Using your DBS Physical Token

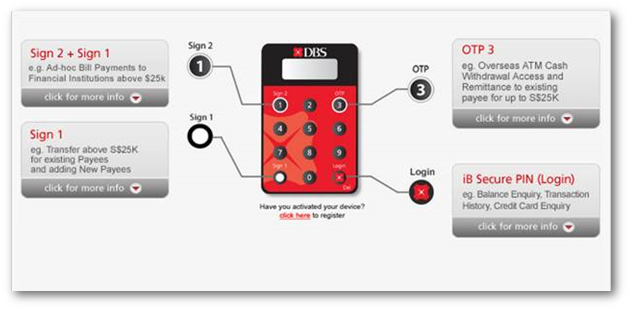

Find out what the various buttons on your DBS Physical Token are used for.

Part of: Guides > Your Guide to digibank Online

Part of: Guides > Your Guide to digibank Online

iBanking Secure PIN (Login)

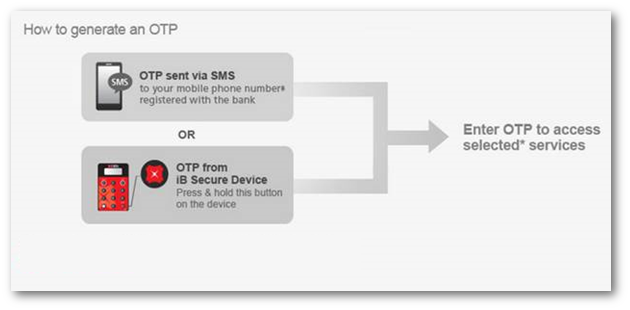

To access services such as Transaction History, Bill Payment or Funds Transfer, you will need an iBanking One-Time Password (OTP).

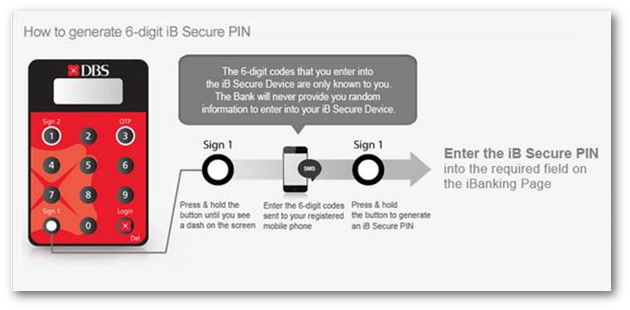

Sign 1

For transactions such as "Add New Recipient" or "Funds Transfer to Existing Recipients", you may be required to enter the required transaction details into your iB Secure Device when prompted.

Related articles

Was this article helpful?

We welcome your feedback

Thanks for your feedback!

We’ll continue to work towards serving you better.

Need more help?

Contact support and we'll try to resolve your issue quickly.

Contact Customer Support