![]()

If you’ve only got a minute:

- FX involves the exchange of one currency for another and is always quoted in currency pairs.

- The FX market is a global exchange on which foreign currencies are traded and is open 24 hours a day, 5 days a week.

- For any given currency pair, rates are affected by supply and demand, economic data, geopolitical events, and central bank policies, among others.

- On top of spending and saving, foreign currencies can also for investing like with foreign currency denominated equities, ETFs, unit trusts and Foreign Currency Fixed Deposits (FCFDs).

Whether the term “foreign exchange” resonates with you as an investor, globetrotter, or simply a curious learner, it is an inevitable part of all our lives. If you have ordered items online that were shipped from overseas, or purchased any imported goods, you would have come into contact with the foreign exchange market in one way or another.

With that in mind, it is helpful to understand the basics of what it is and how it works.

“Foreign exchange” or “FX” in short, are often used interchangeably. As its name suggests, it describes the exchange of one currency for another.

What is the FX market?

With trillions of dollars exchanged each day, the FX market, which is the global exchange where foreign currencies are traded, it is the largest financial market.

The main players in this market are institutional traders, like banks, governments, fund managers and multinational corporations (MNCs). The large quantity and speed of trade provides great liquidity, meaning that FX rates can fluctuate by the second.

Currencies are traded over-the-counter (OTC), without needing to be sold on a central exchange (like equity markets). This means that FX is traded directly between market participants or through brokers. Since trading is done via online computer networks, a physical location for a central marketplace or exchange is not needed, and trading can happen round the clock, 5 days a week.

Unlike equity and fixed income markets, which close at the end of each business day, the FX market never sleeps. It simply shifts to different financial centres and time zones around the world.

The rate of exchange between currencies on the FX market are driven by supply and demand. On top of this, rates can be affected by a broad range of factors including economic data, geopolitical events, and changes to central bank policies.

It is common for the central bank of a country to take active measures to keep its currency stable and free from any drastic fluctuations. They can do so by managing interest rates and foreign currency reserves or issuing new currency. This in turn impacts the supply or demand of the currency and hence its value.

Other factors like trade between countries also plays a part. In general, if a country exports more than it imports, this means there is a high demand for its goods and consequently, for its currency. All other things constant, when the demand for a currency is high, its value should also appreciate.

For example, between 2005 and 2013, the Chinese Yuan (CNY) appreciated considerably due to China’s reduced current account surplus. This means that there was a high demand for CNY due to a high demand for exports out of China.

How are currencies represented?

All currencies are denoted by a 3-letter code, prescribed by the International Organisation for Standardisation (ISO).

| The 8 most traded currencies (not in order) in the FX market and their corresponding currency codes are as follows. | |

|---|---|

| Euro | EUR |

| British Sterling Pound | GBP |

| Australian Dollar | AUD |

| New Zealand Dollar | NZD |

| U.S. Dollar | USD |

| Canadian Dollar | CAD |

| Swiss Franc | CHF |

| Japanese Yen | JPY |

| There are more than a hundred currencies traded on the FX market. These include exotic currencies which are less traded, making them more illiquid and volatile. Some examples include currencies of developing or emerging market countries and non-fiat currencies, among others. | |

|---|---|

| Thai Baht | THB |

| Malaysian Ringgit | MYR |

| Mexican Peso | MXN |

| Indian Rupee | INR |

| Bitcoin | BTC |

| Ethereum | ETH |

Quoting conventions

Since FX involves the exchange of 2 currencies, it is always quoted as a pair. The 1st currency is known as the “base currency”, and the 2nd as the “counter currency”.

FX rates are traditionally quoted to 4 decimal points (d.p.), making the smallest possible price change within a currency pair 0.0001. This is a percentage in point, commonly referred to as a “pip”. For example, if an FX rate moves from 1.3600 to 1.3650, we can say that it has moved by 50 pips.

An exception to this is the JPY. For currency pairs with JPY as the counter currency, it is quoted to 2 d.p., making a “pip” in this case a 0.01 movement.

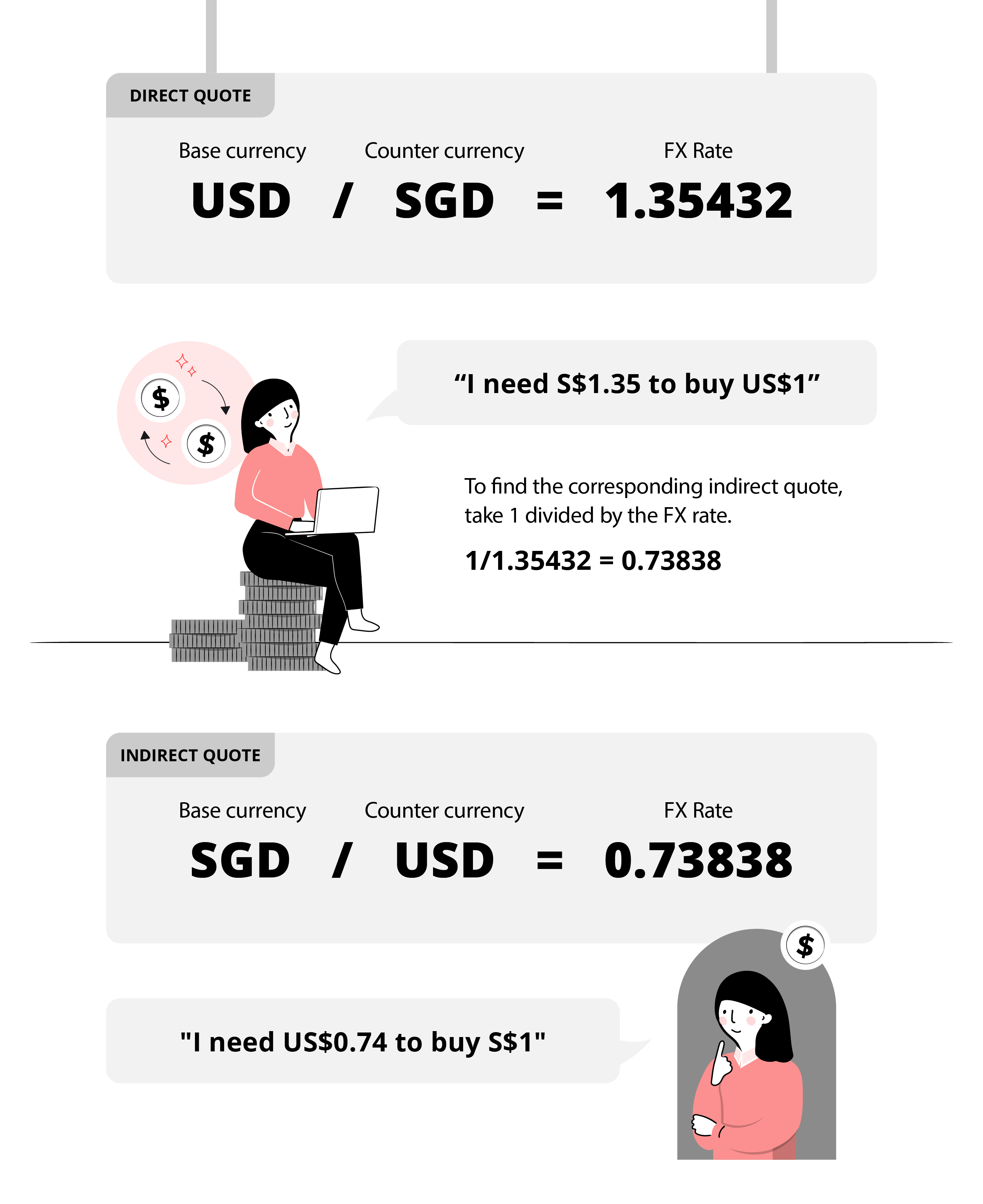

When a fixed unit of foreign currency is expressed in variable units of local currency, it is known as a “direct quote”. For example, if the USD/SGD FX rate is 1.3500, it means that you need S$1.35 (local currency) to buy US$1 (fixed unit of foreign currency).

Conversely, when the unit price of the local currency is expressed in variable units of a foreign currency, it is known as an “indirect quote”.

By convention, traders use a fixed hierarchy to determine which currency should be used as the base and which as the counter currency. Examples include USD/SGD, EUR/USD, and USD/JPY (as opposed to SGD/USD, USD/EUR, and JPY/USD).

Understanding price movements

If the USD/SGD moves from 1.35432 to 1.3700, it means that US$1 is now worth S$1.37. Since the same amount of USD is worth more of the counter currency, its value has increased. This means that on a relative basis, the SGD has decreased in value against the USD.

To put it in another way, when USD/SGD is 1.37000, the SGD/USD is 0.72993. This means S$1 is now worth US$0.73, as opposed to US$0.74. Since the same amount of SGD is now worth less of the counter currency, its value has decreased.

Spreads

When exchanging currencies, you might have noticed that the rates shown on an online calculator seem more favourable than what you were quoted by the bank or broker at the point of exchange.

This is because what you see on most currency calculators is the “interbank rate” – the rate institutions trade at when they conduct FX with each other. Given the high volume and frequency, they are able to get the most favourable market rate.

Retail investors do not have direct access to the FX market and trade through an intermediary.

The intermediary buys the currency at the “buy” price and sells it to you at the “sell” price – the difference between these 2 prices being the FX spread. Spreads tend to be lower for currency pairs that are more liquid.

The DBS Currency Converter shows you the indicative FX rates offered to clients. You can also log in to the DBS digibank app to get the actual quote for your transaction. If there are special rates that apply to your account, they will be automatically reflected.

Investing in FX

For corporate investors, FX is commonly used as a hedging tool to help manage their exposure to currency risk. This helps investors to set a fixed rate at which they do foreign currency related business in. When executed effectively, a hedge will provide protection against currency fluctuations. The main aim of hedging is to protect against losses, and not for profit making.

On the other hand, for the average retail investor, the main aim of FX trading is to make a profit from the buying and selling of currencies. Like any investment, the ideal goal is to “buy low, sell high”.

There are 4 main types of FX trading strategies:

- Scalping

- Day trading

- Swing trading

- Position trading

Scalping

Scalp traders buy and sell currencies quickly, usually within minutes. They aim to make many small but quick profits through large number of trades made daily. As such, these are usually trades made in currencies with high liquidity and trading volume. This often requires a high amount of time and focus.

Day trading

As the name of the strategy suggests, day traders make their trades within the same day, usually holding positions for a period of minutes or hours. This removes the risk of any large overnight fluctuations.

Swing traders

Swing traders hold positions ranging several days or weeks. Unlike scalp and day traders, swing traders do not have to constantly monitor FX charts and fluctuations through the day.

Position traders

Position traders aim to gain maximum profit from major fluctuations over a medium- to long-term period from a few months to years.

In general, most retail investors are likely to be swing or position traders.

For example, many of us bought the JPY when it weakened in 2023. While some may have bought it with a cheaper holiday in mind, others might see an opportunity to buy and hold it until it appreciates before selling it for a profit.

On the surface, this might sound easy, but FX markets are extremely volatile and difficult to predict. As such, FX trading is a high-risk investment vehicle.

Before making any investment, do your due diligence to understand your investment time horizon, risk appetite and financial goals. Since you may need to hold on to foreign currency for long periods of time when waiting for rates to be favourable, it is also important that you are comfortable with the currencies in which you chose to trade.

How can I buy FX?

With a DBS multi-currency account, you can trade in 13 different currencies online at attractive exchange rates with no FX conversion fees.

If you find yourself holding on to currencies that you do not have immediate use for, you can consider placing them in foreign currency denominated instruments like equities, exchange traded funds (ETFs), and unit trusts, that are in line with your risk tolerance.

You can also place your cash into a Foreign Currency Fixed Deposit in exchange for a higher interest than if it were left in your regular savings account. Note that unlike SGD Fixed Deposits, FCFDs are not covered by the Singapore Deposit Insurance Corporation.

Read more: What can I do with my foreign currency?

Find out more about:

DBS MyAccount

DBS Multiplier Account

In summary

While not all of us trade in FX directly, it is important to understand the basics of how it works and what affects it. The value of foreign currencies will impact how much we pay for imported goods and decision making in our holiday planning and budgeting.

For those looking to invest (or already investing) in FX, remember to do your due diligence in researching on the currencies you are looking to invest into. Find out about what factors affect it and the risks involved as this can be different for each unique currency pair.