Between a rock and a hard place

By Lorna Tan

![]()

If you’ve only got a minute:

- Gig workers, boomers, low- and middle-income earners find their cashflows getting tighter and/or squeezed by higher debt payment like mortgages, due to higher interest rates.

- Gig workers are the most financially stretched and their incomes were insufficient to cover their spending.

- Customers’ investment flows shifted towards short-duration risk-free assets, while riskier assets such as equities fell out of favour.

![]()

The growth momentum has slowed as we move into a post-Covid era. Yet inflation, despite easing from last year’s peak, remains elevated. High inflation erodes everyone’s purchasing power, while high interest rates take a toll on the balance sheets of those with existing financial liabilities (for example, credit cards debt and mortgages).

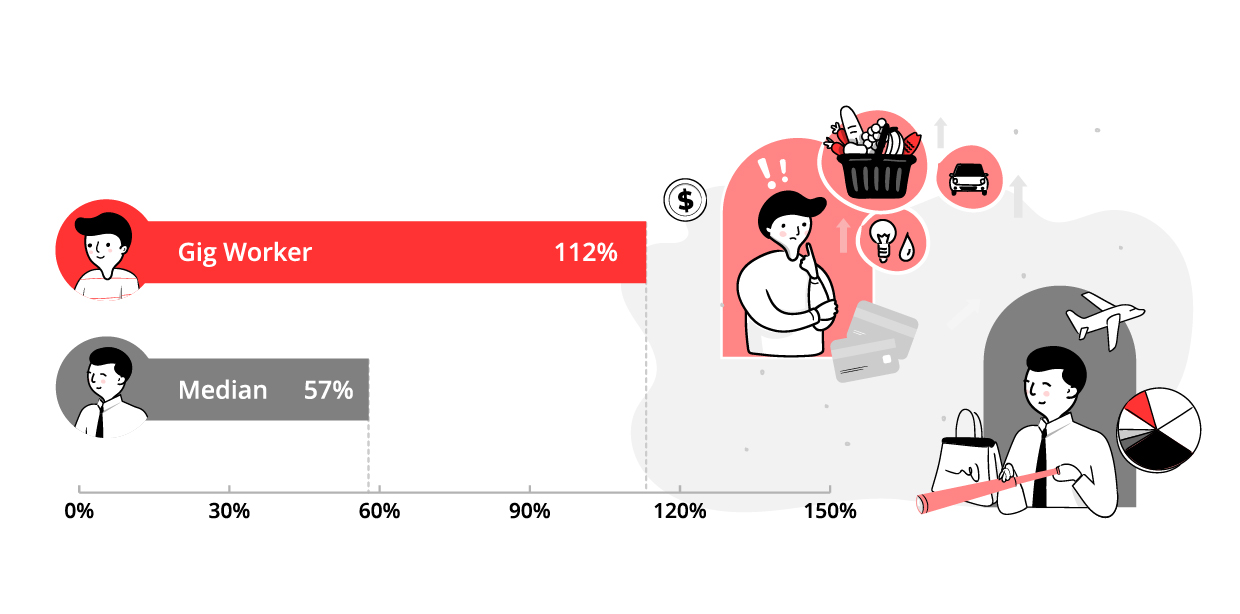

As a result, some customers (particularly gig workers, boomers, low- and middle-income earners) find their cashflows getting tighter and/or squeezed by higher debt payment like mortgages, due to higher interest rates. In fact, gig workers are the most financially stretched and their incomes were insufficient to cover their spending.

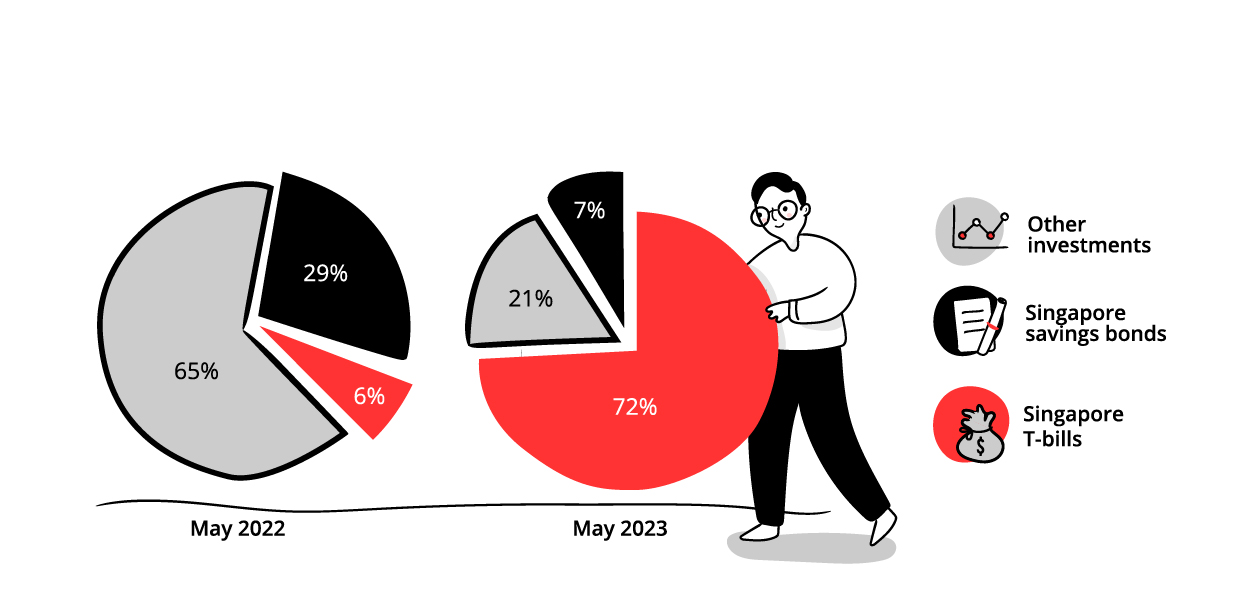

Those who are financially savvy with cash are better positioned to leverage the higher interest rate environment. We saw customers’ investment flows shift towards short-duration risk-free assets, while riskier assets such as equities fell out of favour. Across all generations and income groups, investments moved towards fixed income securities in May 2023 versus May 2022, especially into Singapore Treasury bills (T-bills).

This research paper “Between a rock and a hard place” is the 5th instalment in the DBS NAV Financial Health Series that analysed aggregated and anonymised data insights from 1.2 million DBS retail customers in May 2023 relative to May last year. It sheds light on the impact of high inflation and interest rates on financial wellness.

The findings underscore the importance of sustainable financial planning for everyone to enhance their well being. This is particularly so for those who are caught between a rock and a hard place, as relentless inflationary pressures and escalating expenses that outpace growth in wages lead to further erosion of savings.

Here are 8 key findings and 6 financial planning tips from this study.

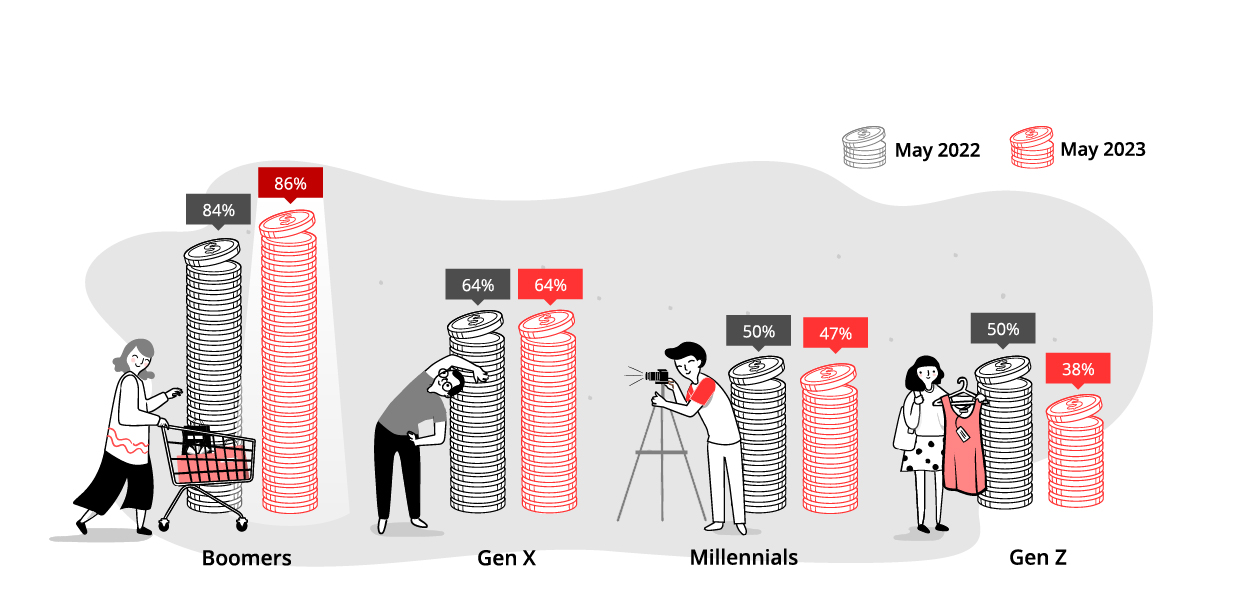

- Customers saw improved expense-to-income ratios at 57%, down from 59% last year. Income of a median customer grew 7.2%, which is 2.7x faster than that of expenses at 2.7%, which led to declining expense-to-income ratios.

Expense-to-income (%), by generations

- Boomers and low-income customers saw worsening wallet bandwidth. Contrary to other customers, both groups saw expense-to-income ratios inch up to 86% and 93%, respectively, as expenses grew 5.5x and 1.2x faster than that of income.

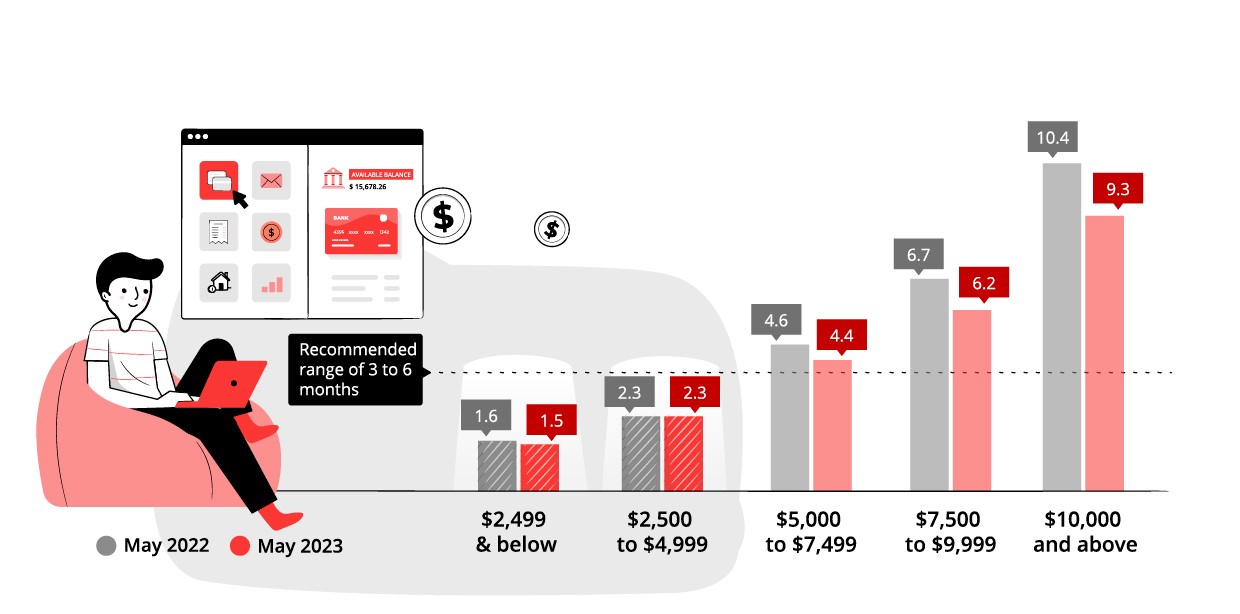

- Savings dipped but remain healthy, except for the low-income. The median customer saw their savings decline marginally from 3.7 to 3.5 months of expenses. Yet, savings for the low-income could only last them 1.5 months, which may be concerning.

Savings (as defined by number of months of expenses), by income groups

- Gig workers are the most financially stretched. Their expense-to-income ratio of 112% in May 2023 was significantly higher than that of the median customer at 57%. Their savings of just 1.7 months of expenses are deemed too low.

Expense-to-income (%) of gig workers vs median customer in May 2023

- Higher monthly mortgage payments leave lesser for lower-to-middle income customers to enjoy from their income growth. They could use more than 50% of income growth to service the increase in monthly mortgage payment.

- Watch for further impact on mortgages as higher rates linger. More than half of lower-to-middle income customers (earning below $5,000) have mortgage loans under floating rates. Additional stresses could come when mortgages are refinanced on higher interest rates.

- Credit card debt looks manageable despite the 12.8% increase in card spending. Higher growth in non-interest bearing, non-revolving balances at 23.6% suggest that most customers are making timely payments to avoid hefty interest charges.

- Investments were partly channelled from savings, while flows shifted towards short-duration risk-free assets amid a volatile investment landscape. The move towards risk-free assets was observed in all generation and income groups. Singapore T-bills accounted for an overwhelming >70% of total flows in May 2023.

% share of investment flows, by asset classes

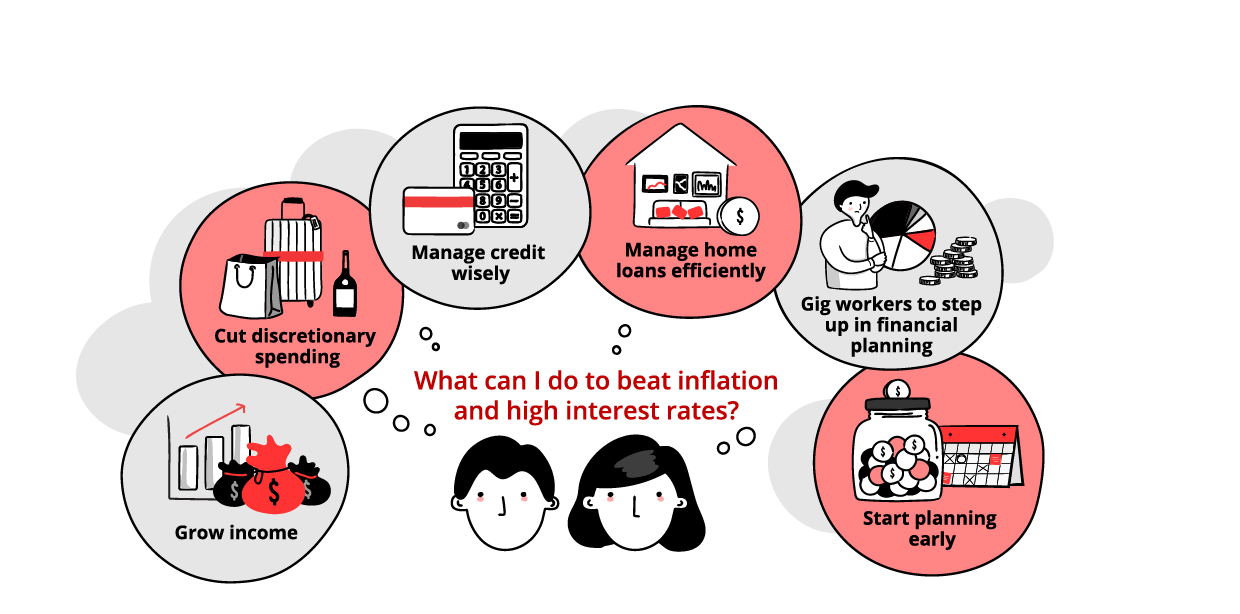

Here are 6 tips to boost financial resilience for everyone, especially vulnerable groups like gig workers, boomers, low- and middle-income earners:

1. Grow income

Upskill your capabilities by taking advantage of your SkillsFuture credits and continue to stay relevant and employable. Look beyond your comfort zone and consider job opportunities in other sectors.

Eligible individuals can take advantage of government support schemes like Workfare Income Supplement (WIS) that empower workers to uplift their lives. WIS considers the worker’s age, employment status (employee or self-employed), and income when determining the disbursement amount.

Side hustles can boost your income streams too. Try putting your baking skills to use by selling some of your home-baked cookies. If you are proficient in English, Chinese, and/or Mathematics, giving tuition in the evenings or during weekends can be a lucrative source of income. Love to create videos? You can sign up on freelancer platforms to earn some money and gain some job experience.

Retirees are realising that working part-time helps to keep them mentally stimulated and connected to the community which enhances their general well-being. And the extra income helps to boost their nest egg so it can last longer to counter longevity and inflation risks.

If you have saved up at least 3 to 6 months’ worth of monthly expenses as emergency cash, make your money work harder via higher yielding accounts and suitable investments that are aligned to your financial situation, risk profile and time horizon.

With an inflation rate of 5% to 6% in Singapore, not taking any investment risk is a risk as your purchasing power will erode with idle cash. With rising interest rates, this is an opportune time for new investors to embark on their investing journey by dipping their toes in low-risk products that can offer decent yields.

Backed by the Singapore Government, Singapore Government Securities (SGS), Singapore Savings Bonds and T-bills are examples of extremely low risk investment vehicles that offer good yields. As such, they are popular among beginners and investors as a means to diversify their portfolios.

However, while they can form part of the fixed income allocation of your investment portfolio, do note that the steady returns from these instruments are unlikely to help you stay ahead of high inflation, nor offer compounding benefits.

To grow your wealth in the long-term, build a diversified mix of assets that includes equities, and reap the benefits of compounding. Invest in yourself by upgrading your financial knowledge on how investments and insurance work and set up a comprehensive plan.

2. Cut discretionary spending

With inflation eroding our purchasing power, we need to track our cashflows more diligently and reduce discretionary spend. While the DBS report showed that expense-to-income ratio has decreased for median customers compared to a year ago, we need to be mindful of lingering inflation and that income may not increase at the same rate in the coming year. Boomers and low-income customers are also seeing worsening wallet bandwidth, highlighting the need to reduce discretionary expenses.

Going back to the basics of tracking your expenses and setting up a monthly budget can help rein in excess discretionary spending, and offer clarity on your money leaks. Use the “Plan” tab in DBS digibank to help you set up a budget and track your spending categories.

Here are 4 ways to keep expenses manageable.

- Reduce frequency of eating out and cutting usage of meal delivery services (prices of food are often marked up compared to ordering in-store)

- Unsubscribe from memberships that you no longer use (Netflix, gym, online software)

- Travelling has become more expensive due to rising fuel prices and inflation so look for cheaper alternatives, such as budget flights and travelling during non-peak periods. Compare prices of air tickets and hotel rooms before making a purchase and take advantage of discounts via credit cards and deals platforms.

- Have a habit of shopping around for cost-effective options. You can even make it a family challenge!

3. Manage credit wisely

Although credit card usage has increased, the good news is that most customers are aware of the high interest chargeable on late credit card bill payments.

Credit cards offer attractive benefits such as earning cashback, miles, rewards, and discounts on selected retailers. Make the best use by selecting credit cards that are aligned with your lifestyle spending and ensure that you keep expenses in check by setting a suitable credit limit. Most importantly, always pay your monthly bills in full and before the due date, to avoid hefty penalties.

Buy-Now-Pay-Later (BNPL) schemes have gained gaining popularity among consumers, but there are pros and cons. They can be useful in the event you need to buy an expensive item immediately but want to reduce the amount of expenditure or credit for a period of time. For the younger generation who do not have substantial savings, using BNPL schemes can enable them to make necessary big-ticket purchases such as laptops without the need for a credit card.

However, they may also give a false sense of financial security. By turning a large expense into something more “affordable” as the payments are stretched over time, it may result in impulsive buying and overspending. Furthermore, it becomes harder for you to track your exact expenses as well, resulting in potentially mismanaging your budget and finances. If late payments are incurred, additional charges will be imposed adding to the outstanding debt.

Generally, BNPL plans are probably not a good idea for those who are often low in cash. Ultimately, affordability is key. Do ensure that the purchase is within your budget and that you will be able to repay them. Remember that paying your purchases in smaller amounts over time does not work for everyone. It will be more prudent to save harder and make these purchases later with money you already have.

Loans or purchases funded by credit can accumulate through interest charges and fees, becoming a constant source of distress. If you find that your debts are spiralling out of control, you may want to consider the Debt Consolidation Plan (DCP) offered by banks or the Debt Management Programme (DMP) from Credit Counselling Singapore.

4. Manage home loans efficiently

Rising mortgage rates have made headlines since last year, with interest rates on home loans doubling within the year. Homeowners who did not manage to lock in rates before the rise may be grappling with a larger monthly home loan repayment.

As mortgage payments are likely to make up about a third or more of household expenses, borrowers need to keep an eye on their repayments and take steps to actively manage their mortgage.

Here are 4 tips to help manage your mortgage.

- Delay making property purchases

New homeowners will be hit by the double whammy of rising property prices and high mortgage rates. If possible, delay the purchase until rates are lower. Alternatively, consider making a bigger down payment to reduce the home loan amount. For those who are planning to buy investment properties, the recent announcement on higher ABSD would substantially increase the investment cost.

If buying an HDB flat is a priority, POSB is supporting home buyers and existing HDB owners earning less than S$2,500 per month with an exclusive HDB home loan rate package at 2.60% p.a. This rate is the same as the HDB home loan rate.

- Tapping into CPF funds

To help finance your monthly mortgage payment, consider utilising your CPF OA savings temporarily instead of cash, if you are in a tight cashflow situation.

Once your financial health improves, consider switching back to using cash to fund your instalments, unless your investments can generate returns in excess of the risk-free 2.5% pa return from CPF OA. At all times, ensure that your OA savings can provide a buffer of monthly mortgage loan instalments for at least 12 months, in case of you lose your job.

- Refinance or reprice your home loan

If your current home loan is out of the lock-in period, look out for refinancing/repricing opportunities that can offer you a better rate than what you are paying for. If you have a large amount of idle cash, consider making partial repayments to your mortgage.

- Synergise your banking product

Look for accounts/products that give you a better overall deal in your banking relationships. For instance, you stand to earn higher interest with the DBS Multiplier account if you credit your salary, have a home loan, and invest with DBS.

Similarly, you stand to receive up to S$700 cash bonus when you save with POSB Save As You Earn (SAYE) account, take up a POSB home loan, and protect yourself by taking up a mortgage insurance plan with us.

5. Gig workers to step up in financial planning

Our report has found that gig workers are the most financially stretched, with an expense-to-income ratio of 112% in May 2023. In addition, the gig workers’ savings of just 1.7 months of expenses are way below our recommended 12 months for those with unstable income streams, and under the lower end of the recommended 3 to 6 months range for other customers.

Faced with the uncertain economic climate that may increase the volatility of their income, gig workers would need to work harder to ensure that their financial cushion can support them through tough times. For instance, gig workers should aim to set aside at least 12 months’ worth of monthly expenses as savings.

Come 2024, CPF contributions will be mandatory for younger gig workers aged 30 and below, while older workers will be given the choice to opt in. But why wait till then? All gig workers should consider contributing to their CPF, so that they can leverage the attractive interest in the long term.

Gig workers are encouraged to optimise their CPF savings by transferring their Ordinary Account (OA) savings to the Special Account (SA) to earn higher interest rates of up to 5% pa. When doing so, adopt a long-term view as such transfers are irreversible. Other avenues include investing your OA savings wisely, and performing cash top-ups to the SA to reap the power of compounding over time.

Platform workers may be more susceptible to injuries during work. Check that the company provides insurance that covers accidents and injuries while working. If not, consider some coverage that can provide financial relief during times when they are unable to work. This includes hospitalisation, critical illness, and personal accident plans.

If you have a limited budget, DBS has an insurance starter plan ProtectFirst that helps young Singaporeans kickstart their protection journey affordably at a lower premium. It offers varied coverage for critical illnesses (including early stage), life protection and serious accidents. Do review your protection needs regularly in view of changing lifestyle and life-stage needs to ensure adequate coverage.

6. Start planning early

Make time your ally by planning early for your financial well-being to take advantage of the longer runway for savings and investments to grow and compound. A key aspect is optimising the CPF nest egg, especially for the vulnerable groups who have limited savings.

Your CPF feature in DBS digibanking app gives users a clearer picture of their future CPF savings against the projected CPF Retirement Sums for their age cohort. Coupled with your personalised consolidated financial information from SGFinDex (banks, insurers, CPF, HDB, IRAS, CDP), the Your CPF tool can harness the information and show whether you are on track. It will also offer customised insights for you to take the necessary steps to close the money gaps.

If you are not on track to meet your financial goals, you can make better informed decisions such as getting a smaller home, boosting income, and reducing unnecessary spend. Use the “Plan” tab in DBS digibank to set up a customised robust and comprehensive financial plan.

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Alternatively, check out NAV Planner to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?