Although Trump’s looser stance on fiscal matters and penchant for tariffs are likely to weigh on gold prices in the short-term, the structural case for gold remains compelling as US fiscal deficit looks set to grow under Trump while the return of the inverse gold-rate/ dollar correlation since 2H24 remains the main tailwind for gold in recent times

- Policy rate trajectory appears to be unaffected by Trump’s victory for now

- "Higher for longer” is not a given with no evidence that yields will increase post-election

- Rising fiscal deficits to drive long-term gold demand through safe haven demands, a weaker dollar, and policy rate constraints

- Gold to remain structurally bullish despite short-term uncertainties

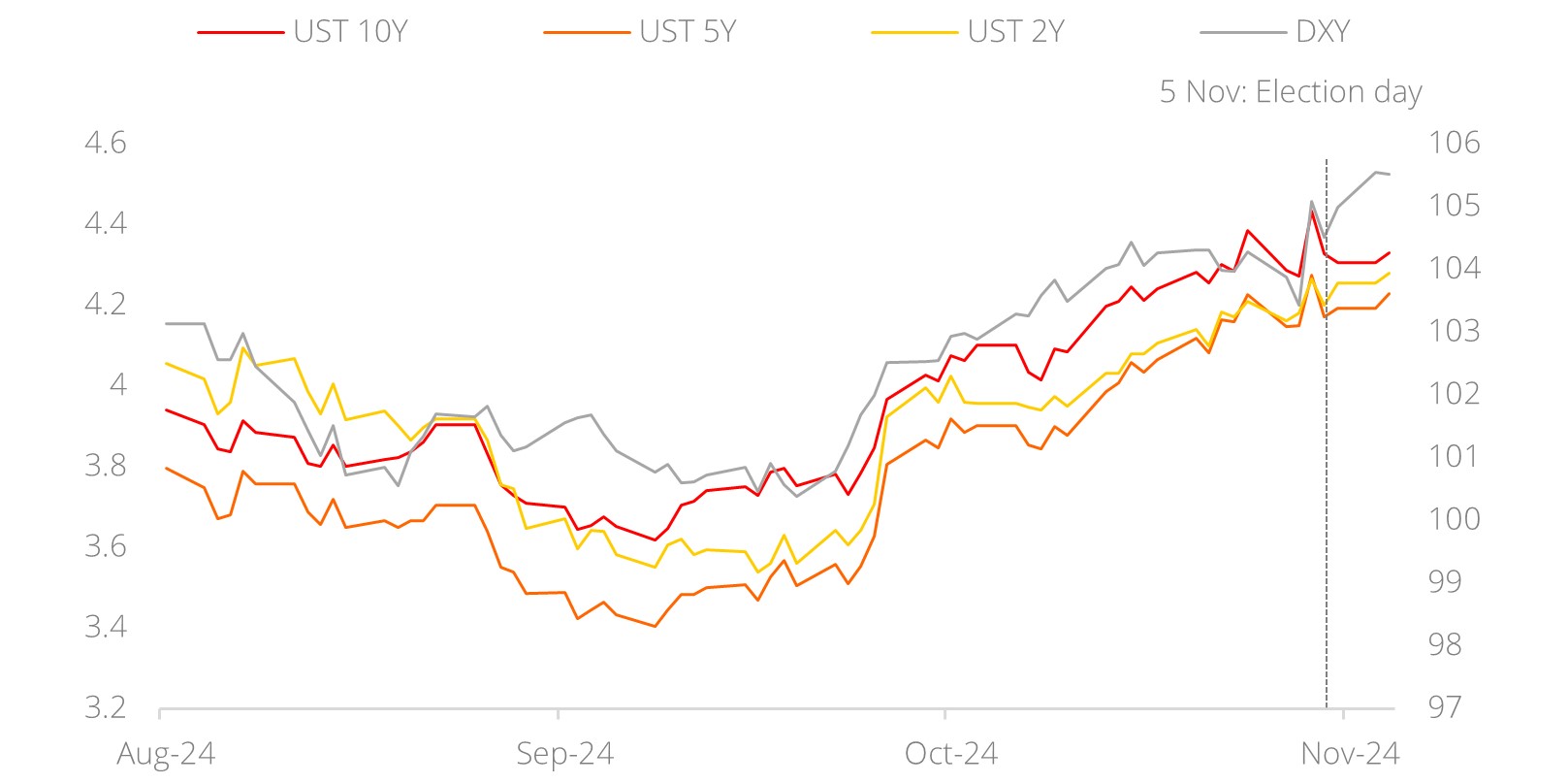

Figure 1: Treasury yields, dollar have risen post the US election

Source: Bloomberg, DBS

Topic

GENERAL DISCLOSURE/DISCLAIMER

This report is prepared by DBS Bank Ltd. This report is solely intended for the clients of DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd, its respective connected and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS Bank Ltd.

The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd, its respective connected and associated corporations, affiliates and their respective directors, officers, employees and agents (collectively, the “DBS Group”) have not conducted due diligence on any of the companies, verified any information or sources or taken into account any other factors which we may consider to be relevant or appropriate in preparing the research. Accordingly, we do not make any representation or warranty as to the accuracy, completeness or correctness of the research set out in this report. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained in this document does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate independent legal or financial advice. The DBS Group accepts no liability whatsoever for any direct, indirect and/or consequential loss (including any claims for loss of profit) arising from any use of and/or reliance upon this document and/or further communication given in relation to this document. This document is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. The DBS Group, along with its affiliates and/or persons associated with any of them may from time to time have interests in the securities mentioned in this document. The DBS Group, may have positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking services for these companies.

Any valuations, opinions, estimates, forecasts, ratings or risk assessments herein constitutes a judgment as of the date of this report, and there can be no assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments. The information in this document is subject to change without notice, its accuracy is not guaranteed, it may be incomplete or condensed, it may not contain all material information concerning the company (or companies) referred to in this report and the DBS Group is under no obligation to update the information in this report.

This publication has not been reviewed or authorized by any regulatory authority in Singapore, Hong Kong or elsewhere.

There is no planned schedule or frequency for updating research publication relating to any issuer.

The valuations, opinions, estimates, forecasts, ratings or risk assessments described in this report were based upon a number of estimates and assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on which the valuations, opinions, estimates, forecasts, ratings or risk assessments were based will not materialize or will vary significantly from actual results. Therefore, the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments described herein IS NOT TO BE RELIED UPON as a representation and/or warranty by the DBS Group (and/or any persons associated with the aforesaid entities), that:

(a) such valuations, opinions, estimates, forecasts, ratings or risk assessments or their underlying assumptions will be achieved, and

(b) there is any assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments stated therein.

Please contact the primary analyst for valuation methodologies and assumptions associated with the covered companies or price targets.

Any assumptions made in this report that refers to commodities, are for the purposes of making forecasts for the company (or companies) mentioned herein. They are not to be construed as recommendations to trade in the physical commodity or in the futures contract relating to the commodity referred to in this report.

DBSVUSA, a US-registered broker-dealer, does not have its own investment banking or research department, has not participated in any public offering of securities as a manager or co-manager or in any other investment banking transaction in the past twelve months and does not engage in market-making.

General | This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. |

Australia | This report is being distributed in Australia by DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd (“DBSVS”) or DBSV HK. DBS Bank Ltd holds Australian Financial Services Licence no. 475946. DBS Bank Ltd, DBSVS and DBSV HK are exempted from the requirement to hold an Australian Financial Services Licence under the Corporation Act 2001 (“CA”) in respect of financial services provided to the recipients. Both DBS and DBSVS are regulated by the Monetary Authority of Singapore under the laws of Singapore, and DBSV HK is regulated by the Hong Kong Securities and Futures Commission under the laws of Hong Kong, which differ from Australian laws. Distribution of this report is intended only for “wholesale investors” within the meaning of the CA. |

Hong Kong | This report has been prepared by a personnel of DBS Bank, who is not licensed by the Hong Kong Securities and Futures Commission to carry on the regulated activity of advising on securities in Hong Kong pursuant to the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). This report is being distributed in Hong Kong and is attributable to DBS Bank (Hong Kong) Limited (''DBS HK''), a registered institution registered with the Hong Kong Securities and Futures Commission to carry on the regulated activity of advising on securities pursuant to the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). DBS Bank Ltd., Hong Kong Branch is a limited liability company incorporated in Singapore. For any query regarding the materials herein, please contact Dennis Lam (Reg No. AH8290) at [email protected] |

Indonesia | This report is being distributed in Indonesia by PT DBS Vickers Sekuritas Indonesia. |

Malaysia | This report is distributed in Malaysia by AllianceDBS Research Sdn Bhd ("ADBSR"). Recipients of this report, received from ADBSR are to contact the undersigned at 603-2604 3333 in respect of any matters arising from or in connection with this report. In addition to the General Disclosure/Disclaimer found at the preceding page, recipients of this report are advised that ADBSR (the preparer of this report), its holding company Alliance Investment Bank Berhad, their respective connected and associated corporations, affiliates, their directors, officers, employees, agents and parties related or associated with any of them may have positions in, and may effect transactions in the securities mentioned herein and may also perform or seek to perform broking, investment banking/corporate advisory and other services for the subject companies. They may also have received compensation and/or seek to obtain compensation for broking, investment banking/corporate advisory and other services from the subject companies. |

Singapore | This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) or DBSVS (Company Regn No. 198600294G), both of which are Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd and/or DBSVS, may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 6878 8888 for matters arising from, or in connection with the report. |

Thailand | This report is being distributed in Thailand by DBS Vickers Securities (Thailand) Co Ltd. For any query regarding the materials herein, please contact Chanpen Sirithanarattanakul at [email protected] |

United Kingdom | This report is produced by DBS Bank Ltd which is regulated by the Monetary Authority of Singapore. This report is disseminated in the United Kingdom by DBS Bank Ltd, London Branch (“DBS UK”). DBS Bank Ltd is regulated by the Monetary Authority of Singapore. DBS UK is authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. In respect of the United Kingdom, this report is solely intended for the clients of DBS UK, its respective connected and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS UK. This communication is directed at persons having professional experience in matters relating to investments. Any investment activity following from this communication will only be engaged in with such persons. Persons who do not have professional experience in matters relating to investments should not rely on this communication. |

Dubai International Financial Centre | This communication is provided to you as a Professional Client or Market Counterparty as defined in the DFSA Rulebook Conduct of Business Module (the "COB Module"), and should not be relied upon or acted on by any person which does not meet the criteria to be classified as a Professional Client or Market Counterparty under the DFSA rules. This communication is from the branch of DBS Bank Ltd operating in the Dubai International Financial Centre (the "DIFC") under the trading name "DBS Bank Ltd. (DIFC Branch)" ("DBS DIFC"), registered with the DIFC Registrar of Companies under number 156 and having its registered office at units 608 - 610, 6th Floor, Gate Precinct Building 5, PO Box 506538, DIFC, Dubai, United Arab Emirates. DBS DIFC is regulated by the Dubai Financial Services Authority (the "DFSA") with a DFSA reference number F000164. For more information on DBS DIFC and its affiliates, please see http://www.dbs.com/ae/our--network/default.page. Where this communication contains a research report, this research report is prepared by the entity referred to therein, which may be DBS Bank Ltd or a third party, and is provided to you by DBS DIFC. The research report has not been reviewed or authorised by the DFSA. Such research report is distributed on the express understanding that, whilst the information contained within is believed to be reliable, the information has not been independently verified by DBS DIFC. Unless otherwise indicated, this communication does not constitute an "Offer of Securities to the Public" as defined under Article 12 of the Markets Law (DIFC Law No.1 of 2012) or an "Offer of a Unit of a Fund" as defined under Article 19(2) of the Collective Investment Law (DIFC Law No.2 of 2010). The DFSA has no responsibility for reviewing or verifying this communication or any associated documents in connection with this investment and it is not subject to any form of regulation or approval by the DFSA. Accordingly, the DFSA has not approved this communication or any other associated documents in connection with this investment nor taken any steps to verify the information set out in this communication or any associated documents, and has no responsibility for them. The DFSA has not assessed the suitability of any investments to which the communication relates and, in respect of any Islamic investments (or other investments identified to be Shari'a compliant), neither we nor the DFSA has determined whether they are Shari'a compliant in any way. Any investments which this communication relates to may be illiquid and/or subject to restrictions on their resale. Prospective purchasers should conduct their own due diligence on any investments. If you do not understand the contents of this document you should consult an authorised financial adviser. |

United States | This report was prepared by DBS Bank Ltd. DBSVUSA did not participate in its preparation. The research analyst(s) named on this report are not registered as research analysts with FINRA and are not associated persons of DBSVUSA. The research analyst(s) are not subject to FINRA Rule 2241 restrictions on analyst compensation, communications with a subject company, public appearances and trading securities held by a research analyst. This report is being distributed in the United States by DBSVUSA, which accepts responsibility for its contents. This report may only be distributed to Major U.S. Institutional Investors (as defined in SEC Rule 15a-6) and to such other institutional investors and qualified persons as DBSVUSA may authorize. Any U.S. person receiving this report who wishes to effect transactions in any securities referred to herein should contact DBSVUSA directly and not its affiliate. |

Other jurisdictions | In any other jurisdictions, except if otherwise restricted by laws or regulations, this report is intended only for qualified, professional, institutional or sophisticated investors as defined in the laws and regulations of such jurisdictions. |

HONG KONG | SINGAPORE |

INDONESIA PT DBS Vickers Sekuritas (Indonesia) Contact: William Simadiputra DBS Bank Tower Ciputra World 1, 32/F Jl. Prof. Dr. Satrio Kav. 3-5 Jakarta 12940, Indonesia Tel: 62 21 3003 4900 Fax: 6221 3003 4943 e-mail: [email protected] | THAILAND |