By Navin Sregantan

![]()

If you’ve only got a minute:

- A well-diversified investment portfolio can help investors weather the storms of the market.

- Unit trusts are suitable investments for those who seek diversification with relatively little cash outlay.

- In addition, unit trusts are usually included in professionally managed portfolios which offer flexibility, among others.

![]()

A well-diversified investment portfolio is often cited as a key to navigating market volatility, mitigating risk without sacrificing potential returns. However, building such a portfolio from individual stocks and bonds is both daunting and tedious as it demands significant time and research — a considerable hurdle for busy individuals or those new to investing.

Fortunately, there is a range of investment vehicles that offer a convenient alternative. These pooled investment products, such as unit trusts, allow investors to participate in diversified portfolios with relatively small initial investments and offer considerable flexibility.

Over the years, these factors, including potentially lower transaction costs, have continued to drive the popularity of unit trusts as a core component of many investment strategies.

What are unit trusts?

Unit trusts are professionally managed funds that pool the financial resources of investors to buy a diversified portfolio of assets like stocks and bonds. This can reduce risk while providing broad market exposure.

Investors (known as unit-holders) own units representing their proportional share of the fund's assets.

Each unit trust follows a specific investment mandate, outlining its target geographies, industries, and asset classes, which guide the fund manager's decisions toward pre-defined goals such as capital growth or income generation.

As mandates can differ greatly from one unit trust to another, it is important to understand each fund's investment strategy and associated risks before investing.

Unit trusts boast a long history, with early forms said to have first appeared as far back as the 17th century. The first modern unit trust, the MFS Massachusetts Investors' Trust, was launched in the US in 1924, and it is still active today!

Types of unit trusts

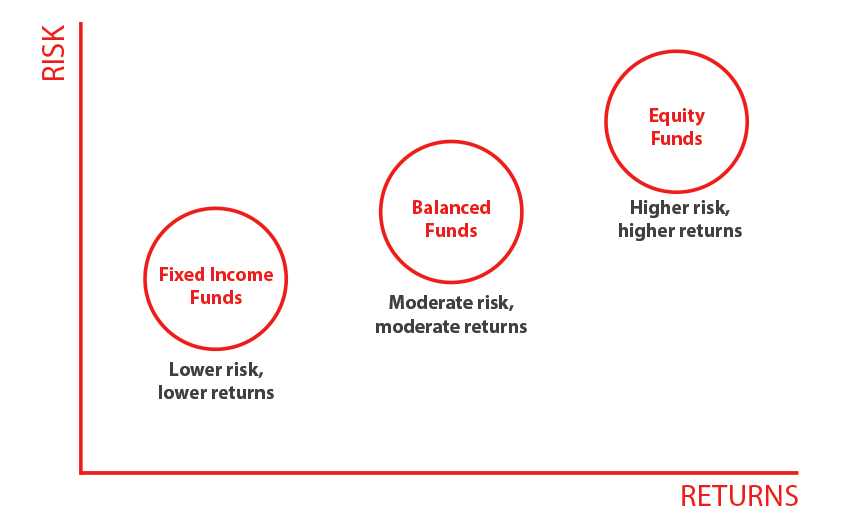

While there isn’t a universally agreed-upon classification of unit trusts, a common and useful way is to broadly categorise unit trusts by their underlying asset classes.

In this case, there are 3 main fund types for unit trusts:

It's important to note that within these broad categories, there are many sub-categories and specialised unit trusts focusing on specific sectors, geographic regions, or investment strategies.

Fixed income funds

These funds focus on investing in bonds and other fixed-income securities, prioritising income generation and capital preservation (protecting your initial investment). They are generally considered lower risk than equity trusts.

For many, a fixed-income fund is a more efficient way of investing in bonds than buying individual bond securities which might have higher entry levels (i.e. higher cash required to make an investment). For instance, a corporate bond typically has a minimum investment amount of S$250,000.

Balanced funds

Also known as multi-asset funds, these diversify across both equities and bonds, aiming for a balance between growth and income. As such, they are geared toward investors who are looking for a mixture of safety, income, and modest capital appreciation.

The specific allocation to equities and bonds varies depending on the fund's investment strategy, resulting in varying levels of risk and potential return.

Equity funds

As their names suggest, these funds invest principally in stocks. aiming for capital appreciation (growth in value). They tend to be higher risk but offer potentially higher returns.

As stocks are generally more risky investments with higher potential returns than bonds, a pure equity fund comes with a higher risk than fixed-income and balanced funds.

Read more: Investing in unit trusts in Singapore

What to note when investing in unit trusts

If you're new to investing, consider these 6 key points about unit trusts to help you make informed decisions aligned with your financial goals:

1. Diversification

Unit trusts offer a simple and affordable way to diversify your investments, especially beneficial for those with limited capital.

Many hold over 100 stocks and bonds, providing broad exposure across various sectors and asset classes, and significantly reducing the risk of concentrating your investments. This ease of access to diversification is a key advantage of unit trusts.

2. Investments options

Bearing in mind your individual investment preferences and risk tolerance, unit trusts offer a diverse range of options.

Funds often specialise in specific areas, such as global or Asian equities, particular sectors (technology, consumer discretionary), asset classes (investment-grade or high-yield bonds, commodities like gold), or even currencies (Forex).

Take the time to research and select a fund that aligns with your goals.

3. Professional management

Unit trusts offer professional management, relieving investors of the burden of individual security research and selection.

Fund managers conduct in-depth research, select investments, and actively manage the portfolio, aiming to maximise returns. This also includes ongoing monitoring of market conditions, security selection, portfolio rebalancing, and adherence to regulatory requirements for transparency (including disclosure of past performance, benchmark comparisons, fees, and holdings).

While this active management may lead to higher returns, it also typically results in higher operating costs.

4. Liquidity

Unit trusts generally offer convenient liquidity, allowing for relatively quick buying and selling of units.

While not as liquid as exchange-traded funds (ETFs), which trade on exchanges, unit trusts typically facilitate withdrawals within a short timeframe—often by the end of the trading day or week—through private markets and distributors such as banks. Therefore, they are considered a reasonably liquid investment option.

5. Flexibility

Unit trusts offer flexible investment options with no lock-in periods, allowing for relatively easy access to your funds. That said, it is typically recommended that you invest with a long-term lens in order to reap the benefits of investing such as staying invested in the market to ride out volatility and compounding returns.

With that in mind, having flexibility allows you to adapt your strategy as needed, using lump-sum or monthly investments through a regular savings plan to suit your budget.

Note that in Singapore, you have the right to cancel a unit trust purchase within 7 calendar days from the date of the purchase agreement (excluding additional investments in existing funds or those listed on the Singapore Exchange).

6. Fees

While unit trust investors do not incur commissions and trading fees associated with exchange-traded securities, investors should be aware of other applicable charges.

These include management fees, transaction costs, and potentially front-load or entry fees, and distribution fees. Comparing fees across different unit trusts may be crucial for maximising your returns over the long-term.

Investing to Grow

Building a strong financial foundation, particularly for your future needs as well as retirement, requires consistent investing.

In Life after work - Preparing for a rewarding retirement journey, a research paper published by DBS in February 2025, that focuses on the critical importance of retirement planning, it highlights the significant advantages of starting investing early to grow your savings over the long term.

The impact of delaying investment is significant: a 25-year-old aiming for S$1.3 million in retirement (at age 65) needs to invest S$850 monthly (assuming a 5% annual return).

Delaying this by 10 years increases the required monthly contribution to nearly S$1,560, nearly double if the person did not start earlier.

Read more: Preparing for a rewarding retirement

At DBS, we encourage you to inculcate money habits in your financial journey: Save, Protect, Grow, and Retire.

If you are new to investing or just considering starting, the good thing is that you can start small, especially if you are younger, with achievable objectives and take it step by step.

Bearing this in mind, the key to building habits is discipline, and one way to get started is by setting aside part of your salary to make regular investments through dollar-cost averaging.

At DBS, you can do so by setting aside a pre-determined amount of savings – starting from S$100 per month – for investing through Invest-Saver.

With this method of investing, you are able to accumulate your investments in a steady and progressive manner by investing in a wide range of unit trusts that DBS has to offer.

Find out more about: DBS Invest-Saver

CIO Insights Funds

Choosing from DBS's wide range of investment funds can be overwhelming, especially for beginners.

If you are facing "choice paralysis" or are simply unsure of where to start, we’re here to help simplify the decision-making process with CIO Insights Funds.

Curated by the investment experts at DBS, these funds provide a steady base for any portfolio, offering long-term diversification across key markets and asset classes while aligning with the DBS Chief Investment Office's investment outlook.

Find out more about: CIO Insights Funds

In summary

Unit trusts offer an accessible and efficient way to invest. By providing diversification, professional management, and relative liquidity, they can form a valuable component of a well-rounded investment strategy.

It is key to build the confidence and discipline to invest steadily. Starting early allows for smaller, manageable contributions, especially during life stages with fewer financial obligations.

Remember to carefully consider your risk tolerance, investment goals, and the fund's characteristics before investing.