Investing as an Accredited Investor

Frequently asked questions

Below are some benefits and consequences of being an Accredited Investor (AI) client:

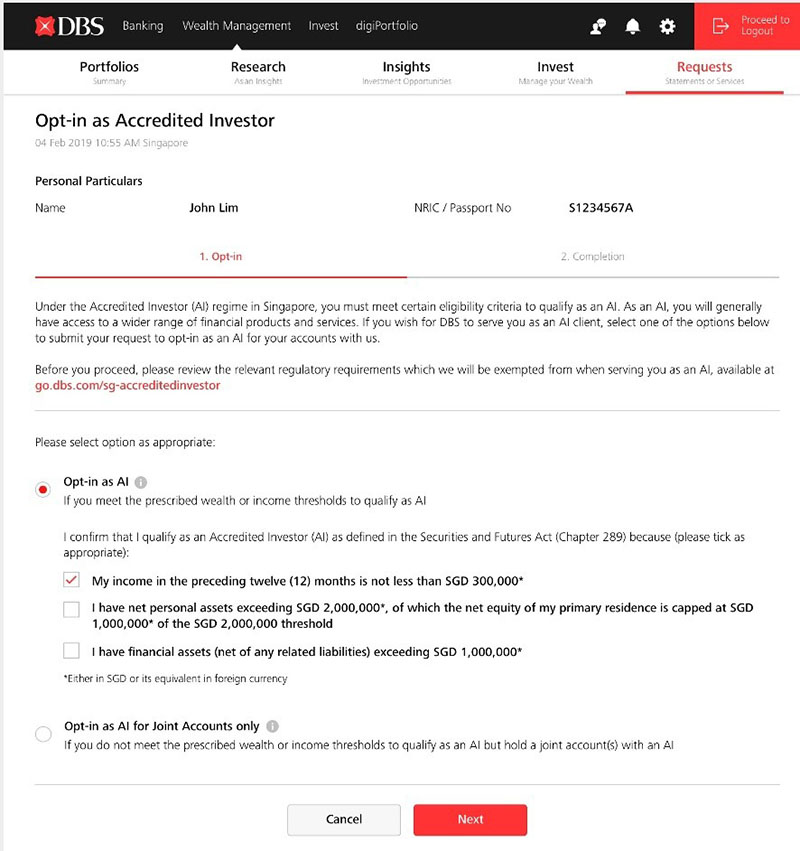

- An AI generally has access to a wider range of financial products and services.

- AIs are assumed to be better informed, and better able to access resources to protect their own interests, and therefore require less regulatory protection.

- Investors who agree to be treated as AIs therefore forgo the benefit of certain regulatory safeguards. For example, issuers of securities are exempted from issuing a full prospectus registered with the Monetary Authority of Singapore in respect of offers that are made only to AIs, and intermediaries are exempted from several business conduct requirements when dealing with AIs.

- Investors should consult a professional adviser if they do not understand any consequence of being treated as an AI.

For details on the relevant regulatory requirements which we will be exempted from when serving you as an AI, please refer to here.

Generally, a non-AI has access to a limited range of financial products and services as compared to those available to an AI.

There may be limitations on the new investment products that we may offer to you. However, we shall continue to provide services to you for your existing investments.

Accredited Investor (AI) status is held on a per financial institution basis. If you opt in for AI status, this will be applied to all DBS account(s) which are held in your name.

The only exception is in respect of non-AIs who maintain joint accounts with at least one account holder who is an AI. For such cases, if there is at least one AI individual account holder, the non-AI account holders may opt in to be treated as an AI but only in respect of dealings through that joint account.

You may wish to note that DBS will be required to treat you as a non-AI for your joint account(s) if (i) the joint account does not have at least one AI individual account holder; or (ii) non-AI account holder has not opted in to be treated as an AI for dealings through that joint account.

You can indicate your wish to opt-in through any of these channels:

- Digitally through DBS digibanking (steps detailed below);

- Returning the AI Opt-In form by mail / scan / fax to your Relationship Manager; or

- Returning a positive email reply to your Relationship Manager if you receive an email from the Bank.

Steps to opt-in via digibanking

Step 1. Login to DBS digibanking

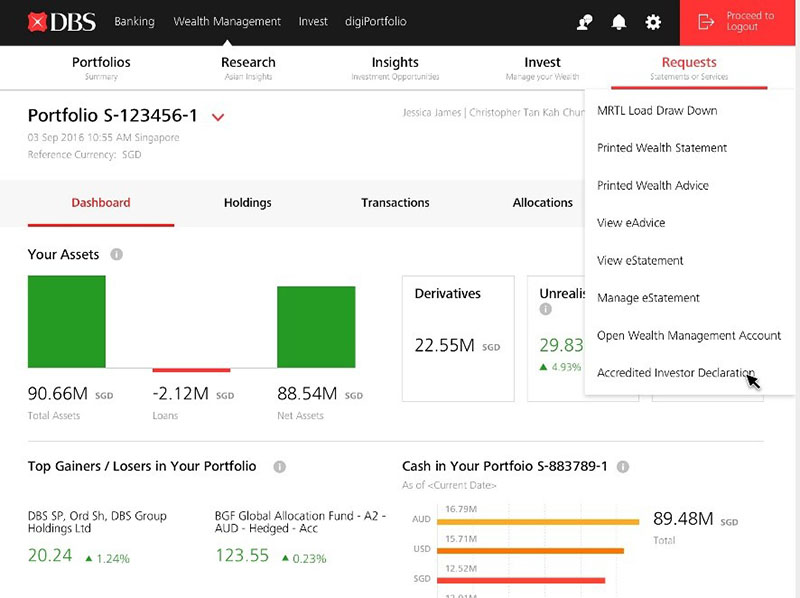

Step 2. Go to “Wealth Management” > “Request” tab and select “Accredited Investor Declaration”.

Step 3. Select “Opt-in as AI”, complete and submit.

Existing AI clients may opt out of the AI status at any time. If you are an existing AI and wish to opt out of the AI status, please inform your Relationship Manager. Do note that DBS may take approximately 14 days to process your request. DBS will notify you once your request has been processed and your investor status has been updated in DBS’ records. Until such time, you would still be considered an AI.