- At the cusp of an economic slowdown, distressed debt funds are poised for opportunities

- Distressed debt investing targets companies with a high likelihood of default

- Elevated interest rates, tightened lending standards, and rising refinancing risks support defaults

- Distressed debt funds to extract value from surge of steeply discounted non-performing debt

Investors in distressed debt do not follow the conventional market psyche. While most investors relish in an environment of optimism, distressed debt funds operate under a different framework. Episodes of strong growth usually mark exit points, while recessions are fertile ground to scavenge for funding gaps that have the potential for huge upside. With the world seemingly at the precipice of an economic slowdown, distressed debt funds are readying their arsenal for what they consider could be a slew of opportunities ahead.

What is distressed investing? Distressed investing strategies involve scouring the market to snap up undervalued debt of bankrupt companies, or those with a high likelihood of default. Distressed debt funds review companies’ capital structure for opportunities and purchase underpriced securities with as deep a discount as possible. They then work with other creditors and enhance the securities’ value (e.g., by negotiating bankruptcies to maximise recovery, taking control of an insolvent yet fundamentally sound business, selling assets of the insolvent business, etc.)

A return of distressed opportunities. The pre-pandemic past decade of cheap funding and relatively low default rates resulted in a dearth of opportunities for distressed debt funds. This is set to change, however, as funding pressures and falling asset prices persist. Although the US economy is displaying remarkable resilience despite undergoing one of the most aggressive monetary tightening cycles in recent history, aggregate data overlooks cracks under the surface. Although households and investment grade corporates could be equipped to weather a challenging macro environment, divergence by credit quality is increasing. Elevated interest rates and slowing growth are already weighing heavily on the weakest borrowers – highly-leveraged companies with floating rate capital structures.

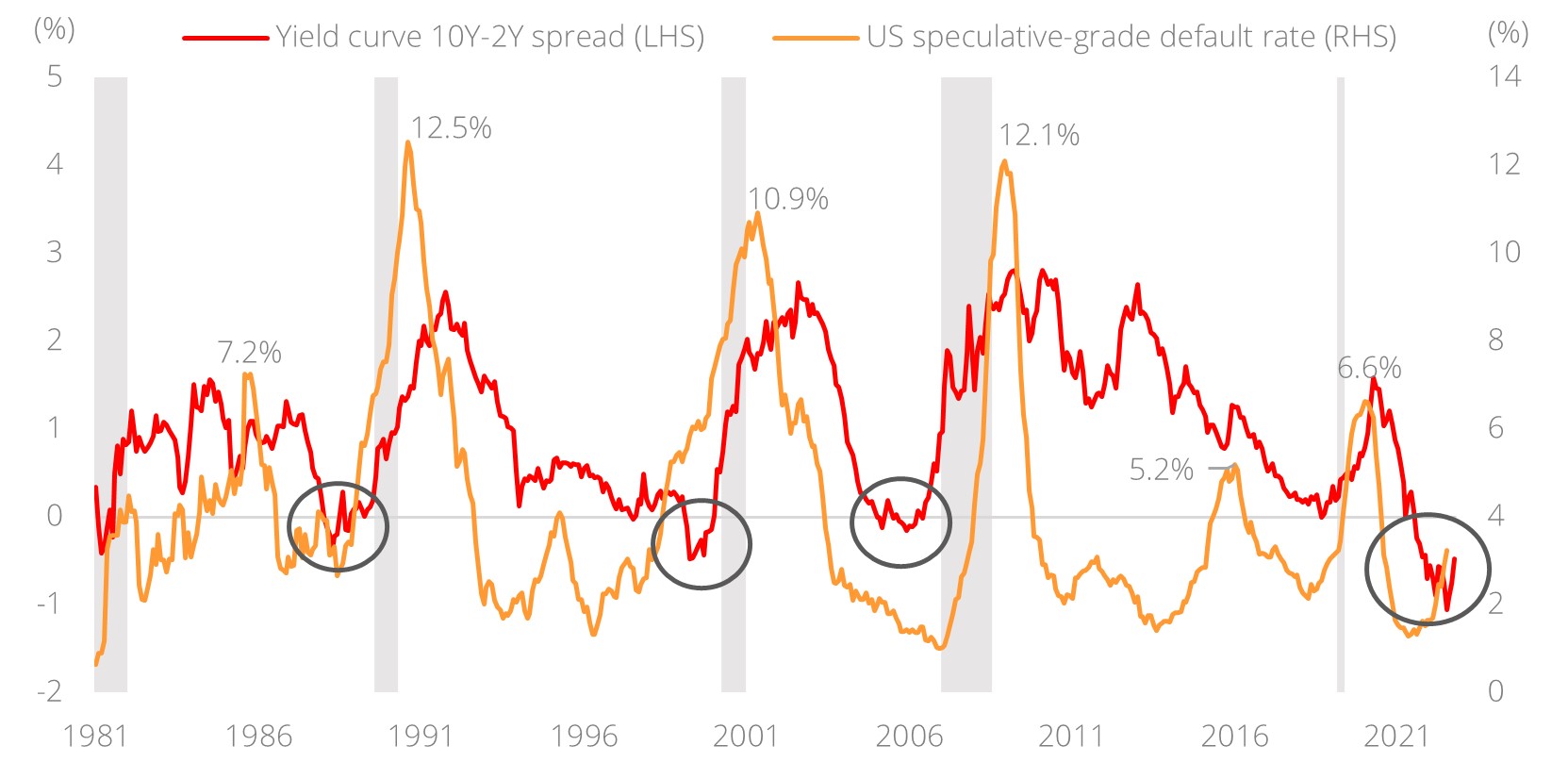

Conditions leading to a rise in distressed opportunities are materialising. For one, recent movements in the treasury yield curve have been sending ominous signals – inversion of the yield curve has historically been a reliable precursor to a US recession, having preceded the past seven recessions by approximately 10 months on average. Furthermore, examining a shorter available history of default data, dis-inversion of an inverted yield curve had foreshadowed the last three peak default cycles in which default rates amongst speculative-grade borrowers reached at least 10% a year. If history is any guide, recent dis-inversion of the deeply inverted yield curve could foreshadow a surge in defaults. The average lead time of inversions across all three prior peaks default cycles was c.34 months, which would place the default rate at c.10% by the second half of 2025, coinciding with a period which sees a spike in speculative grade maturities.

Figure 1: Dis-inversion of an inverted yield curve has preceded the last three peak default rates

Source: Bloomberg, S&P Global Ratings, DBS. Shaded areas represent NBER recessions

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.