By Navin Sregantan

![]()

If you’ve only got a minute:

- CPF and SRS work together to maximise retirement savings, offering a comprehensive approach to building a secure financial future.

- Rather than leaving all your CPF and SRS monies idle, investing them offers the potential for returns that can significantly outpace standard interest rates, accelerating progress towards your retirement goals.

- Aligning investment choices with one's risk tolerance, financial goals, and life stage is crucial for maximising the benefits of CPF and SRS and achieving long-term retirement success.

![]()

The Central Provident Fund (CPF) and Supplementary Retirement Scheme (SRS) are key pillars of Singapore's retirement planning landscape, enhancing financial security and retirement adequacy for many.

While CPF is a compulsory savings plan that forms the cornerstone of Singapore's social security system by allocating funds for housing, healthcare, family protection, and retirement, SRS has gained traction with more Singaporean residents as a voluntary savings programme offering tax benefits.

Though often considered separately, CPF and SRS savings are best viewed as complementary elements of a holistic retirement strategy. CPF provides the mandatory foundation, while SRS offers a valuable voluntary supplement to boost overall retirement resources.

What’s more, CPF and SRS funds can be invested to further accumulate retirement savings, offering another avenue to grow our retirement nest egg.

Why invest with your CPF and SRS monies?

Left alone, the funds in your CPF OA would earn an interest of up to 3.5% per annum, while your SRS funds would earn an interest of just 0.05% per year. By investing these funds, you can get a better return than the prevailing interest rate and grow your retirement nest egg.

For example, John is intending to invest S$10,000 of his SRS funds in the May 2025 tranche of the Singapore Savings Bonds (SSBs).

If he holds his investment to maturity in 2035, he would have made a total return of S$2,706.32 or an effective return of 2.69% each year.

Even if he chooses to withdraw his investment after 5 years, he would still have made a return of 2.49% each year, which exceeds the 0.05% interest earned if he had left his savings untouched in his SRS account.

What if John decided to invest his CPF funds into a portfolio of CPF-approved unit trusts 5 years ago in 2020?

Based on the unit trust available for CPF investing via DBS, the top 10 funds recorded an average annualised return of 27.55% over a 5-year period.

While these represent particularly high investment returns, they serve to illustrate the growth potential of CPF funds over the long run, compared to the 2.5% interest rate John would have earned by leaving their OA savings untouched.

It's also important to remember that CPF funds serve multiple purposes, including housing, so allocating all of your CPF savings to investments might not be the best course of action. Finding the right balance between investing and retaining funds for other needs is crucial.

Should you invest your SA monies?

Unlike the 2.5% earned on OA balances and the base interest of 0.05% for idle SRS funds, your SA funds earn an interest of 4% p.a.. that is guaranteed by the Singapore Government.

As such, the decision to invest your SA monies, which are earmarked specifically for your retirement, requires careful consideration as it may be challenging to beat this rate over the long-run, especially if you do not have a high risk tolerance.

Read more: Investing your CPF Savings

What else to know before investing with CPF & SRS

Broadly speaking, the products that you can invest with your CPF and SRS savings are similar. This includes insurance, unit trusts, equities and Singapore Government Bonds, among others.

However, it is important for you to take note of some of the finer details about the eligible products for each scheme.

For example, as CPF contributions are compulsory and primarily earmarked for retirement, housing, and healthcare, there are specific regulations governing what investment options are available to you. These regulations aim to protect members' retirement savings while still allowing them to grow their funds.

For instance, there are restrictions when it comes to investing CPF monies in complex or high-risk investments. Specific examples of permitted investments include approved unit trusts, Singapore Government Bonds, and certain listed stocks and ETFs on the Singapore Exchange (SGX).

The voluntary nature of SRS also means that there is greater flexibility to tailor your investments to your risk appetite and financial goals.

While members enjoy a wider range of investment options with SRS, do note the specific stipulations concerning withdrawal timelines and tax implications. For example, early withdrawals from SRS before the statutory retirement age are subject to both a penalty and full taxation. This encourages members to preserve their SRS savings for retirement purposes.

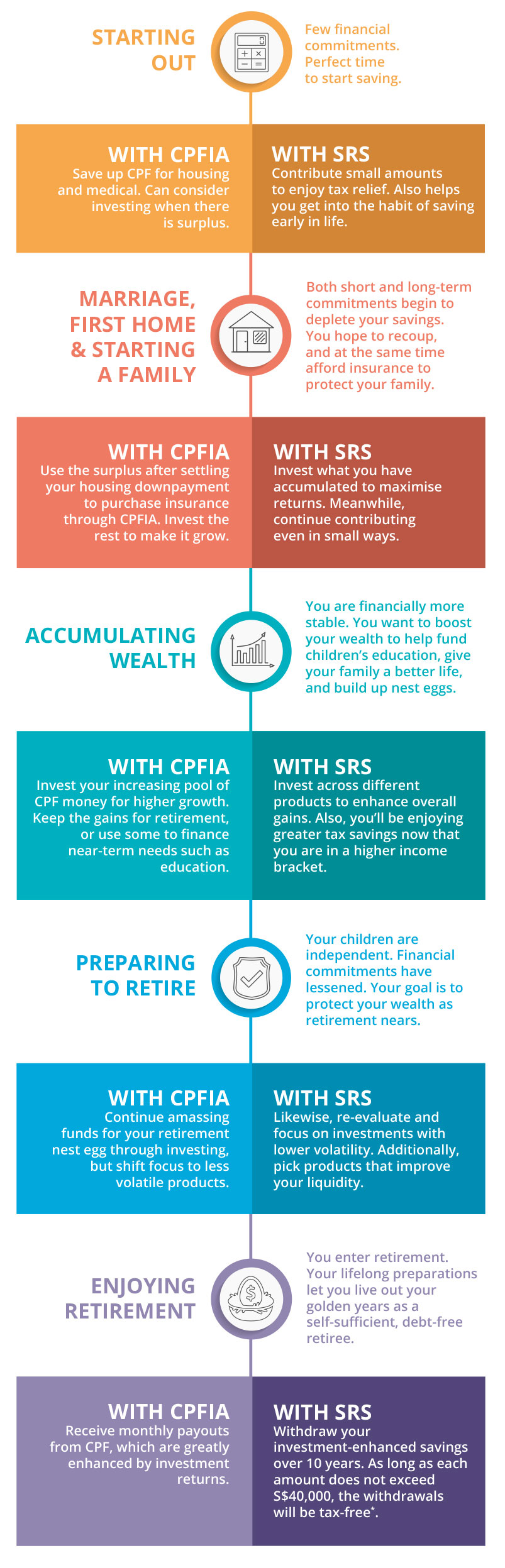

Investing with CPF and SRS through life's stages

How we approach and prepare for retirement is quite different according to our life stage. Likewise, how to use CPF and SRS investing differs through life stage. Here are some considerations to take note of corresponding with each life stage.

* Since 50% of SRS withdrawals are taxable, you only need to pay taxes if your chargeable income exceeds S$20,000 as stated by law.

Read more: Maximise the benefits of your SRS account

What happens to the returns you earn?

With the CPFIA, the funds will go back into your CPF and will become part of your retirement funds that you will receive as an annuity with CPF LIFE when you retire.

When investing with SRS, your accumulated investment returns go back to your SRS account while enjoying tax benefits. You will only be subject to a 50% tax on your savings when you withdraw the monies after your prevailing retirement age.

Withdrawals can be done as a lump sum, over a period of time, or as an annuity if you purchase one.

Getting started

All you have to do to get started is to set up a CPF investment account (CPFIA) to invest your CPF Ordinary Account (OA) and Special Account (SA) savings, and a SRS account with DBS.

You should also check if you meet the eligibility requirements for each scheme, which are listed below.

In Summary

Planning for a secure retirement involves strategically using CPF and SRS. CPF provides a strong foundation, while SRS offers valuable tax benefits and investment flexibility to boost retirement funds.

Investing these funds wisely can potentially yield higher returns compared to leaving them idle, accelerating progress toward one's financial goals. By understanding the nuances of each scheme and aligning investment choices with one's life stage, individuals can build a more robust and fulfilling retirement future.