- Industries

- Power & Utilities

Power & Utilities

Enabling Asia’s energy transition

- Industries

- Power & Utilities

Power & Utilities

Enabling Asia’s energy transition

DBS Power & Utilities industry coverage is at the forefront in providing innovating solutions to support Asia’s energy transition.

As the leading financial services group in Asia, our expertise encompasses financing solutions for lower carbon infrastructure such as LNG to power, as well as the entire range of renewable energy technologies comprising of Onshore and Offshore Wind Farms, Land-based and Floating Solar projects, Hydro, Geothermal and Hybrid projects. We advise and provide solutions for distributed generation and new technologies such as hydrogen, battery storage and energy efficiency.

Enabling Asia’s growing power demand using clean energy is important to fight the war against climate change.

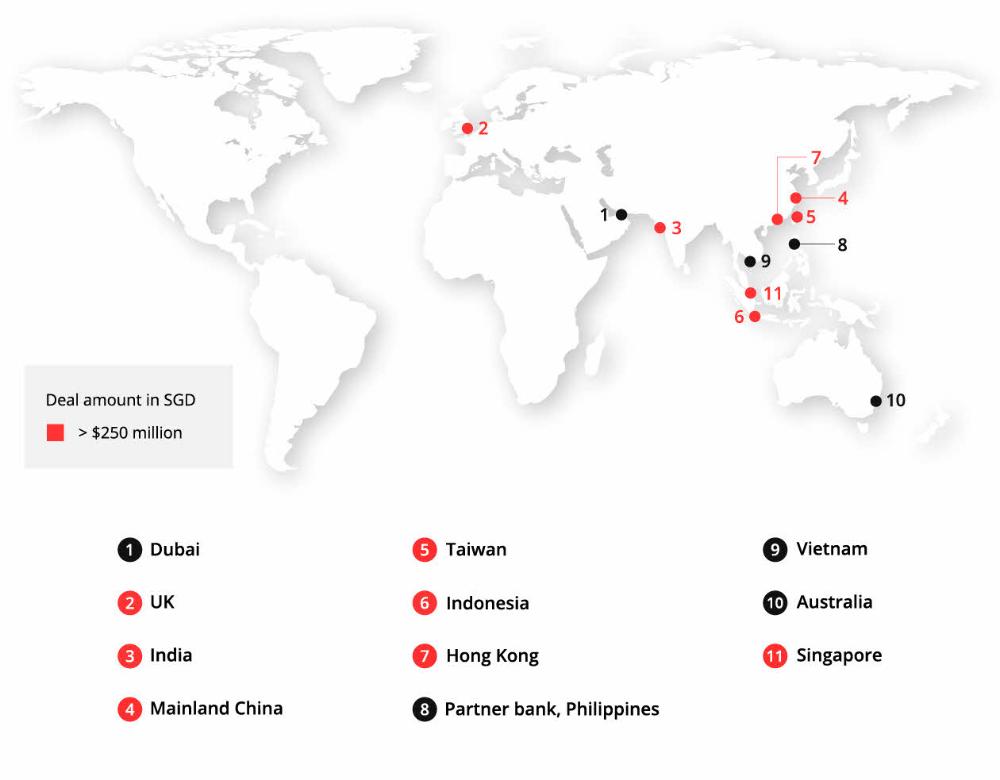

3,000 MW renewable energy projects financed

US$3.6 billion clean energy projects financed

11 countries’ energy transition accelerated

Our strategy and solutions are underpinned by the belief that market forces will continue to drive the energy transition in Asia, which will result in a seismic shift to sustainable investing and driving momentum in green financing.

-

Renewable Energy Platforms

DBS supported Vena Energy in financing its 100MW Li-On Battery Energy Storage System in Australia...

-

Sustainable Investment & Financing

DBS played a key role in financing Singapore’s first Sustainability linked loan in the energy sec...

-

Supply Chain and Digital Solutions

DBS structured a Green Guarantee Facility for Siemens Gamesa to issue Green Guarantees to support...

-

Strategic Advisory and Finance

DBS was the Joint Global Coordinator and played the leading role in securing USD 500m 5-year tran...

-

Structured, Leverage and Acquisition Finance

DBS played a key role as the Lead Debt Financing Coordinator in the acquisition financing of one...

-

Innovating Renewable Energy Project Financing

DBS advised and provided an innovative financing on a limited-recourse basis for an emerging tech...

Bio-LNG turns palm waste into fuel

In agriculture-rich Southeast Asia, bio-liquefied natural gas is turning waste into a renewable energy.

Enabling Asia’s energy transition

Overcoming inefficient energy storage, lack of transparency and access to green financing in Asia.

Green Bonds - Financing the fight against climate change

More than just numbers, Green bonds deliver much-needed investment and services that help uplift whole communities. Learn how DBS, together with Vena Energy is approaching the fight against climate change through sustainable financing.

The Asset

Infrastructure Awards

- Project Finance House of the Year, Singapore, 2017 - 2020

- Project Finance Advisory House of the Year, Asia, 2019

GTR Best Deals

- Yunlin (Wind Power) Project, Joint Lender, 2020

- Cofco International: Sustainability-linked Facilities, Joint Lender, 2020

The Asset

Infrastructure Awards

- Project Finance House of the Year, Singapore, 2017 - 2020

- Project Finance Advisory House of the Year, Asia, 2019

GTR Best Deals

- Yunlin (Wind Power) Project, Joint Lender, 2020

- Cofco International: Sustainability-linked Facilities, Joint Lender, 2020

Kelvin Wong, Managing Director, Head of Power & Utilities

Kelvin has more than 21 years of experience in the energy and infrastructure sectors and corporate and project financing. He has led numerous deals as an advisor and an arranger in the renewable energy, power, and infrastructure sectors in Asia Pacific. Prior to DBS, Kelvin held senior positions with Commonwealth Bank of Australia, Standard Chartered Bank and KPMG. He started his career at Energy Market Authority where he served as a Deputy Director.

Call

From overseas: +65 6222 2200

In Singapore: 1800 222 2200

Operating hours: 8.30am to 8.30pm, Mon - Fri (excluding PH)