If you’ve only got a minute:

Here are ways you use your MediSave funds throughout the different stages in life:

- You can use the MediSave Maternity Package to pay for delivery and pre-delivery medical expenses.

- Patients with complex chronic conditions will be able to use up to S$700 per patient yearly, while other patients will be able to use up to S$500 per patient yearly for selected treatments.

- You can use MediSave to pay for repeated treatments, medical scans, surgeries and hospitalisation, rehabilitation, and palliative care.

- You can use MediSave to pay for your health insurance premiums.

Many people believe that the use of their savings in the Central Provident Fund (CPF) MediSave Account is restricted to hospitalisation bills and major medical illnesses. That is not true. There are other ways you can utilise the funds.

To recap, the MediSave Account attracts a yearly 4% interest rate and is capped at the Basic Healthcare Sum (S$75,500 in year 2025) applicable to you. Once the balance in your MediSave Account exceeds the Basic Healthcare Sum, the excess money will be transferred into your Special Account or Retirement Account, subject to certain conditions.

Here are 9 ways which you can use your MediSave funds throughout the different stages in life:

Welcoming a new baby to your family

To lighten some financial burden off your shoulders, you can use the MediSave Maternity Package that allows you to pay expenses incurred during delivery and pre-delivery medical expenses such as consultations, tests, medications, ultrasounds, etc. using your MediSave Account funds.

When repeated treatment is required

The treatments and the maximum you can use from your MediSave Account include:

- S$450 a month per patient for renal dialysis

- S$1,200 a month for chemotherapy Cancer patients

- Anti-retroviral treatment for HIV – up to S$550 per month per patient

- Immuno-suppressants after organ transplants – S$300 per month per patient

- S$80 - S$2,800 per radiotherapy treatment, depending on the type

For regaining mobility and other functions

Rehabilitation fees can cost you a fortune especially in old age as your body will take a longer time to recover, resulting in additional rehabilitation fees to pay for.

To aid your finances, you can use your MediSave funds of up to:

- S$250/day for hospitalisation charges at community hospitals, up to a maximum of S$5,000 annually

- S$25/day at approved day rehabilitation centres, up to a maximum of S$1,500 annually

Keeping yourself healthy and for women entering their 50s

Expenses incurred from the following can be paid from your MediSave Account. Patients with complex chronic conditions will be able to use up to S$700 per patient yearly, while other patients will be able to use up to S$500 per patient yearly for selected treatments.

- Screening tests

- Recommended vaccinations under the National Childhood Immunisation Schedule

- National Adult Immunisation Schedule and outpatient treatments of 20 approved chronic conditions

One in 11 women will get breast cancer in their lifetime and in order to combat that, early detection is the first step to take. Women turning age 50 may be prompted to undergo a mammogram scan. Under the Health Promotion Board’s (HPB) Screen for Life (SFL)[1], women aged 50 years and above can benefit from subsidised mammogram screenings which cost S$50 for Singapore citizens, S$75 for Permanent Residents (PRs), S$37.50 for Merdeka Generation Cardholders and S$25 for Pioneer Generation Cardholders at participating locations. However, you can tap on MediSave schemes to make payments in full if you fulfil the eligibility criteria.

When you go for diagnosis medical scans

If your doctor suggests for you for go for a check-up and undergo a medical scan to arrive at a more accurate diagnosis, you can use up to:

- S$300 per year per patient on outpatient medical scans such as non-cancer related CT or MRI scans.

- From 1 January 2026, the MediSave annual withdrawal limit for outpatient scans will double from S$300 to S$600 to better support patients with their outpatient bills.

Falling ill for those aged 60 and above

With the increasing life expectancy and ageing population, there is a greater need to plan for healthcare costs in old age. Additionally, as you grow older, your body is more prone to illnesses and to conquer the financial part, you should use your MediSave funds to reduce out-of-pocket payments for outpatient treatments.

Under the Flexi-MediSave scheme, if you are 60 years old and above, you can use your MediSave or your spouse’s MediSave at Specialist Outpatient Clinics and polyclinics in the public sector, and GP clinics under the Community Health Assist Scheme (CHAS):

- The yearly withdrawal cap under the Flexi-MediSave scheme will also rise from S$300 to S$400 from October 2025

- It covers consultation fees, selected tests and drugs, and other services such as physiotherapy, if ordered by the doctor for diagnosis or treatment of medical condition

- It can be used on top of existing outpatient uses of MediSave. For example, if the treatment is for a chronic condition, Flexi-MediSave can be used to pay the remaining bill amount after tapping on MediSave for chronic disease treatment

For surgery or hospitalisation

You can utilise your MediSave for inpatient care of up to S$1,130 per day for the first two days, and up to S$400 per day thereafter. For day surgeries, you can use up to S$830 per day. Additionally, surgical expenses can be paid using your MediSave up to the surgical limit.

Making payments for insurance premiums

All Singaporeans are covered for life for basic hospitalisation needs under the mandatory MediShield Life, unless you do not qualify, or you opted out of it.

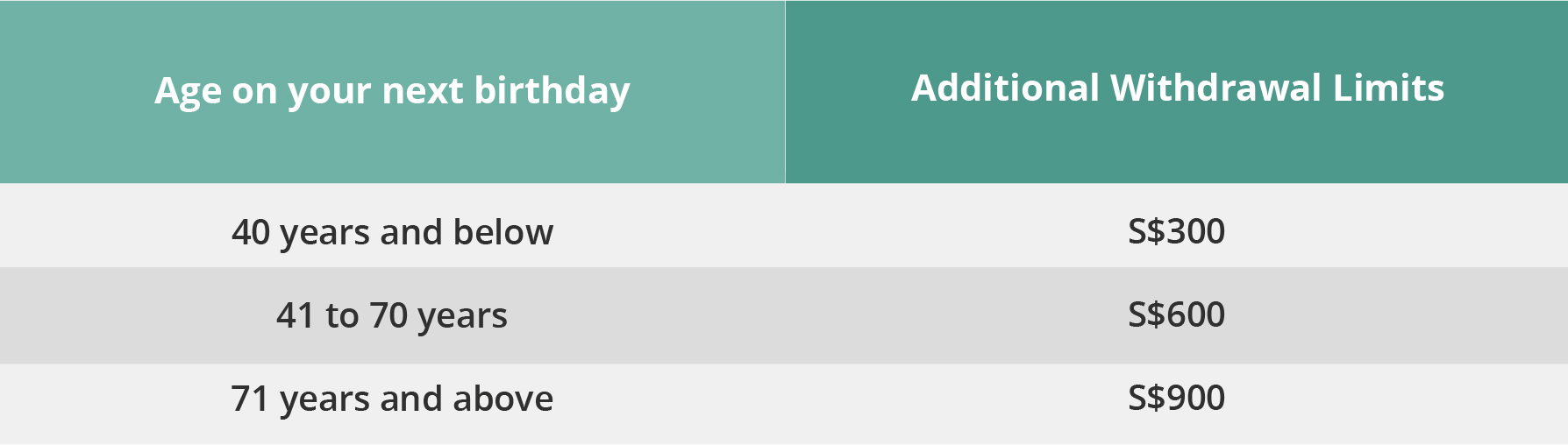

Otherwise, you can use your MediSave to pay for your health insurance premiums such as the Integrated Shield Plan, up to the Additional Withdrawal Limits.

For end-of-life care

Should you need palliative care in approved hospices, you may use

- You can use up to S$250 per day for general inpatient palliative care, and up to S$350 per day for specialised inpatient palliative care.

- The S$2,500 lifetime withdrawal limit applies only if using a family member’s MediSave. There is no lifetime limit if you use your own MediSave.

Do note that there will not be any limit if you’re diagnosed with terminal cancer or end-stage organ failure and if the bill is paid using your MediSave savings.