Key points:

- Interest rates are influenced by central bank decisions.

- In Singapore, interest rates are largely shaped by global interest rates and expectations of Singapore dollar exchange rates.

- When interest rates are rising, savings are more attractive due to higher deposit rates.

- Financials sector such as banks, mortgage and insurance companies stand to benefit as interest rate hikes.

Keen to explore market opportunities with greater assurance?

Interest rates are influenced by central bank. They may be adjusted to stimulate or curb a country's economic growth. In Singapore, interest rates are largely shaped by global interest rates and expectations about the Singapore dollar exchange rate.

Over the past year, interest rates have been on a rising path. The US Federal Reserve has raised its interest rate 11 times since March 2022. The Bank of England has raised its interest rate 14 times since December 2021. And the European Central Bank has raised interest rates to the highest in 23 years.

Understanding how the rise and fall of interest rates affect businesses, individuals and ultimately your investments, will help you ride the wave with confidence.

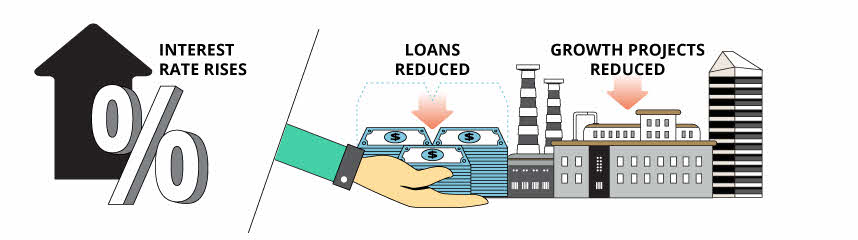

What happens when interest rates rise

IIn general, high interest rates cool an overheated economy and reduce inflation. This is because higher interest rates makes borrowing costs impede business plans, and businesses will likely halt or reduce growth projects.

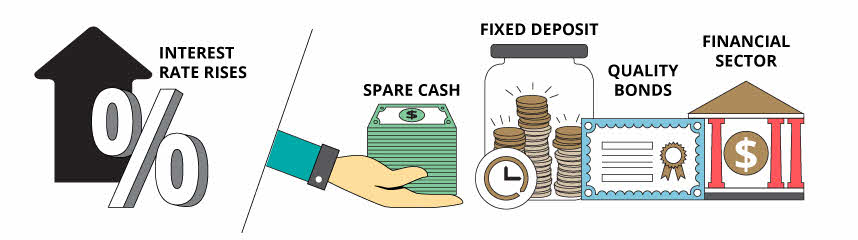

Hunt for quality bonds and companies in Financials sector

Savings are more attractive due to higher deposit rates; individuals may consider investing in assets, businesses or sectors that will benefit from rising interest rates.

Sectors and assets that benefit from rising interest rates

Investment opportunities in the midst of a high interest rate environment:

- Financials sector such as banks, mortgage and insurance companies stand to benefit as interest rate hikes.

- Attractive fixed deposit rates may entice savers. Investors may be able to pick up quality bonds at a favourable trading price.

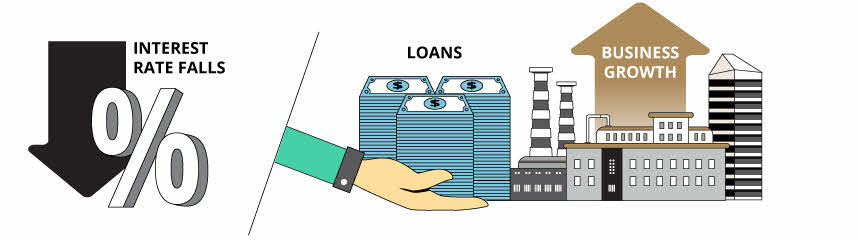

What happens when interest rates fall

In general, low interest rate stimulates economic growth and increases inflation. This is because it is cheaper for businesses to borrow.

With a reduced cost for businesses to borrow money, businesses will likely embark on growth projects such as business acquisitions and expansions and product developments.

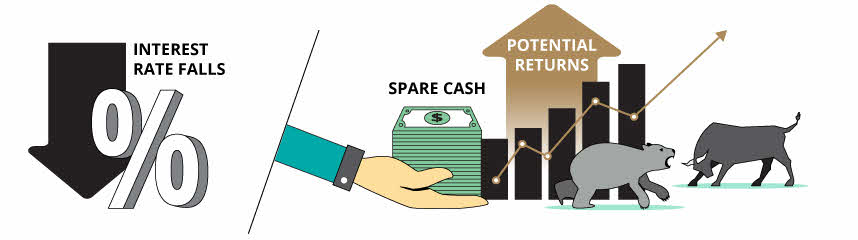

Invest for better returns

Savings are less attractive due to lower deposit rates; individuals are likely to invest spare cash into investment instruments for better returns.

Sectors that benefit from falling interest rates

Investment opportunities in the midst of a low interest rate environment:

- Look for Growth stocks or sectors as researched and curated by our Chief Investment Office and Group Research teams.

- Seek bonds with attractive coupons or higher dividend paying stocks. If you are holding to such high demand assets, this might be an opportunity to capitalise your assets.

Get expert analysis to invest with clarity

Guidance from our Chief Investment Office (CIO) and Chief Economist underpins all the insights, analyses and advice you get from us.

And digital intelligence works behind the scenes to make sure you see what you need to see, so you spend less time searching or sifting through research and reports.

Keen to explore market opportunities with greater assurance, and get expert insights that are matched to your portfolio?