Whatever the market condition, there may be great value to be found if you do your homework.

Markets are constantly changing, with ebbs and flows, good and bad times. So it’s a useful skill to be able to identify stocks that might be worth investing in, no matter what the current market conditions look like.

Where should you start?

"Know what you own, and know why you own it" - US investment guru Peter Lynch

While it’s common sense to stay away from companies that have a hard-to-comprehend business model, it is very easy to get carried away. When there’s a lot of excitement and everyone seems to be investing in that opportunity, “herd mentality” can cloud your judgment and lead you to put your money into a company that operates in an area about which you have no idea.

Before investing, learn what the company does, understand its business, its operations and its financials before you take the plunge. The next step is equally important: Always review your investments. What makes a good investment today may not be so a few months or years later.

A stock screener is very helpful as it collates data, and allows you to test out your investment ideas Such a tool also allows you to select the industry that you want to target, and analyse various companies based on pre-decided criteria.

You can filter your search results on the basis of:

- Total market capitalization - the market value of the company calculated by multiplying the share price of the stock with the number of shares outstanding

- Total revenue

- P/E ratio

- Dividend yield

Many investors base their buying decisions on fundamental factors such as revenue growth, profitability, return on equity, and the other data that affects a company’s performance.

Some others use technical analysis to decide if it’s worth acquiring a share at a particular price.

Yet others use a combination of fundamental and technical analysis. So they understand what drives a company (the fundamentals), and study statistics and data related to market activity (technical analysis).

6 useful ways find undervalued stocks

1. A sudden fall in prices

There are times when a company’s share price falls rapidly over a short period. For many investors, this is a signal to take a closer look at what is happening within the company.

A company’s share price can fall for many reasons, including the release of quarterly financial results that fail to meet market expectations.

However, there are times when the share prices fall by more than is justified. In a situation like this, once you have established that the company’s fundamentals are still intact, you may have identified an undervalued stock.

This method of identifying an undervalued stock could be particularly useful for sectors like commodities which are cyclical in nature and susceptible to changes in the business cycle. That means the business tends to outperform the market when the economy is moving out of recession and growing, but performs poorly when economic growth begins to weaken.

For long-term investors, a sector that is out of favour in the business cycle may be a good place to look for undervalued stocks.

2. Growing earnings

A company that reports steadily growing earnings could be a good candidate for your money. Try and identify a firm that has reported increasing profits for the last five years or more. Then, determine if its business is sound and offers further growth potential using fundamental analysis. As a word of caution, past performance is not necessarily an indication of future performance.

Of course, it is possible that the share price is already at a level that indicates that the market has factored in this possibility of further growth. Therefore, it is prudent to make a buying decision only after considering other details about the investment opportunity, in addition to its earnings growth.

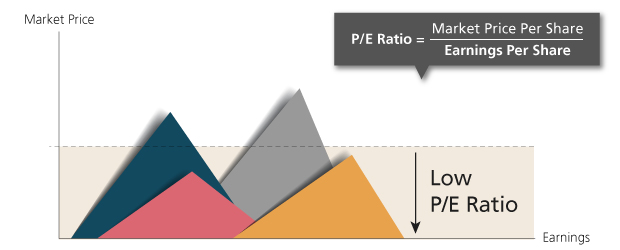

3. Low Price-to-Earnings ratio

The price-to-earnings ratio (P/E ratio) is a good place to start if you are looking for an undervalued company. It tells you how much an investor is willing to pay for $1 of the company’s earnings.

A higher ratio might mean it would take investors a longer period before recovering their capital investment.

A low P/E ratio could signal a potential buying opportunity.

But remember that this is only one of the factors to consider. A depressed price to earnings ratio could also mean that the market has advance information about the company’s poor performance.

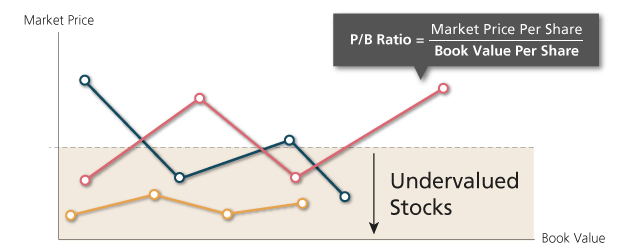

4. Price-to-Book ratio is less than 1

The price to book ratio signifies the number of times that a company’s market price is greater than the book value of its equity.

When the P/B ratio is less than 1, it signifies that investors believe that the firm is not able to utilise its assets profitably. It could also mean that you have spotted a buying opportunity.

A firm with a low price to book ratio deserves your attention. If it meets other investment criteria, you could have spotted a stock that will provide high returns in the months and years ahead.

5. High dividend yield

This financial ratio tells you how a company’s dividend payout compares with its market price. A high ratio may be a sign that the firm is undervalued.

But it is wise to proceed with caution. Are the profits sufficient to sustain the generous level of dividends? It may also be the case that the company is unable to deploy its surplus funds effectively and is paying higher dividends because of this reason.

6. Robust big picture

Financial data and ratio analysis can point you in the right direction, but it would be a mistake to base your investment decision entirely on the conclusions that you draw from numerical calculations. There is a wealth of information available in annual reports and press reports. It is absolutely essential that you gather as many details as you can before investing your money.

There is one non-numerical technique that will be of great help in your hunt for a stock that offers the possibility of capital appreciation. Warren Buffett says that when he is researching a company, one of the primary issues that he considers is whether it can effectively keep the competition at bay. He compares this ability to a castle’s moat. A firm should be able to ward off its competitors in the same manner as a moat keeps attackers from getting into a castle.

But remember: a “moat” cannot last forever. Scores of companies have lost their competitive advantage over the years. Before you take an investment decision, it is crucial to extend your research beyond the company, and to the industry that it operates in and its competitors.

Trade the markets with confidence

6 useful ways find undervalued stocks

Start investing in undervalued stocks from a wide range of markets at competitive fees and rates.

Get access to stock markets and personalised investment ideas

Or get in touch for specialist advice on smart wealth solutions.

Disclaimers and Important Notices

This article is for information only and should not be relied upon as financial advice. Any views, opinions or recommendation expressed in this article does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability. This article is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.