Key summary points:

- Having the foresight to understand how your financial needs change across your retirement years helps you make wiser decisions in building your funds.

- Before retiring, the focus will primarily be on working your money harder to beat inflation and grow your retirement nest egg.

- Upon retirement, the focus shifts to drawing down from whatever you’ve accumulated, for your living expenses.

Everyone wants to enjoy their retirement. With good financial planning, you can draw down on your nest egg to fund your expenses in an optimal manner, and come up tops during retirement.

Keen to get started on rocking your golden years?

Before retiring, the focus will primarily be on working your money harder to beat inflation and grow your retirement nest egg. Upon retirement, the focus shifts from accumulating wealth to drawing down from whatever’s been accumulated to fund our expenses.

Here are some facts about retiring in Singapore1.

- Most Singaporeans expect to retire at the age of 62, and the average life expectancy is currently 83.2 years.

- Cash and bank accounts are the most popular way of saving for retirement.

- This is followed by personal savings, endowment insurance, or recurring income from investments that aren’t unit trusts.

Source: Manulife Asia Care Survey 2023

Understanding Retirement Through 3 Stages

At present, Singaporean men live to an average of 81.1 years, and Singaporean women, 85.9 years2. While this means you have more time to make the most of your retirement, it also means that your funds need to last longer.

Having the foresight to understand how your financial needs will vary across your retirement years helps you make wiser decisions in building your funds.

Here’s a ‘playlist’ reflecting the pace across the 3 stages of retirement:

Retirement’s just started: Dancing in the Moonlight

You’re in your mid-60s and just beginning to embrace retirement. The kids are doing well, your mortgage is paid up, and your alarm clock is set permanently to ‘off’. This is your time to do what you’ve always wanted – see the world, learn a new skill, indulge in a hobby.

Since you’re not drawing a regular salary any more, you’ll be relying on other sources of income. So it’s essential to make sure you have enough to continue living it up.

Tips to help you find your groove:

- Maintain a steady stream of income and keep your investments growing

Dividends and CPF retirement payouts give you a regular income stream. By relying on these, you can keep your equities portfolio growing, to build greater security for the years ahead. Meanwhile, your time deposits, bonds and other insurance plans that would have matured can supplement your income. - Consider tapping on your Supplementary Retirement Scheme (SRS) funds

This could give you another steady stream of income to help cover your living and medical expenses which your insurance plans or Medisave don’t. Withdraw smaller amounts annually, and you may not even be taxed. - Look into a Multi-Currency Term Loan on your investments

If you need to release funds from your fixed assets, a Multi-Currency Term Loan on your investment holdings could unlock some spare cash that can be used to cover your living expenses, or reinvested to create another stream of income.

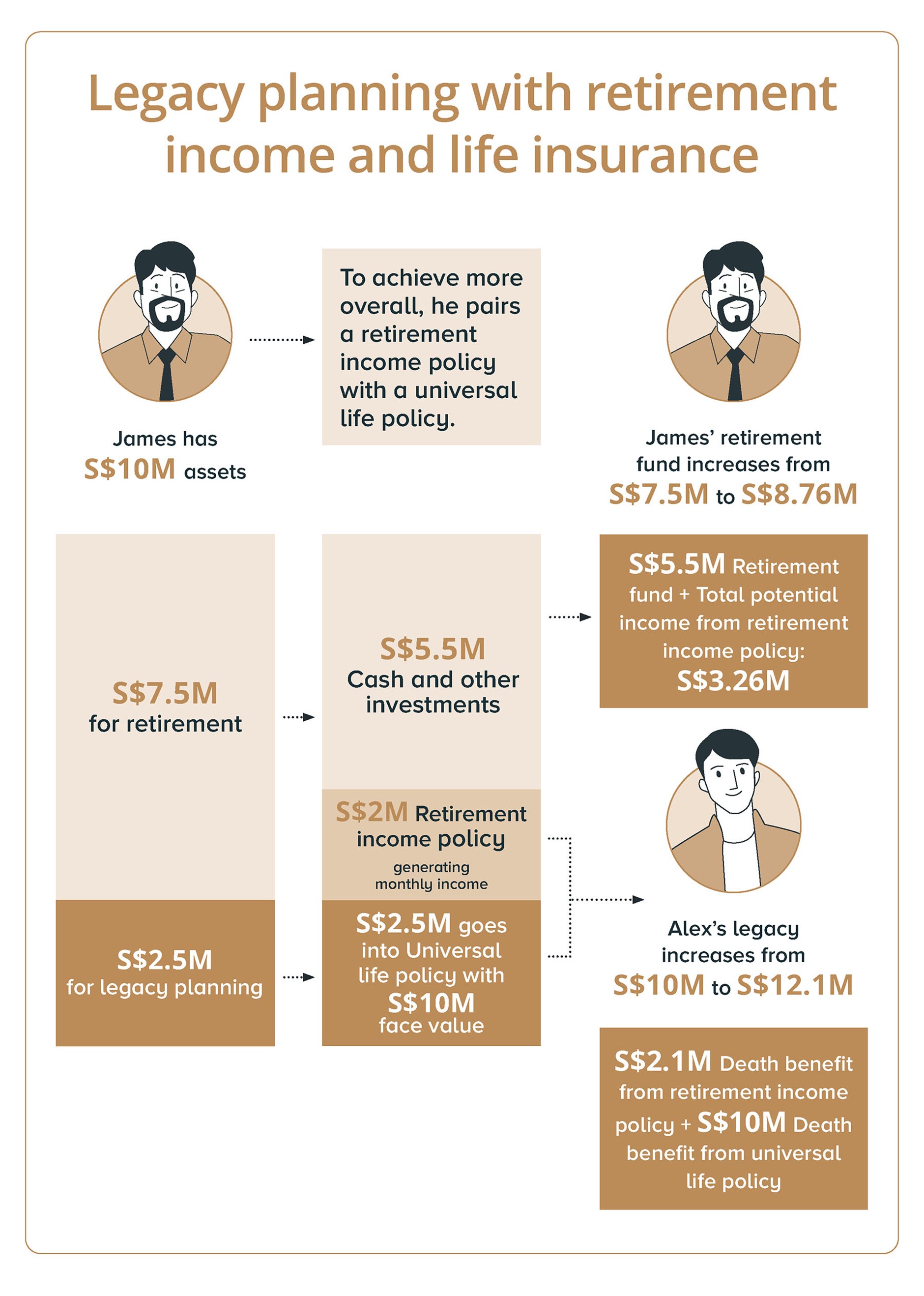

- Plan your legacy

A Universal Life policy is one way to build, preserve and share your wealth while giving you more flexibility to spend throughout your retirement.

^Actual legacy amount varies from Product to Product as well as profile of life insured.

T&Cs apply. Please refer to respective product summaries for more details.

As these policies are highly customised, your Relationship Manager can best advise you on setting up one that meets your needs.

After some busy years in retirement passions: Don’t Worry, Be Happy

It’s about a decade into your retirement and you are comfortably enjoying your 70s. You’re happy to take your foot off the pedal, and cruise a little... travel less, play less golf... but now you have more quality time with family and friends. Your needs are a little simpler, although no less comfortable. Some concerns, like healthcare, might come up. Fortunately, you have a little more flexibility with your assets.

Tips to help you find your groove:

- Review your portfolio, examine its weightage

It’s good to do this periodically. Maintain a portfolio of dividend-yielding investments like bonds, unit trusts and stocks because you want to generate a stable cash flow. Also, if longer-term investments are not so important to you now, perhaps it’s time to rebalance your portfolio. The capital you free up could be reinvested for the shorter term to bring steady returns. - Consider a home that’s easier to upkeep

With a smaller home, there’s less to keep clean. You may also want to move closer to your children. The cash you unlock can be used to cover your expenses or for further investment.

Switch gears and bask in the family moments: Walking on Sunshine

In your 80s, you are learning to treasure what truly matters in life. The grandkids are growing up fast, and by now it’s mostly about spending time with family and friends. Your ultimate contentment now comes from having your family around you.

They support you by ensuring you get help with the things you used to do around the house, including laundry and general cleaning. And it’s good to know there’s someone to accompany you to doctor’s appointments and remind you about your medication, help that you’ve graciously come to accept.

Inflation, however, is not your friend. But planning well has given you enough for what you want to do.

Tips to help you find your groove:

- Tap on maturing assets, consider fixed deposits

At this stage, you don’t want to take on any more market risks. Investing in fixed deposits could help you beat inflation and get more stable returns. Your maturing life insurance, endowment or other insurance plans could now give you a steady source of income.

How early should you start your retirement planning?

You’ve heard this often, and it’s true: The earlier you start planning and investing, the better. Starting at 35 or even 25 gives you 30 to 40 years to grow your investments and take advantage of the value of compounding interest. At the same time, you’re more likely to ride out market volatility.

But don’t fret if you haven’t started – it is never too late. There are always solutions to allocate your finances across different investment streams so that you can get closer to the amount you desire to retire with.

Get in touch for smart solutions to rock your retirement years

1Manulife, 29 March 2023. Singapore respondents’ hope of saving for retirement stifled by more immediate financial and lifestyle pressures – Manulife survey shows. Accessed 11 April 2023 at https://www.manulife.com.sg/en/about-us/newsroom/singapore-respondents-hope-of-saving-for-retirement-stifled-by-more-immediate-financial-and-lifestyle-pressures.html.

2Department of Statistics Singapore. Death and Life Expectancy. Accessed on 11 April 2023 at https://www.singstat.gov.sg/find-data/search-by-theme/population/death-and-life-expectancy/latest-data

Disclaimers and Important Notices

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.