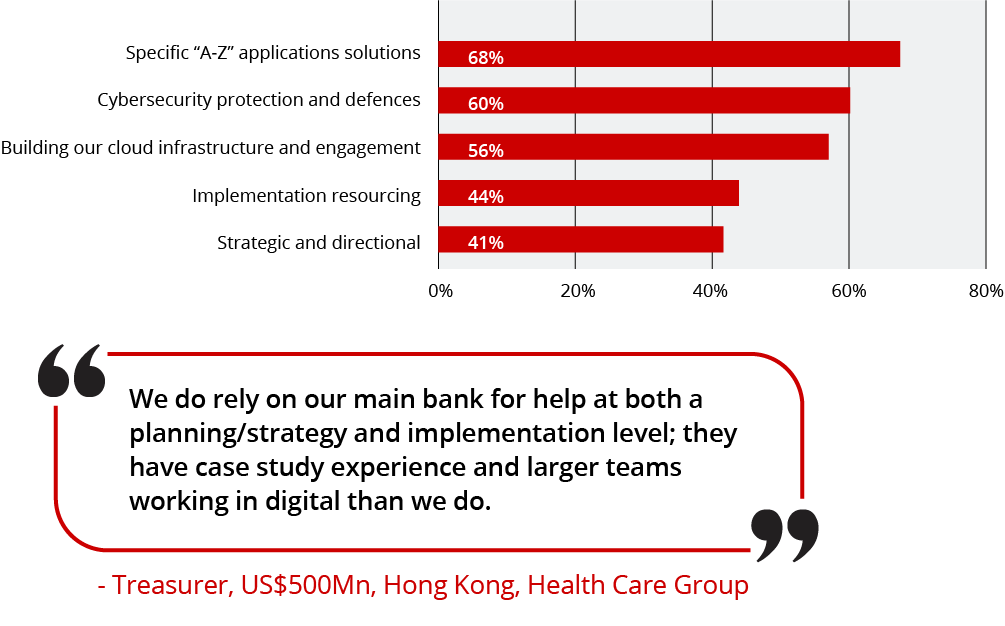

Banks are also being viewed as more than a simple facilitator of effective collaboration between corporates and fintechs and are being asked for strategic and directional guidance on fintech engagement (41%), as well as for implementation resourcing (44%) to assist in the digital transformation of treasury.

% of corporates

API adoption in 'business to bank' connectivity has passed a tipping point, driven by the demand for real-time treasury and the benefits of embedding banking services directly within client workflows and platforms.

As the pace of digitalisation accelerates, many APAC corporates are changing how they connect to their banks.

Traditional host-to-host connections and file uploads are rapidly being replaced by Application Programming Interfaces (APIs) to take advantage of real-time data and deliver direct access to the growing number of instant payment rails throughout APAC.

This has resulted in API connectivity growing from 37% to a staggering 56% over the last 12 months. This has been further turbocharged by employing APIs in the co-creation of new customer value propositions – from 'use cases' involving real-time insurance claims settlement through to multi-tier supplier financing.

However, there is significant variance by market. Corporates in China (95%) continue to hold pole position in terms of API adoption, followed by Australia (80%), Singapore (74%) and India (67%), with Vietnam (22%) in the early stages of adoption.

Compared with international markets, APAC as a region (56%) is now firmly ahead of the US (47%) and rapidly catching up to the UK (61%) in the use of APIs for banking connectivity.

% of corporates

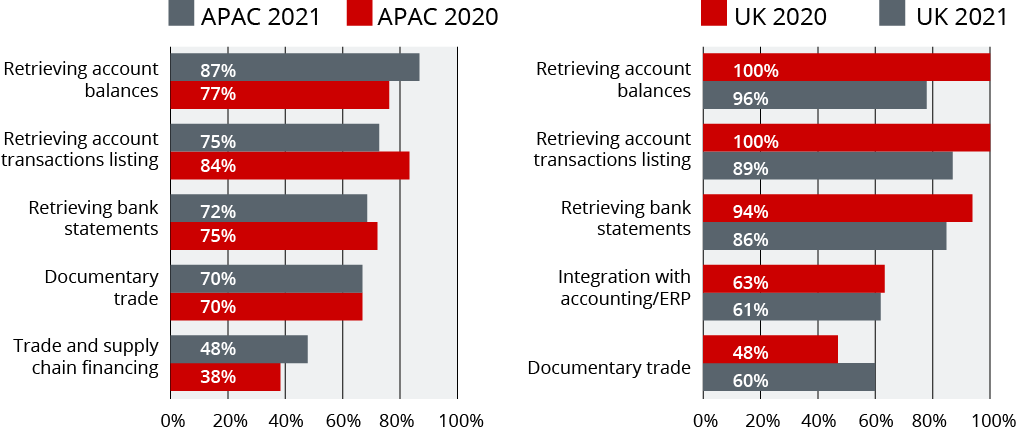

The results also show that APAC Treasurers are expecting banking APIs to gain further traction over the next 12 months, with adoption rates reaching 65%. While retrieving real-time account-related data remains the core requirement, Treasurers are also deepening their adoption of documentary trade (70%) and trade and supply chain financing (48%) APIs, to both reduce the cost and friction in document submission and processing, and to gain faster access to working capital support.

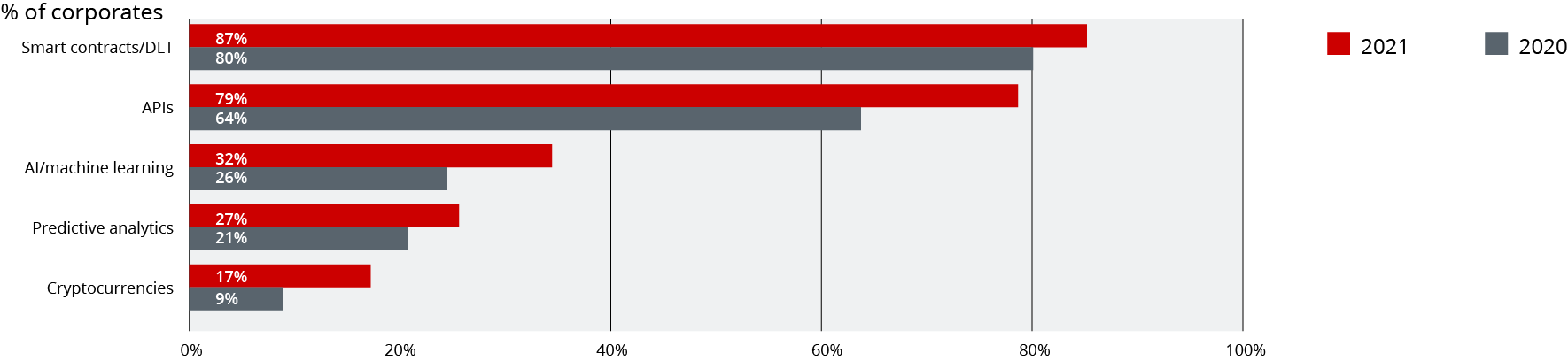

Treasurers believe smart contracts and APIs to be the most valuable technologies for driving business transformation.

Consistent across all markets and with the previous rounds of the survey, eight in ten Treasurers see smart contracts (87%) and APIs (79%) as the top two most valuable technology investments moving forward.

Smart contracts continue to gain acceptance and traction in procurement, supply chain management, and 'know your customer' certification – with use cases increasing exponentially across insurance, financial services, healthcare, technology, media, telecommunications, and the public sector. And the transformative power of API enablement and adoption is well understood.

Additionally, Treasurers are also expressing interest in using artificial intelligence (AI) and machine learning (ML) solutions, to dynamically improve their processes.

With a third (32%) of Treasurers either already experimenting, or considering the application of AI and ML within their forecasting models and risk analytics, these technologies are playing an important role in the digital transformation of the treasury function.

Treasurers are, however, less enthusiastic about using Robotic Process Automation (RPA) to achieve real-time treasury services, with many seeing it only as a short-term component of a broader digital strategy.

And despite market attention and coverage of the cryptocurrency space, appetite for cryptocurrencies as part of the broader digital transformation remains relatively muted across APAC (17%), US (14%) and UK (13%). However, interest in the possibility of CBDCs (Central Bank Digital Currencies) for faster and cheaper payments with data payloads and security is growing, along with new blockchain-based cross-border payment platforms such as Partior2.

Treasurers continue to prioritise investment in technology to support their ongoing transaction services requirements.

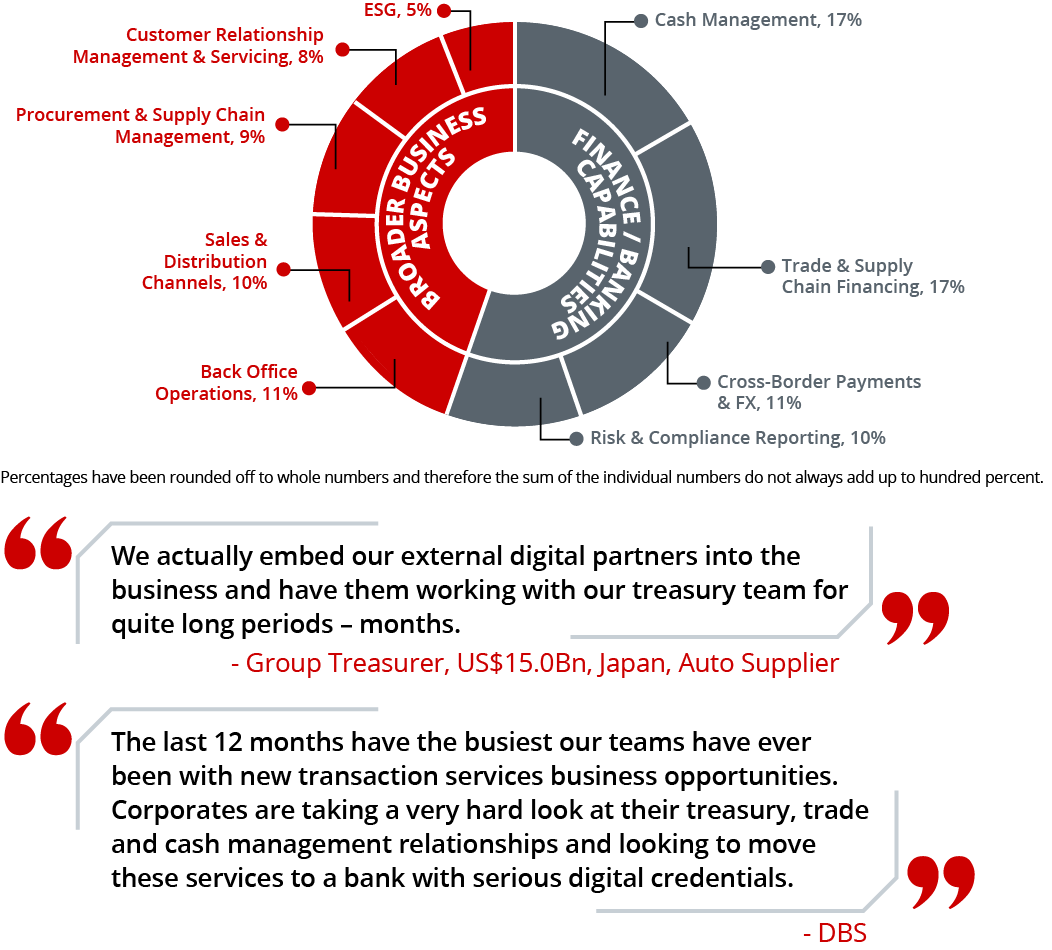

When it comes to investment priorities, Trade and Supply Chain Financing (65%) and Cash Management (56%) are top of the agenda for APAC Treasurers.

In a crucial year to build trust across key ecosystems, Trade and Supply Chain Financing investment has received a particular boost. Blockchains are on the rise, and Treasurers are investing in digital supplier and distributor financing platforms, whether to provide funding support across their own trading ecosystems, or to access working capital support for themselves.

Investment in cash management technology also continues to hold through the pandemic as Treasurers are challenged by their CFOs and boards to deliver more granular levels of cash visibility and forecasting during such a critical time.

Investment in Sales and Distribution channels (eCommerce storefronts) and Procurement solutions are next on the list, with Risk and Compliance reporting only managing eighth place. By way of comparison, in the US and the UK, Risk and Compliance Reporting takes out first and fourth place respectively.

The percentage of spend in each area is also broadly aligned to the priority, with Trade and Supply Chain Financing (17%) and Cash Management (17%) both leading the quantum of spend across APAC. Investment in Risk and Compliance Reporting (10%) is less than a third of the combined spend on Trade and Supply Chain Financing and Cash Management, compared to well over half of the same spend in the US and the UK.

% of current financial technology / platform spend

The global pandemic has demonstrably solidified the need for eCommerce and where it used to be simply one of the many options to making a sale, it is fast becoming a primary method of doing business.

For corporates that had already engaged in eCommerce and pivoted to online sales and fulfilment models prior to the pandemic, efforts in this space have really paid off.

Corporates in Singapore and China stand out as the regional, and perhaps global leaders in eCommerce, deriving 42% and 36% of their overall revenue through online channels respectively. This compares to eCommerce revenue of 32% for a typical business in UK and 30% in US.

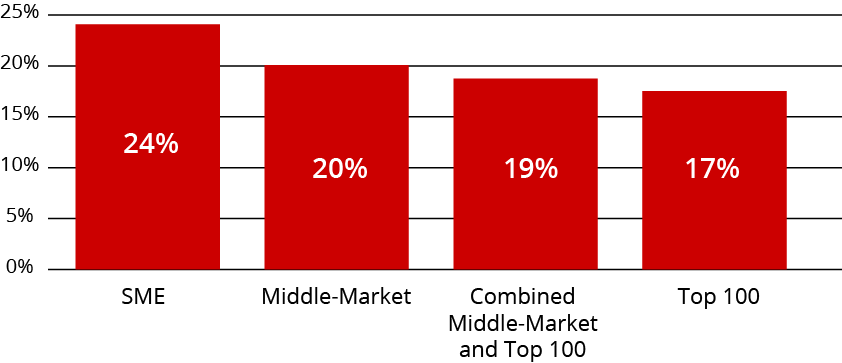

That said, eCommerce revenue currently accounts for just 19% of APAC's corporate revenue, suggesting that that there is considerable upside across the region for further digital transformation and eCommerce investment across many of the APAC markets.

Particularly so, as these corporates are operating in the backyard of the world's largest eCommerce market with Asia accounting for nearly 60% of online retail sales3. Corporates may well look to SMEs in the region for further inspiration here, given they derive a considerably larger portion of their overall revenues (24%) from eCommerce.

3 www.digitalcommerce360.com/article/asia-ecommerce-top-retailers

% of overall revenue

APAC corporates are placing increasing importance on developing environmental, social and governance (ESG) related capabilities and practices to enhance brands, drive performance and do good.

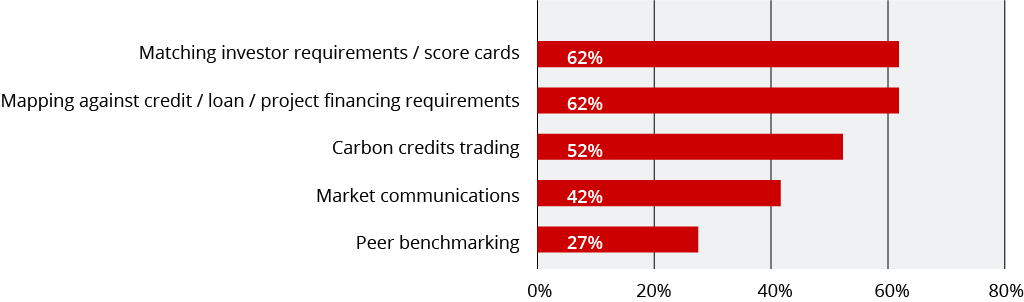

Although investment in new technology directly related to ESG and sustainability outcomes has yet to enter the mainstream, with less than one in five (17%) APAC corporates currently investing in this area, corporates are planning to allocate greater digital spend towards ESG related systems and applications over the next 12 months.

Among those corporates that are investing in digital solutions for ESG purposes, six in ten expect to leverage digital tools to match investor requirements (62%) and map against financing requirements (62%) in relation to their ESG agendas, while 52% are investing in technology to offset their carbon footprint through the trading of carbon credits.

In addition to these initiatives, Treasurers and supply chain managers are also actively looking at technology options to drive transparency, trace-ability and provenance across their supply chains – including the use of Blockchains to verify origin, authenticity, custody and integrity of products, in accordance with sustainable practices.

These moves are all part of a broad trend – a shift from shareholder capitalism to stakeholder capitalism – as APAC corporates consider the long-term effects to people and the planet, in their efforts to create value.

% of corporates

In 2019, when DBS embarked on this effort to better understand and guide how treasury and finance professionals across APAC were embracing digital technologies, we found that the digital transformation journey was only just starting for many corporates in the region. The exceptions two years ago, were the more advanced markets of Singapore, Hong Kong, China and Japan, where digitalisation journeys were well underway.

2020 saw the region more broadly making significant strides in digital transformation, accelerated by the need to deliver business continuity during the global pandemic.

This year, 2021, it is apparent that APAC corporates are crystallising plans into a more holistic enterprise-wide digital strategy that covers the entire ecosystem of customers, suppliers, employees and partners. And they have made material progress not only in developing, but also adopting these strategies, significantly closing the gap with international benchmarks including the US and the UK.

However, perhaps the most interesting learning from this year's survey is the extent to which experiences from the most digitally-progressed markets in APAC suggest that the digital transformation journey may be a 'never ending' one, as the quest for digital-readiness morphs into more of a continuous process of fine-tuning and enhancement.

And whether future surveys reveal the digital transformation journey as an 'infinite game' or not, it is certainly a journey that is reinforcing the evolution of the treasury function from what was previously perceived as a back-office support team to an integral value-driver of the business – and key informer of future business strategy.

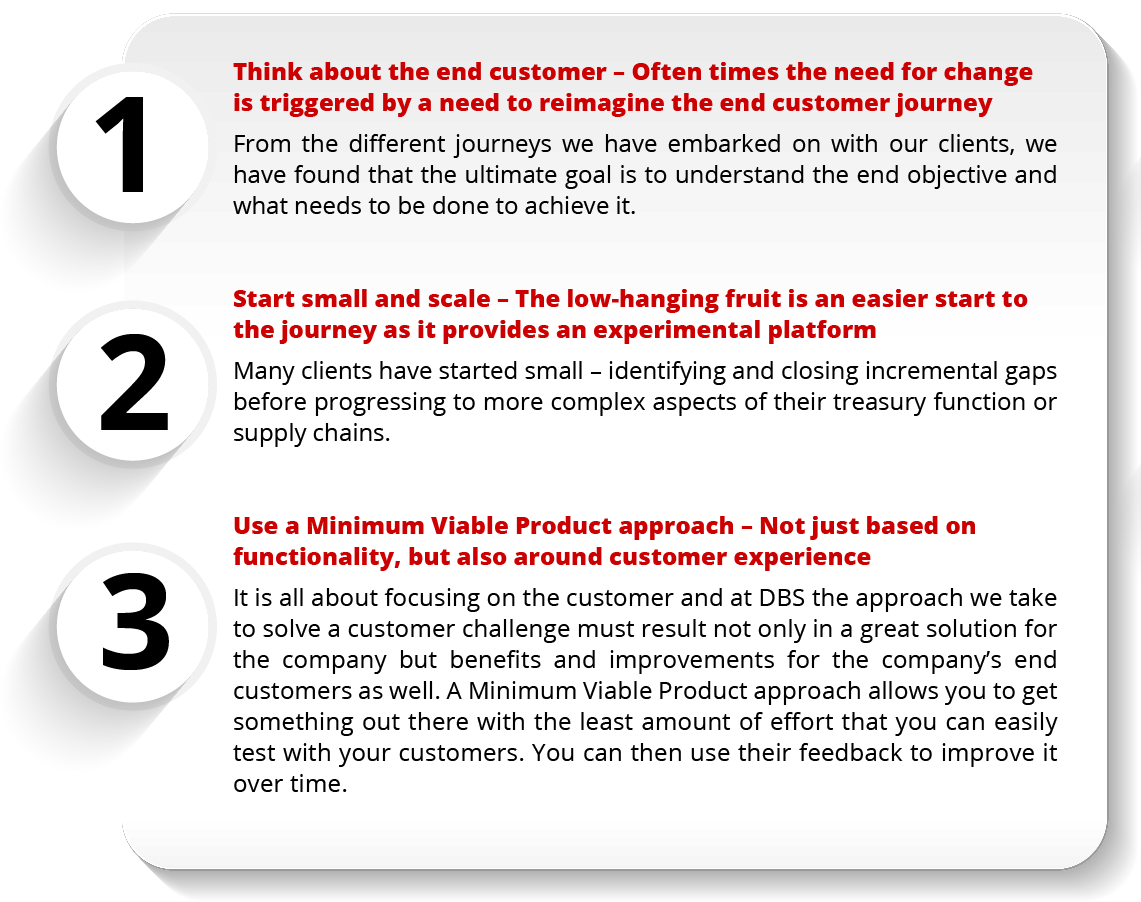

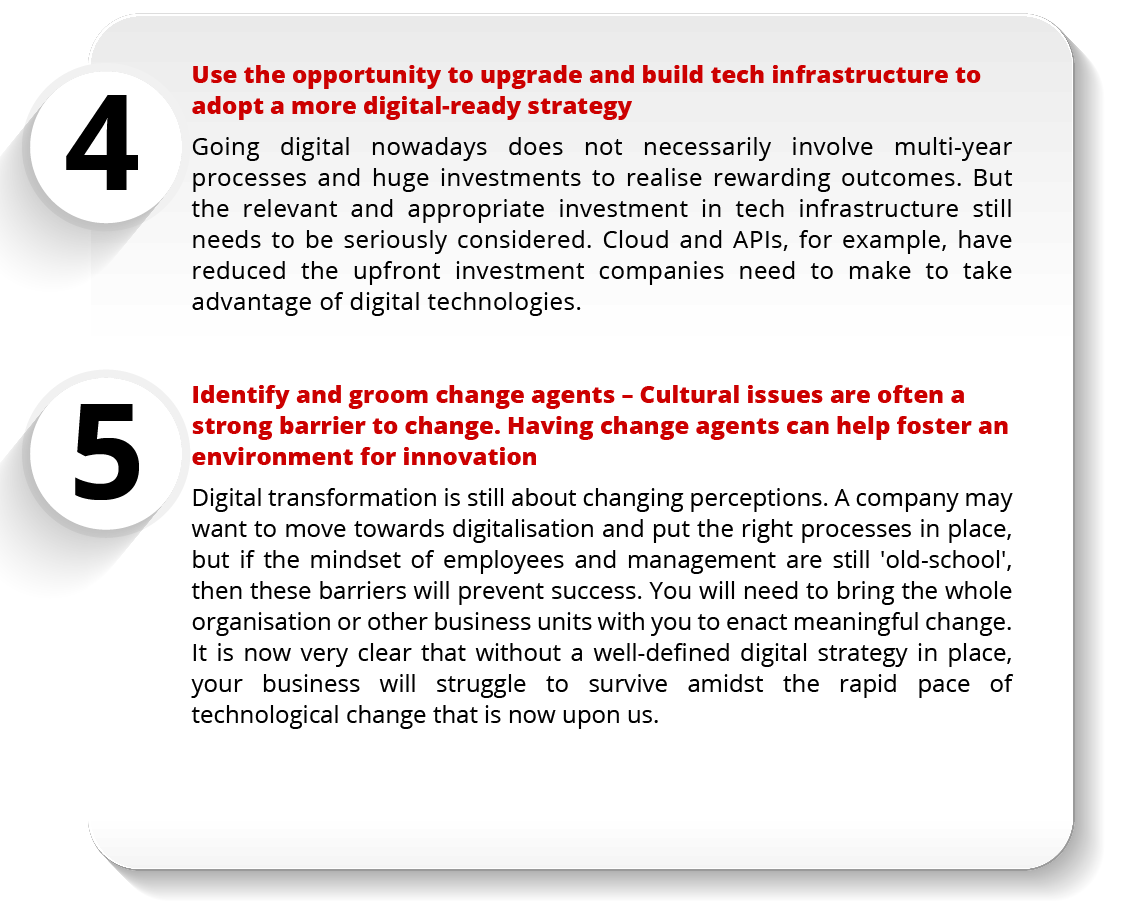

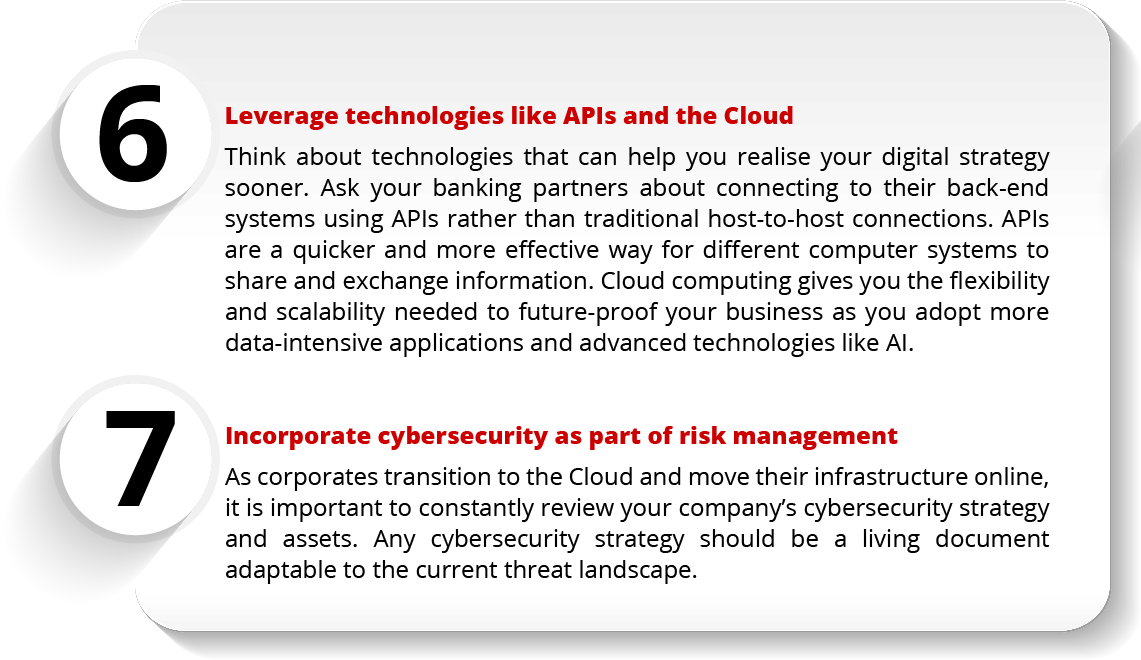

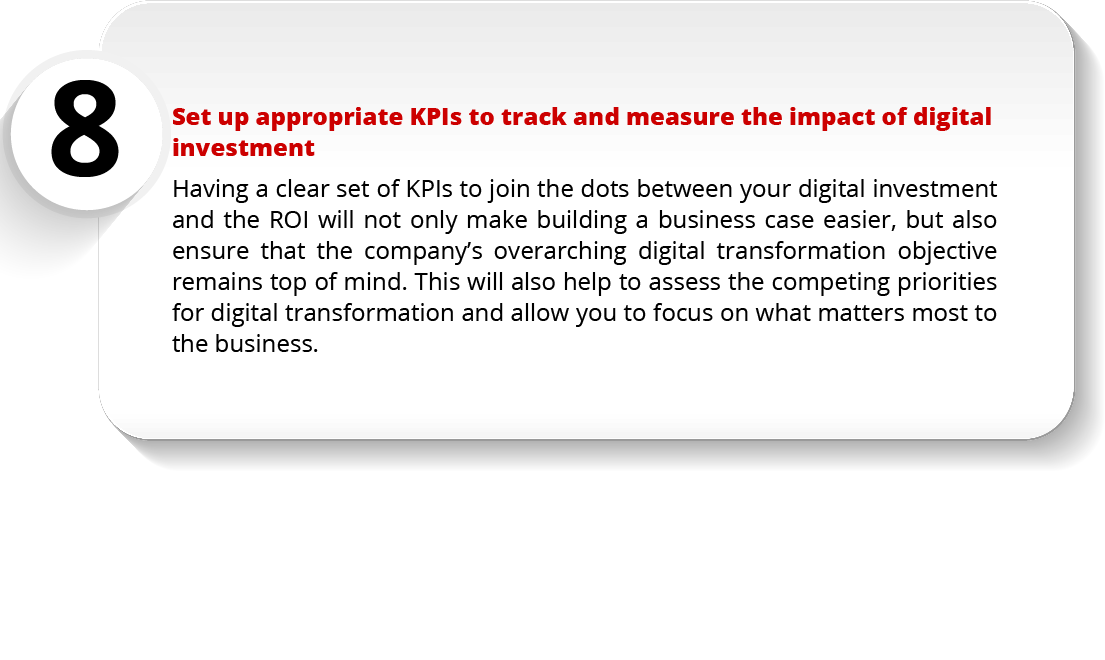

Going digital is a journey of continuous fine-tuning. From our work with companies, as well as the steps we have taken ourselves as a bank to leverage digital technologies to make us more agile and responsive to our customers' needs, we have identified eight key steps to help companies accelerate their digital transformation.