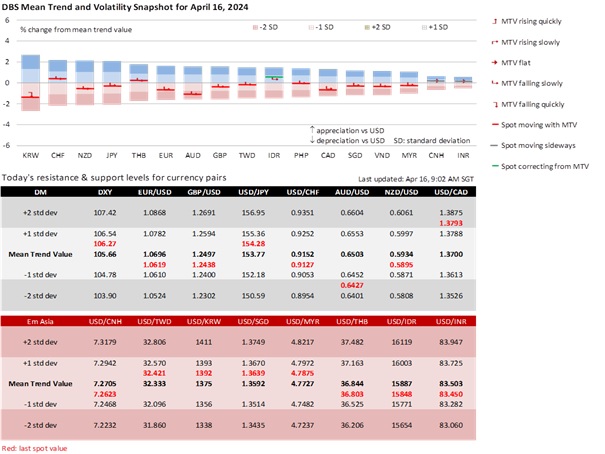

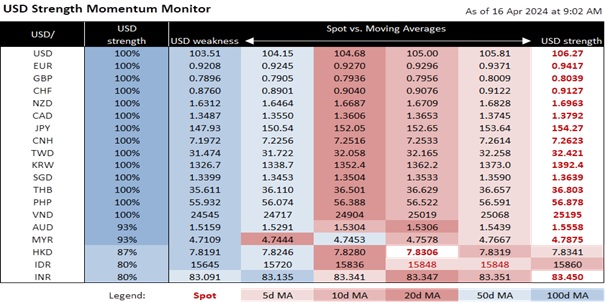

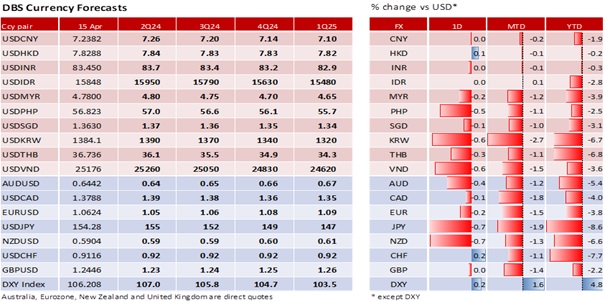

DXY appreciated the fifth session by 0.2% to 106.21, its best close since early November. Within the basket, the JPY took the brunt of the USD’s strength, depreciating 0.7% to 154.27 per USD, its worst level since mid-1990. Markets will be alert to intervention risks around 155. EUR depreciated a fourth session by 0.2% to 1.0624. Breaking this level, the 75% Fibonacci retracement level of EUR’s rally in 4Q23 would open the door towards the 1.05 low last October. CAD also fell a fourth day by 0.1% to 1.3787 per USD, approaching 1.39, or its weakest level at the start of November. Although the CHF bucked the USD’s strength and appreciated 0.2%, USD/CHF has been trapped between 0.9080 and 0.9150 in the past three sessions. With markets pushing out Fed cuts to September, EUR, CAD, and CHF remain pressured by expectations for their central banks to cut rates in June.

The US Treasury 10Y yield increased 8 bps to 4.60%, its highest close since mid-November. The yield initially rose to an intra-day high of 4.66% on stronger-than-expected US retail sales of 0.7% MoM in March vs. the 0.4% consensus; February was also revised to 0.9% from 0.6%. With the data cementing expectations for the PCE deflator to mirror the strength in CPI inflation, markets brushed aside New York Fed President John Williams’ comments about looking to lower interest rates on slowing inflation this year. Today, consensus expects capacity utilisation to improve to 78.5 in March from 78.3 in February. However, the 10Y yield came off its highs from WTI crude oil prices rebounding from the session’s low of USD84/barrel to USD85.41, near last Friday’s close.

The ongoing conflict between Israel and Iran in the Middle East had a significant impact on the US stock market. Fearful that the tit-for-tat attacks this month would lead to a wider conflict, investors dumped US stocks. The Dow, S&P 500, and Nasdaq Composite Indices fell 0.7%, 1.2%, and 1.8%, respectively, with all three indices closing below their 50-day moving averages. The VIX Volatility Index rose 11% to 19.2, on top of Friday’s 16.1% surge, to its highest level since the end of October. The Dow has fallen 5.2% this month to 37735, its lowest level since mid-January.

Risk aversion will weigh on the Australasian and emerging Asian currencies. NZD depreciated most by 0.7% on Monday, followed by 0.4% in the AUD. The KRW depreciated to 0.6%, mirroring the JPY’s weakness, with players keeping an eye on the Bank of Korea taking necessary steps to address excessive currency volatility. The VND was the worst-performing Southeast Asian currency, depreciating 0.6% to a record low of 25200 per USD. The PHP was next with a 0.5% loss to 56.8, its weakest close since early November. The Philippine central bank (BSP) said it hardly intervened in the FX market and would delay rate cuts to 2025 on inflation.

Quote of the day

" If we desire to avoid insult, we must be able to repel it; if we desire to secure peace, one of the most powerful instruments of our rising prosperity, it must be known, that we are at all times ready for War.”

George Washington

16 April in history

In 1789, George Washington started his 200-mile journey by carriage to be sworn in as the first US President.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.