Key points:

- Investment Grade Bonds offer a steady flow of income with an assurance that you’ll get back the face value of the bond upon maturity (assuming the issuer does not default).

- Investment Grade Bonds have a lower default risk compared to high yield bonds and have a credit rating of at least Baa3 from Moody’s or BBB- from Standard & Poor’s.

- Only Accredited Investors can purchase Investment Grade Bonds via over-the-counter (OTC) dealer networks like banks.

To get started with Investment Grade Bonds as an Accredited Investor, leave us your contact and a Relationship Manager will reach out to you.

Investment Grade (IG) bonds are like the versatile, timeless basics in everyone’s wardrobe – they suit investors of all risk profiles. Always in style, IG bonds are popular as they offer a steady stream of income at a lower level of risk compared to many other investments.

Another reason for their popularity is the current investing environment. In response to inflation, the US Federal Reserve has increased interest rates to multi-year highs in 2023, making yields for IG bonds especially attractive.

The essentials of bonds

Bonds are issued by companies (corporate bonds) or governments (government bonds).

Investors who buy a bond are essentially lending money to an organisation in return for a promise of repayment in full upon its maturity, accompanied by interest as compensation for the loan. The interest payment (known as a coupon) is often a fixed amount paid out at regular intervals through the term of the bond. Because of this regular payment, bonds are known as ‘fixed-income investments’.

The relationship between bond prices and interest rates

The core principle is simple: when interest rates rise, bond prices fall – and vice versa.

When interest rates are rising, investments with higher potential returns become more enticing. Existing bonds may start to lose their appeal as investors seek out other growth opportunities for their wealth.When that happens, bond prices adjust downward such that the yield, calculated as the fixed coupon as a percentage of the bond price, remains competitive (such as what we are seeing today1).

It's worth noting that when interest rates change, the impact on its price varies based on the bond's maturity. Generally, longer-term bonds see a more noticeable drop in prices compared to shorter-term ones.

What are Investment Grade (IG) Bonds

IG bonds are issued by companies or countries with a credit rating of at least Baa3 from Moody’s or BBB- from Standard & Poor’s and Fitch Ratings. This credit rating indicates that the company or country is considered to have a low risk of defaulting on its payments.

Non-IG bonds are known as high yield or ‘junk’ bonds. These bonds have a higher risk of default and pay investors higher coupon rates to compensate for the additional risk taken.

Some bond issuers may choose not to seek a credit rating as acquiring a rating can incur hefty costs. These issuers might feel that their target investor segments are already familiar and comfortable with their credit worthiness without needing a rating.

Why IG Bonds should be an essential in your investment wardrobe

Investors typically include IG bonds to their portfolios for 4 reasons:

1. Steady income stream

Bonds provide a steady stream of income. As coupon rates of a bond are fixed at the time of issuance, the dollar value of the coupon payments is set in stone.

This predictable cash flow provides some downside protection to your investment portfolio, making bonds a statement piece that guards against future uncertainties.

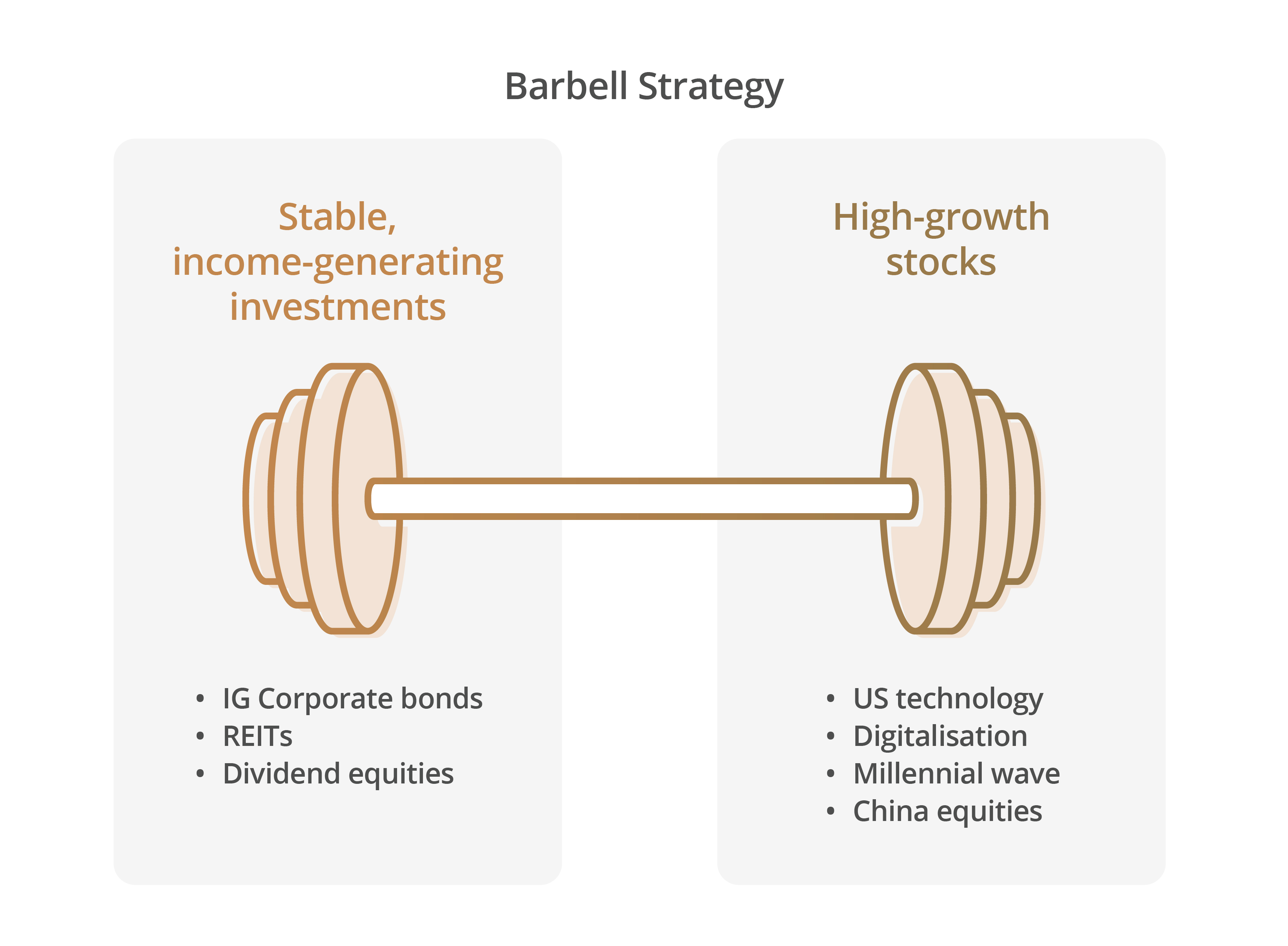

In fact, holding income-generating assets is in line with the DBS Chief Investment Office’s Barbell Strategy, with investments heavily weighted at two ends of the risk spectrum. This means investing in high growth stocks on one end and stable, income-generating investments on the other.

Compared to fixed deposits, high quality IG bonds tend to offer higher returns while remaining relatively safe investments. Longer-term IG bonds (compared to short term T-bills which are a subset of IG bonds) can help to mitigate the reinvestment risk faced by shorter term cash deposits when rates eventually fall.

2. Lower default risk

IG bonds are less volatile and historically have had a low default rate compared to non-IG bonds (i.e., high yield bonds). This advantage would be more pronounced in the current environment, as DBS CIO expects default risks for high yield bonds to mount with high interest rates1.

3. Diversification

In general, bonds are a key component of investment portfolios for investors with different risk profiles as they are a useful tool to achieve diversification.

Bonds and stocks are less correlated – which means it is less likely for them to move in the same direction. This can reduce (although not eliminate) the risk of extensive losses in a portfolio.

Bonds are generally considered to be less volatile than stocks. There are however exceptions, such as in 2022 when bond performance was very volatile because of rapidly-changing interest rates.

4. Capital preservation

As long as the bond issuer remains solvent, they have a legal obligation to repay the principal of the bond to you upon maturity. This provides a form of capital preservation, helping to stabilise your portfolio.

In addition, bonds are a lower risk asset due to its higher position on the debt hierarchy. In the event of liquidation, assets are paid out to bondholders before shareholders of common stock.

Risks of investing in bonds

While bonds are quite a safe addition to your wealth wardrobe, there are a couple of risks you should know about before getting in.

- Credit risk. This is the risk that the issuer will default on its debt obligations and not be able to make the interest payments or repay the principal on the bond.

- Interest rate risk. This is the risk that rising rates might drive down the value of bond holdings. It is not a concern if you hold the bond to maturity, as you’ll get back the entire principal.

How to add IG Corporate Bonds to your financial ensemble

There are 4 ways to integrate IG Corporate Bonds into your portfolio, of which two are exclusively available to Accredited Investors.

Pooled investment instruments

The most common and accessible way is through instruments like unit trusts or robo-advisors (like DBS digiPortfolio).

Pros: Pooled investment instruments provide the benefits of diversification, liquidity and a lower entry price as compared to individual corporate bonds.

Cons: The coupon varies, and such instruments do not offer the assurance of the return of principal at a fixed maturity date (the instrument would need to be sold at the prevailing net asset value).

For example, the DBS CIO Liquid+ fund, available on digibank, offers a diversified portfolio of IG Bonds with a minimum investment amount of just S$1,000, while also offering the flexibility for investors to redeem their funds in a matter of days.

Retail bonds

A second way is through retail bonds.

Pros: In Singapore, new issues of retail bonds can be purchased easily via ATMs, and thereafter traded on the Singapore Exchange (SGX).

Cons: There are only 16 retail bonds available on SGX. An example is Temasek Holding’s retail bond issues in 2018 and 2021, which were available for retail investors for small investment sizes from S$1,000.

Individual bonds via over-the-counter (OTC) dealer networks

Corporate bonds are sold via OTC dealer networks like banks.

Pros: This is a good option if you want a fixed coupon and the assurance of receiving your principal on a fixed maturity date. You get more choices compared to the 16 retail bonds available on SGX.

Cons: These usually have a higher entry level (a minimum piece of S$250,000 for SGD-denominated bonds), and are offered only to Accredited Investors.

Structured Notes

Another option are open-ended notes that reference bond portfolios globally, such as the DBS In-house Fixed Income Notes – which allow Accredited Investors to gain exposure to a large number of bonds with a relatively low minimum investment amount of US$50,000/S$100,000.

Pros: Accredited Investors with DBS Treasures are able to invest in bespoke solutions that are more tailored to their goals.

Cons: As Accredited Investors are considered to have better knowledge and have resources to protect their own interests, these sophisticated investments potentially carry higher risk and require less regulatory protection.

The final look

Adding IG Bonds isn’t just a savvy move, it’s an essential one that seamlessly weaves stability and lucrative yields into your financial ensemble. IG bonds act as the classic, must-have piece that not only serves as a foundation of your portfolio but also deliver an attractive return at an unparalleled value.

As an Accredited Investor, getting started with IG Corporate Bonds is easy. Simply leave us your contact and one of our Relationship Managers will reach out to you.

Footnotes:

1 27 September 2023, Chief Investment Office. CIO Insights 4Q23: The Next Yield Play.

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.