Profile

Previous Close Price

Key Statistics

| Mar SGD mn | 2024 | 2025f | 2026f |

|---|---|---|---|

| Revenue | 5,150 | 5,704 | 5,971 |

| Net Profit | 74.4 | 261 | 282 |

| Profit Gth (%) | 1140 | 250.8 | 8 |

| PE (X) | 87.0x | 19.6x | 17.4x |

| Div Yield (%) | 0.5 | 1.7 | 2.3 |

| P/BV (X) | 2.1x | 1.9x | 1.8x |

Recent Developments

- 24 Feb 2025SATS: Negatives baked in, long-term potential intact

- 11 Nov 2024SATS Ltd: Reaching new heights with achievable ambitious

- 08 Nov 2024SATS Ltd: Another solid quarter with a surprise interim dividend

- 22 Aug 2024SATS Ltd: 1QFY25 results handily beat expectations; raised FY25/26 core net profit estimates by 7-8% and TP to SGD4.10

- 04 Jun 2024SATS: 4QFY24 results above expectations with resumption of dividends; ambitious long-term growth aspirations

- 29 May 2024SATS Ltd: 4QFY24 results above expectations with surprise reinstatement of dividends

- 01 Mar 2024SATS Ltd: 3QFY24 results in-line; FY25/26F earnings estimates largely unchanged despite positive developments due to margin pressures

- 15 Nov 2023SATS: 1HFY24 results in line, with encouraging signs of recovery in the cargo handling segment

- 14 Nov 2023SATS Ltd: <Earnings Analysis!> In-line 2QFY24; encouraging signs of stabilisation in air cargo market

- 16 Aug 2023SATS: 1QFY24 results largely in line; unfavourable accounting impact on earnings

Our Views

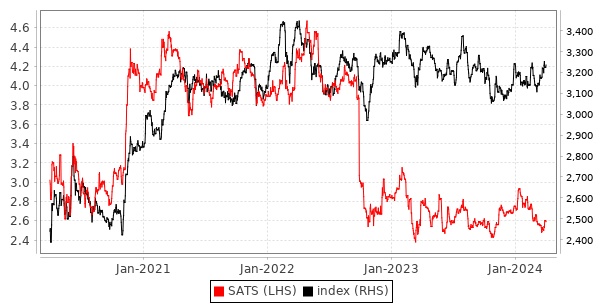

Globally diversified aviation services and food solutions provider. SATS is one of the world’s largest ground and air cargo handlers (no.1 in cargo tonnage), with an extensive global network of over 215 ground and cargo stations in 27 countries, commanding significant market share across multiple key airports. Additionally, it is a leading player in Asia’s food solutions sector, with a strong foothold in in-flight catering. Over the years, the group has successfully expanded its reach into non-aviation segments such as retail, food services, and HoReCa (hotels, restaurants, and catering).

Trade disruptions likely to affect FY26F earnings, but food and ground handling segments remain resilient. We turn more cautious on SATS’ near-term outlook due to headwinds in its air cargo division, stemming from tariffs and the imminent elimination of De Minimis tax exemptions in the US. Nevertheless, we still expect rising air passenger traffic and its fresh-frozen meal strategy to underpin solid growth in SATS’ aviation food and ground handling businesses. In addition, its partnership with Mitsui, coupled with an expanding product portfolio, should support growth in non-aviation food. As a result, we now expect modest core EPS growth of 8% y/y in FY26F, with a rebound likely in FY27F (+20% y/y).

On track to exceed WFS synergy target; additional scope to reduce debt cost. SATS has made impressive strides in realising synergies from its acquisition of WFS, already achieving 92% of its SGD100mn target, and looks set to surpass its original goal in FY26F. We believe the group is well positioned to leverage its extensive network to secure more commercial wins and expand market share. Additionally, SATS stands to further lower its cost of debt by 50–100 bps following upcoming debt repayments and refinancing this year.

Maintain BUY with TP of lower TP of SGD4.00. We cut our TP to factor our negative earnings revisions and reduce our valuation multiple peg due to heightened uncertainties. Our blended valuation framework incorporates both a forward EV/EBITDA multiple (pegged to 8.0x blended FY25/26F EBITDA) and a DCF valuation.

Risks

Research Platform: Insights Direct

GENERAL DISCLOSURE/DISCLAIMER

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR.