![]()

If you’ve only got a minute:

- Designing the retirement lifestyle you want to have is the first step to planning a sustainable retirement.

- Understand your financial commitments and build sustainable income streams to match your retirement needs and wants.

- Utilise your CPF, investments, insurance, government schemes, estate planning tools and sound financial planning concepts to form a robust retirement plan.

![]()

For many of us, our parents have spent much of their working lives earning their keep to provide for our needs. Once we are no longer financially dependent on them, the next natural phase of life that they approach will be retirement.

Retirement can be something for our parents to look forward to, or something to dread. The key difference comes with the planning done in the years leading up to retirement, and how they design the retirement lifestyle they want to have.

Everyone has their idea of what they might want to do in their retirement – some may have dreams of travelling the world and others may want to spend their newfound free time doing volunteer work or looking after their grandchildren.

Regardless of what their ideal retirement looks like, helping them to plan it is one way you can show your appreciation for their years of provision.

It is important to first understand their financial obligations, wants and needs. From there, you can help devise a system for regular, predictable, and sustainable cashflows which will help pave the way to a comfortable, secure, and sustainable retirement.

Here are 6 useful tips to get you started.

1. Top-up CPF accounts

By topping up your parents’ Central Provident Fund (CPF) accounts, you can help them to build up their retirement funds. They are also able to make such top-ups to their accounts.

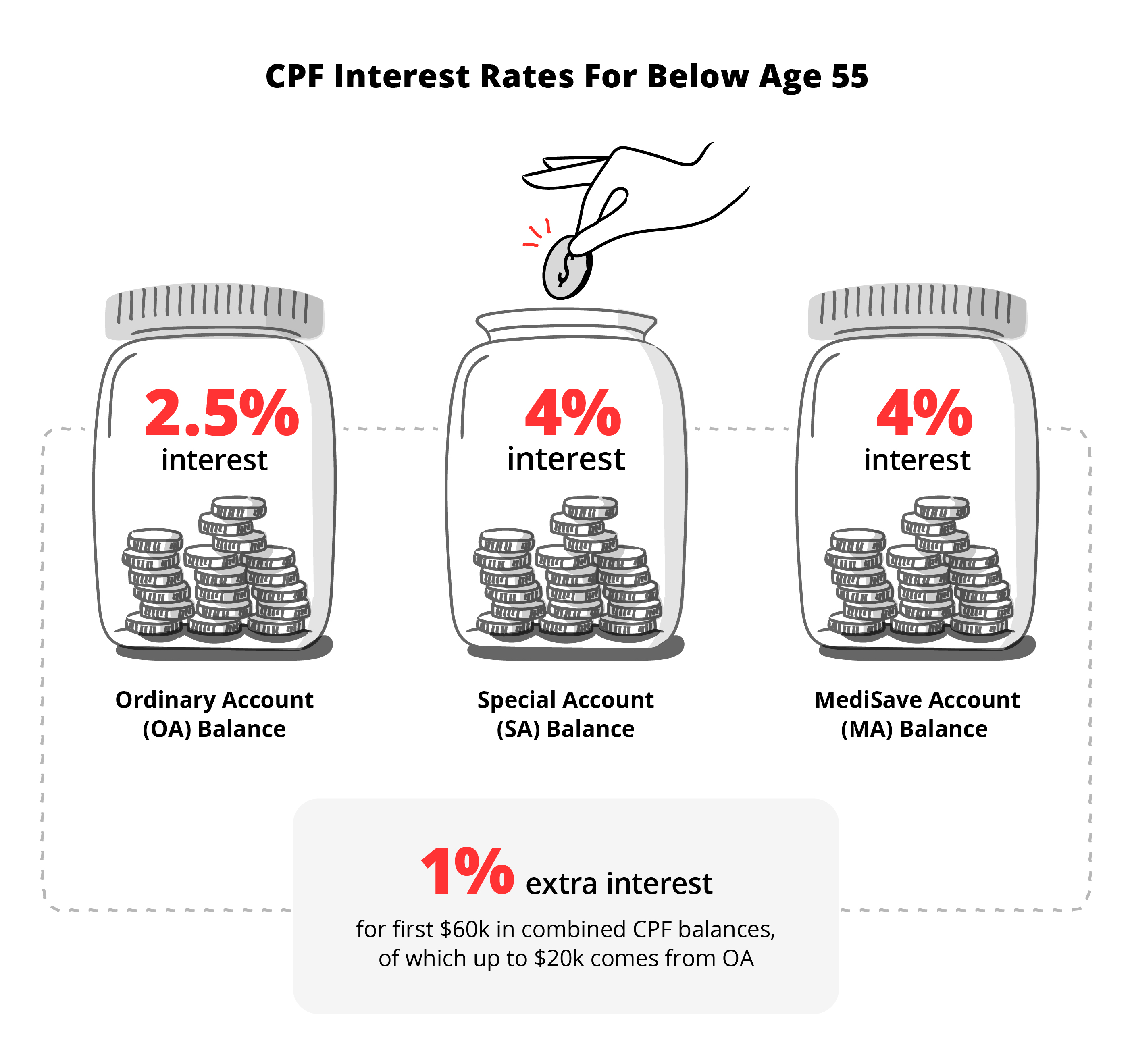

If your parents are below the age of 55, they can earn an interest of up to 5% per annum (p.a.) on the first S$60,000 of their combined CPF savings.

If they are 55 and above, they can earn an interest of up to 6% p.a. on the first S$30,000 of their combined CPF savings, and 5% on the next S$30,000. The interest earned and compounded over time will go a long way in helping them achieve higher CPF LIFE payouts from age 65.

Furthermore, you get to enjoy potential tax relief of up to S$8,000 p.a. when you do a cash top-up to their CPF Special Account (SA) or Retirement Account (RA). If they top up their own account, they will also be eligible for this tax relief, subject to conditions.1 That works out to a maximum of S$16,000 income tax relief per year!

2. Continue to invest excess cash

In the “Are you losing the race against inflation?” report by DBS, it highlighted that baby boomers (ages 59-77 in 2023) are among those who are most vulnerable to inflation, suggesting a lower capacity to stomach rising inflation. The report also indicated that nearly half a million DBS customers had incomes that were not keeping up with surging inflation rates.

Many still have the mentality that “saving money” is the best way to build up their wealth for retirement. This is not the case with current inflation rates causing the value of cash to decline more rapidly.

Instead, consider helping your parents understand their financial objectives, situation, time horizon and the amount of risk they can stomach. It is also good to do some due diligence on investments, common mistakes in investing and the emotions that can come with it.

Read more: Is my CPF enough to beat inflation?

Find out more about: Retirement digiPortfolio

3. Review insurance policies

Staying insured protects your family against unforeseen events and ensures your financial security especially in the light of high healthcare costs in Singapore. As our insurance needs change with our age and life stage, it is important to review your parents’ insurance policies to see if they continue to meet their needs.

For example, it is important to ensure your parents are adequately insured given the increased likelihood of being hospitalised or having a disability as they age. Having a basic hospitalisation plan and long-term care plan (such as ElderShield/CareShield Life) may help to tide the family through financially should there be a need to pay for medical fees, nursing home care and/or engaging a helper.

If your parents have bought any insurance coverage for you, they can consider transferring the policy ownership to you so that the funds for premium payments can be freed to be used elsewhere in their retirement plan.

Read more: 4 types of insurance plans to boost your retirement income

Find out more about: Save, plan and invest for your retirement with DBS

4. Reduce outstanding debt

If possible, help your parents aim to be debt free before retirement as debt repayments will eat into their retirement savings.

Start by listing down all their debts, then prioritise and pay off the debts with the highest interest rates first. Debt with high interest can quickly compound and snowball into larger amounts, affecting their retirement plans.

Alternatively, depending on the type of debt they have, they could also focus on paying off smaller outstanding debt first. This would likely help them gain confidence in managing and clearing off debt.

5. Set up a sound estate plan

Your parents need to set up a sound estate plan. Besides having a will in place, they can also consider using tools like CPF Nomination and insurance nominations to direct how their belongings should be distributed.

As part of their estate planning, they can also consider setting up a Lasting Power of Attorney. This allows them to indicate a trusted person to step in on their behalf should they lose the ability to make their own decisions.

Read more: The importance of Estate Planning

6. Monetise your home to supplement retirement income

There are several ways to incorporate home planning into your retirement planning strategy. These include government schemes like the Silver Housing Bonus (SHB) and the Lease Buyback Scheme, as well as DBS’ Home Equity Income Loan.

If your parents are looking to right-size their home to a 3-room or smaller flat, the SHB will supplement their retirement income with a cash bonus of up to S$30,000. This is applicable whether they are selling a private property or HDB flat, as long as its Annual Value does not exceed S$21,000.

They will also have to top-up their CPF Retirement Account (RA) with S$60,000 from the sale proceeds and join CPF LIFE. If the top-up is less than that, they will receive a pro-rated cash bonus of S$1 for every S$2 top-up made.2

The LBS allows HDB owners to unleash equity from their existing flat without having to sell it entirely. They can choose to sell part of their flat's lease back to HDB. The proceeds from that will be used to top up their CPF RA which in turn will be used to buy a CPF Life Plan that will provide them with a monthly income for life. This scheme is not applicable to private property owners.3

An alternative avenue for private property owners between ages 65 and 79 looking to unlock some cash while still living in their home is the DBS Home Equity Income Loan. Singapore citizens or PRs are eligible to borrow against their fully paid private residential property and use the funds to top up their CPF RA to receive higher CPF Life payouts.

The maximum loan they can get is the amount required to top-up their CPF RA to the prevailing CPF Enhanced Retirement Sum (S$308,700 in 2024).

With the average life expectancy of Singaporeans getting longer each year, it is crucial that we plan well not only with our parents, but also for ourselves, so that we do not outlive our resources.

Retire smart when the time comes by exercising diligence now. Build a sustainable retirement lifestyle so as not to place any unnecessary financial burden on your loved ones.

Minimise your liabilities where possible, invest wisely, engage in careful estate planning, keep abreast of opportunities and of course, cultivate a healthy mind and body.

Source:

1 CPF Board, “What are the conditions for me to enjoy tax relief?”, retrieved 8 Jan 2024.

2 HDB, “Silver Housing Bonus”, retrieved 8 Jan 2024.

3 HDB, “Lease Buyback Scheme”, retrieved 8 Jan 2024.