DBS PayLah!–Your ultimate everyday app

Get rides, tickets, meals, rewards and more – all on PayLah!

DBS PayLah!–Your ultimate everyday app

Are you a student looking for cashless payment options?

We’ve got you covered! Plus, you get to earn cashback when paying in tertiary schools using PayLah!

Savour meals

Go places

EZ-Link

Skip the lines and top up using EZ-Link app, and check out with PayLah! for your EZ-Link products.

Buy tickets and book shows

Golden Village

Enjoy S$2.50 off movie tickets on Wednesdays and Sundays.

Plus, enjoy blockbuster deals!

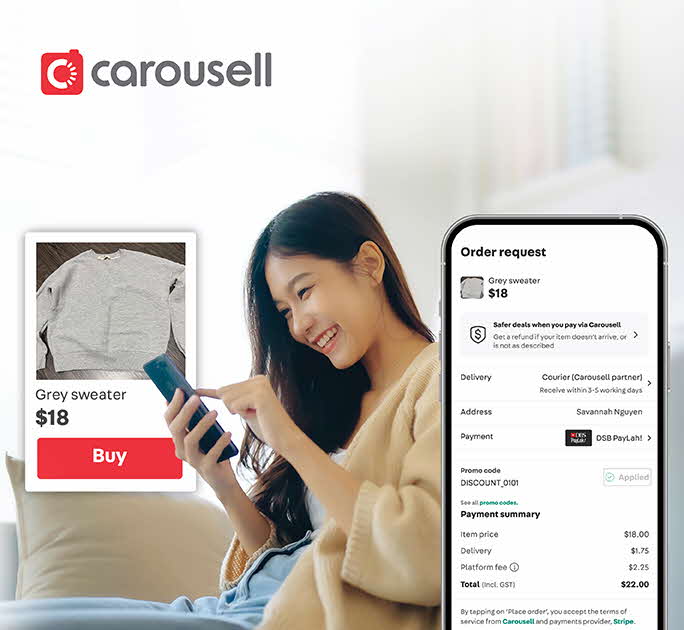

Shop and get rewarded

Pay bills

Support Our Heartlands

POSB Support Our Heartlands

Enjoy weekly cashback at heartland shops, wet markets, coffee shops and hawkers when you scan to PayLah!

All your hawker favourites

Order, pay, and discover hawker favourites with your ultimate everyday app.

Meet your 2023 Hawker Awards Winners

Thank you for supporting our hawkers. Meet the winners of our 8 categories!

Useful Links

Others

Need Help?

Terms & ConditionsPrivacy PolicyFair Dealing CommitmentCompliance with Tax RequirementsVulnerability Disclosure Policy

©2025 DBS Bank LtdCo. Reg. No. 196800306E