iBanking Digital Registration FAQ

-

Tell me more about the new iBanking Online Application service.

Effective from Feb 2016 when you register online for iBanking, you will:

-

Gain instant access into iBanking and

- Enjoy greater convenience with the following digital services:

-

digibank app: Bank on the go

-

eStatement: Go Green. Go paperless

-

SMS Banking: Perform simple banking transactions with an SMS

-

PayLah! app: Send money to any mobile number

Click here to find out more about these services. The DBS iB Secure Device will be mailed to you within 3 business days of your registration.

-

-

How do I register for the iBanking access?

You can register for iBanking via the following channels:

- Online at www.dbs.com.sg/bankonline

- digibank mobile app by selecting on "Get Started"

- DBS/POSB Branches

- Contact Centre at 1800 111 1111

For online registration, we will need you to identify yourself using any of the following 4 options which will be display to you dynamically.

-

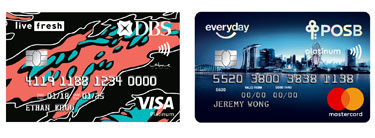

Debit/ATM Card option

Debit/ATM Card Number: Enter your 16-digit DBS/POSB Debit Card number or 8-digit ATM Card number as it appears on the front of your Debit/ATM Card.

Debit/ATM Card PIN: Enter your 6-digit Debit/ATM PIN

-

Credit Card option

Credit Card Number: Enter your 15 or 16-digit DBS/POSB Credit Card number as it appears on the front of your Credit Card.

Credit Card PIN: Enter your 4 or 6-digit Credit Card PIN

-

iB Secure Device (Token) option

You will need both your registered DBS iB Secure Device and One Time Password (OTP) sent to your registered mobile phone to complete this transaction.

-

Temporary User ID option

If you do not have any Debit/ATM/Credit Cards and a registered token, we will issue you a temporary User ID starting with "P" for your online registration. One Time Password (OTP) sent to your registered mobile phone is required for this option.

-

Can I update my mailing address during the registration process?

Unfortunately you will not be able to proceed with your online registration if your current mailing address is not correct and does not match the one in our records. As the mailing address will be used for all iBanking correspondences including the mailing of your iBanking Secure Device (token), hence to safeguard your interests, we will need your latest current mailing address to be updated on our bank records. Your new mailing address may be updated via the Personal Details Update Form OR at any AXS machine OR at any DBS/POSB branch near you.

-

Can I update my mobile number and email address during the registration process?

Yes, you may update your mobile number and email address during registration. Note that your new personal details will be updated on our records only after you log in to iBanking or digibank mobile app with your iB Secure Device and confirm the details there.

Once confirmed, all official banking alerts and One Time Passwords (OTP) will be sent to the new mobile number.

-

Can I login/activate my iBanking account immediately after I have done the online registration?

Yes, we have enhanced the application experience so you can log in to iBanking or digibank mobile app immediately with your newly created iBanking User ID and PIN.

-

I have just signed up for iBanking but have not received my PIN Mailer.

We will not be sending you a separate PIN mailer. Please click here to create your iBanking User ID and PIN.

-

How do I opt-out of the digital services?

digibank app

You do not need to opt-out at this point. digibank app registration will be complete only after you have downloaded the app and done your first-time login.

eStatement

Please login to iBanking and complete the steps below:

-

Click on "Request" on the top navigation menu and select "More Requests"

-

Under "Statements & Advices", select "Manage eStatement"

-

Change the eStatement Status of the statement you wish to opt-out

SMS Banking

You can deregister from SMS Banking by sending an SMS to 77767 in the following format:

Deregister NRIC/Passport no.

Example: Deregister S1234567APayLah!

You do not need to opt-out at this point. PayLah! registration will be complete only after you downloaded the app and completed the first-time login.

-